Municipals Posted Negative Returns During the Week

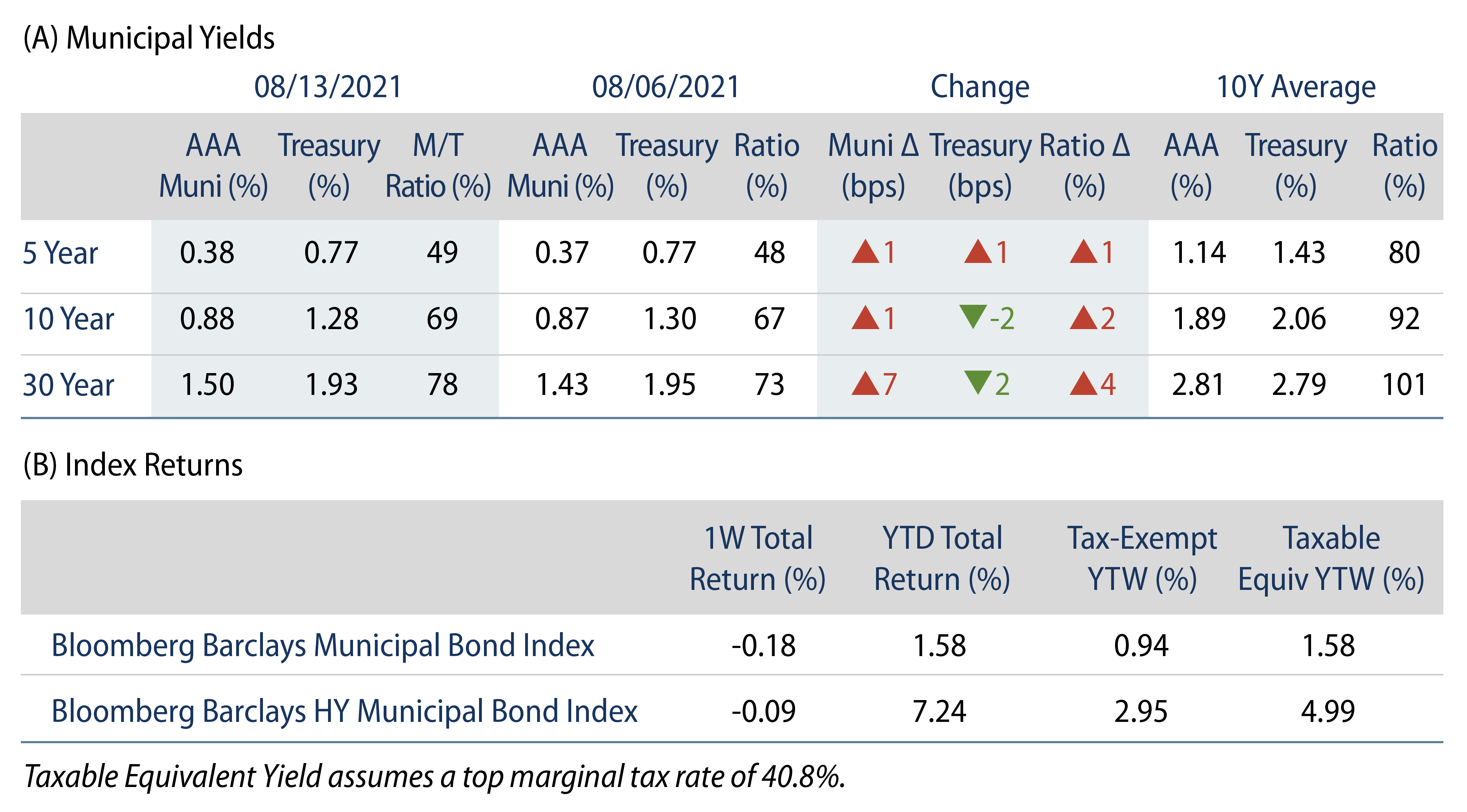

AAA muni yields moved higher across the curve, which continued to steepen; yields moved 1 bp higher in 5-years and 7 bps higher in 30-years. US munis underperformed Treasuries across the curve, as Muni/Treasury ratios moved 1% to 4% higher. The Bloomberg Barclays Municipal Index returned -0.18%, while the HY Muni Index returned -0.09%. Technicals remain strong as municipal mutual fund flows maintain a record pace. This week, we evaluate developments associated with the bipartisan infrastructure bill advanced by the Senate.

Fund Flows Extend Record Pace

Fund Flows: During the week ending August 11, municipal mutual funds recorded $1.9 billion of net inflows. Long-term funds recorded $1.1 billion of inflows, high-yield funds recorded $493 million of inflows and intermediate funds recorded $287 million of inflows. Municipal mutual funds have now recorded inflows 64 of the last 65 weeks, extending the record inflow cycle to $139 billion, with year-to-date (YTD) net inflows also maintaining a record pace of $77 billion.

Supply: The muni market recorded $8.5 billion of new-issue volume during the week, down 11% from the prior week. Total issuance YTD of $279 billion is 9% higher from last year’s levels, with tax-exempt issuance trending 18% higher year-over-year (YoY) and taxable issuance trending 12% lower YoY. This week’s new-issue calendar is expected to keep pace at $9.6 billion of new issuance. The largest deals include $1.2 billion County of Miami Dade Seaport and $1.2 billion New York Liberty Development Corporation transactions.

This Week in Munis—Infrastructure Progress: PABs Not BABs

On August 10, the Senate advanced the bipartisan infrastructure bill, with 69 votes in favor and 39 votes against the measure. Updated from the original proposal highlighted in our June blog, the Senate-approved Infrastructure Investment and Jobs Act includes approximately $550 billion in federal investment across roads and bridges, water utilities, infrastructure resilience and broadband measures. The majority of the legislation is focused on physical infrastructure measures, with transportation initiatives comprising $284 billion of the package.

Notably, the current legislation does not include tax increases, but does include unspent emergency relief funds, corporate user fees, strengthened cryptocurrency tax enforcement, the spectrum 5G broadband auctions and economic growth to fund the infrastructure measures.

Despite efforts to include direct-pay federally subsidized taxable issuance as a means of funding the proposals, similar to the 2009-2010 Build America Bonds (BABs) program, direct-pay taxable municipal securities are not part of the Senate-approved bill. However, the bill does call for a $16 billion expansion of tax-exempt private activity bonds (PABs), which would equate to approximately 5% of 2020 tax-exempt issuance levels. Additionally, with maximum federal funding levels as low as 50% for certain projects, we anticipate this could bolster traditional tax-exempt muni supply to fund the projects that do not receive full federal funding.

While progress continues, we have always expected any bipartisan measure that would make it through the Senate to be met with strong resistance from the House. We have already observed key members of the Progressive Caucus speak against the current legislation in its current format. Ultimately, we anticipate a pared-back resolution likely in the fourth quarter, and a more moderate headline figure could have even less of an impact on the muni market than the current proposal outlines.