Muni Rally Continued Despite Rate Weakness

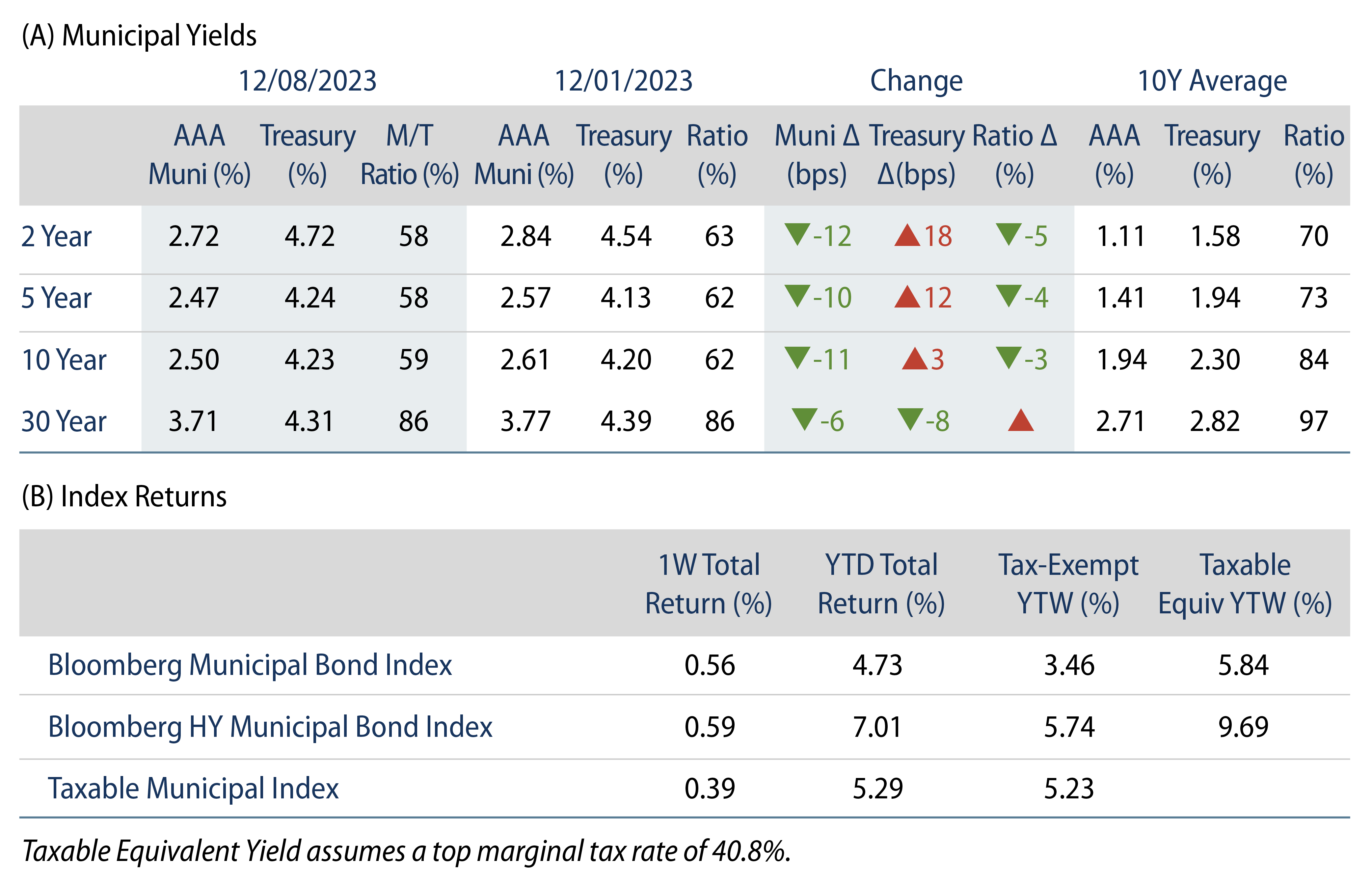

The muni rally continued last week, as municipals outperformed Treasuries, which moved higher on stronger than expected payrolls data, sidestepping the broader rate weakness associated with strong payroll data. Meanwhile, high-grade muni yields moved 6-12 bps lower across the curve. The Bloomberg Municipal Index returned 0.56% during the week, the High Yield Muni Index returned 0.59% and the Taxable Muni Index returned 0.39%. This week we highlight Federal Reserve muni holders data released last week.

Technicals Weakened Amid Fund Outflows, Elevated Supply

Fund Flows: During the week ending December 6, weekly reporting municipal mutual funds recorded $144 million of net outflows, according to Lipper. Long-term funds recorded $299 million of inflows, high-yield funds recorded $6 million of outflows and intermediate funds recorded $390 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to an estimated $15 billion, with $26 billion of outflows reported from open-end funds and $11 billion of inflows reported into ETFs.

Supply: The muni market recorded $12 billion of new-issue volume last week, up 13% from the prior week. YTD issuance of $356 billion is 2% higher from last year’s level, with tax-exempt issuance 8% higher and taxable issuance 34% lower year-over-year. This week’s calendar is expected to decline to $5 billion. Large transactions include $394 million City of Chicago Midway Airport and $344 million of New York State Urban Development Commission transactions.

This Week in Munis: Holders of Muni Debt

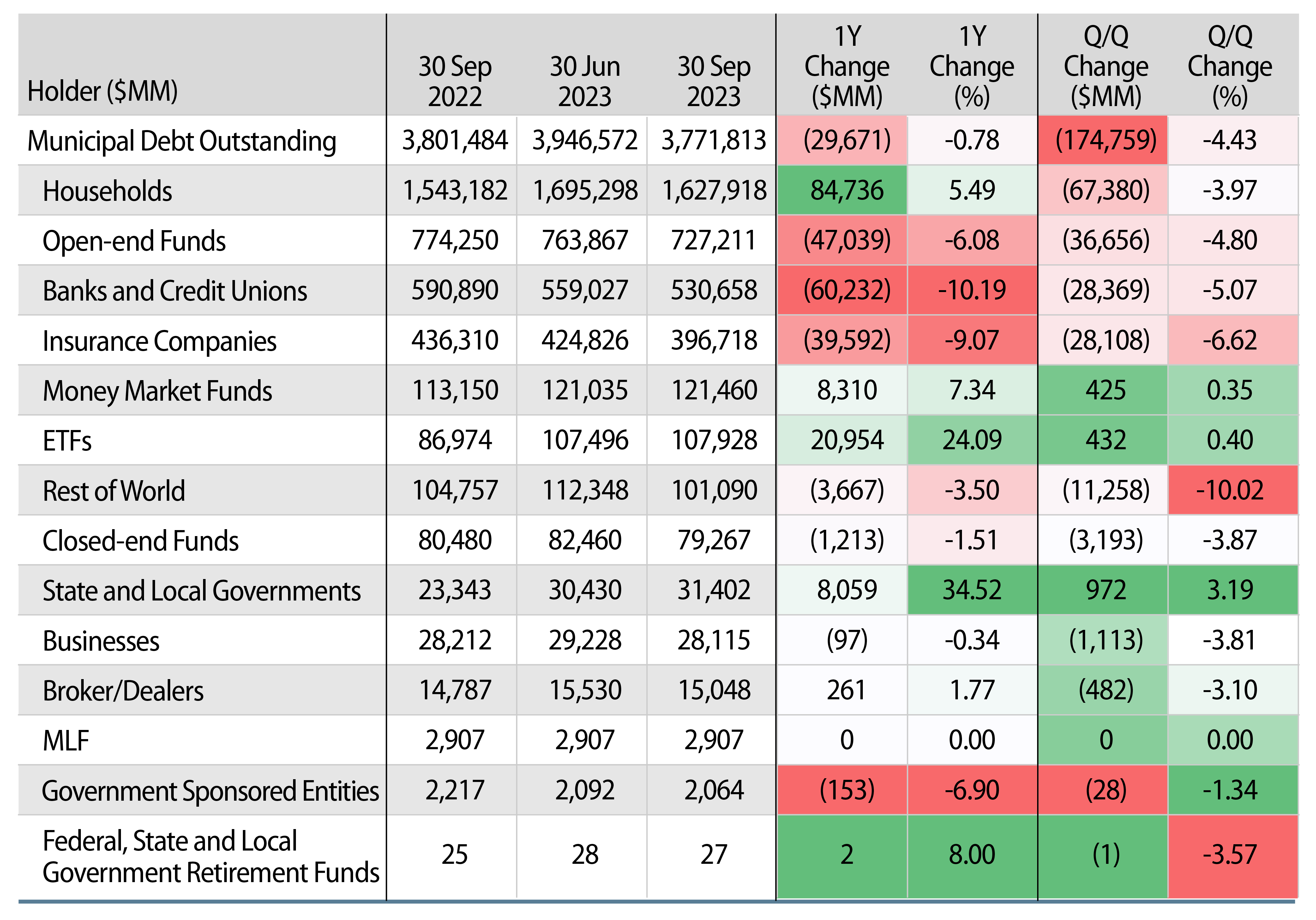

Last week the Federal Reserve released its quarterly report of holders of municipal debt for the 3Q23. According to the data, holdings of muni debt declined 4.4% in the third quarter to $3.8 trillion, a slightly greater decline from the -4.0% return of the Bloomberg Municipal Bond Index; this is an indication of negative net supply conditions observed over the year.

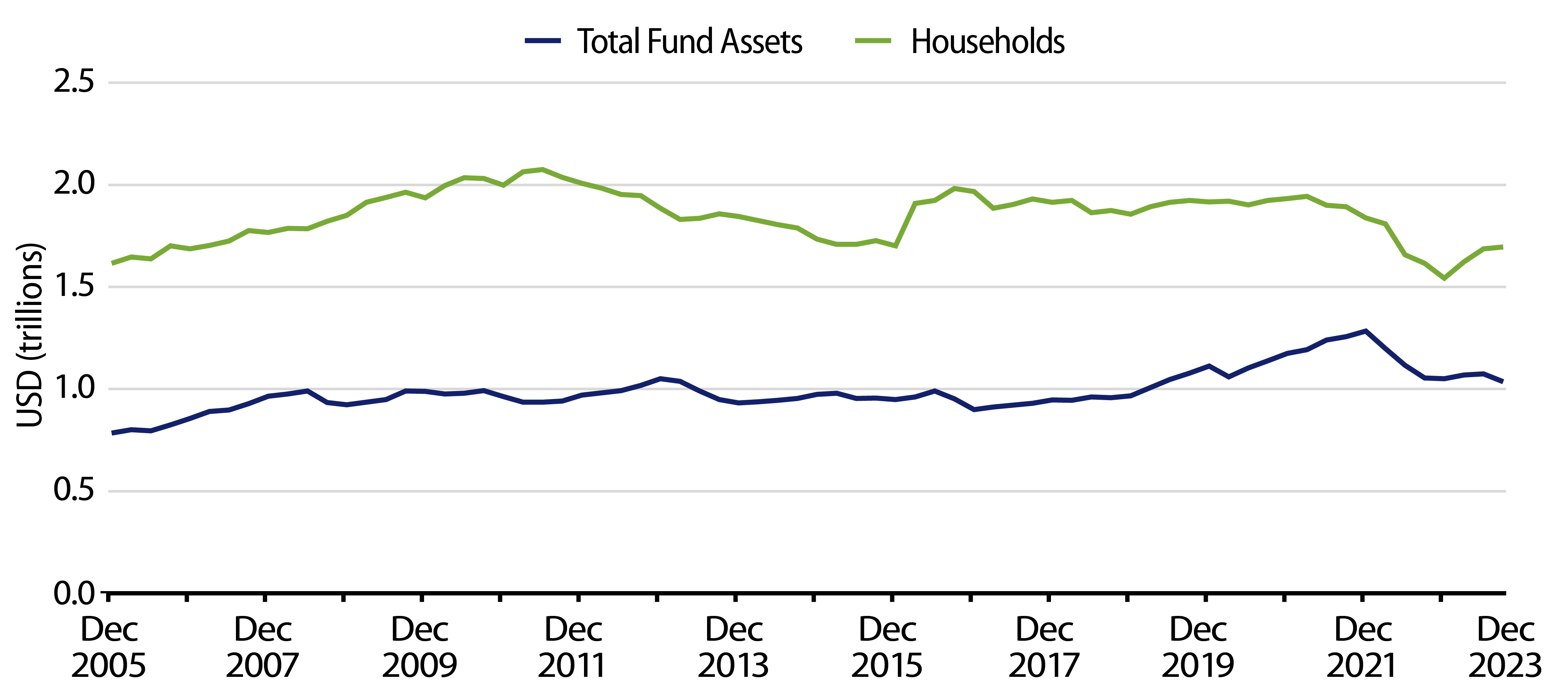

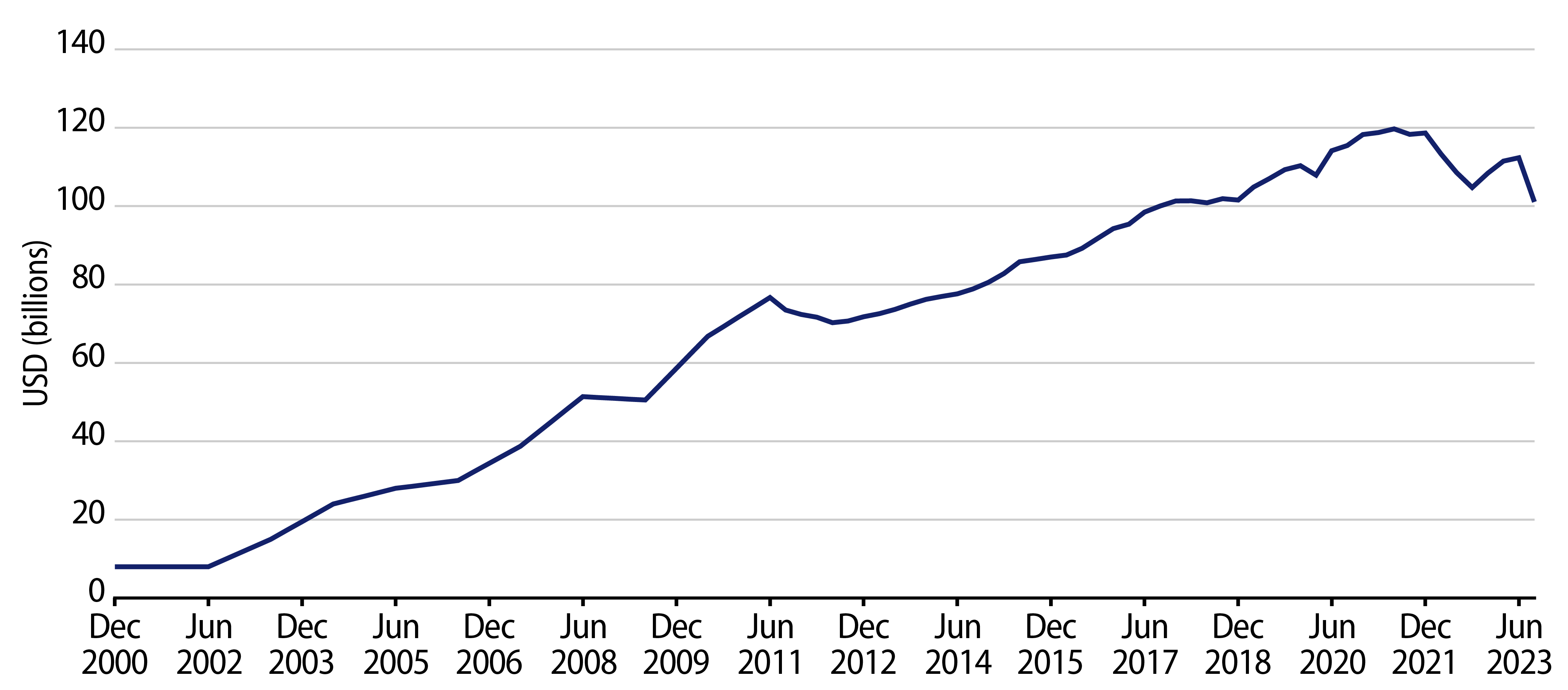

Major individual retail holders of municipal debt generally declined with the market during the quarter. Individual bondholders, including separately managed accounts, declined 4.0% to $1.6 trillion, in line with market declines during the quarter. Open-end fund assets declined $37 billion or 4.8%, which is greater than the market pace, as mutual funds recorded outflows in the quarter. Conversely, ETFs observed growth despite market declines, increasing 0.4% during the quarter to $108 billion. Municipal money market fund assets also observed growth as the inverted yield curve continued to attract capital to cash equivalents, growing $425 million over the quarter.

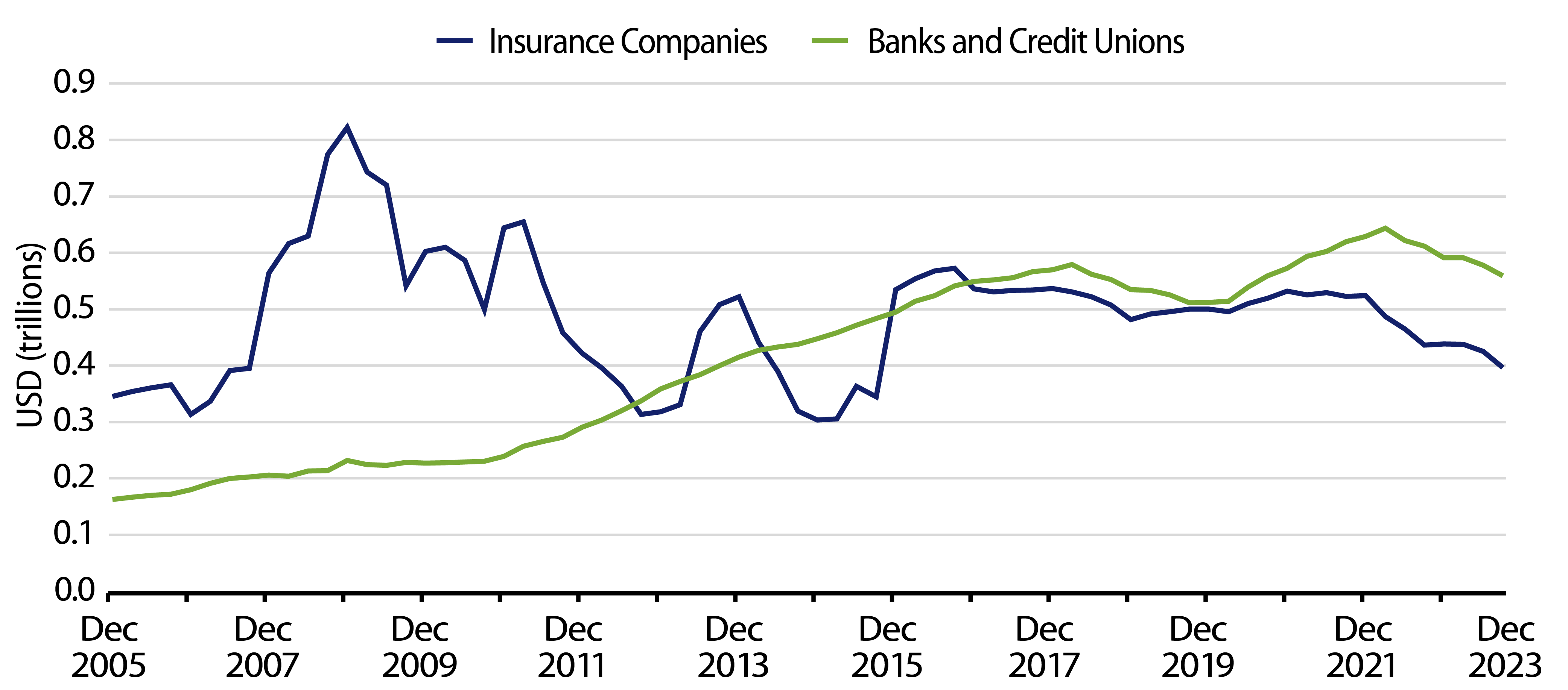

Among institutional holders of muni debt, banks and insurance companies continued a trend of muni asset declines over the quarter. Insurance company municipal assets declined 6.6% over the quarter while bank assets declined 5.0%. These asset declines can be attributed to the lower tax rates corporate entities now face following the 2017 Tax Cuts and Jobs Act, along with ongoing bank de-risking following the regional banking crisis earlier this year. Over the past year, bank and insurance company assets are down $100 billion (-9.7%).

Non-US municipal holders, typically of taxable municipal issuance, also declined at greater than market levels, at -10% or $11 billion in the third quarter. A combination of lower taxable municipal supply and higher hedging costs throughout the year contributed to lower demand from foreign investors.

The Fed holdings data highlights individual taxpayer demand growth at the expense of institutional demand, leading to greater market concentration associated with the retail muni buyer. Because of this greater demand concentration, along with the muni market’s structural liquidity dynamics (one million securities that might not trade daily), Western Asset expects municipals to be more susceptible to market volatility amid shifts in market sentiment. Western Asset also believes these liquidity challenges likely will continue to provide opportunities for an active manager to navigate mispricing that results from bouts of volatility.

Western Asset Key Themes for Muni Investors

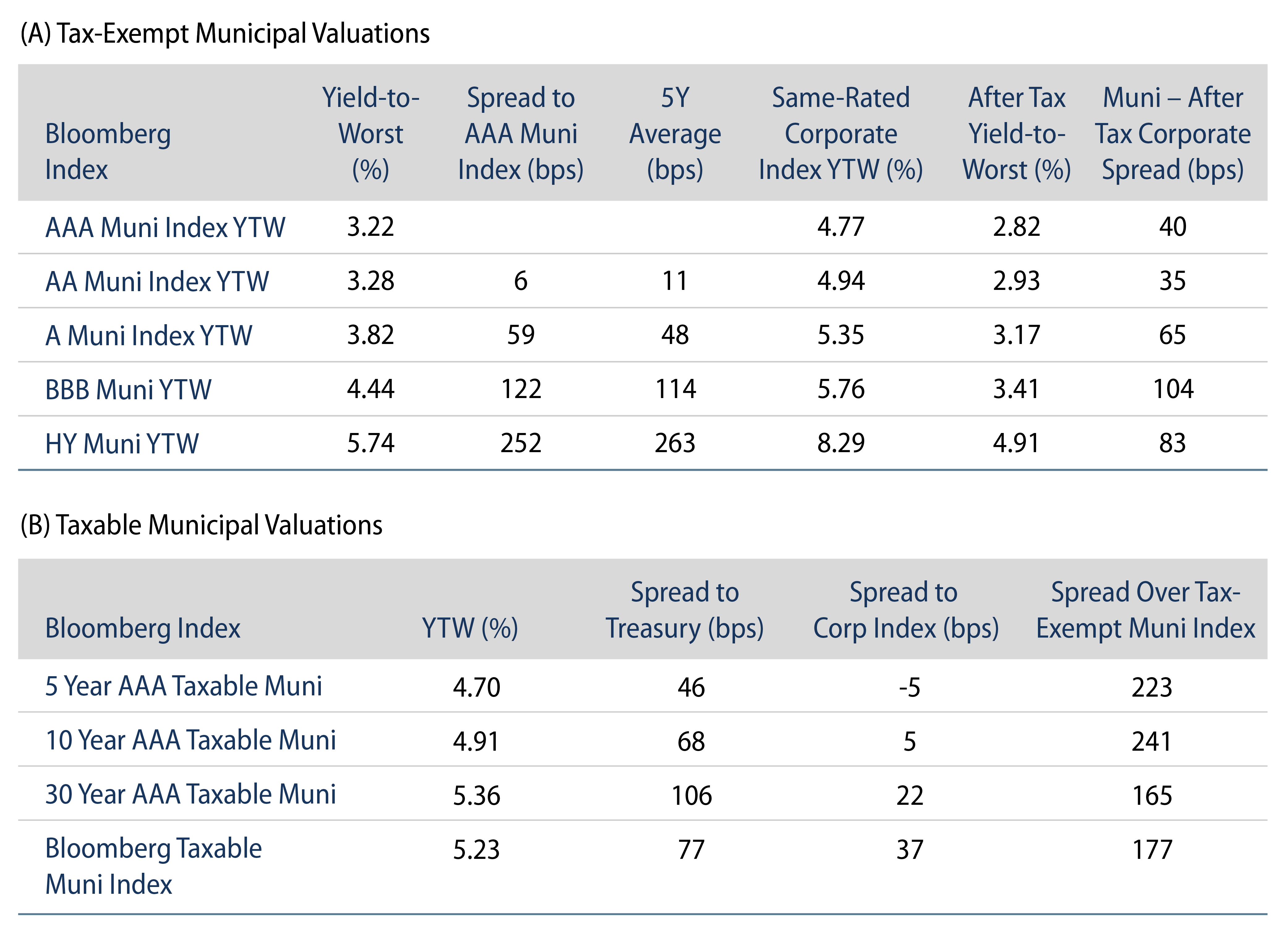

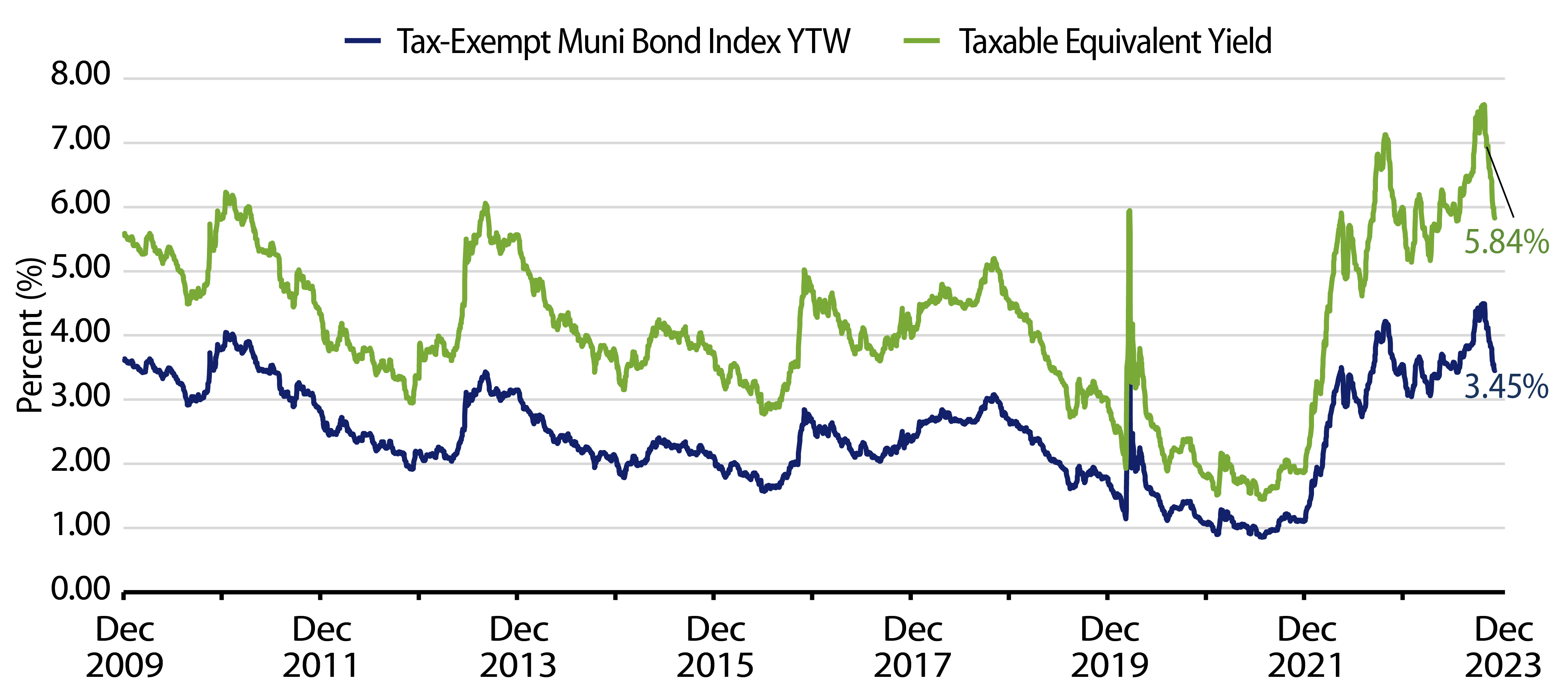

Theme #1: Despite the recent rally, municipal index yields and taxable equivalent yields are near decade highs.

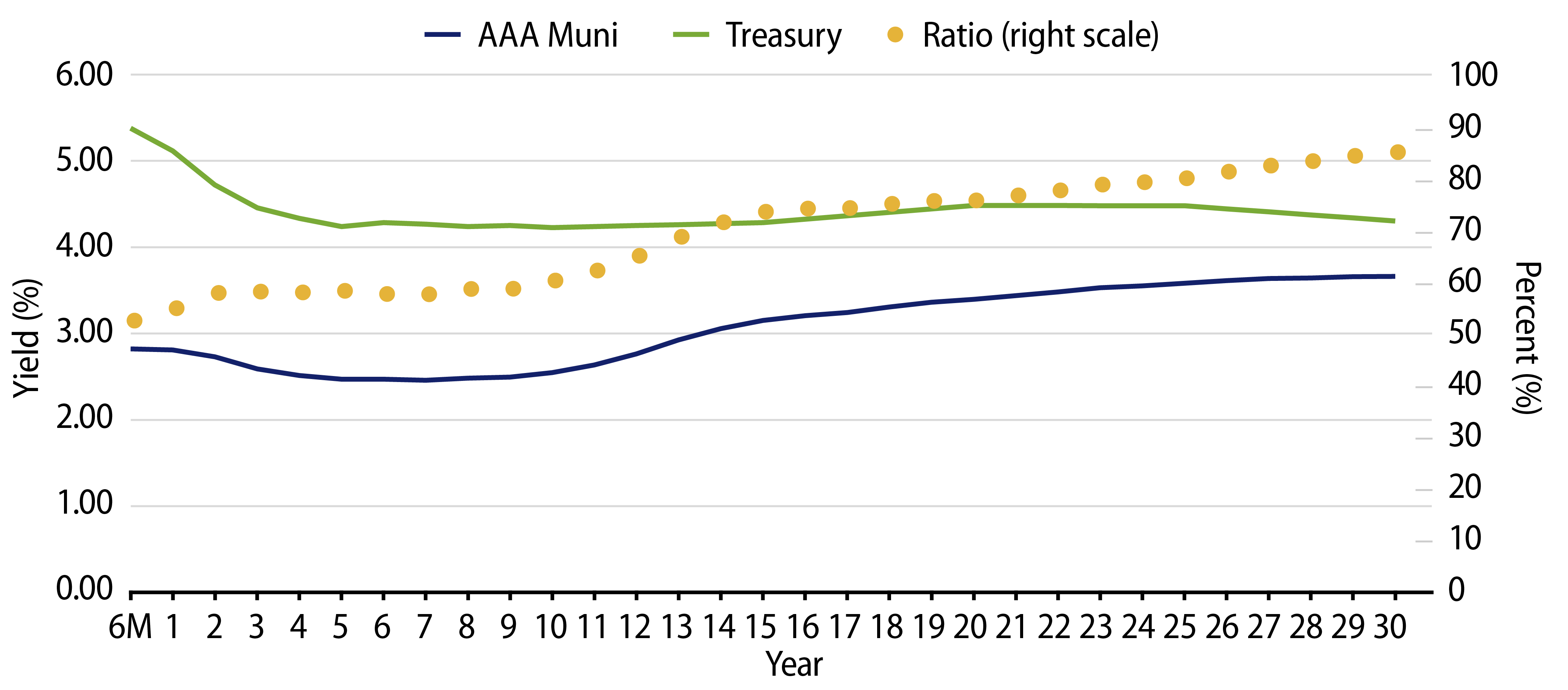

Theme #2: Recent disinversion of the muni yield curve offers better relative value out the curve.

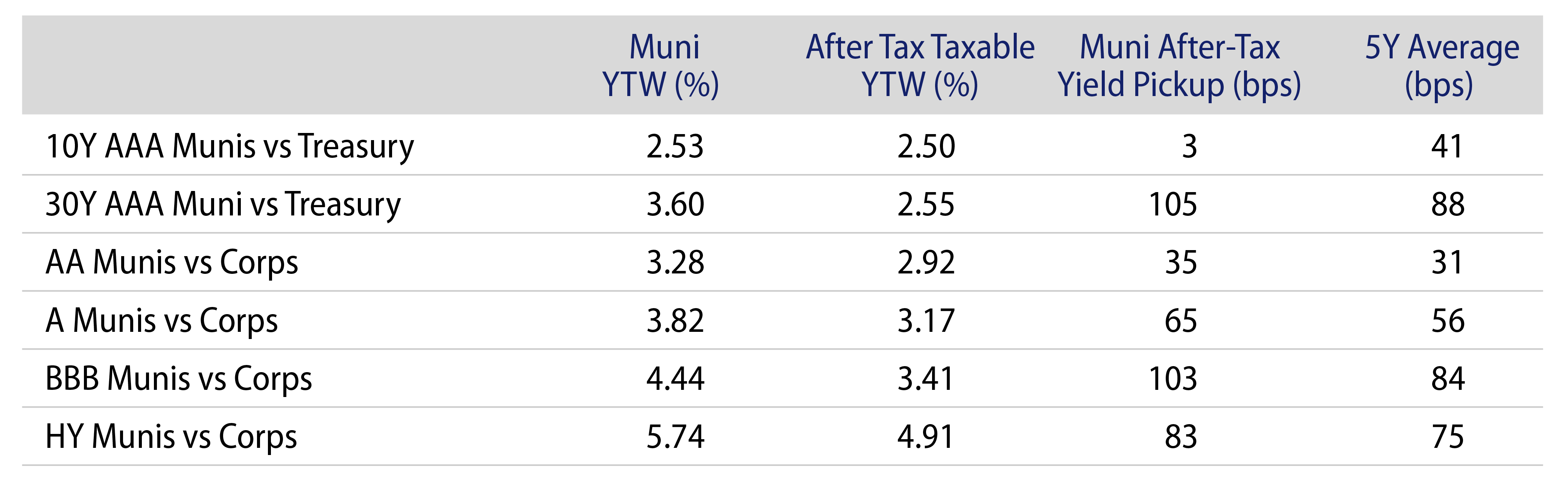

Theme #3: Munis offer attractive after-tax yield pickup versus Treasuries and corporate credit.