Municipals Posted Positive Returns Last Week

Municipals posted positive returns last week as high-grade yields moved lower across the curve. Munis outperformed Treasuries as market technicals strengthened and muni mutual funds posted inflows. The Bloomberg Municipal Index returned 0.30% during the week, the High Yield Muni Index returned 0.49% and the Taxable Muni Index returned 0.37%. This week we highlight recently released 1Q23 state and local revenue data.

Market Technicals Improved as Mutual Funds Recorded Inflows

Fund Flows: During the week ending June 21, weekly reporting municipal mutual funds recorded $672 million of net inflows, according to Lipper. Long-term funds recorded $837 million of inflows, high-yield funds recorded $321 million of inflows and intermediate funds recorded $32 million of inflows. This week’s inflows bring year-to-date (YTD) net outflows down to $8.0 billion.

Supply: The muni market recorded $6 billion of new-issue volume last week, up 59% from the prior week. YTD issuance of $163 billion is down 14% year-over year (YoY), with tax-exempt issuance down 7% YoY and taxable issuance down 49% YoY. This week’s calendar is expected to tick up to $10 billion. Larger transactions include $1.5 billion City of Los Angeles Tax and Revenue Anticipation Notes and $675 million Houston Airport System transactions.

This Week in Munis: State and Local Revenues Slip

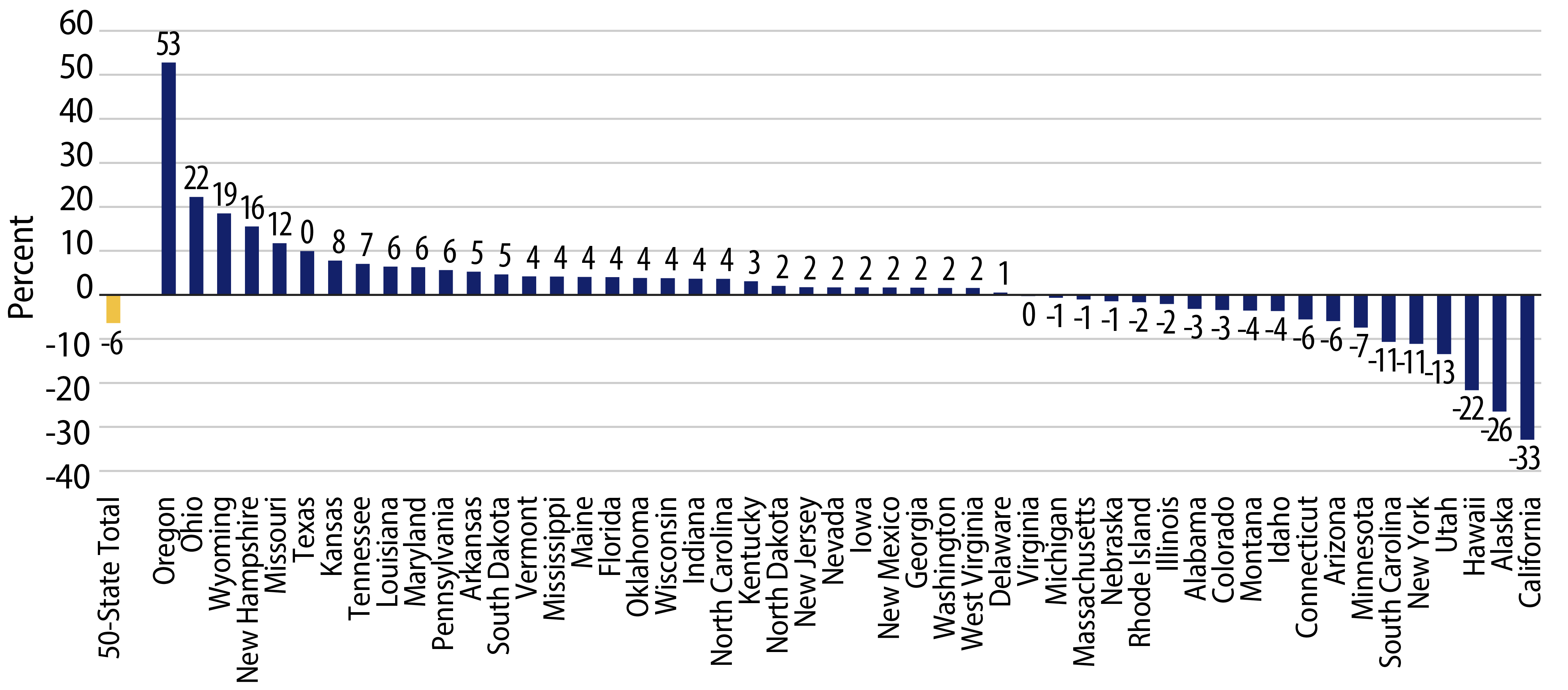

Earlier this month the Census released 1Q23 state and local tax collection data, highlighting a rare decline in overall state and local revenues. First-quarter state and local tax collections were down 3.9% from 1Q22 to $473 billion. Performance of underlying major tax components was mixed, as individual income tax receipts declined 17.9% and corporate income tax receipts declined 18.2% YoY, while sales tax collections increased 6.2% and property tax collections increased 4.8% YoY. The YoY growth of state and local tax collections has now slowed for four consecutive quarters, coinciding with the Federal Reserve’s (Fed) rate hiking cycle to temper inflationary pressures.

The YoY decline in tax collections is largely attributable to the decline in individual income tax collections, which represent the largest source of state tax receipts. Capital gains taxes are a key component of individual income taxes, and we expect that these taxes fell sharply following negative returns across capital markets. The impact of lower capital gains collections can also be observed from the tax collection data across states. States with higher wealth levels, such as California, Hawaii and New York recorded the largest YoY declines in overall tax collections at -33%, -22% and -13%, respectively.

Western Asset anticipates that strong labor conditions will continue to support state and local revenues through the year. However, as the Fed continues efforts to temper inflation, and as the effects of pandemic-era federal stimulus measures continue to wear off, we anticipate revenue growth to remain at lower rates versus what was observed during the pandemic recovery period. While an economic slowdown would likely contribute to a ratcheting down of revenue expectations and potential budgetary pressures, state and local revenues remain near record levels, which have contributed to record reserve levels that we expect would support municipal credit conditions through a downturn.