Municipals Posted Positive Returns Last Week

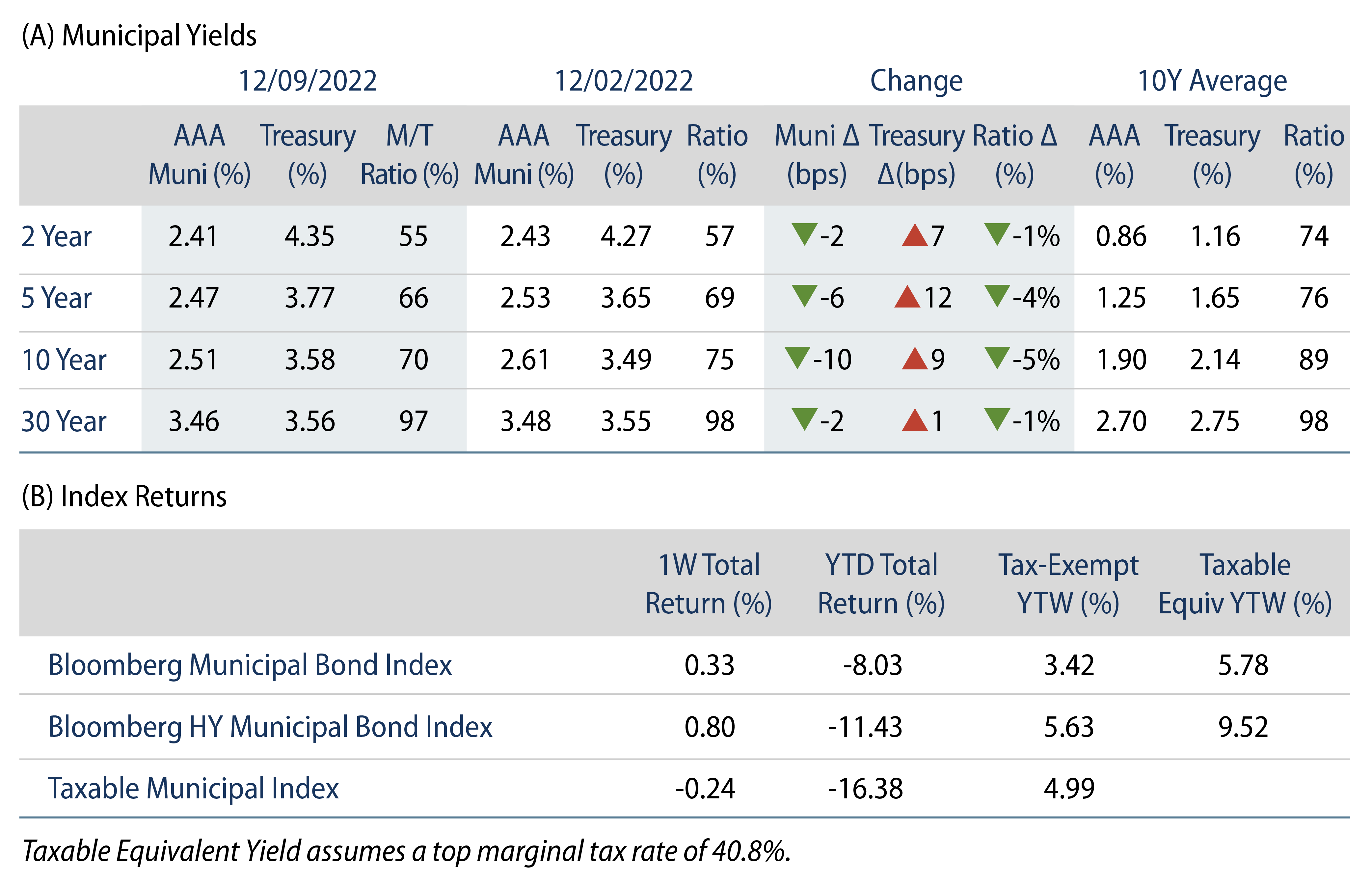

Municipal yields continued to move lower last week, shrugging off strong inflation data. High-grade municipal yields moved 2-10 bps lower across the curve as weekly reporting municipal funds posted modest inflows. The Bloomberg Municipal Index returned +0.33%, the HY Muni Index returned +0.80% and the Taxable Muni Index returned -0.24%. This week we highlight improving fundamentals for the water & sewer muni sector, and the potential for sustainable investment within the sector.

Municipal Mutual Funds Post Modest Inflows

Fund Flows: During the week ending December 7, weekly reporting municipal mutual funds recorded $47 million of net inflows. Long-term funds recorded $448 million of inflows, high-yield funds recorded $552 million of inflows and intermediate funds recorded $228 million of outflows. The week’s flows bring year-to-date (YTD) net outflows to $115 billion.

Supply: The muni market recorded $8 billion of new-issue volume last week, down 9% from the prior week. Total YTD issuance of $355 billion is 18% lower than last year’s levels, with tax-exempt issuance trending 7% lower year-over-year (YoY) and taxable issuance trending 54% lower YoY. This week’s new-issue calendar is expected to decline to $4 billion of new-issue volume. Larger deals include $1.9 billion Pennsylvania Economic Development Financing Authority and $254 million Idaho Housing and Finance Authority transactions.

This Week in Munis: Outperforming Water & Sewer Sector Could Offer Quality Opportunities

The water & sewer utility sector was one of the top-performing municipal sectors so far in 2022, as the higher quality Bloomberg Water and Sewer Index returned -7.55% YTD through December 9, outperforming the Bloomberg Municipal Index by 48 bps. Improved credit fundamentals combined with a flight-to-quality market sentiment contributed to favorable performance for the sector, and the sector’s funding opportunities could potentially attract a larger buyer base going forward.

As an essential service sector with monopolistic pricing power and predictable revenue streams, the water & sewer sector has often represented a higher quality segment of the municipal market. Over the past year, key credit metrics such as total debt service coverage and liquidity have trended higher. Western Asset’s sector-wide median debt service coverage trended higher to 2.04x in fiscal-year 2022 (up from 1.98x the prior year) and liquidity as measured by the number of days of cash on hand is robust at 553 days (up from 509 days the prior year).

Considering legacy infrastructure challenges seen across many parts of the nation, Western Asset anticipates the water & sewer sector could offer increasing sustainable investment opportunities, as the use of proceeds for many water & sewer issues can be aligned to environmental responsibility, along with affordable and clean drinking water and wastewater for residential and commercial consumers. As issuers and investors become more familiar with the process for both self-reported and third-party green bond verification, green bond investing opportunities in this sector are likely to show continued growth. Western Asset expects that any potential spread volatility associated with expanded balanced sheets to fund clean water initiatives could be offset by a growing buyer base for the sector, and further support liquidity in the market segment for those seeking a high-quality source of income.