Municipals Posted Positive Returns Last Week

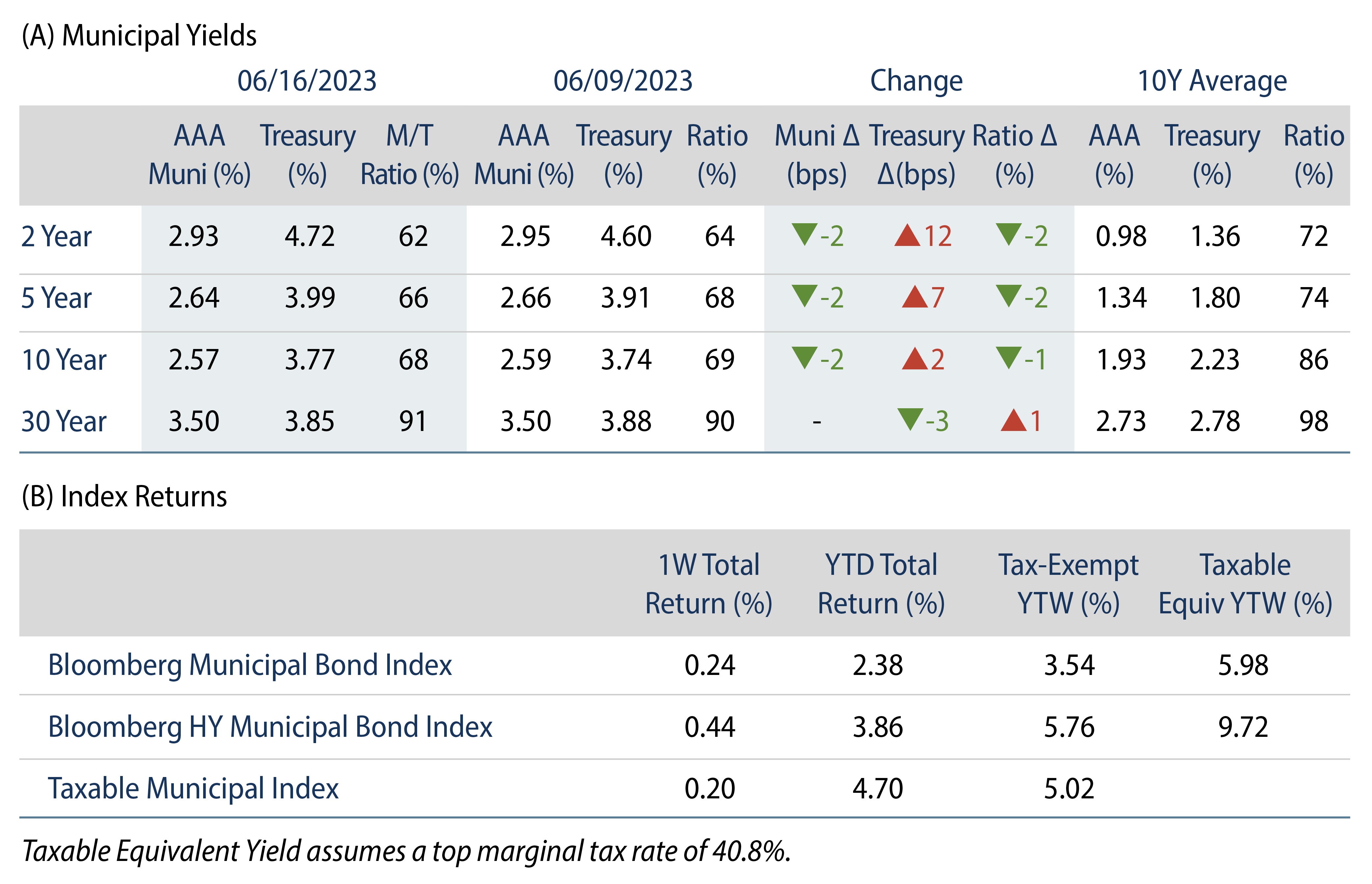

Municipals posted positive returns last week as high-grade muni yields moved higher across the curve. Municipals outperformed Treasuries, which moved higher as the Federal Reserve (Fed) indicated a higher probability of multiple hikes by the end of the year despite holding rates steady at last week’s Federal Open Market Committee (FOMC) meeting. Muni mutual funds recorded outflows and new-issue supply was limited. The Bloomberg Municipal Index returned 0.24% during the week, the High Yield Muni Index returned 0.44% and the Taxable Muni Index returned 0.20%. With the Fed’s decision last week not to increase the target fed funds rate for the first time since the start of this hiking cycle, here we evaluate historical performance of munis versus other asset classes following the final Fed hike.

Negative Technical Pressures from Fund Outflows Were Offset by Declining New-Issue Supply

Fund Flows: During the week ending June 14, weekly reporting municipal mutual funds recorded $257 million of net outflows, according to Lipper. Long-term funds recorded $259 million of inflows, high-yield funds recorded $80 million of inflows and intermediate funds recorded $50 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to $8.7 billion.

Supply: The muni market recorded $4.5 billion of new-issue volume last week, down 58% from the prior week. YTD issuance of $158 billion is down 16% year-over year (YoY), with tax-exempt issuance down 9% YoY and taxable issuance down 49% YoY. This week’s calendar is expected to remain limited considering the holiday-shortened week. Larger transactions include $417 million San Diego Regional Transportation Authority and $313 million Arizona Industrial Development Authority transactions.

This Week in Munis: Planning for a Pause

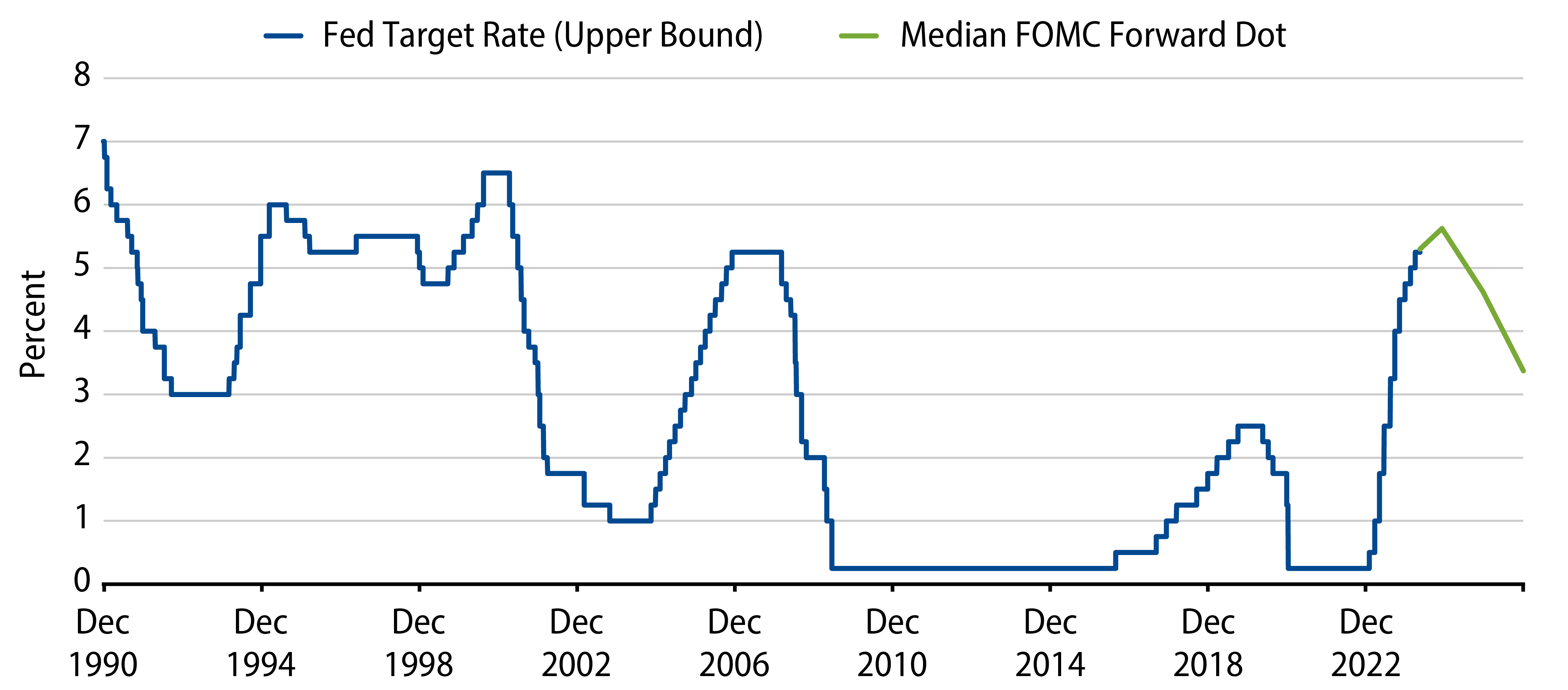

Last week the Fed left the target fed funds rate unchanged at 5.25%, choosing not to increase the rate for the first time since the start of its 500-bp hiking cycle in March 2022. The FOMC highlighted increased expectations of two additional 25-bp hikes to 5.625% by the end of the year, with longer-run fed funds rate expectations declining to 2.5%.

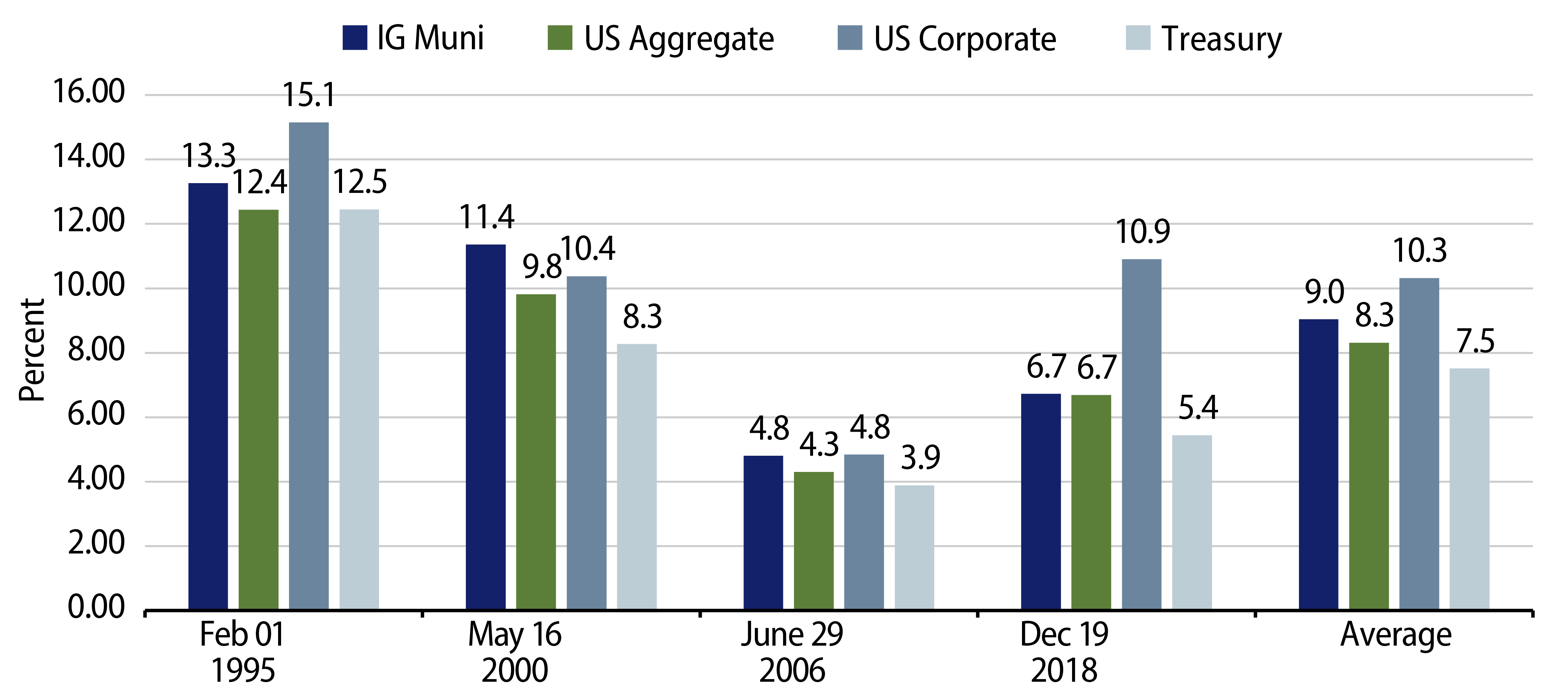

Unsurprisingly, fixed-income performance historically benefits from a lack of upward pressure on interest rates. Nominal fixed-income returns ranged from 4.9% to 20.5% in the year following the final hike of the last four Fed hiking cycles when considering the Bloomberg Investment-Grade Muni, US Aggregate, US Corporate and US Treasury Indices. Municipals, which can provide additional tax-exempt income in higher-rate environments, have offered attractive after-tax returns over these last four hiking cycles, averaging a 9.0% after-tax return, falling to second place, just behind the lower average credit quality US Corporate Index.

While the Fed increased expectations for two additional 25-bp hikes by the end of the year, the probability that these additional hikes are realized could be diminished by additional softening of inflation data. Even if realized, we expect any downside price impact of such hikes should be dwarfed by what was realized from the 500 bps of policy rate increases, and could ultimately be offset by expectations of rate reductions that could follow. These are not only highlighted by the FOMC dot plot through 2024, but also priced into market conditions. If these rate reductions are realized in 2024, the longer-duration municipal asset class could stand to benefit from another year of attractive after-tax returns following a Fed pause.