Municipals Posted Positive Returns

Municipals posted positive returns during the week and outperformed Treasuries across most maturities. High-grade municipal yields moved 10-18 bps lower across the curve. Meanwhile, technicals stabilized as mutual fund flows turned positive against the backdrop of light new-issue supply. The Bloomberg Municipal Index returned 0.92% while the HY Muni Index returned 1.37%. This week we explore pension issues expected to re-emerge following challenged market performance over the past year.

Municipal Technicals Improved as Mutual Funds Recorded Inflows Amid Light Supply

Fund Flows: During the week ending July 27, weekly reporting municipal mutual funds recorded $233 million of net inflows, according to Lipper. Long-term funds recorded $739 million of inflows, high-yield funds recorded $549 million of inflows, and intermediate funds recorded $35 million of outflows. Year to date (YTD) outflows stand at -$80.6 billion.

Supply: The muni market recorded $2 billion of new-issue volume, down 75% from the prior week. Total YTD issuance of $232 billion is 8% lower than last year’s levels, with tax-exempt issuance trending 3% higher year-over-year (YoY) and taxable issuance trending 43% lower YoY. This week’s new-issue calendar is expected to decline to $3 billion.

This Week in Munis: Pension Challenges Back in Spotlight

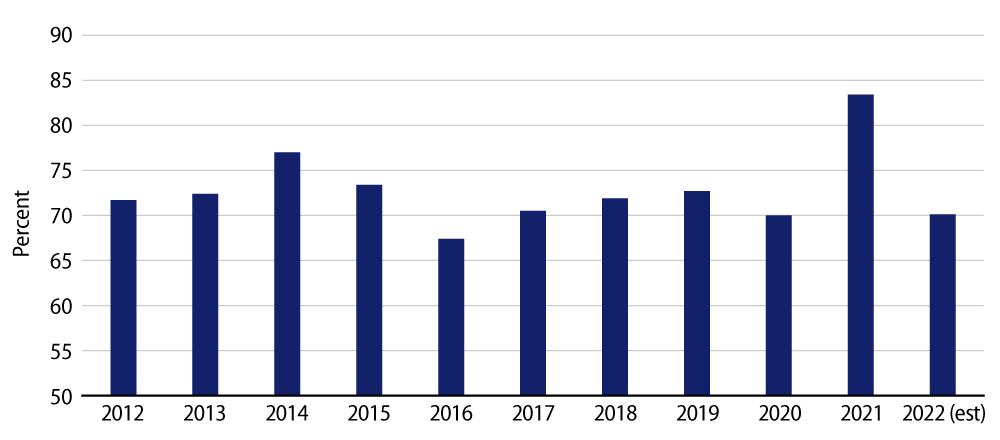

Fiscal year (FY) 2021 (ending June 30) proved to be a strong year for pension plans, driven by rallying markets and high investment returns, alongside improved contributions from state and local governments experiencing strong tax receipts. Initial fears of lower contributions in 2021 due to COVID-19 did not materialize, and state level reforms that have increased employer contributions continued to take effect. All told, pension funded ratios increased from 69% to 83% during the fiscal year, according to Wilshire Associates.

However, FY2022 has introduced new challenges to public pension systems, with most funds on pace for market-driven losses. The S&P 500 returned -10.64% and the Bloomberg Global Bond Aggregate returned -15.25% in FY2022. S&P Global estimates an average -7% return for a typical pension plan, well below actuarial assumed returns of 6% to 8% required for public pensions to fulfill unfunded liabilities.

In addition to negative market returns, higher inflation contributed to reduced funded status of pension systems. Cost of living adjustments, typically indexed to CPI, are applied to future benefits and increase unfunded pension liabilities. Moreover, the competitive labor market is also expected to increase final-year salaries for payment calculations for future liabilities. All told, Wilshire estimates state pension systems gave back the vast majority of 2021 gains as the estimated aggregate funded ratio fell to 70% in FY2022.

Rising unfunded pension liabilities result in higher actuarially required contributions from plan sponsors (state and local employers). Municipalities that participate in lower-funded plans will face a more difficult task, already navigating rising contribution schedules and elevated fixed costs which could coincide with an expected economic slowdown. In the event of operational stress caused by an economic slowdown, state and local governments may look to temporarily reduce contributions, which could hurt the long-term fiscal health of the pension plans, and contribute to higher future required contributions.

Underfunded pensions are one of the reasons that Western Asset prefers revenue-backed debt over general obligation (GO) securities, as we believe the risks associated with underfunded liabilities and rising fixed costs are often not fully priced into GO bond pricing. In the precedent set by recent municipal bankruptcies, pension recoveries were higher and often unimpaired, at the expense of GO bondholders. While this year’s pension decline represents a reversal of the prior year’s gain, we are cautious on the potential implications a longer-term economic slowdown could have on GO debt that is exposed to outsized unfunded pension liabilities.