Investment-Grade Municipals Posted Negative Returns Last Week

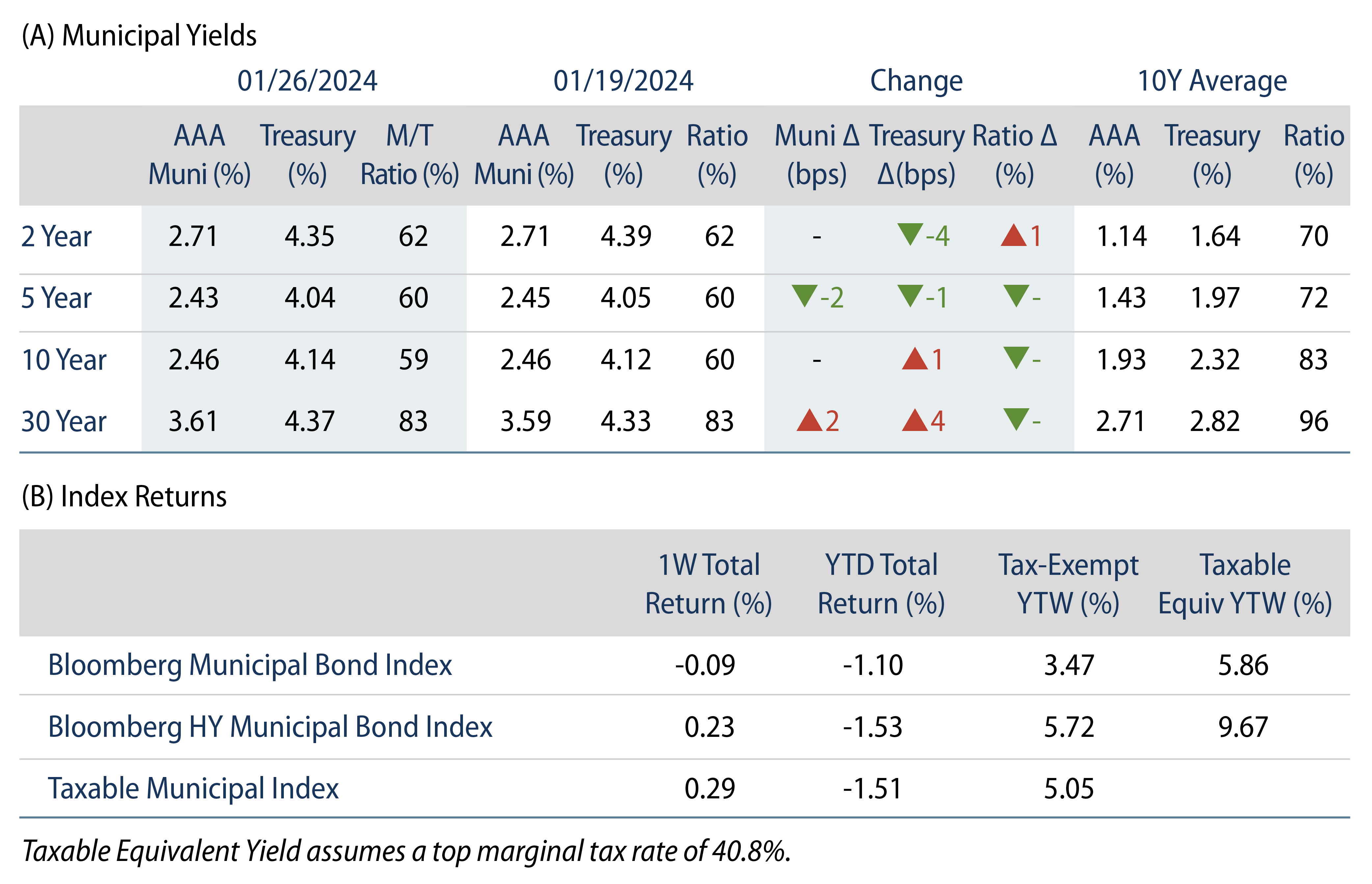

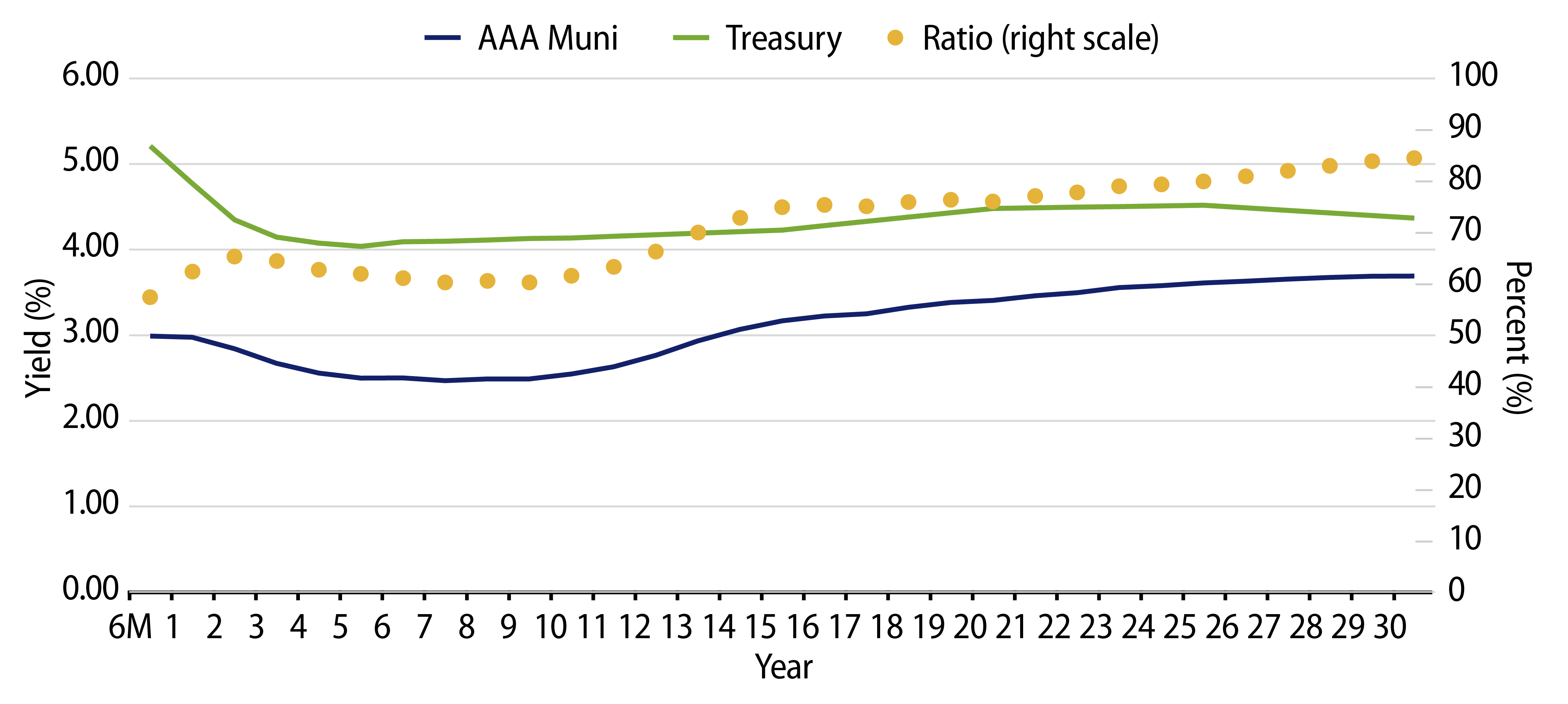

Investment-grade munis posted negative returns last week as the yield curve steepened following higher-than-anticipated Q423 GDP data and a continued downtrend in core Personal Consumption Expenditures (PCE) inflation, which fell to 2.90% year-over-year (YoY). High-grade muni yields moved 2 bps lower in short maturities and 2 bps higher in long maturities. Meanwhile, market technicals improved with municipal mutual funds recording inflows. The Bloomberg Municipal Index returned -0.09% during the week, the High Yield Muni Index returned 0.23% and the Taxable Muni Index returned 0.29%. Ahead of this week’s nonfarm payroll report, we highlight recent state and local employment trends.

Technicals Remained Solid Amid Improving Flows

Fund Flows: During the week ending January 26, weekly reporting municipal mutual funds recorded $211 million of net inflows, according to Lipper. Long-term funds recorded $227 million of inflows, high-yield funds recorded $1 million of inflows and intermediate funds recorded $109 million of inflows. This week’s inflows mark the third consecutive week of inflows and lead year-to-date (YTD) net mutual fund flows higher to $590 million.

Supply: The muni market recorded $9 billion of new-issue volume last week, in line with the prior week. YTD issuance of $29 billion is 80% higher from last year’s level, with tax-exempt issuance up 87% and taxable issuance up 9% YoY. This week’s calendar is expected fall to $5 billion. Largest deals include $1 billion New York State Thruway Authority and $800 million Triborough Bridge & Tunnel Authority (MTA Bridge and Tunnel) transactions.

This Week in Munis: Muni Payrolls Recover

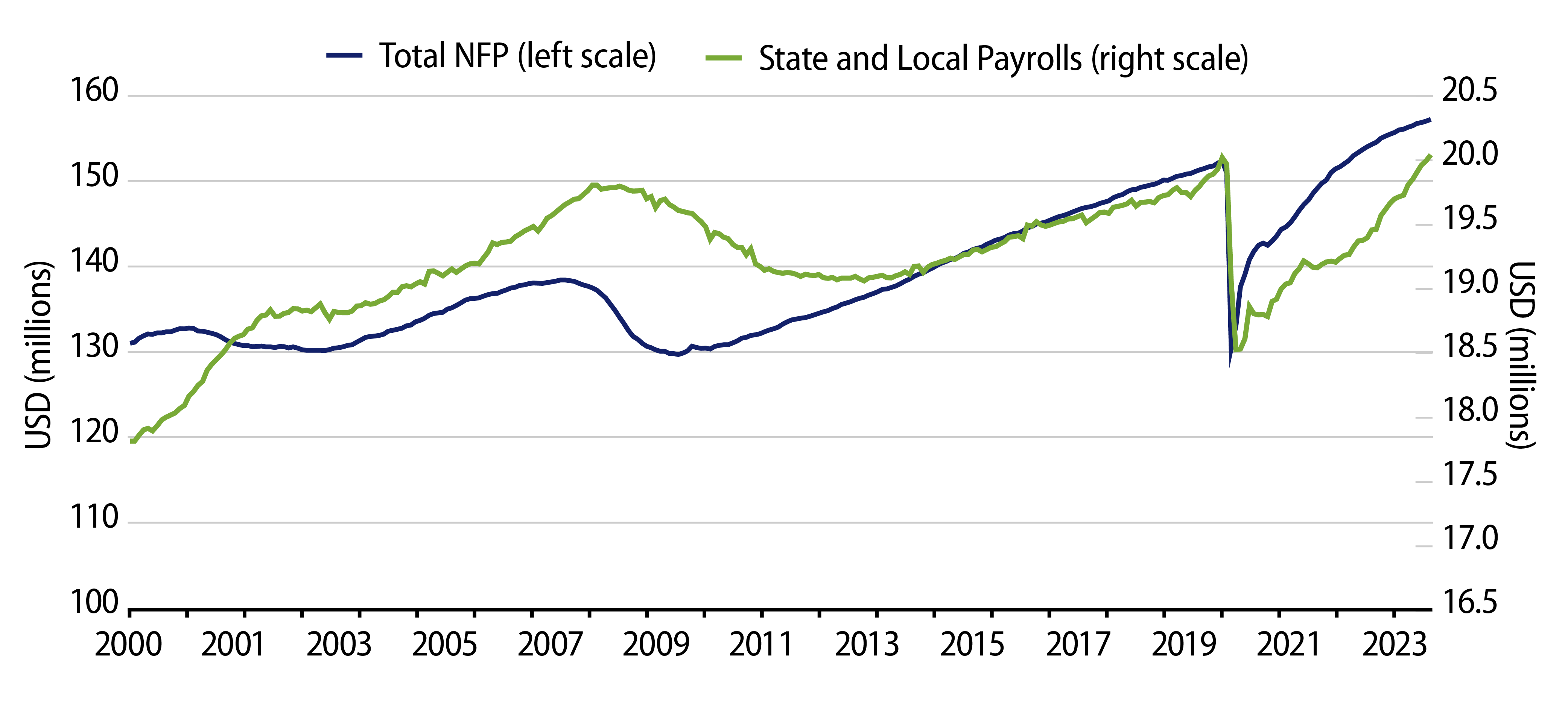

During the pandemic recovery from late 2020 through 2022, public sector employment growth underperformed the private sector. National nonfarm payrolls recovered to pre-pandemic highs in June 2022, state and local payrolls did not fully recover until last month when payrolls crossed the pre-pandemic high of 20 million. The recent public sector recovery follows robust payroll growth in 2023, with state payrolls increasing 5.1% YoY to 5.4 million in December and local payrolls increasing 2.4% to 14.7 million, each outperforming the 1.7% growth observed by national nonfarm payrolls.

At the state level, non-education employment reached 2.7 million in December, 1.4% above prior March 2020 highs. However, state education employment remains 1.3% below February 2020 highs, indicative of potential structural challenges higher education institutions continue to face following the pandemic.

At the local level, education employment of 8 million is just -0.4% (or 28,000 jobs) shy of pre-pandemic highs. Local non-education employment of 6.7 million is 0.6% higher than the pre-pandemic high-level set in February 2020.

While some questioned whether states and local employment would fully recover following the pandemic drawdowns and ensuing post-pandemic realities, strong public sector employment growth is indicative of the resiliency of muni credit amid tighter economic conditions. The slow early rebound of public-sector employment also reflects the measured spending increases that occurred during high-priced labor conditions, likely contributing to budgetary stability. At the same time, we believe the ongoing recovery in higher education employment reflects post-pandemic realities that challenge certain market segments. As economic conditions continue to tighten, we remain cautious on those issuers that are more susceptible to factors such as tight margins and higher labor costs.

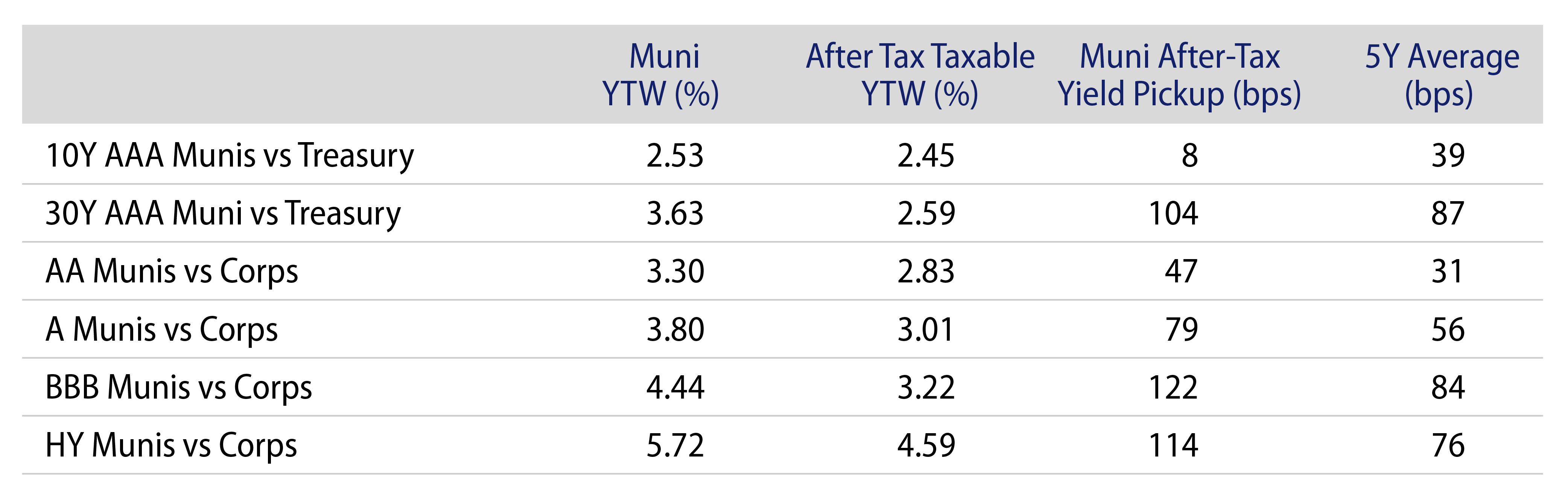

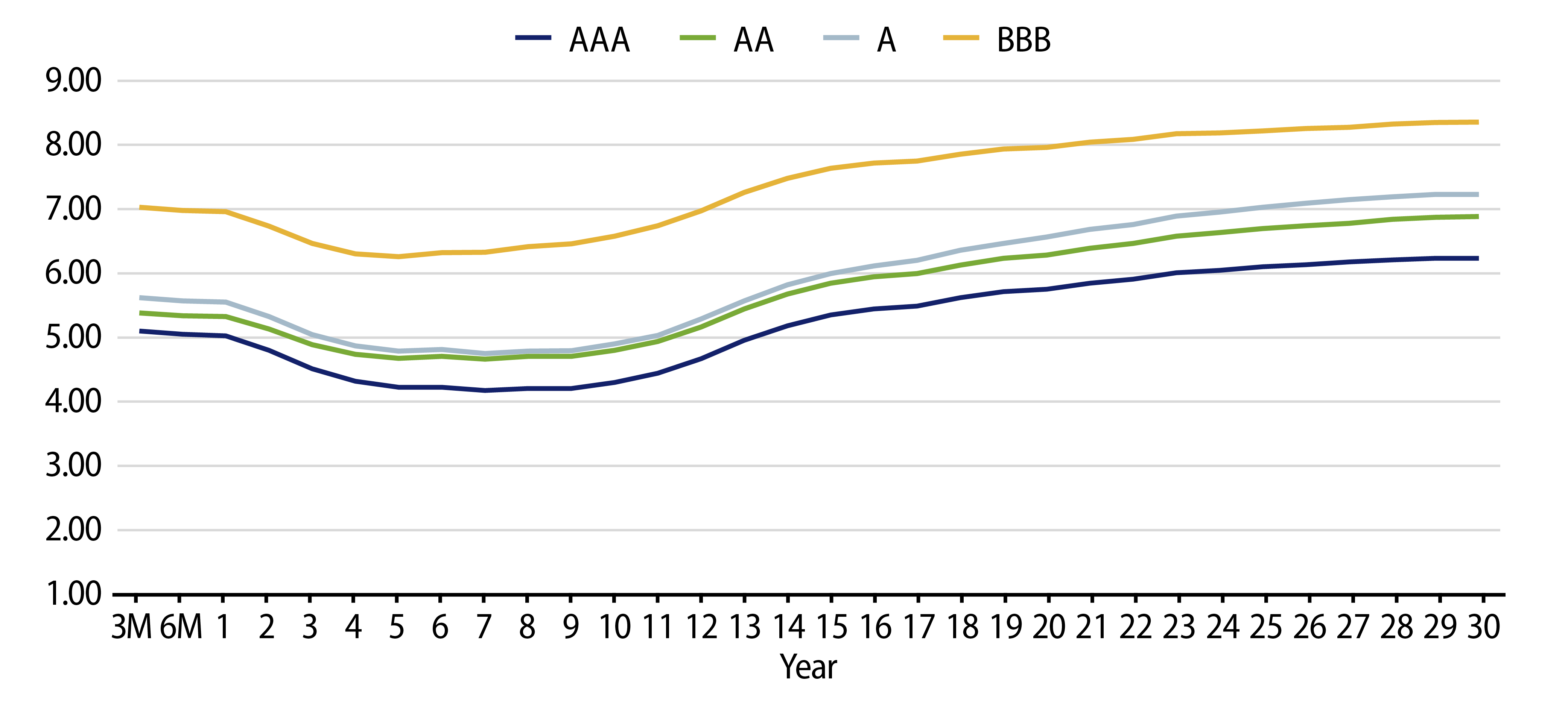

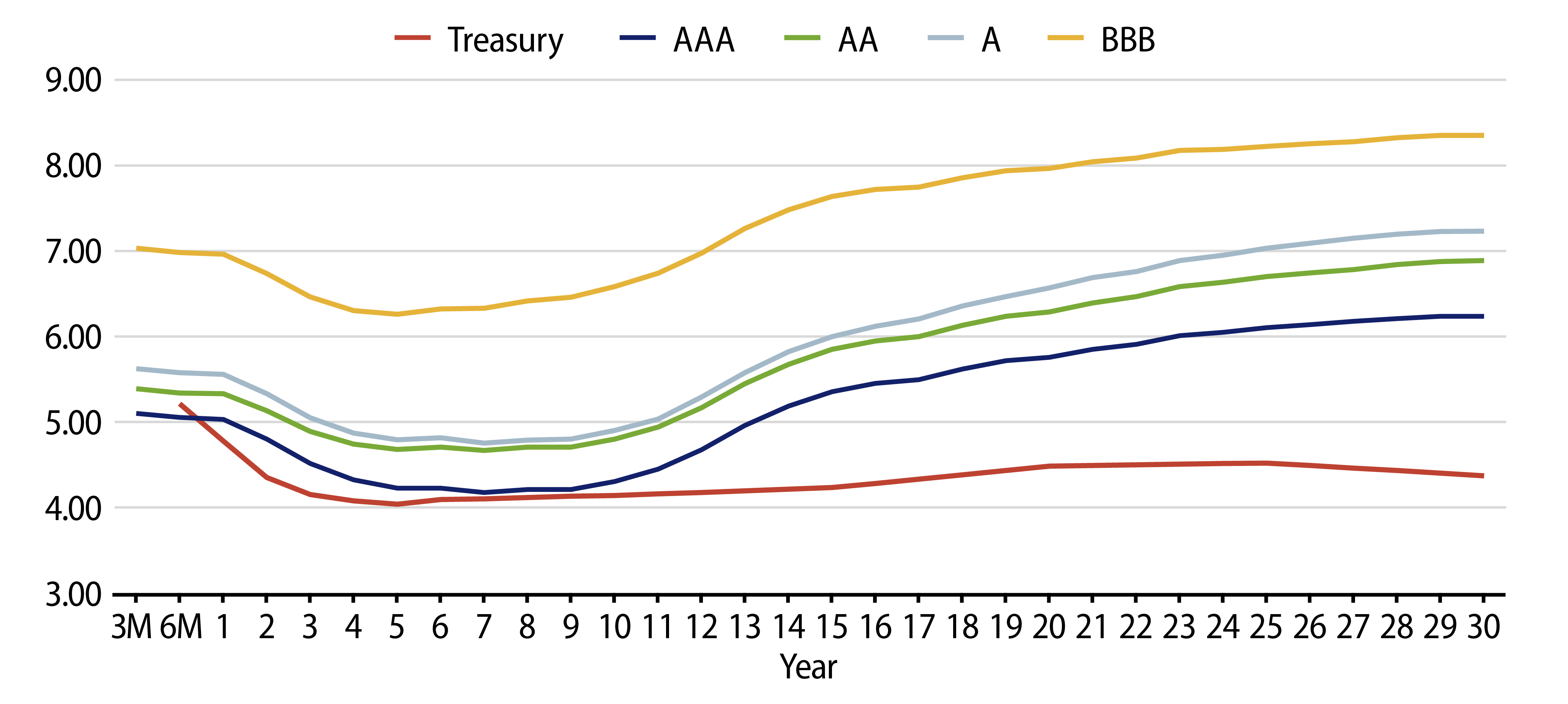

Theme #1: Municipal index yields and taxable-equivalent yields are above decade highs.

Theme #2: Recent yield curve steepening has highlighted value in longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.