Munis Posted Negative Returns Last Week

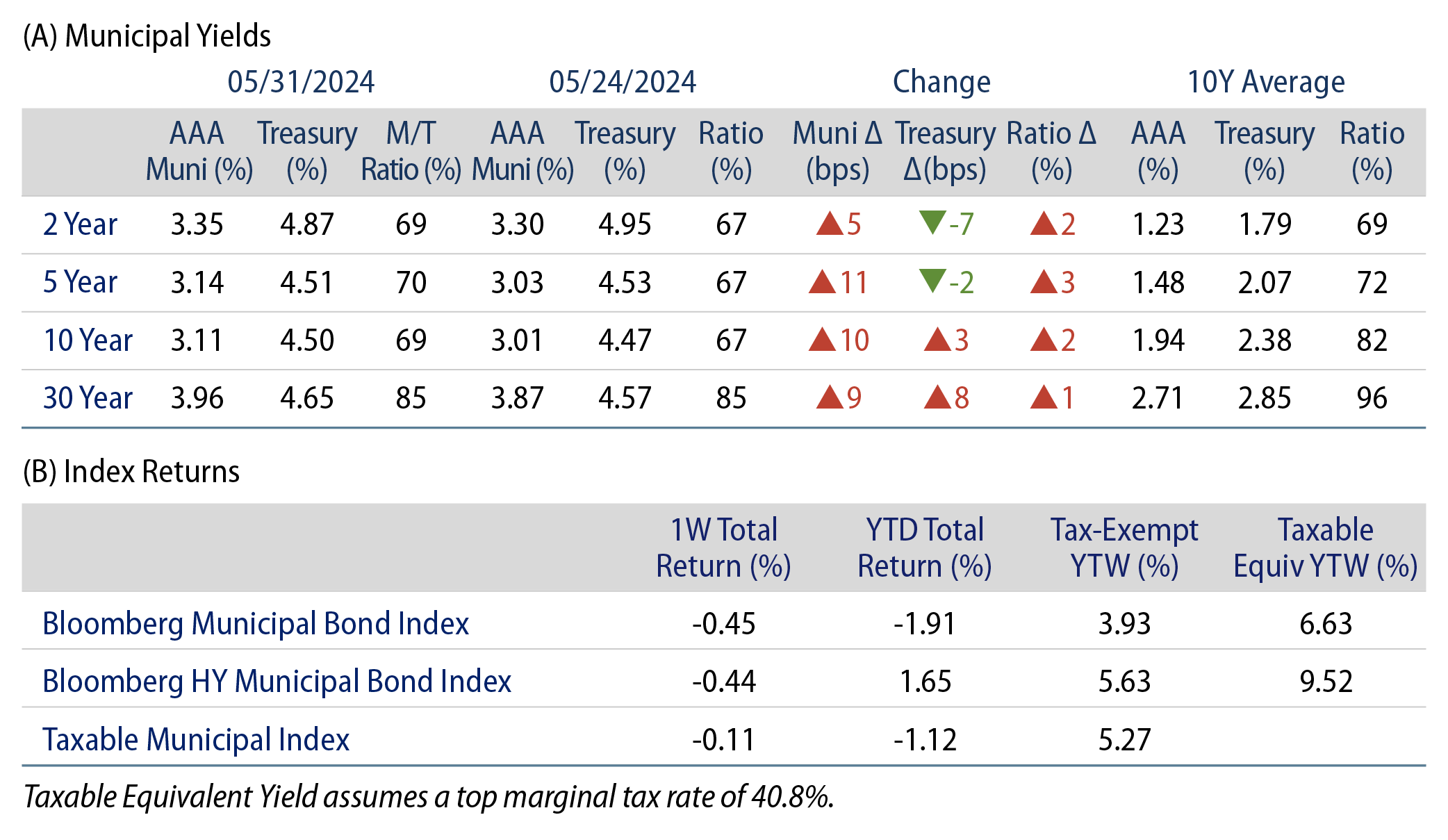

High-grade munis underperformed Treasuries last week due to weaker technicals as the Treasury curve steepened following hawkish early-week comments from Federal Reserve (Fed) officials. This was ultimately offset by downward revisions to 1Q24 GDP and lower-than-expected personal consumption and core Personal Consumption Expenditures (PCE) data. Muni yield changes were mixed across the curve while market technicals remained weak. The Bloomberg Municipal Index returned -0.45% during the week, the High Yield Muni Index returned -0.44% and the Taxable Muni Index returned -0.11%. This week we highlight the Illinois budget that was passed last week.

Technicals Remained Weak Around Fund Outflows and an Elevated New-Issue Calendar

Fund Flows: During the week ending May 29, weekly reporting municipal mutual funds recorded $89 million of net outflows, according to Lipper. Long-term funds recorded $32 million of outflows, intermediate funds recorded $45 million of outflows and high-yield funds recorded $70 million of inflows. Short-term funds recorded $19 million of inflows. This week’s outflows lead estimated year-to-date (YTD) net inflows lower to $10.5 billion.

Supply: The muni market recorded $6 billion of new-issue volume last week, down 55% from the prior week but still elevated for a holiday week. YTD issuance of $191 billion is 42% higher than last year’s level, with tax-exempt issuance 47% higher and taxable issuance 3% lower year-over-year. This week’s calendar is expected to pick back up to an elevated $15 billion. Largest deals include $829 million Metropolitan Washington Airport Authority and $700 million Commonwealth of Massachusetts transactions.

This Week in Munis: Illinois Passes Budget

Last week, the Illinois legislature passed a $53 billion budget for fiscal year (FY) 2025, underscoring a trend of credit improvement for the state that has been characterized by a recent track record of passing on-time budgets, higher-than-expected revenue collections, increasing rainy-day funds and addressing long-underfunded pension contributions.

The state’s FY25 spending plan is 5% higher than FY24 levels, with increased investment in universal pre-K education, as well as increased funding toward migrant services and health care initiatives. The budget fully funds its required pension contribution and adds $198 million to the state’s rainy-day fund, bringing its total to $2.3 billion. The spending bill includes $870 million of new tax measures, largely derived from raising the sports betting tax to 35% (from 15%).

The trend of on-time balanced budgets and underlying credit improvement has resulted in 12 positive ratings and outlook actions by S&P, Moody’s and Fitch since March 2020. This resulted in the state’s ratings moving from BBB-/Baa3 (Negative Outlook) to A-/A3 (Stable) from all three major rating agencies. Western Asset remains constructive on Illinois, though the state will still need to contend with elevated liabilities and fixed costs. Despite the starkly lower spreads from what was observed in 2020, the market is still pricing a concession to A rated municipal securities, presenting opportunities for those who believe the state can continue its upward credit momentum.

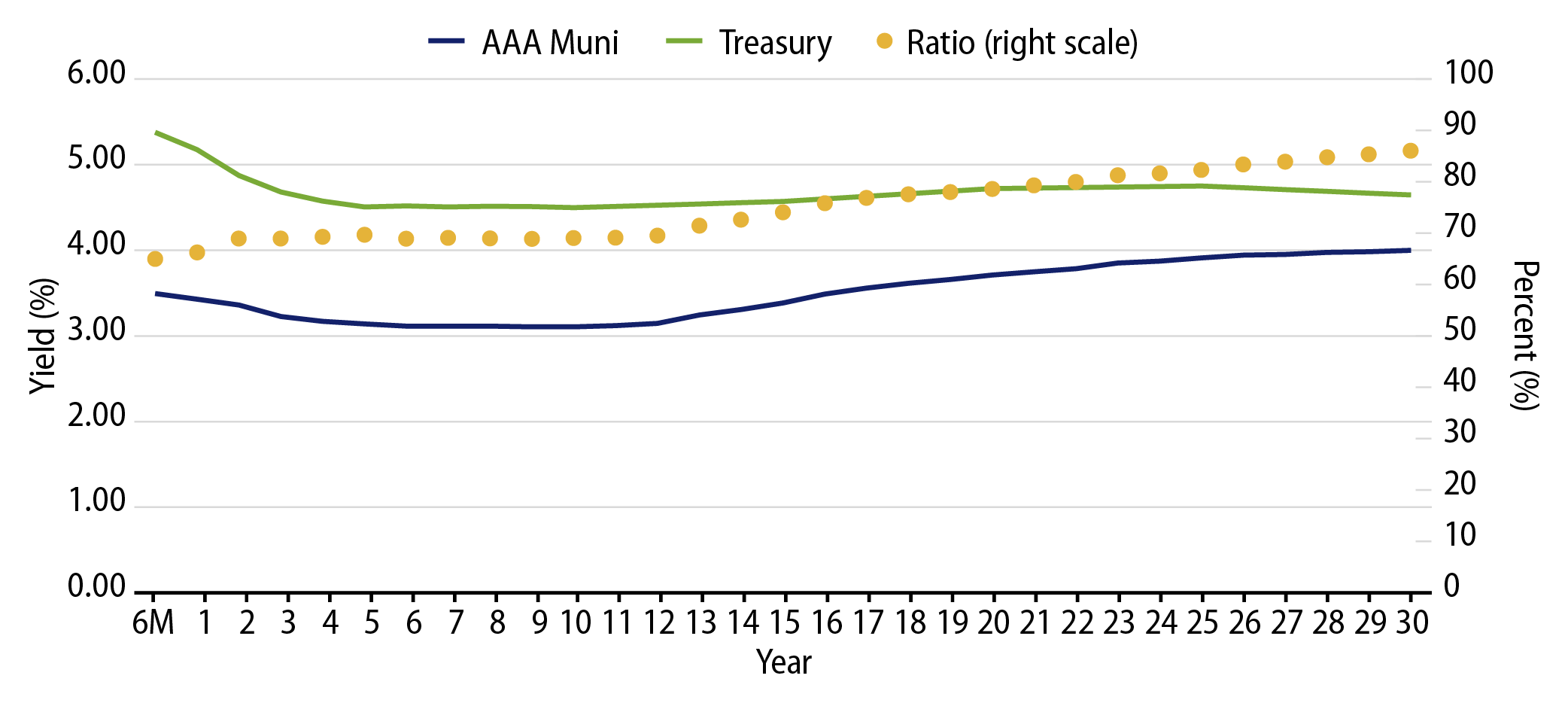

Municipal Credit Curves and Relative Value

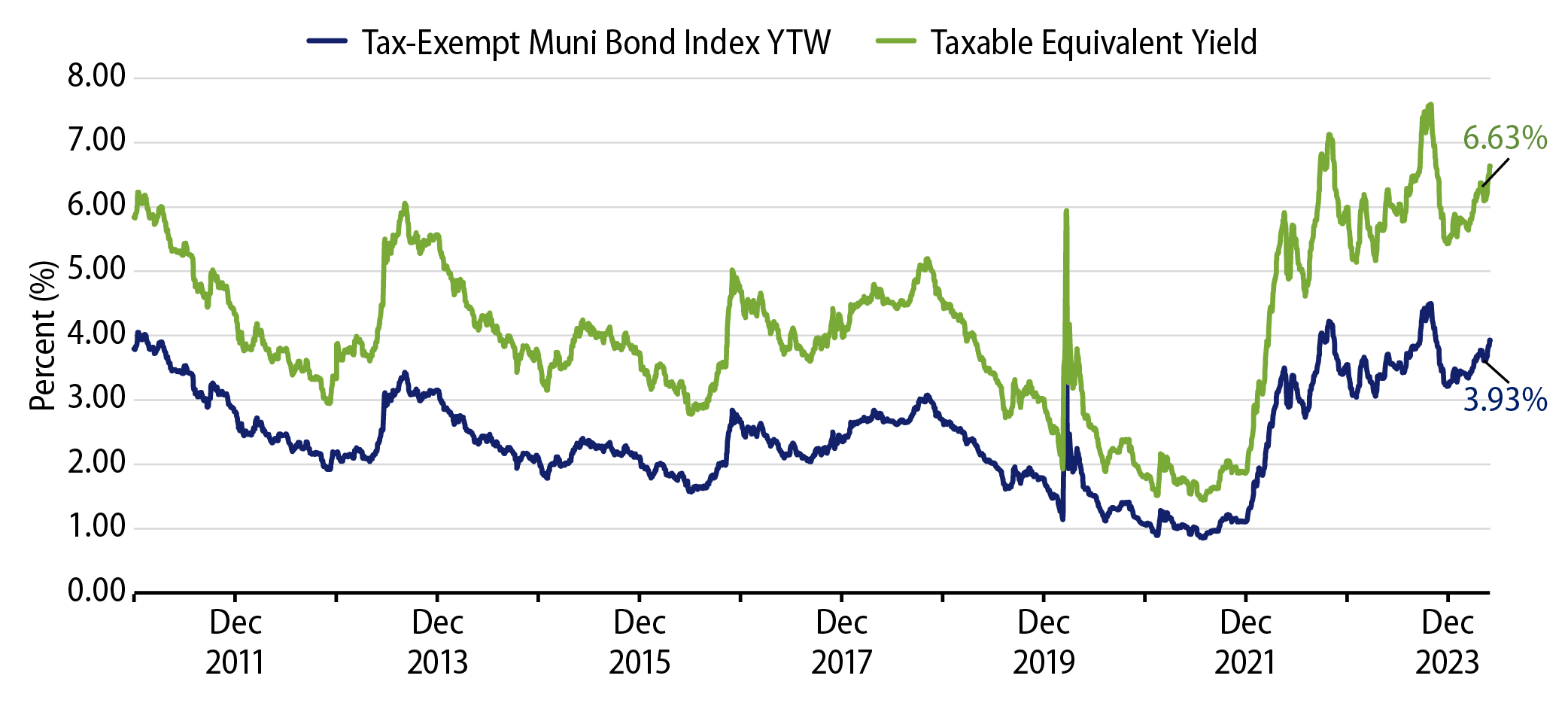

Theme #1: Municipal taxable-equivalent yields are above decade averages.

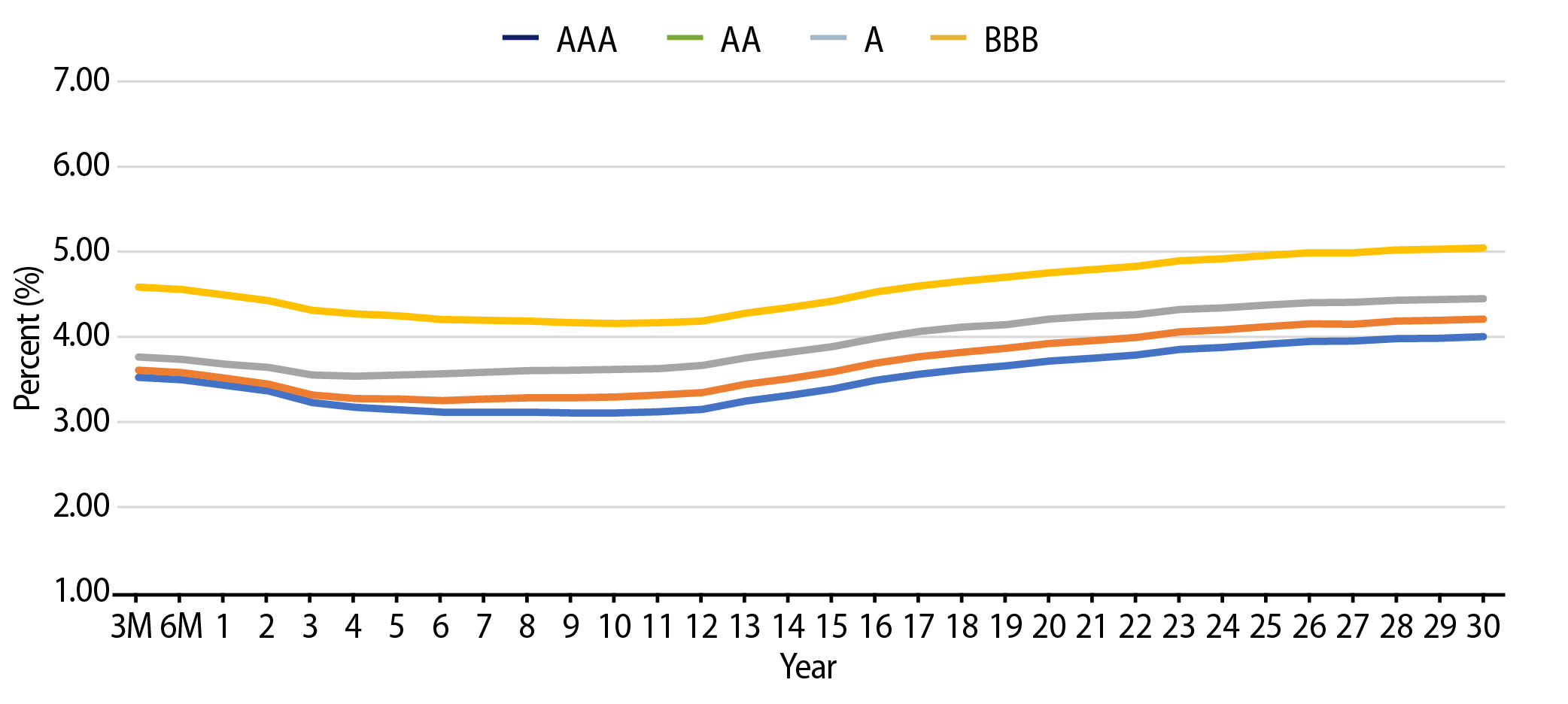

Theme #2: Recent underperformance in 5- and 10-year maturities has supported a modest curve disinversion.

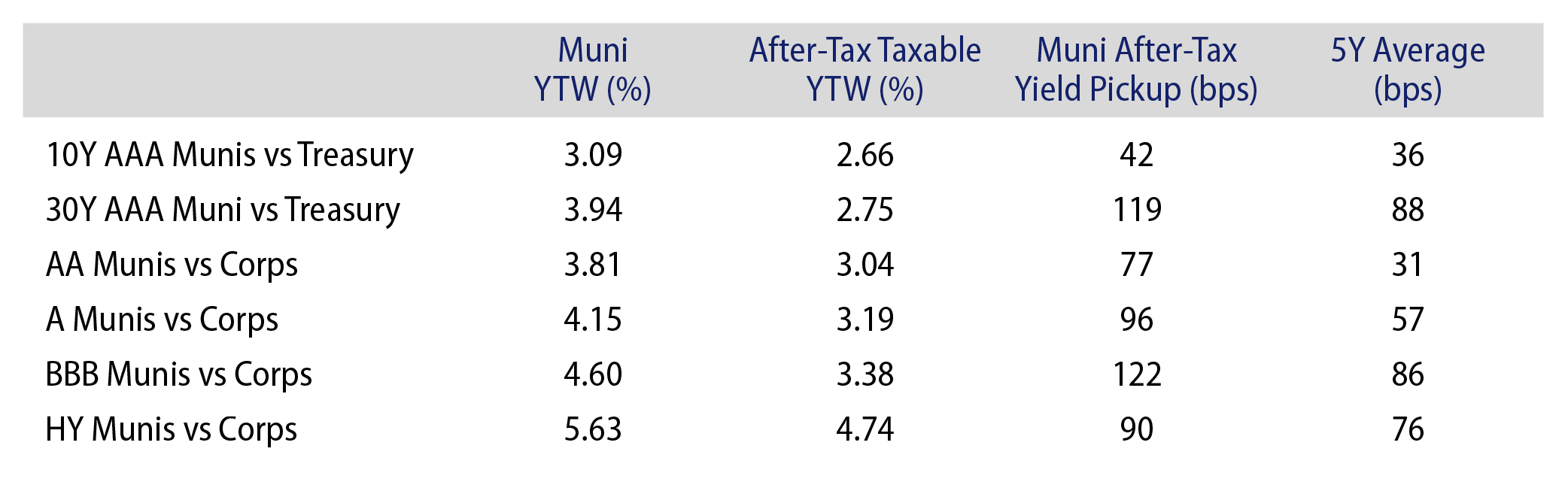

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.