Municipals Rallied With Treasuries Last Week

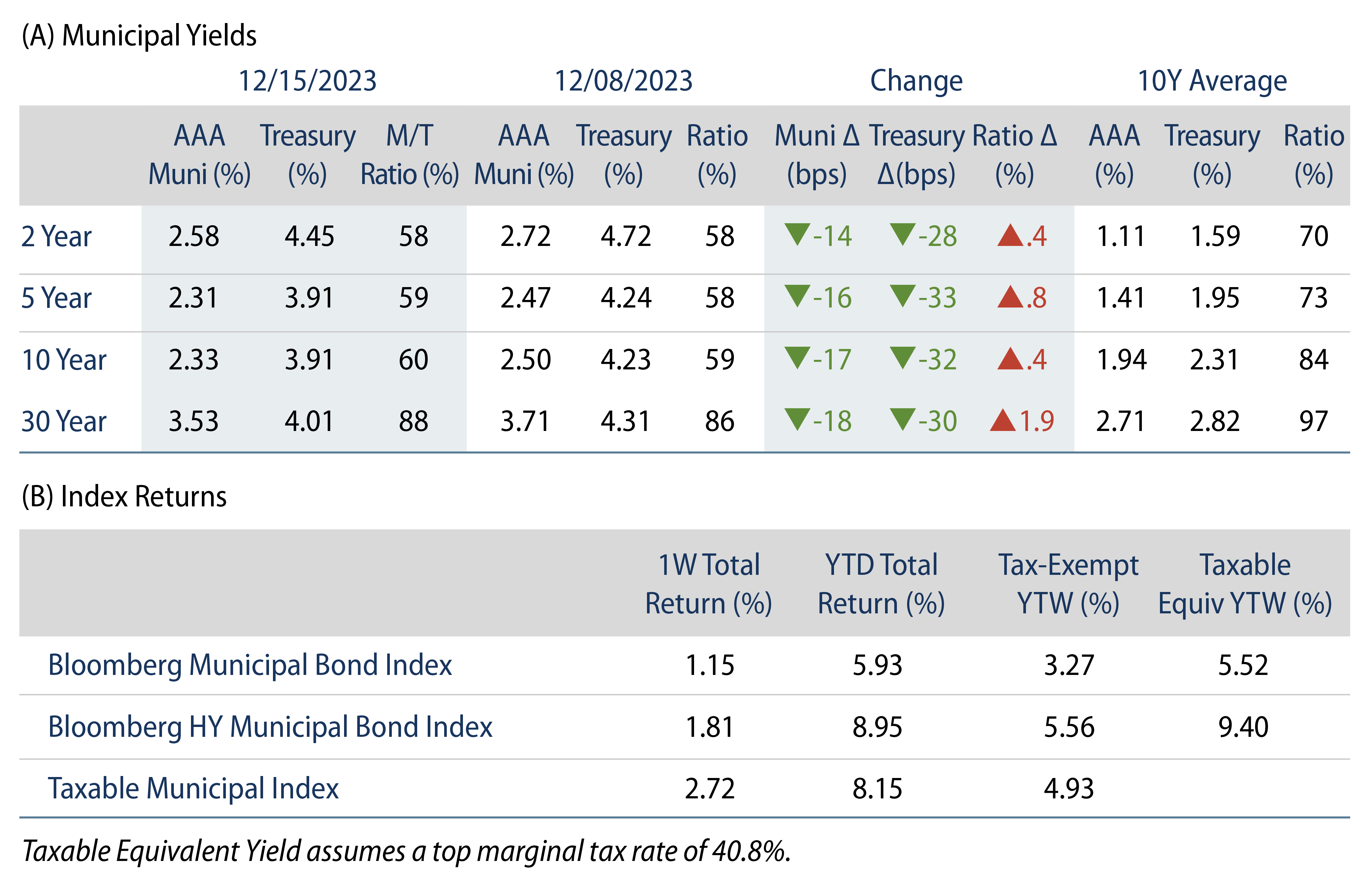

The muni rally continued last week, with munis trailing Treasuries lower as inflation data continued to trend downward due to the Fed’s dot plot signaling three rate cuts for next year. Meanwhile, high-grade muni yields moved 14-18 bps lower across the curve and muni technicals weakened amid tax-loss selling. The Bloomberg Municipal Index returned 1.15% during the week, the High Yield Muni Index returned 1.81% and the Taxable Muni Index returned 2.72%. This week we highlight 3Q23 state and local revenue estimates released by the Census last week.

Fund Flows Remained Challenged Amid Tax-Loss Season

Fund Flows: During the week ending December 13, weekly reporting municipal mutual funds recorded $524 million of net outflows, according to Lipper. Long-term funds recorded $228 million of outflows, high-yield funds recorded $58 million of outflows and intermediate funds recorded $25 million of inflows. This week’s flows bring year-to-date (YTD) net outflows to an estimated $16 billion.

Supply: The muni market recorded $7 billion of new-issue volume last week, down 45% from the prior week. YTD issuance of $363 billion is 2% higher from last year’s level, with tax-exempt issuance 8% higher and taxable issuance 34% lower year-over-year (YoY). This week’s calendar is expected to drop ahead of the holidays to $2.7 billion. Largest transaction includes a $725 million Main Street Natural Gas and $343 million California Public Finance Authority (Sharp Healthcare) transactions.

This Week in Munis: State and Local Revenues Stabilize

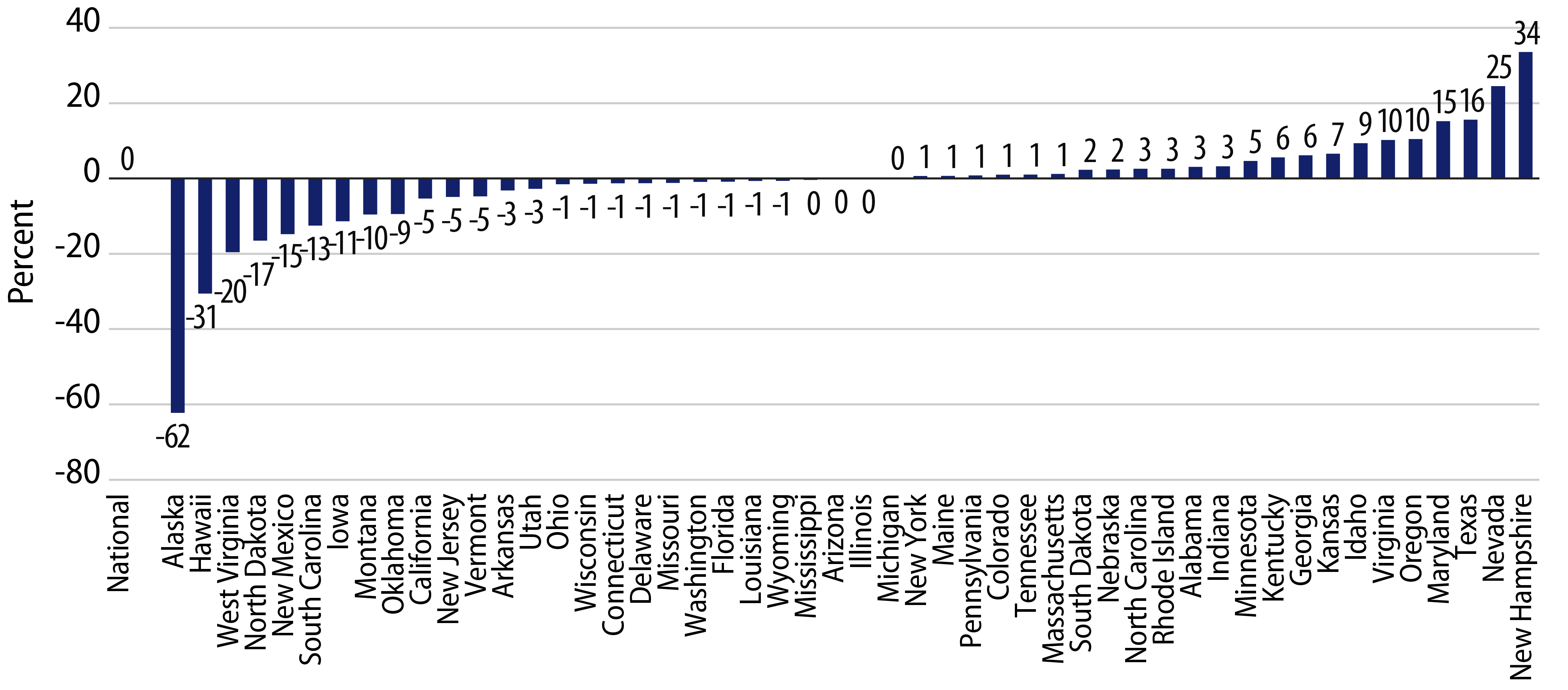

Last week the Census released 3Q23 state and local revenue estimates, which highlighted continued tax-collection strength. Following two consecutive quarters of YoY declines, third quarter state and local tax collections climbed 1% from 3Q22 to $413 billion. On a four-quarter trailing basis, total state and local revenues remain unchanged from a year ago at $2.0 trillion, 2% shy of the record four-quarter trailing level set in 4Q22.

Among the largest major tax categories, 3Q23 property tax collections increased 4% YoY to $129 billion, sales tax collections increased 1% to $138 billion, and corporate income taxes increased 3% to $27 billion. Notably, individual income taxes, which comprise the majority of state revenues, declined for the third consecutive quarter, falling 2% to $119 billion, potentially indicative of the slowing wage growth throughout the year.

Among major states, New Hampshire, Nevada and Texas observed the greatest 3Q tax-collection increases from the prior year, while Alaska, Hawaii and West Virginia observed the greatest YoY declines.

The stability of state and local tax collections continues to reflect strong labor and real estate markets. Absent a sharp economic downturn, we expect strong state and local revenues to be sustained around near record levels. While Western Asset anticipates headline budget deficits as the impact of restrictive monetary policy translates into slower growth, we expect elevated cash levels and budgetary flexibility to support credit conditions throughout the medium term. As such, Western Asset remains comfortable with taking credit risk in the municipal market, but believes current valuations and slower revenue growth trends warrant greater scrutiny versus the recent past.

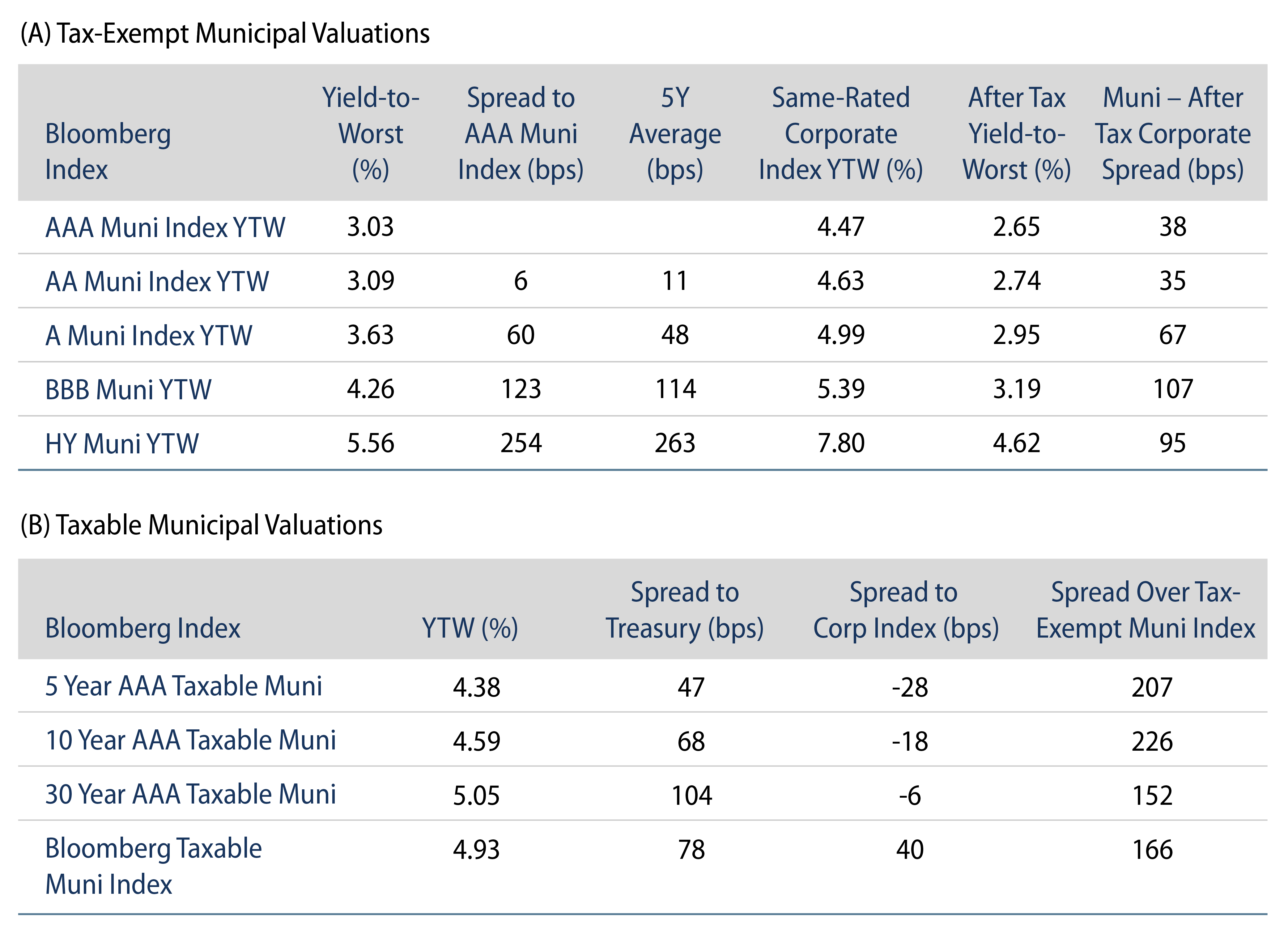

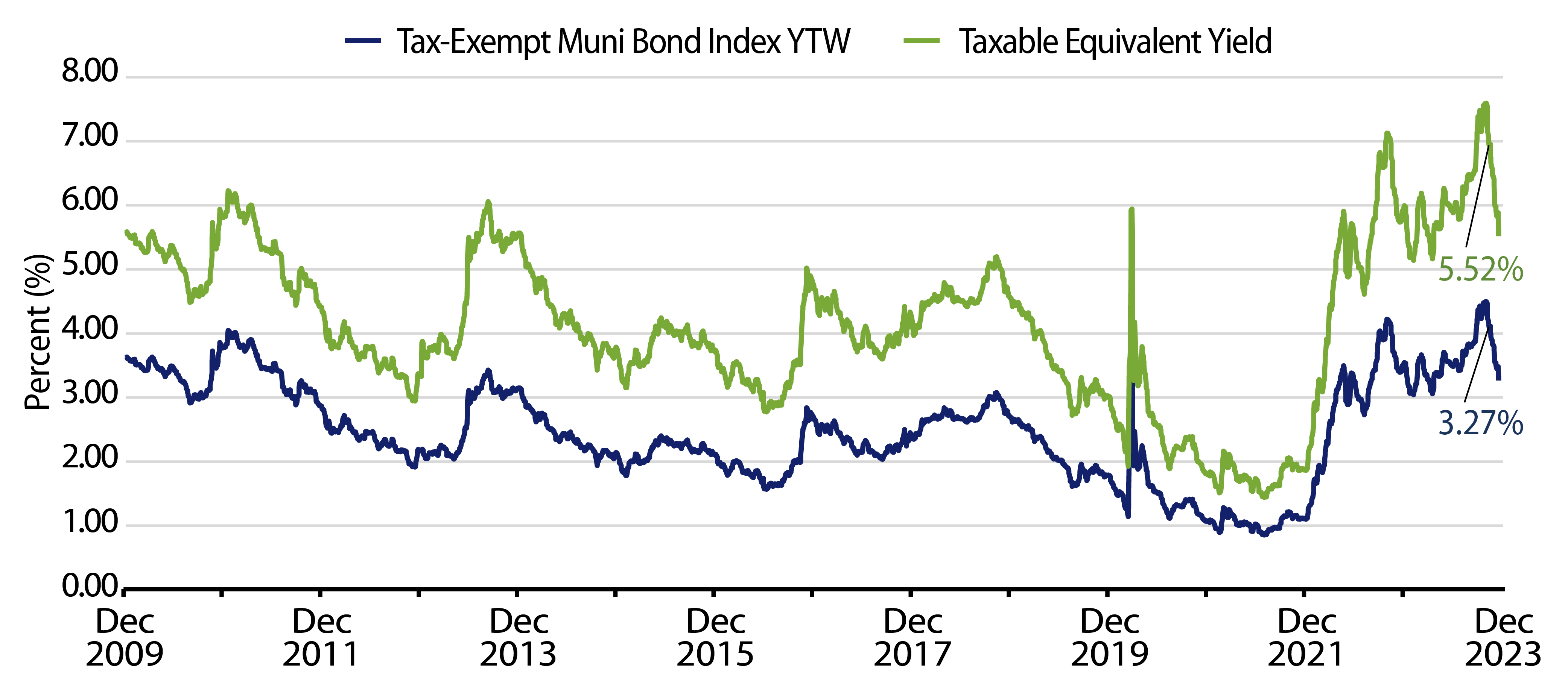

Theme #1: Municipal index yields and taxable-equivalent yields are above decade highs.

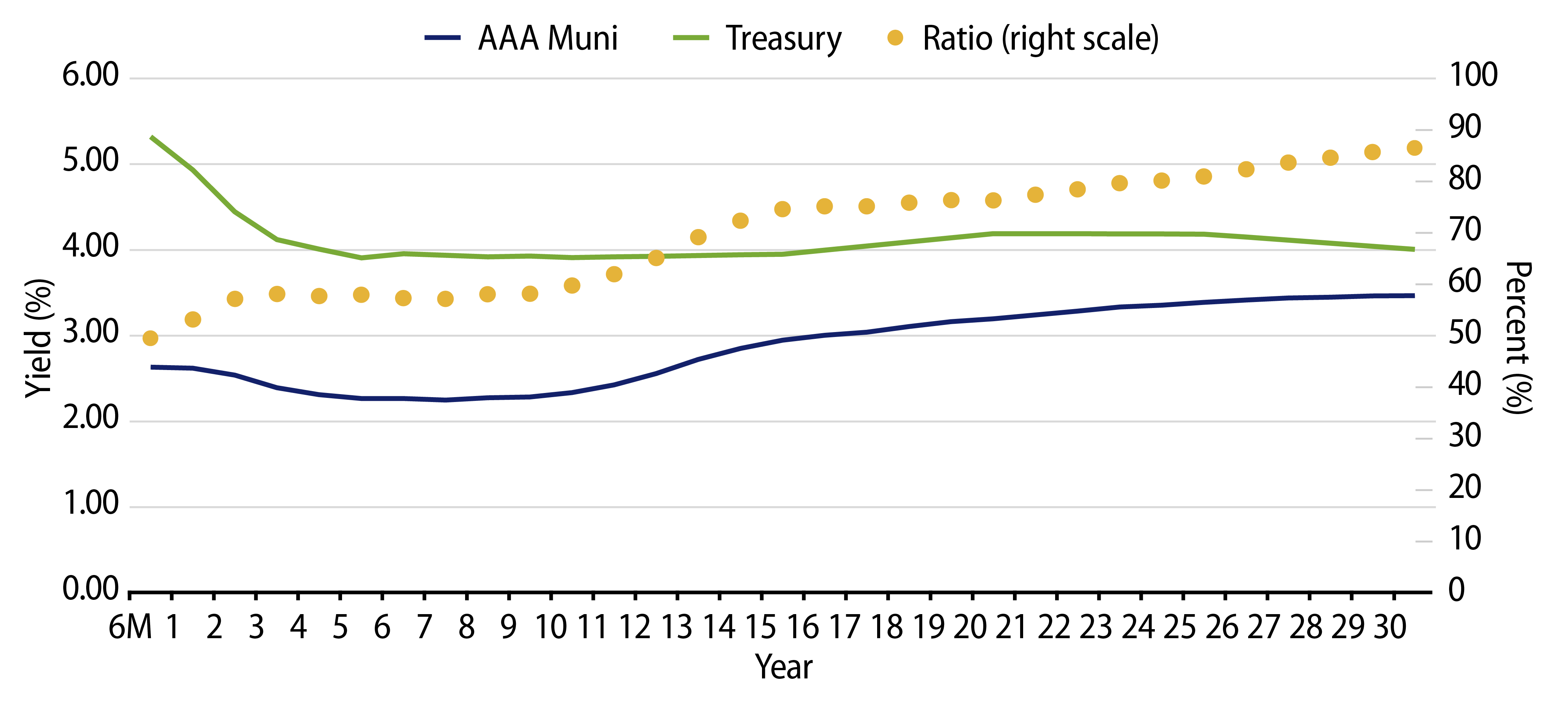

Theme #2: Recent disinversion of the muni yield curve highlights potential value in moving out to longer maturities.

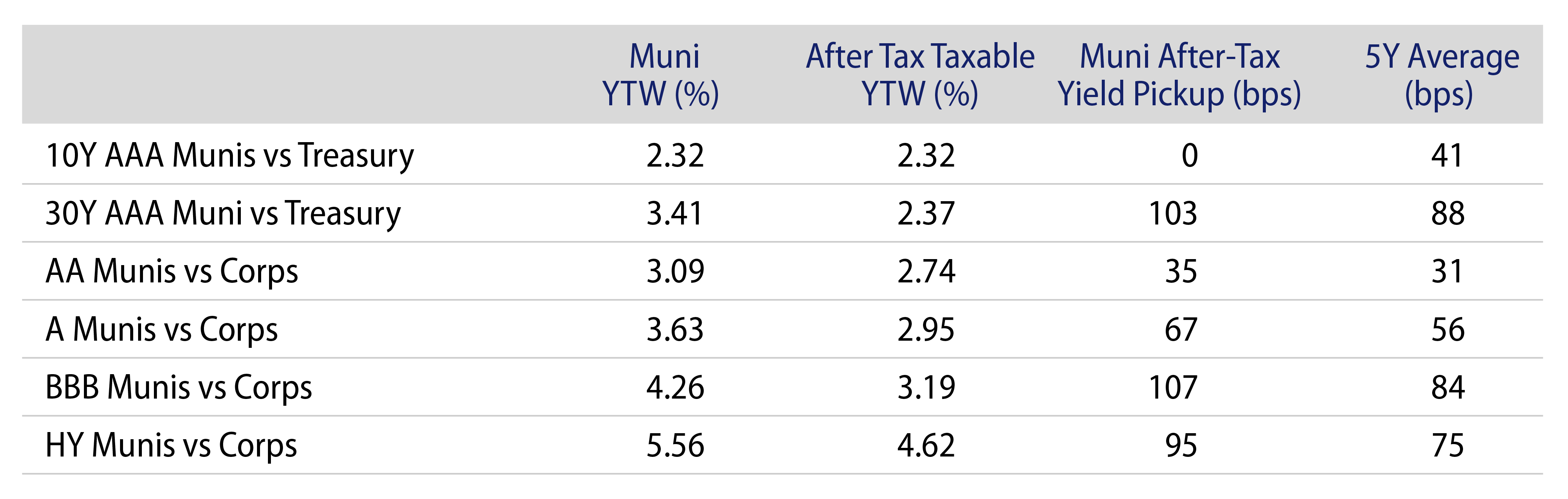

Theme #3: Munis offer attractive after-tax yield pickup versus Treasuries and corporate credit.