Tax-Exempt Municipals Posted Positive Returns

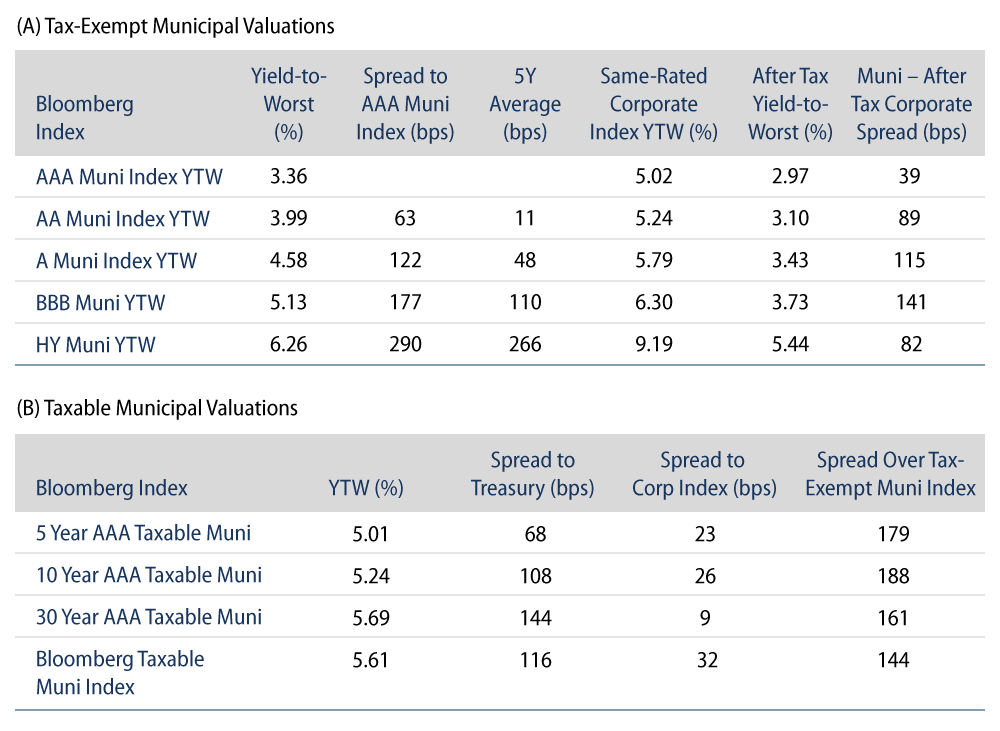

Tax-exempt municipals posted positive returns last week and municipals outperformed the Treasury selloff as Muni/Treasury ratios moved lower across the curve. High-grade municipals moved 1-6 bps lower across the curve. Technicals remained challenged as weekly fund outflows continued. The Bloomberg Municipal Index returned +0.42%, the HY Muni Index returned +0.12%, while taxable munis posted negative returns of -1.09%. This week we highlight the scope of bond ballot initiatives in the upcoming midterm election.

Technicals Remained Weak as Weekly Fund Outflows Continue

Fund Flows: During the week ending November 2, weekly reporting municipal mutual funds recorded $2.4 billion of net outflows, according to Lipper. Long-term funds recorded $1.3 billion of outflows, high yield funds recorded $867 million of outflows and intermediate funds recorded $440 million of outflows. Combined weekly and monthly reporting funds recorded net inflows of $926 million, reducing year-to-date (YTD) outflows to $104 billion.

Supply: The muni market recorded $3.5 billion of new-issue volume last week, down 61% from the prior week. Total YTD issuance of $324 billion remains 16% lower than last year’s levels, with tax-exempt issuance trending 5% lower year-over-year (YoY) and taxable issuance trending 52% lower YoY. This week’s new-issue calendar is expected to remain low at $4 billion. Larger deals include $617 million JobsOhio Beverage System (Citigroup, Inc) and $500 million South Carolina Public Service Authority (Santee Cooper) transactions.

This Week in Munis: Midterm Tax Proposals

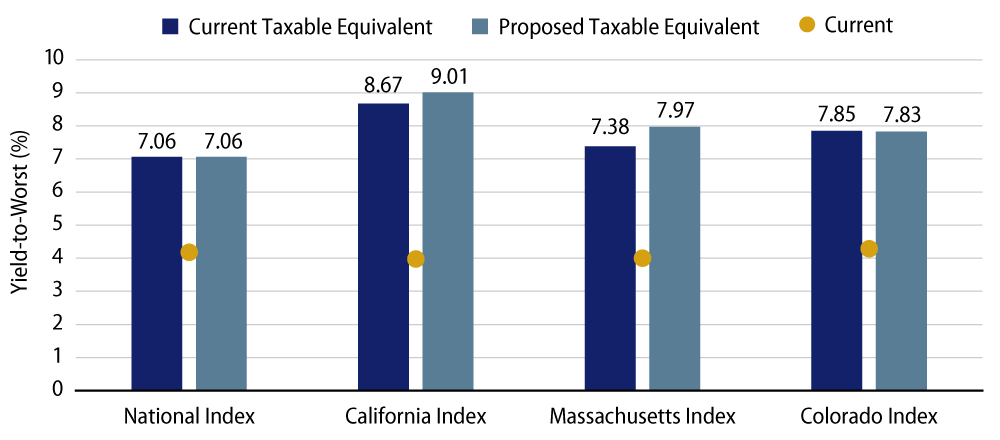

Following last week’s note on bond initiatives on the ballot, this week we explore tax policy initiatives that could impact state and local tax collections and after-tax relative valuations for municipal investors. This midterm election cycle, California and Massachusetts are proposing tax increases, while Colorado and West Virginia are proposing tax reductions, as follows:

Tax Hikes

- California’s Proposition 30 would raise the personal income tax on annual earnings above $2 million starting in 2023 by 1.75%. The annual revenue collected is estimated between $3 billion to $5 billion and would impact 0.2% of California tax filers. Of the revenues collected, 80% would be used to help individuals, businesses and governments pay for zero-emissions vehicles, as well as to install and operate vehicle charging stations. The remaining funds would support wildfire protection and prevention. The proposal would raise the state’s top marginal individual income tax rate to 15.05% from 13.3%, which is already the highest in the nation. Notably, California’s Governor is against the tax increase measure, citing progress the state has made on climate initiatives without this tax increase that could contribute to high taxpayer outmigration.

- Massachusetts’ Question 1 increases the personal income tax rate from 5.0% to 9.0% for those with annual earnings over $1 million. The initiative is estimated to impact 0.6% of Massachusetts households and generate approximately $1.3 billion of revenue, provide resources for public education and the repair of transportation infrastructure throughout the state.

Tax Reductions

- Colorado’s Proposition 121 would reduce the state’s income-tax rate from 4.55% to 4.40%. While this could potentially reduce state revenues by $400 million, the rate reduction is intended to minimize the refund that the state would need to give to taxpayers under the Tax Payer Bill of Rights (TABOR) which caps revenues the state can collect. Recent strong revenue trends have driven elevated TABOR refunds to taxpayers, and therefore this tax initiative would likely have a neutral impact on near-term revenues. However, if tax collections fall below the TABOR cap, a lower tax rate could challenge the state’s ability to generate revenue to address any future budget gaps.

- West Virginia’s Amendment 2 would allow business machinery and equipment, inventory and personal vehicles to be exempt from property taxation and potentially reduce tax revenues by $515 million. Two-thirds of property tax revenue currently helps fund school districts, while the balance supports local governments. While state officials highlighted that state funds would make up the difference for local municipalities, West Virginia’s legacy budget challenges could hamper the ability to pass through sufficient revenues.

Western Asset believes Colorado and West Virginia’s initiatives will have a higher likelihood of advancing versus California’s and Massachusetts’, considering that tax increases are typically more difficult to garner voter approval. As the economic cycle turns and states and local governments shift away from potential peak revenue growth following the windfall of tax collections and federal stimulus, any tax rate reductions could add to potential future budget gaps. If the CA and MA measures do pass, the value proposition of in-state municipal debt for individuals subject to higher tax rates would increase. The taxable equivalent yield for the average yield (4.0%) of the Bloomberg CA Muni Index would increase 34 bps from 8.67% to 9.01%, while the MA Muni Index (yield-to-worst: 4.0%) taxable-equivalent yield would increase from 7.38% to 7.97%.