Municipals Posted Positive Returns Last Week

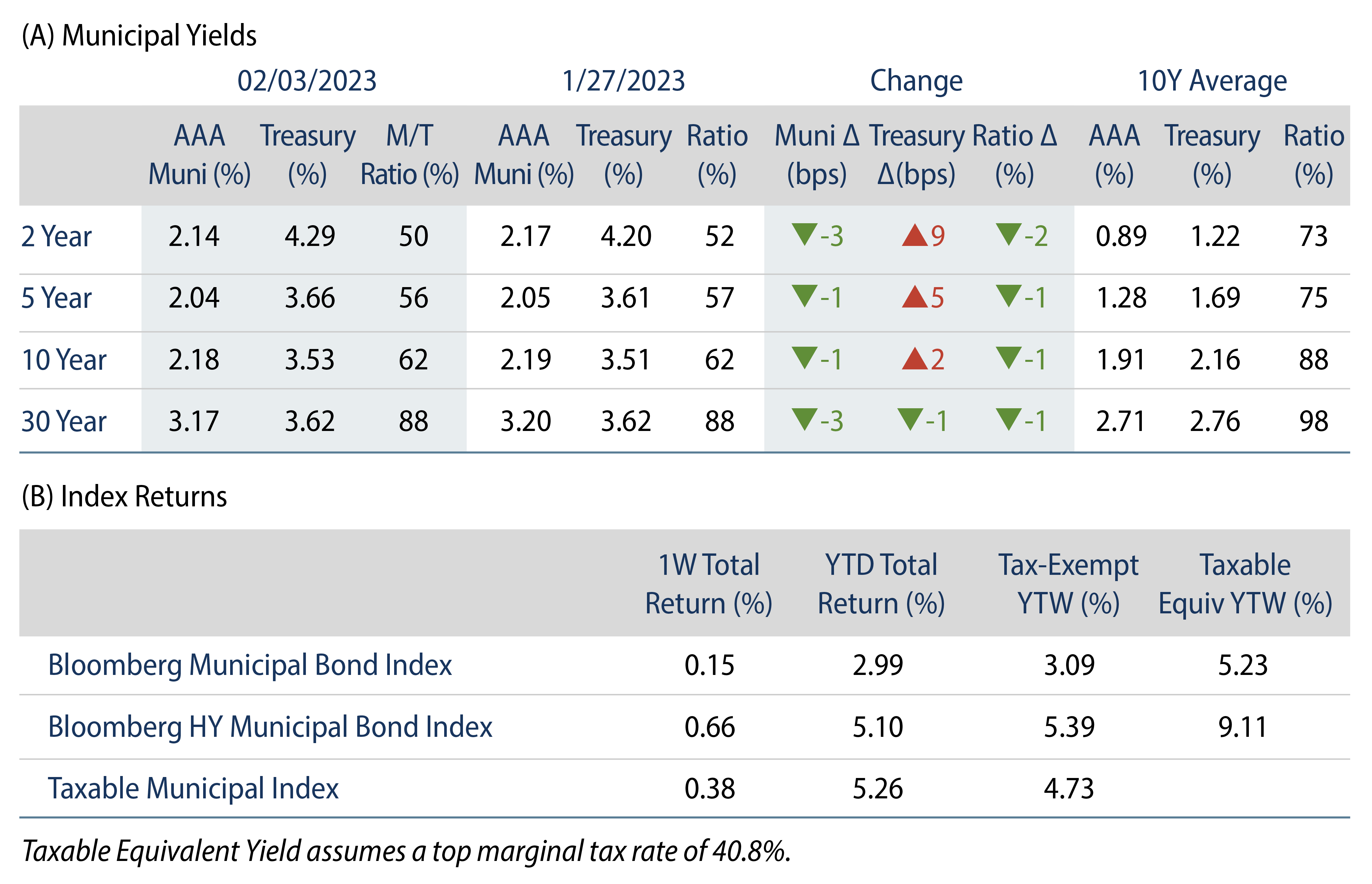

Municipals rallied last week, with high-grade muni yields moving 1-3 bps lower across the yield curve. A lack of new-issue calendar continued to support muni outperformance versus Treasuries, as Treasury rates mostly moved higher following the stronger than expected payrolls number. Despite modest outflows, light new-issue supply supported muni market technicals and outperformance versus Treasuries. The Bloomberg Municipal Index returned +0.15% during the week, the HY Muni Index returned +0.66% and the Taxable Muni Index returned +0.38%. Following the blockbuster jobs number last week, here we evaluate state and local government payrolls and potential implications on municipal credit conditions.

Limited New Issuance Supported Market Technicals

Fund Flows: During the week ending February 1, Lipper weekly reporting municipal mutual funds recorded $362 million of net outflows. Long-term funds recorded $231 million of inflows, high-yield funds recorded $60 million of outflows and intermediate funds recorded $25 million of outflows. This week’s flows bring year-to-date (YTD) municipal fund net outflows to $1.7 billion.

Supply: The muni market recorded $2 billion of new-issue volume last week, down 69% from the prior week. YTD issuance of $25 billion is down 7% year-over year (YoY), with tax-exempt issuance in line with last year’s levels and taxable issuance down 47% YoY. Next week’s calendar is expected to increase, but remain below average at $4.7 billion. Large transactions include $2.1 billion University of California and $950 million Port of Portland, Oregon (Portland International Airport) transactions.

This Week in Munis: Muni Payrolls Lag National Strength

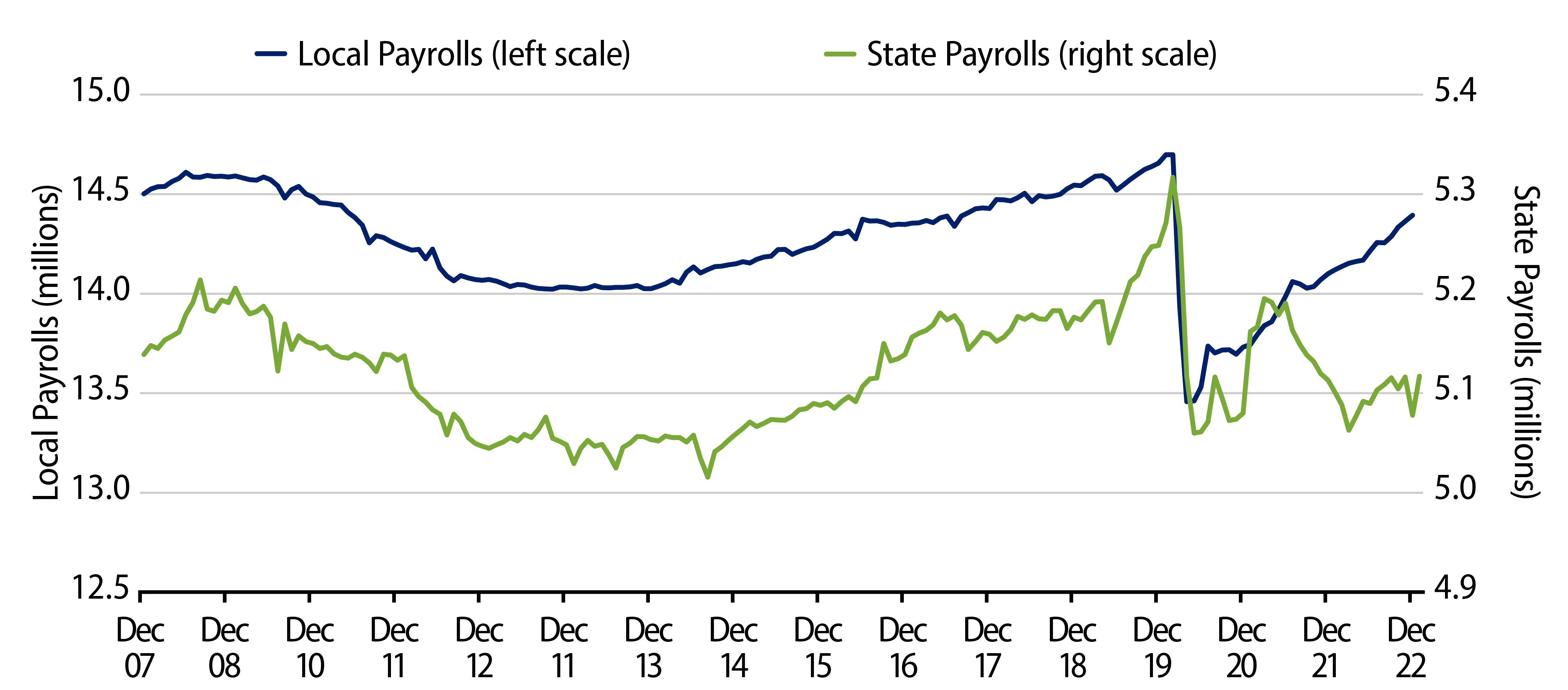

Last week’s nonfarm payroll (NFP) report highlighted accelerated job growth, with a better than expected 517,000 jobs added in January contributing to a 53-year low unemployment rate of 3.4%. National nonfarm payrolls of 155 million now stand 1.8% above pre-pandemic highs. Despite the employment strength observed at the national level, state and local government payrolls continue to lag the recovery observed in the private sector, with 19.5 million state and local government positions falling 2.6% below pre-pandemic peak levels.

Evaluating state versus local employment trends, local payrolls—which comprise the majority of public sector positions—have recorded a more consistent recovery from pandemic drawdowns, but remain 2% below the pre-pandemic peak. Meanwhile, state payroll growth has stalled near pandemic lows at 5.1 million, remaining 4% below pre-pandemic highs.

The Bureau of Labor Statistics classifies two primary types of state and local employment as education and non-education employment, neither of which have recovered to pre-pandemic levels. After initially declining nearly 9% at the early stages of the pandemic, education employment remains approximately 4% below the pre-pandemic peak. Non-education employment of 9.2 million remains approximately 2% below its pre-pandemic peak.

Western Asset attributes the lackluster public sector job growth to the increasingly competitive labor market that potentially drives higher wages to the private sector, and to states and localities managing through revenue uncertainty. While strong labor conditions could contribute to labor cost pressures for municipalities, strong employment trends also bode well for future municipal tax collections. The demonstrated ability for state and local governments to operate at lower headcount levels while continuing to collect record-level revenues is positive for municipal credit fundamentals, particularly ahead of any potential economic slowdown.