Investment-Grade Municipals Posted Negative Returns Last Week

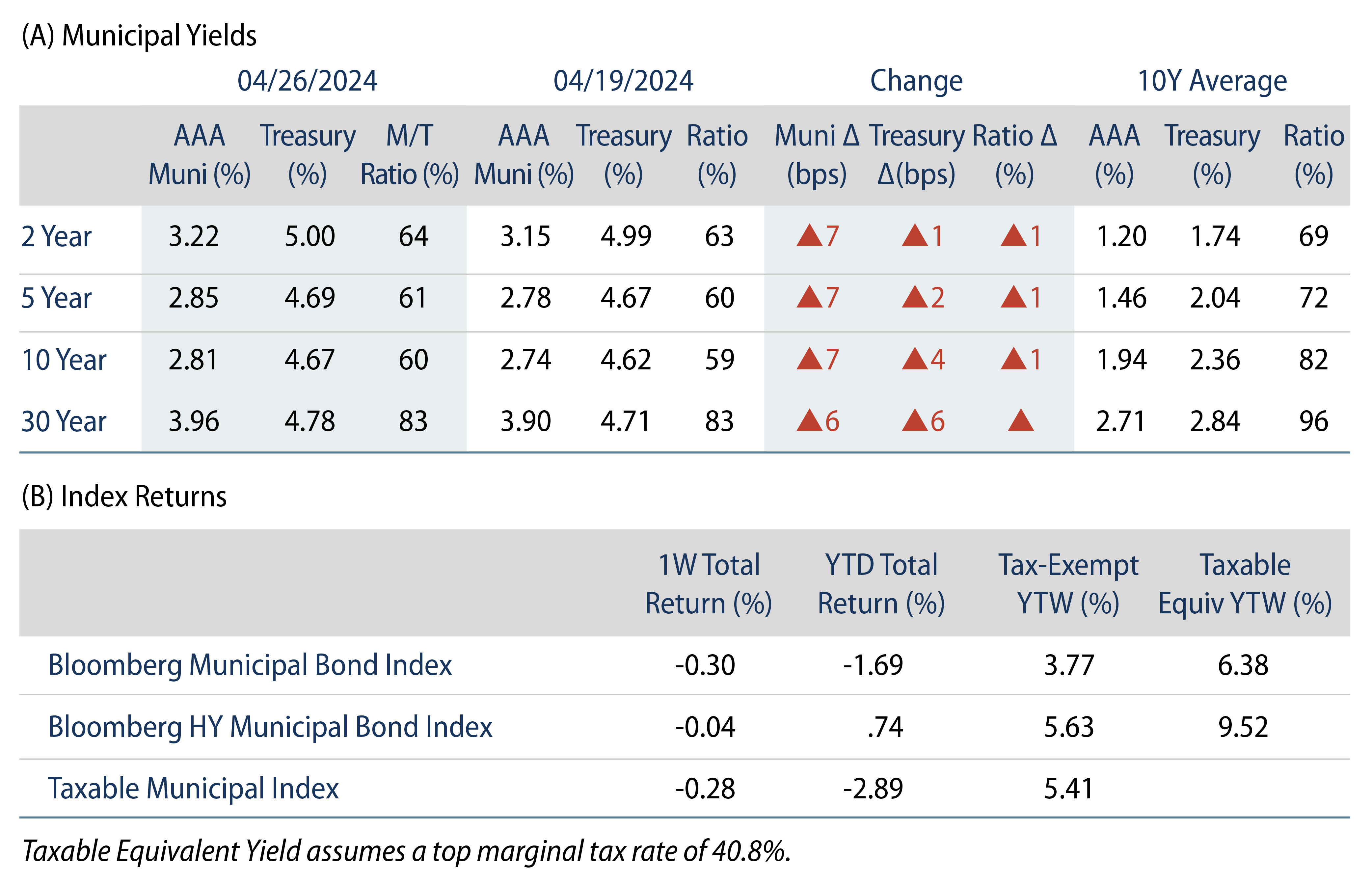

Investment-grade munis posted negative returns last week as high-grade muni yields moved higher across the curve. Muni technicals were challenged due to elevated supply levels. The weaker technical factors contributed to muni underperformance versus Treasuries, as yields moved higher on strong durable goods data, personal spending data and steady core inflation, as measured by the Personal Consumption Expenditures (PCE) price index. The Bloomberg Municipal Index returned -0.30% during the week, the High Yield Muni Index returned -0.04% and the Taxable Muni Index returned -0.28%. This week we highlight potential challenges faced by popular municipal ladder strategies.

Technicals Were Relatively Weak Amid a Heavy New-Issue Calendar

Fund Flows: During the week ending April 24, weekly reporting municipal mutual funds recorded $200 million of net inflows, according to Lipper. Long-term funds recorded $236 million of inflows, intermediate funds recorded $39 million of inflows and high-yield funds recorded $83 million of inflows. Short-term funds recorded $61 million of outflows. This week’s inflows lead estimated year-to-date (YTD) net inflows lower to $9.4 billion.

Supply: The muni market recorded $15 billion of new-issue volume last week, up 72% from the prior week. YTD issuance of $139 billion is 41% higher than last year’s level, with tax-exempt issuance 51% higher and taxable issuance 26% lower year-over-year. This week’s calendar is expected to fall to $6 billion. Largest deals include $1.9 billion Novant Health and $650 million NY/NJ Port Authority transactions.

This Week in Munis: Languishing Ladder Opportunities

For much of the past decade the municipal ladder separately managed account (SMA) solution served as a cost-effective vehicle to provide consistent income and a higher yield investment. A conventionally upward sloping yield curve also provided price support from the roll-down effect and consistent reinvestment at higher yields, underpinning the value proposition of ladder strategies. However, recent inflation-driven rate volatility has created new challenges for ladder mandates.

The increase in interest rates observed in 2022 and 2023 has driven greater demand for tax-loss harvesting within muni SMA mandates. Many ladder strategies, which typically involve buying and holding bonds to maturity, encountered new municipal liquidity concerns as investors sought to realize losses on securities not initially intended for sale. Tax loss harvesting can be a key advantage of SMA mandates; however, investors should be aware that returns could be further diminished by market liquidity challenges.

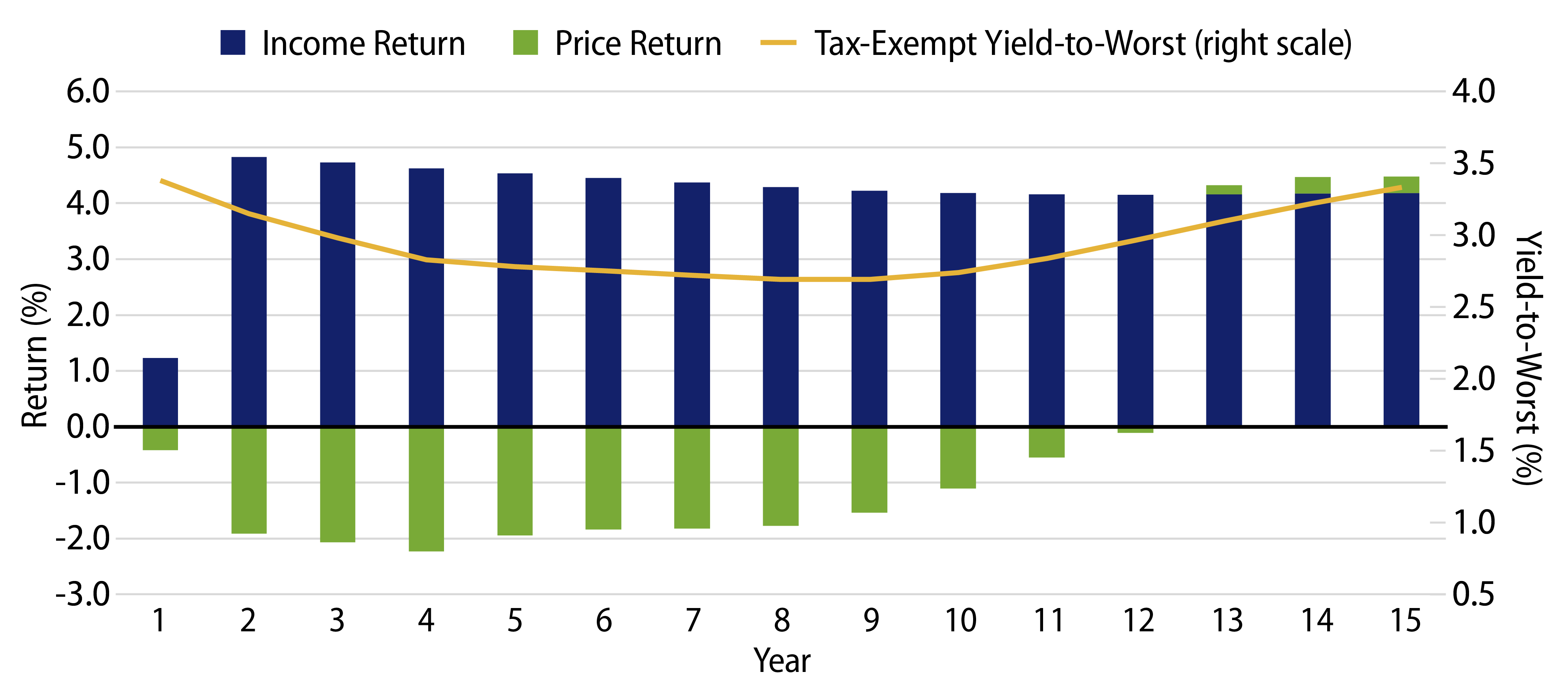

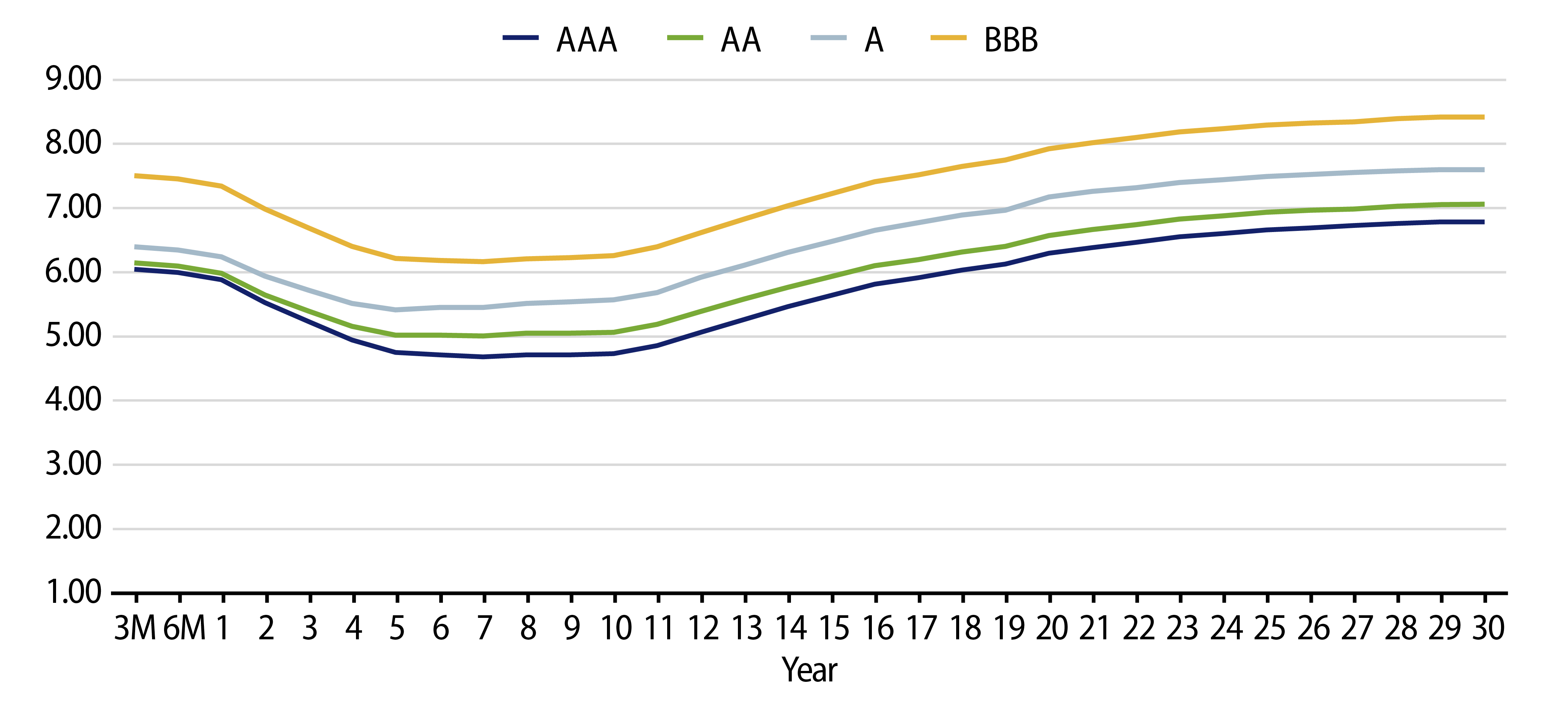

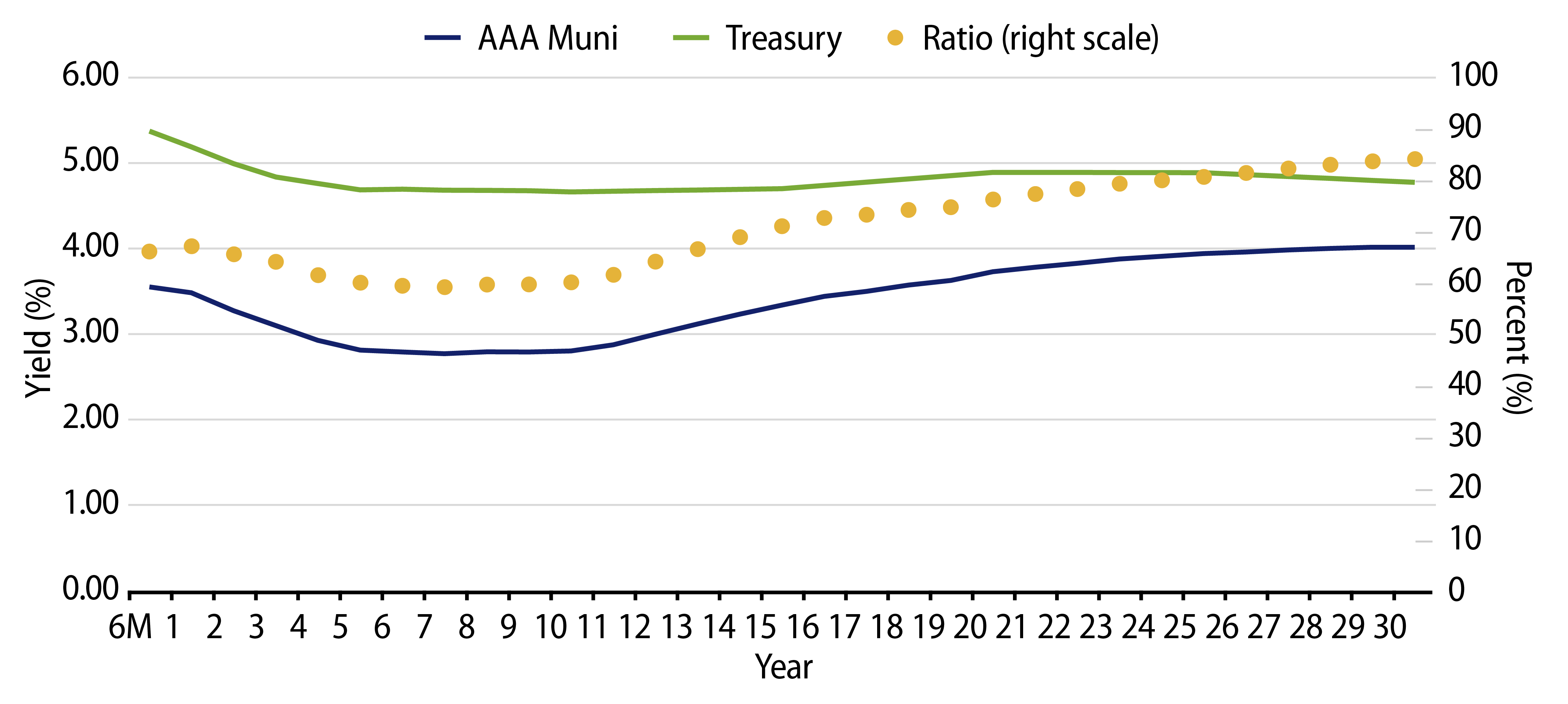

The significant inversion of the municipal yield curve has also limited the income and return potential of ladder structures, which seek to allocate a bond in every year. From an income perspective, the average yield to worst (YTW) of AAA securities within 5-9 years is 2.73%, nearly 50 basis points (bps) lower than the yields within 0-5 years. While a traditional upward sloping yield curve provides the benefit of carry plus the “roll-down” price advantage, the significant and persistent yield curve inversion has contributed to a “roll-up” price disadvantage. All else being equal, an investor who invests in a 4-year municipal bond may expect a -2.23% price return and a 2.39% total return.

While muni investors have turned to ladders over the past decade to minimize costs in a low interest rate environment, Western Asset believes current market conditions underscore the benefit of active management, even within SMA portfolios. Certain market environments may favor a ladder-like allocation, and some investors may even prefer to forego the economic benefits of an active allocation for more predictable cash flows, but we believe those who maintain the flexibility to invest across the curve will be better positioned to capitalize on the risk-adjusted return opportunities that market conditions can present.

Municipal Credit Curves and Relative Value

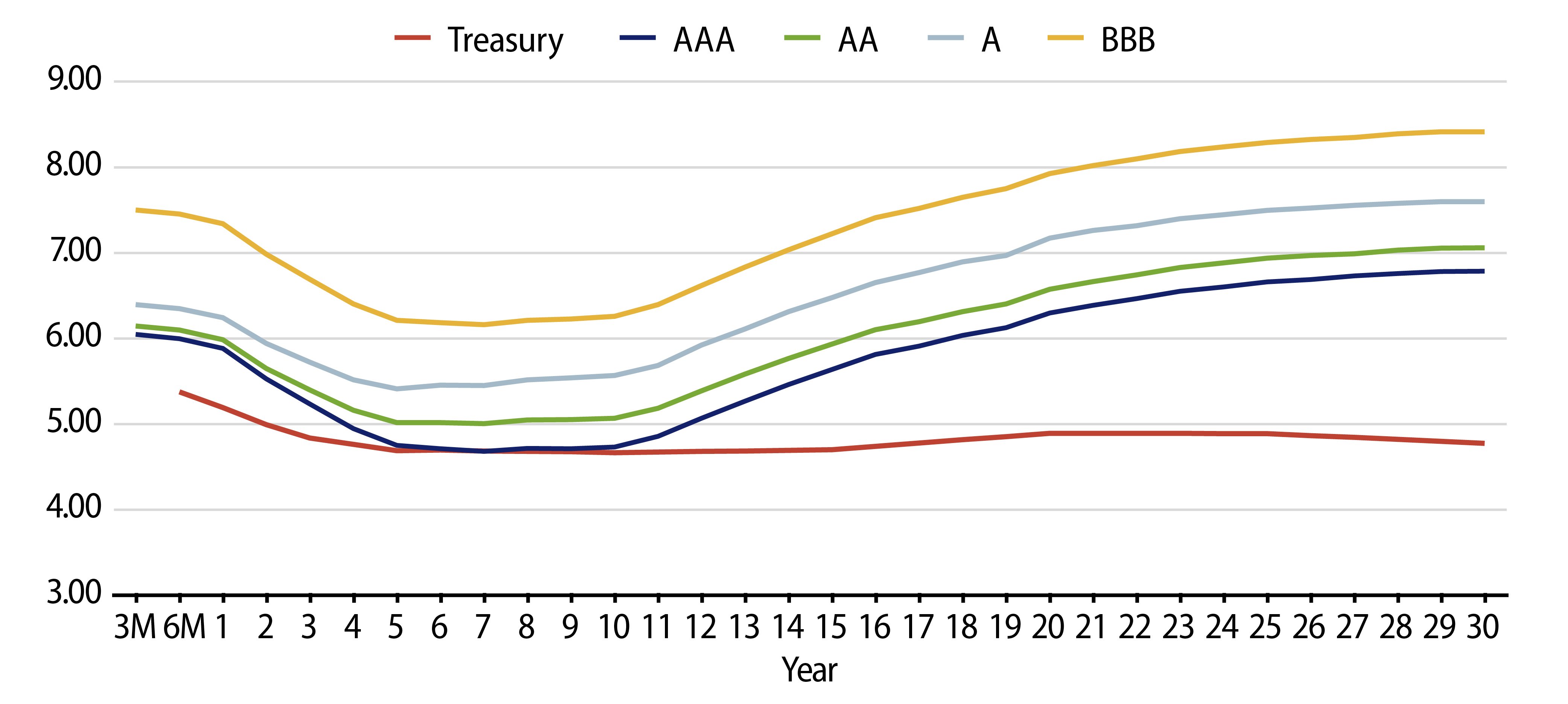

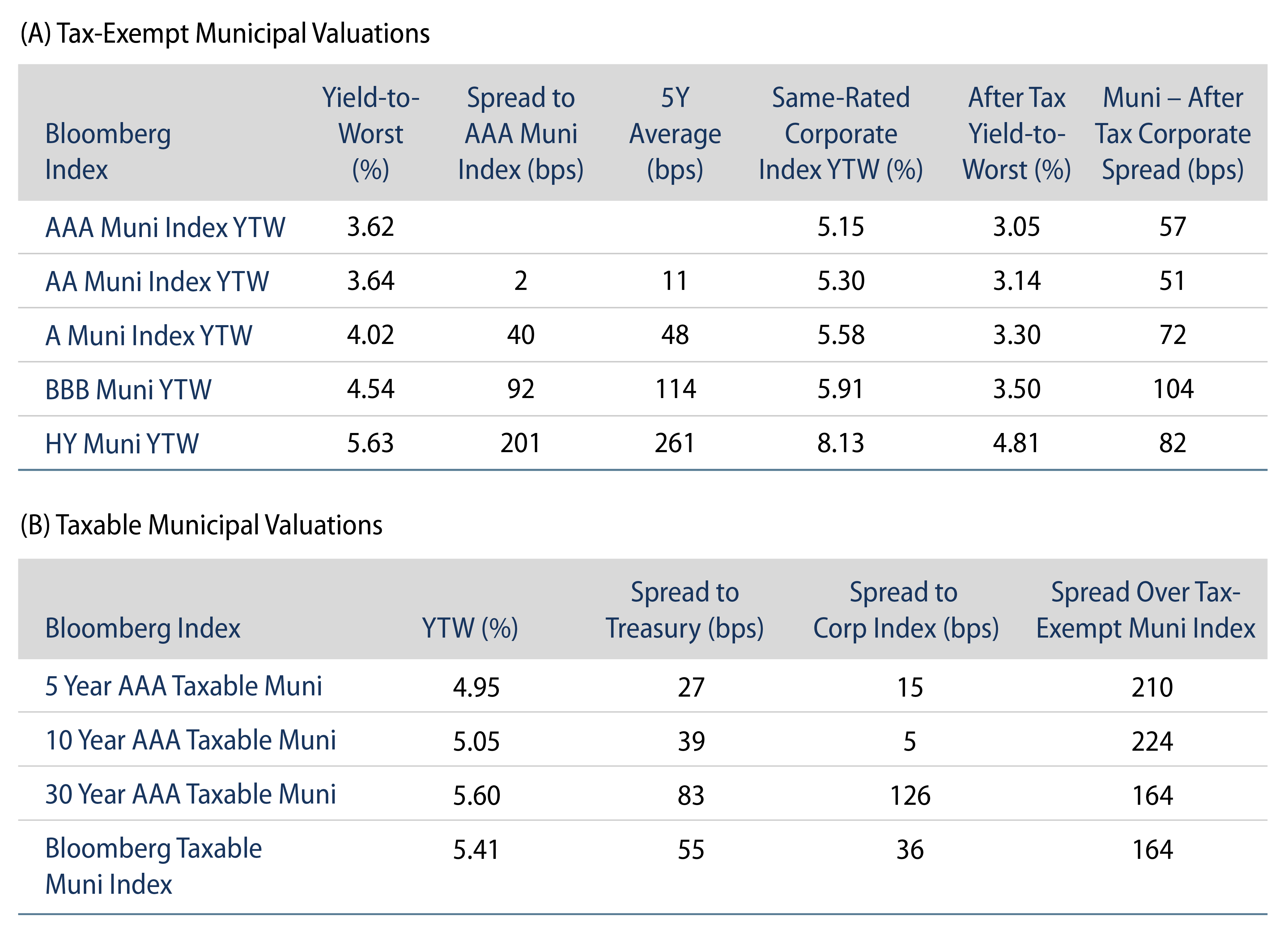

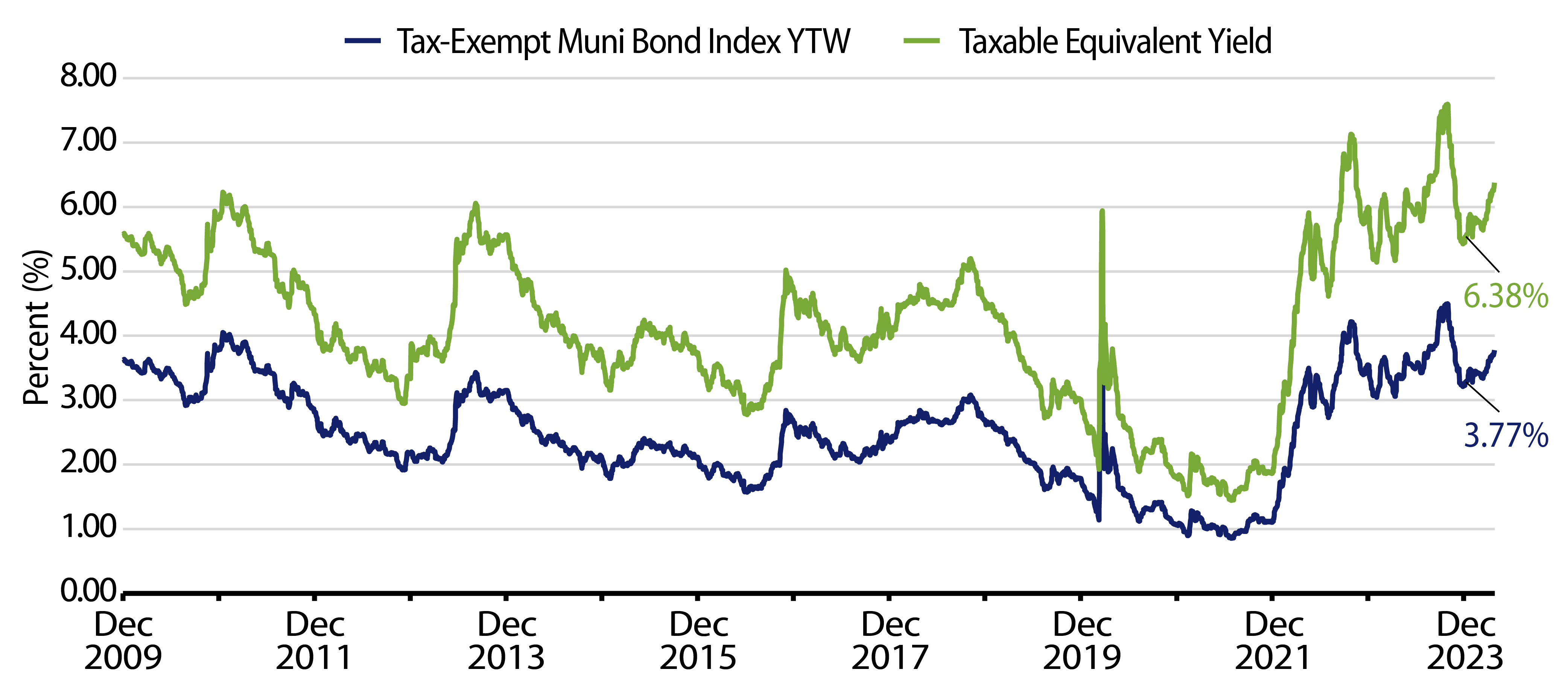

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: The inverted yield curve suggests less relative value in 5- and 10-year maturities.

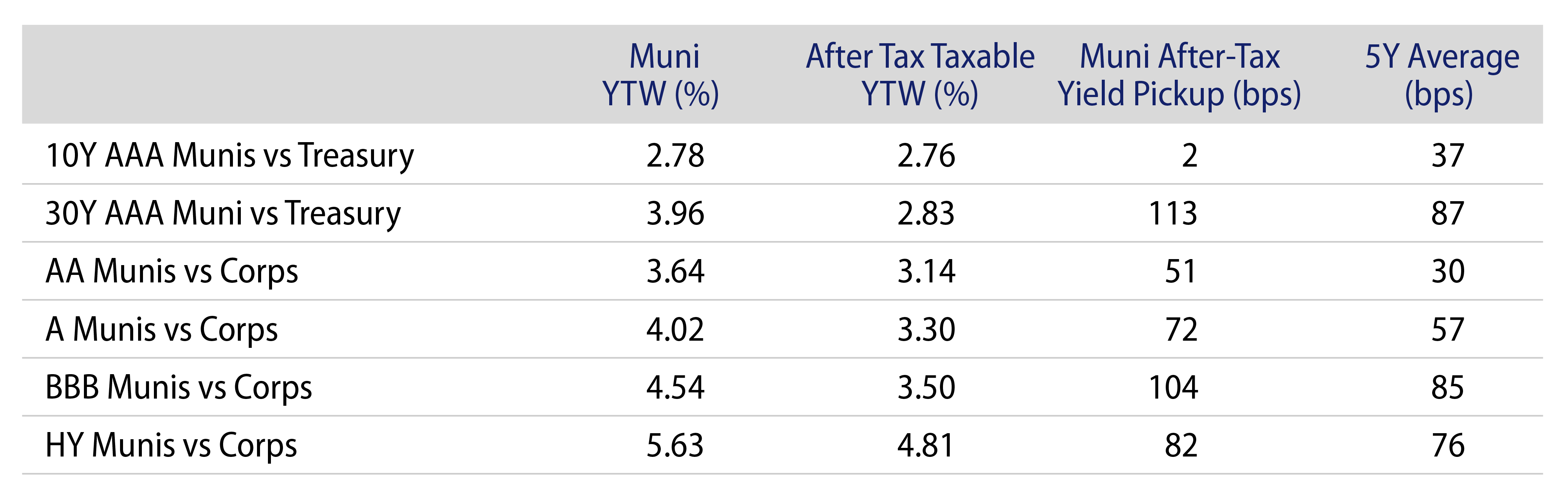

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.