Municipals Posted a Fourth Consecutive Week of Positive Returns

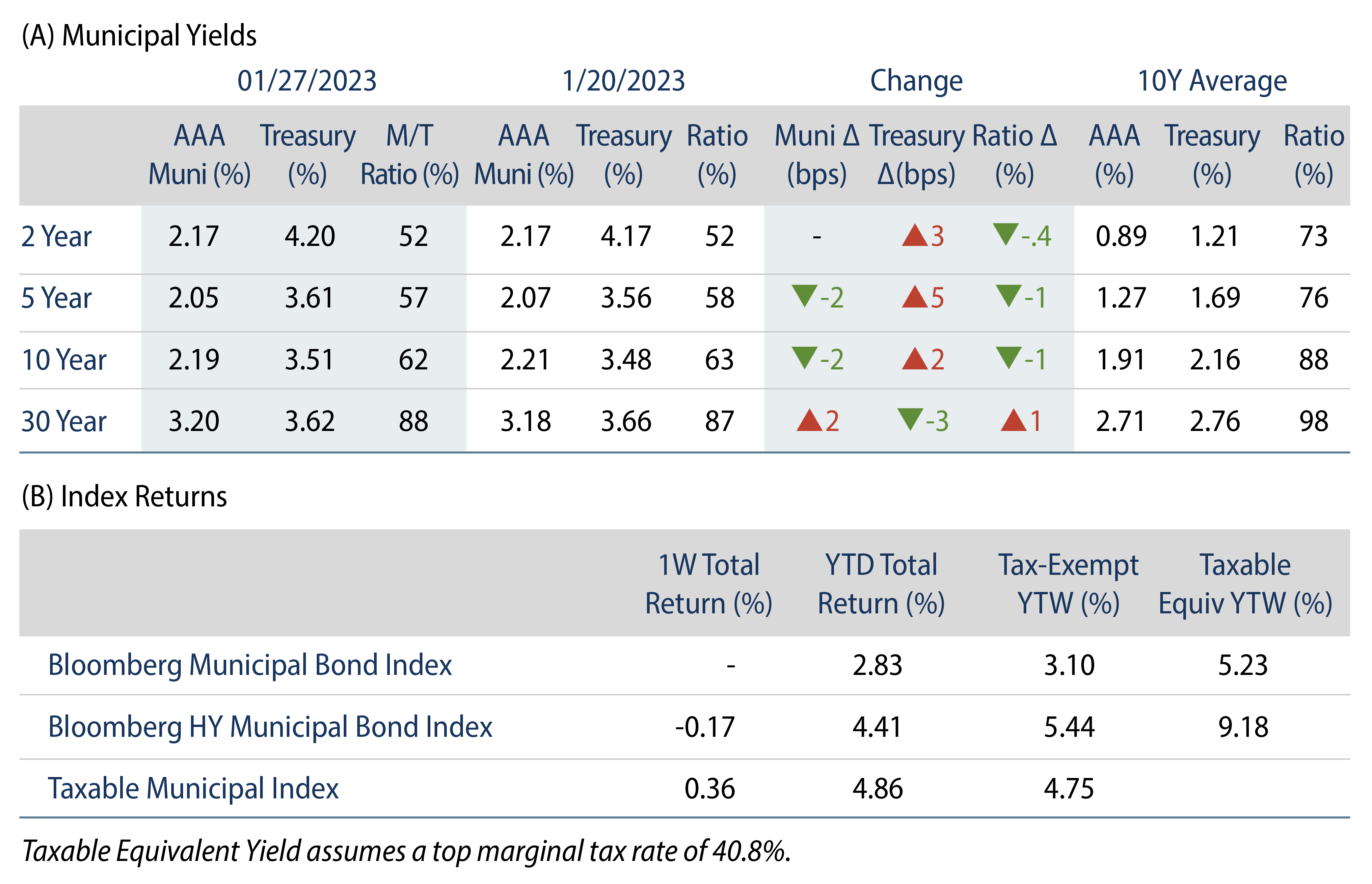

Municipals posted positive returns for a fourth consecutive week, as high-grade municipal yields moved 2 bps lower in intermediate maturities and 2 bps higher in long maturities. Favorable technicals continued to support general municipal outperformance versus Treasuries, which moved marginally higher as 4Q22 GDP surprised to the upside, highlighting growth of 2.9% year-over-year (YoY). The Bloomberg Municipal Index return was unchanged over the week, the HY Muni Index returned -0.17% and the Taxable Muni Index returned +0.36%. This week we highlight upside surprises in the State of New York tax collections, and the relative value for securities issued within the state.

Municipal Mutual Fund Inflows Continue

Fund Flows: During the week ending January 25, Lipper weekly reporting municipal mutual funds recorded $1.3 billion of net inflows. Long-term funds recorded $934 million of inflows, high-yield funds recorded $652 million of inflows and intermediate funds recorded $312 million of inflows. The week’s inflows mark the third consecutive week of fund inflows, continuing to show signs that record outflows could be behind us and reducing year-to-date (YTD) outflows to $2.0 billion.

Supply: The muni market recorded $7 billion of new-issue volume last week, down 34% from the prior week. Issuance of $24 billion YTD is 15% higher YoY. The vast majority of issuance this year has been tax-exempt, with just 9% of total issuance coming as taxable. Challenged supply conditions continue this week as the new-issue calendar is expected to decline to less than $1 billion. Large transactions include $277 million Fort Worth Independent School District and $175 million Troy, Michigan, School District transactions.

This Week in Munis: New York State Tax Collections Surprise to Upside

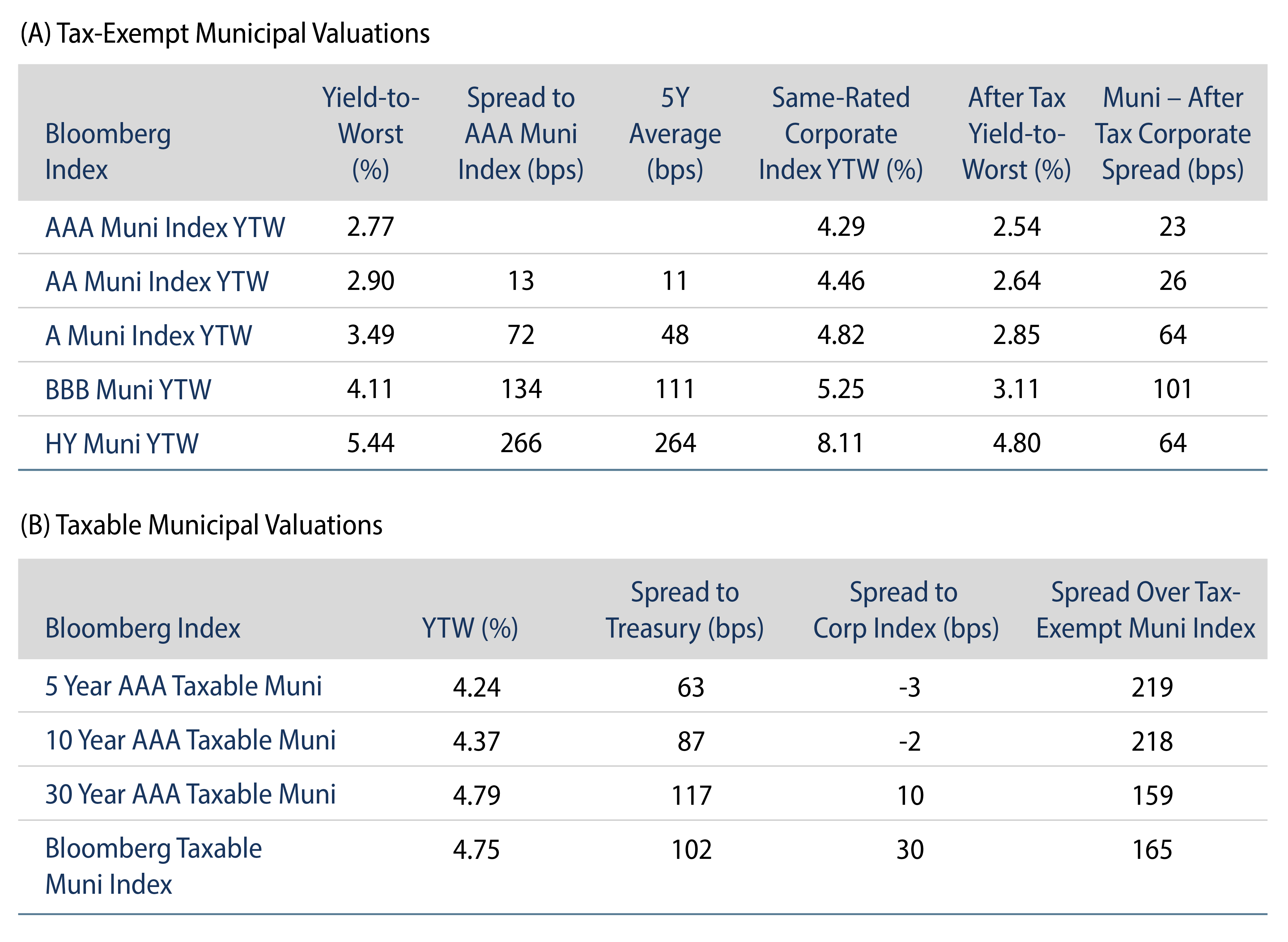

Recent strong tax collections in the State of New York have bolstered the appeal for the state’s municipal securities, particularly for NY state residents. Earlier this month, New York state highlighted a total of $79.8 billion of tax receipts through the third quarter of the 2023 fiscal year (ending December 2022), exceeding expectations outlined at the beginning of the quarter by $7.7 billion, or 11%. Higher than expected tax collections were primarily driven by personal income tax collections of $42 billion, which were 24% higher than expected, while sales tax and corporate tax collections were largely in line with projections.

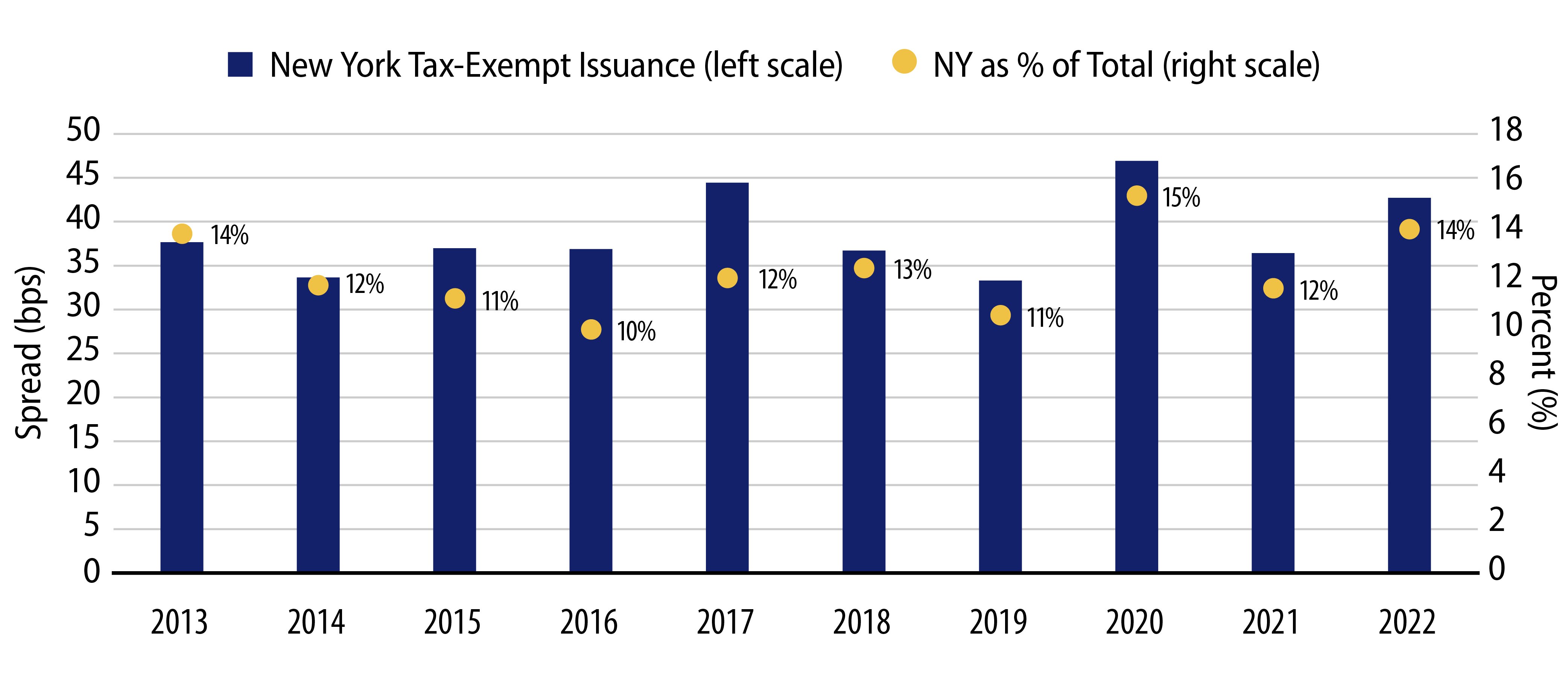

Over the last three years, elevated NY state supply and lower demand from New York municipal mutual funds also contributed to more attractive yield levels for New York securities. For two of the last three calendar years from 2020 to 2022, New York long-term issuance surpassed all other states. From a demand perspective, as non-New York mutual funds recorded $49 billion of inflows from 2020 to 2022, according to Morningstar, New York municipal mutual funds recorded $5 billion of net outflows, potentially lowering the structural demand for New York securities.

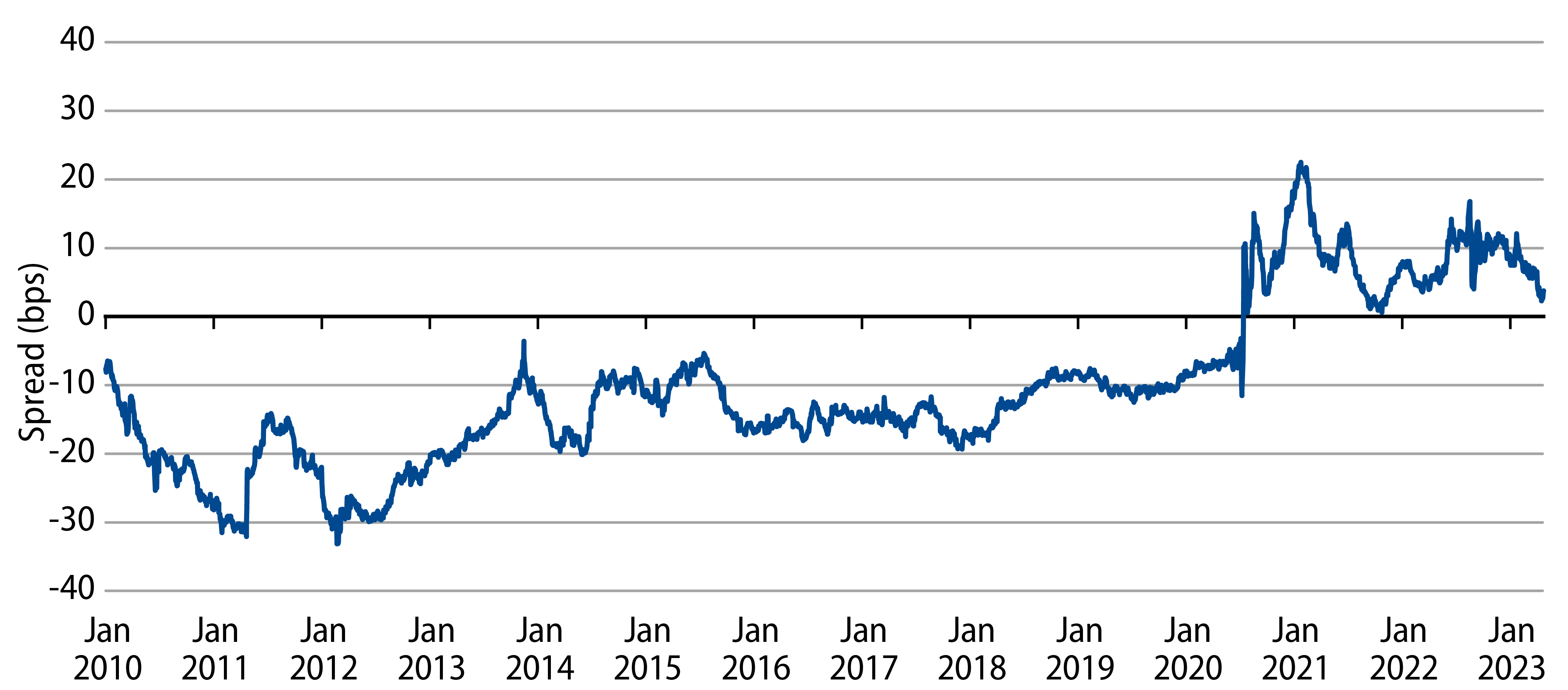

All told, improving fundamentals, higher supply and lower demand have improved the relative value proposition for New York-domiciled securities. In the Bloomberg Indices’ history prior to pandemic-driven market drawdowns in 2020, the average Bloomberg New York Municipal Index yield was traditionally lower than the national Bloomberg Muni Bond Index yield, largely attributable to relatively higher tax rates in New York that drive in-state demand for New York tax-exempt securities. Following the pandemic-related market drawdowns, New York municipal yields have increased past, and remained higher than, the national municipal yields.

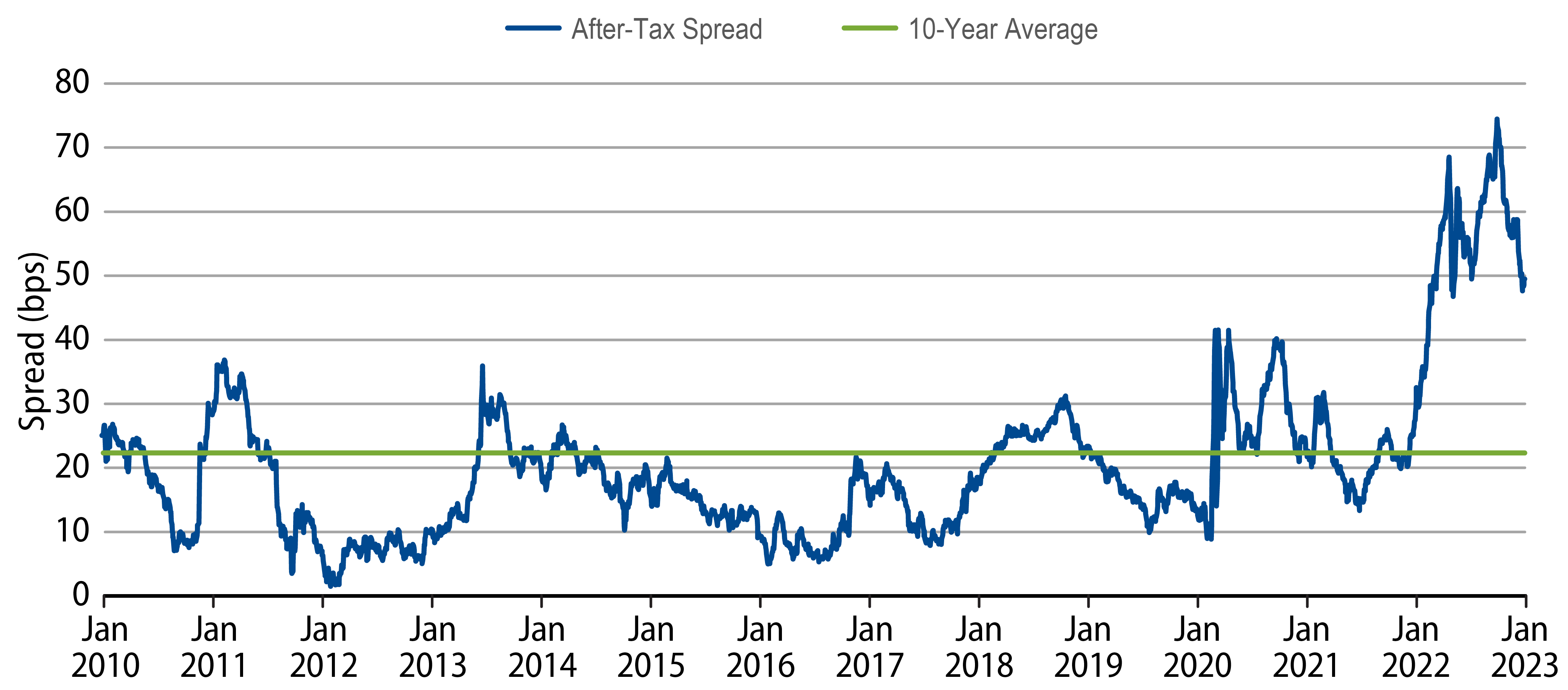

When considering the in-state tax exemption of New York securities for New York taxpayers, the relative value versus national securities has extended further. For a New York investor in the highest tax bracket, the average after-tax yield pickup between the New York Municipal Bond Index and the Municipal Bond Index (after taxes) has averaged 22 bps over the past 10 years (through January 27, 2023). Following the recent technical weakness, combined with the state increasing its top marginal income tax rate to 10.9%, the after-tax relative value proposition extended to 49 bps. As such, Western Asset believes New York municipal securities present significant value for New York taxpayers and national municipal investors that can benefit from the relative yield pickup and potential NY spread compression associated with improved fundamentals and higher tax rates.