Macros, Markets and Munis

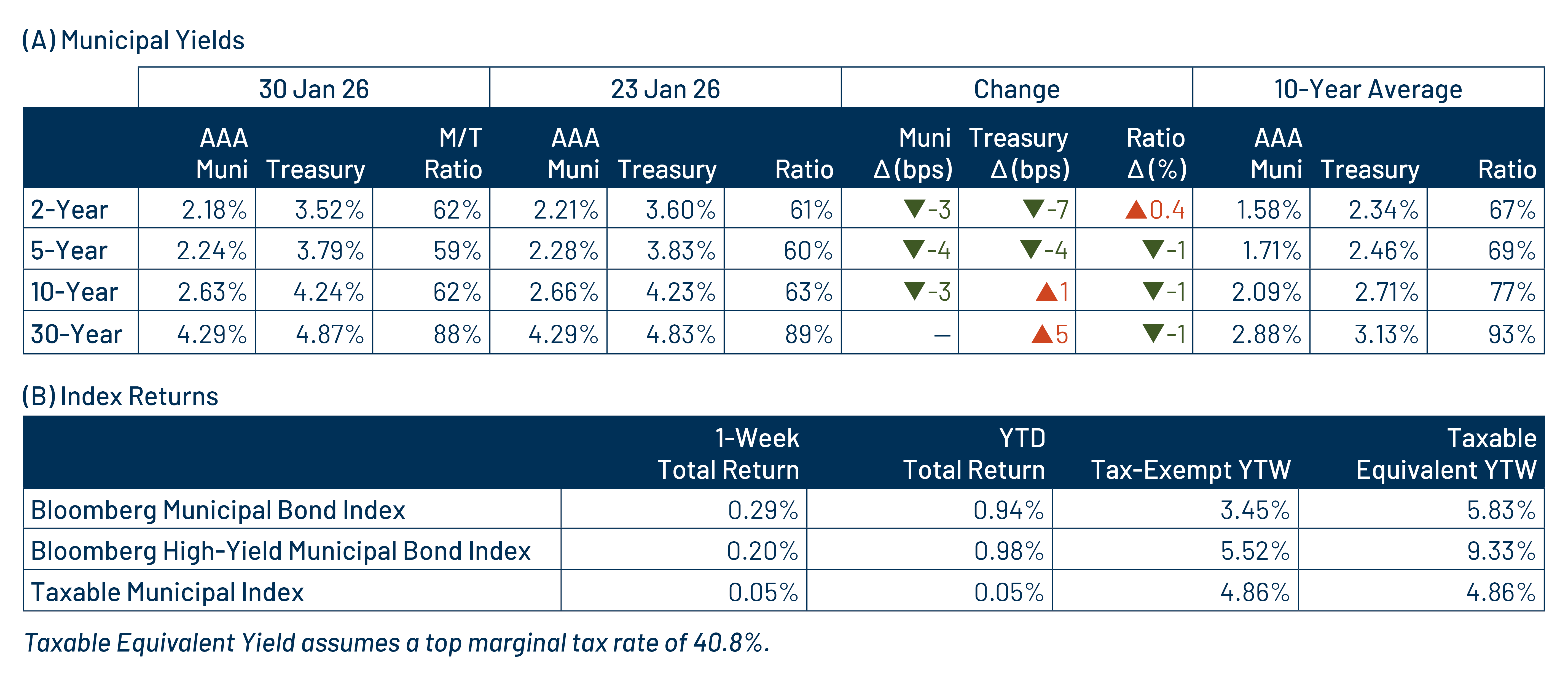

Munis posted positive returns and outperformed US taxable fixed-income last week. Fixed-income markets were focused on the Federal Open Market Committee (FOMC) meeting last week, which resulted in keeping rates unchanged as anticipated and included dovish language around labor market stabilization in its press release. The week closed with President Trump’s announcement to nominate Kevin Warsh as the successor to Jerome Powell as the Federal Reserve Chair. The Treasury curve steepened during the week, with yields moving 4-7 basis points (bps) lower in shorter maturities and 1 to 5 bps higher farther out the curve. Municipals outperformed amid strong supply and demand technical conditions as demand accelerated and new-issue supply was modest. Following the release of state and local tax collection estimates from the Census last month, this week we provide an update on state and local revenue drivers.

Technicals Strengthened Amid Strong Inflows, Lighter Supply Conditions

Fund Flows ($2.1 billion of net inflows): During the week ending January 28, weekly reporting municipal mutual funds recorded $2.1 billion of net inflows, according to Lipper. Long-term, intermediate and short-term categories recorded $1.0 billion, $603 million and $239 million of inflows, respectively. Last week’s inflows marked the 10th consecutive week of net inflows and led year-to-date (YTD) inflows higher to $6 billion.

Supply (YTD supply of $36 billion; up 23% YoY): The muni market recorded $5 billion of new-issue supply last week, down 58% from the prior week. The YTD new-issue supply of $36 billion is 23% higher than the prior year, with tax-exempt issuance up 23% year-over-year (YoY) and taxable issuance up 11%, respectively. This week’s calendar is expected to remain lighter at $6 billion. The largest deals include $718 million Goldman Sachs Black Belt Energy and $750 million Triborough Bridge and Tunnel Authority transactions.

This Week in Munis: State and Local Tax Collections Remain Strong

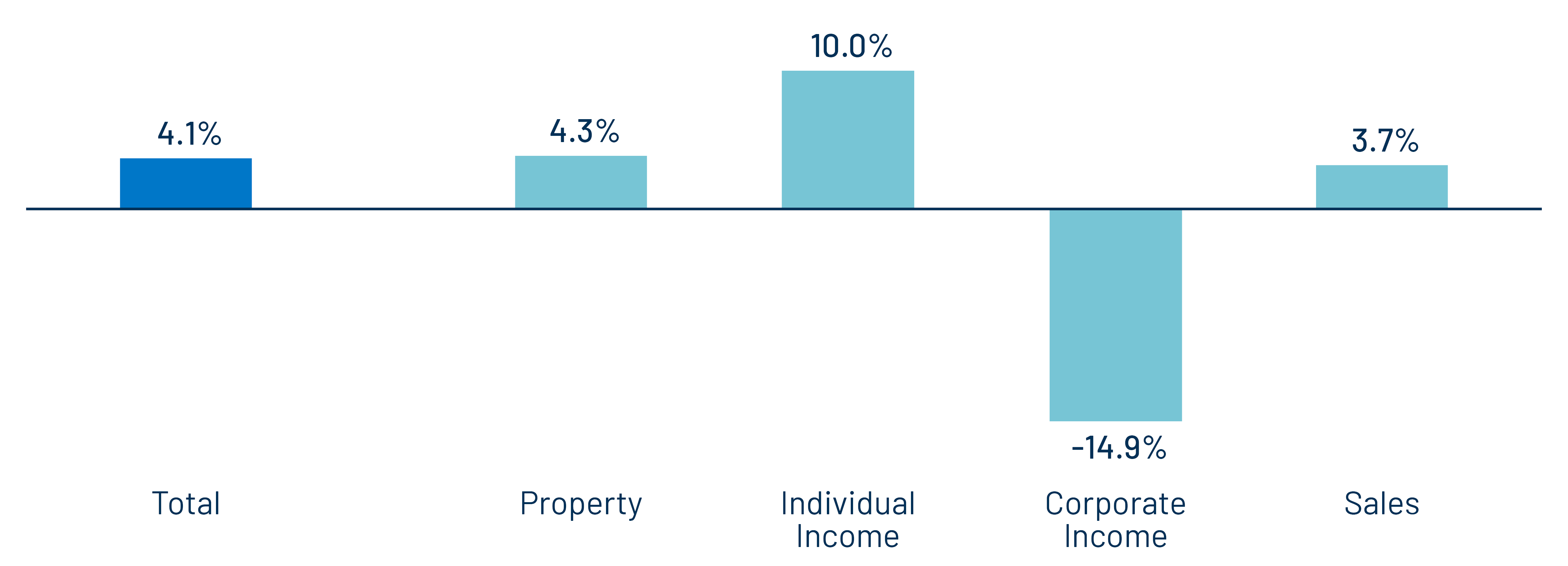

In January, the Census released 3Q25 state and local tax collection estimates, which were delayed due to the government shutdown but underscored continued resilience for traditional state and local credit conditions. State and local government tax collections increased 4.1% in 3Q25 from 3Q24 levels to $562 billion. Among the major state revenue sources, individual income taxes increased 10.0%, sales tax collections increased 3.7% YoY, while corporate income tax collections declined 14.9%. Property tax collections, the primary source of revenues for local governments, increased 4.3% YoY.

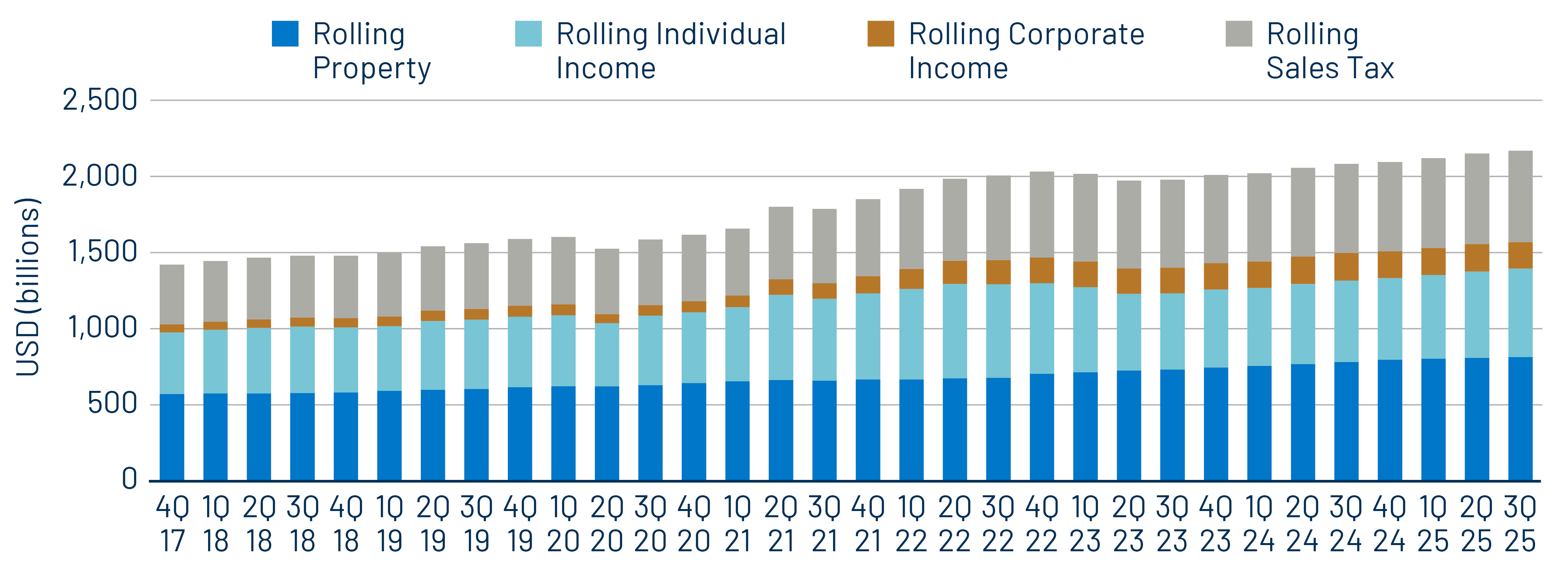

Twelve-month trailing collections increased 4.2% YoY to $2.2 trillion, marking a record high according to Census data. On a 12-month trailing basis, individual income tax collections increased 8.6% YoY and sales tax collections increased 2.6%, while corporate income tax collections declined 3.6%. Twelve-month rolling property tax collections increased 4.2% YoY.

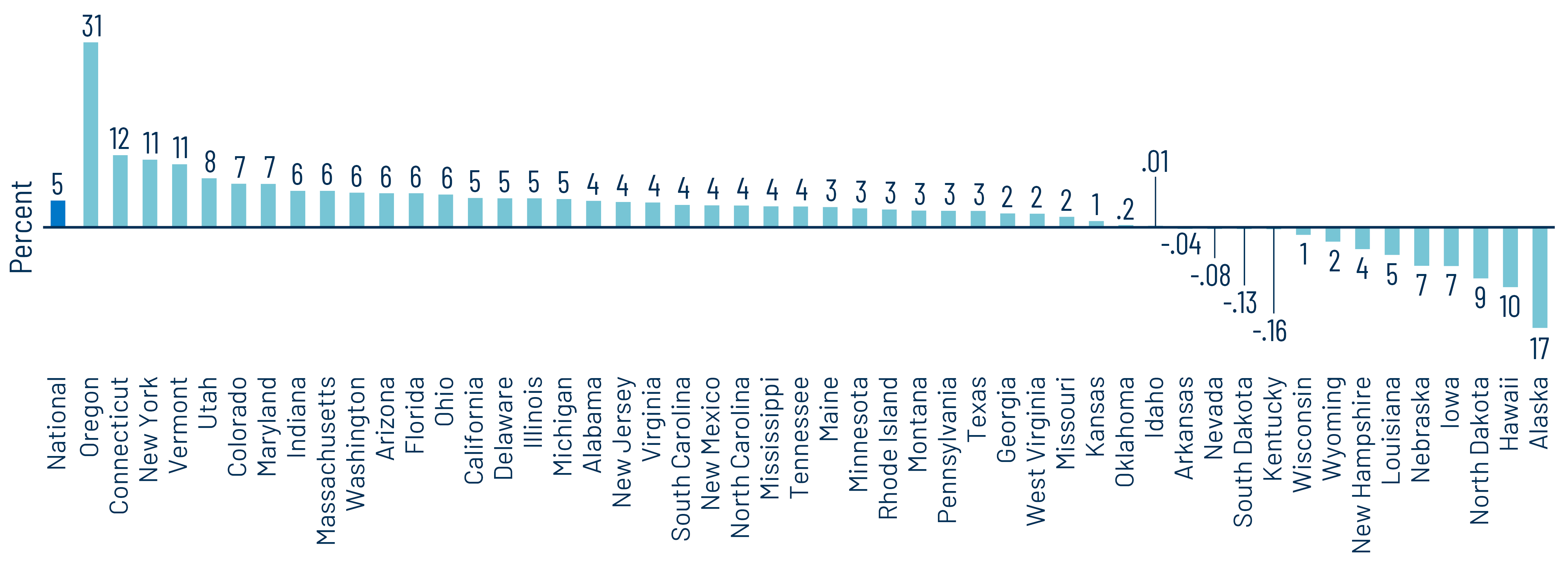

From a state perspective, the Census estimates that most states recorded revenue increases over the trailing 12 months, with total state tax collections increasing 4.6%. On a YoY basis, Oregon (+31%), New York (+13%) and Connecticut (+12%) recorded the highest growth in estimated tax revenue. Conversely, Alaska (-17%), Hawaii (-10%) and North Dakota (-9%) saw the sharpest 12-month trailing YoY declines.

The continued growth in state and local tax collections highlights the resilience of these revenue streams, which consistently surpass US GDP growth. Despite recent softening, we expect the labor market and consumer spending to remain supportive of tax collections and municipal credit conditions over the medium term. However, tax collection performance will likely become more critical for budgets if federal spending reductions impact broader state and local funding or challenge labor conditions.

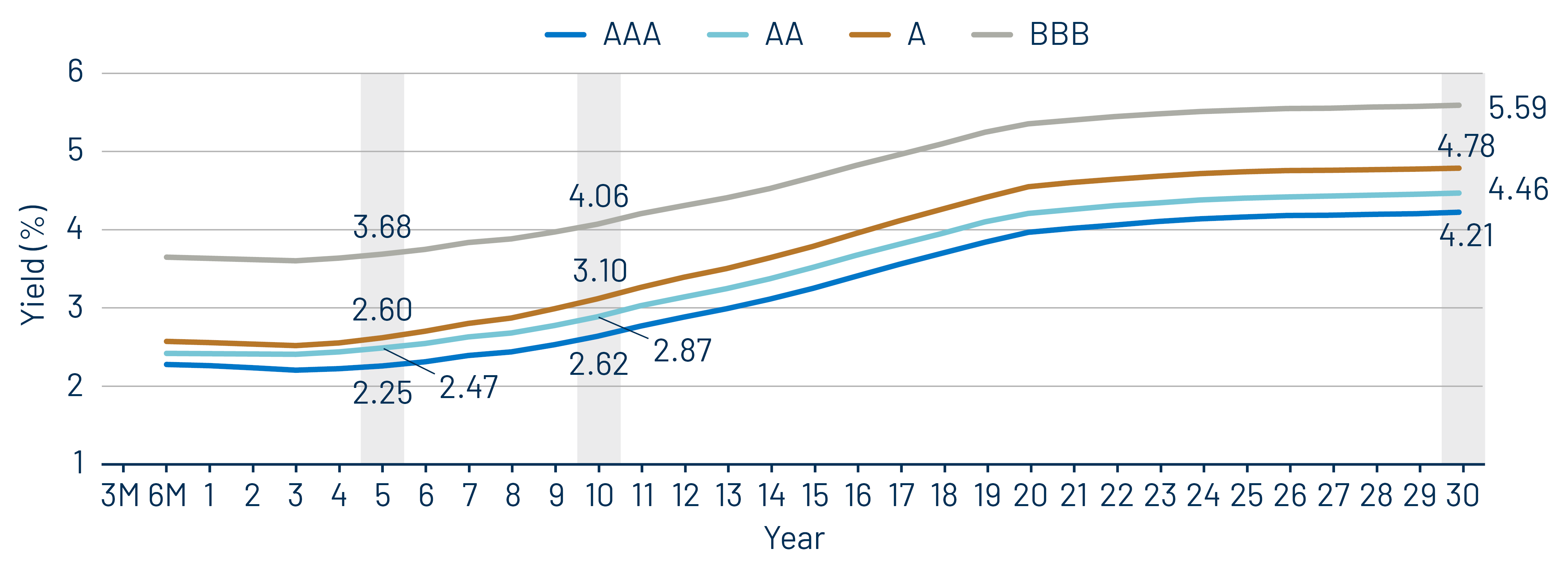

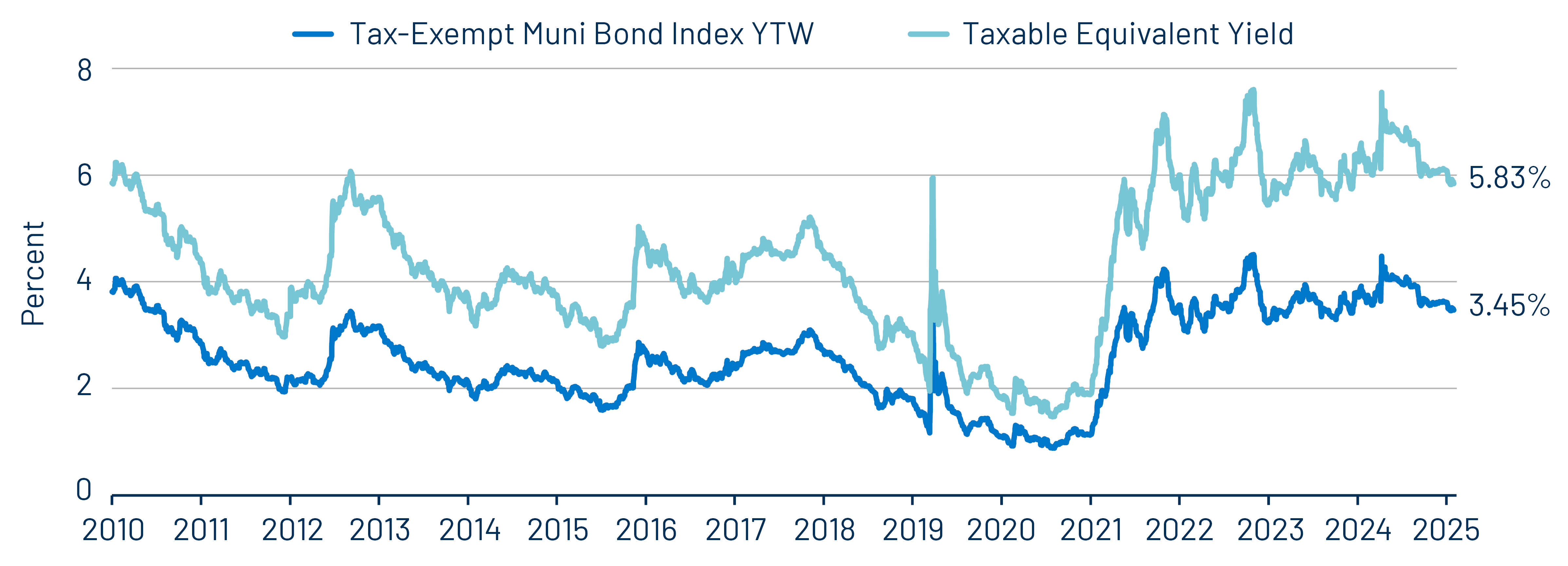

Theme 1: Municipal taxable-equivalent yields moved lower in 2025, but remain above historical averages.

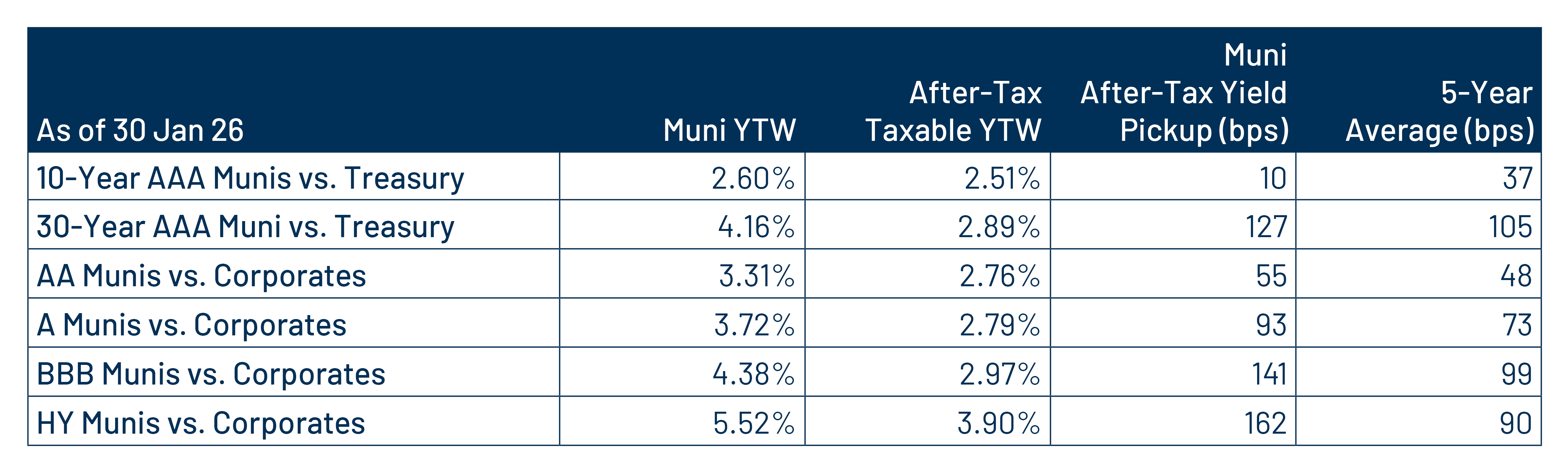

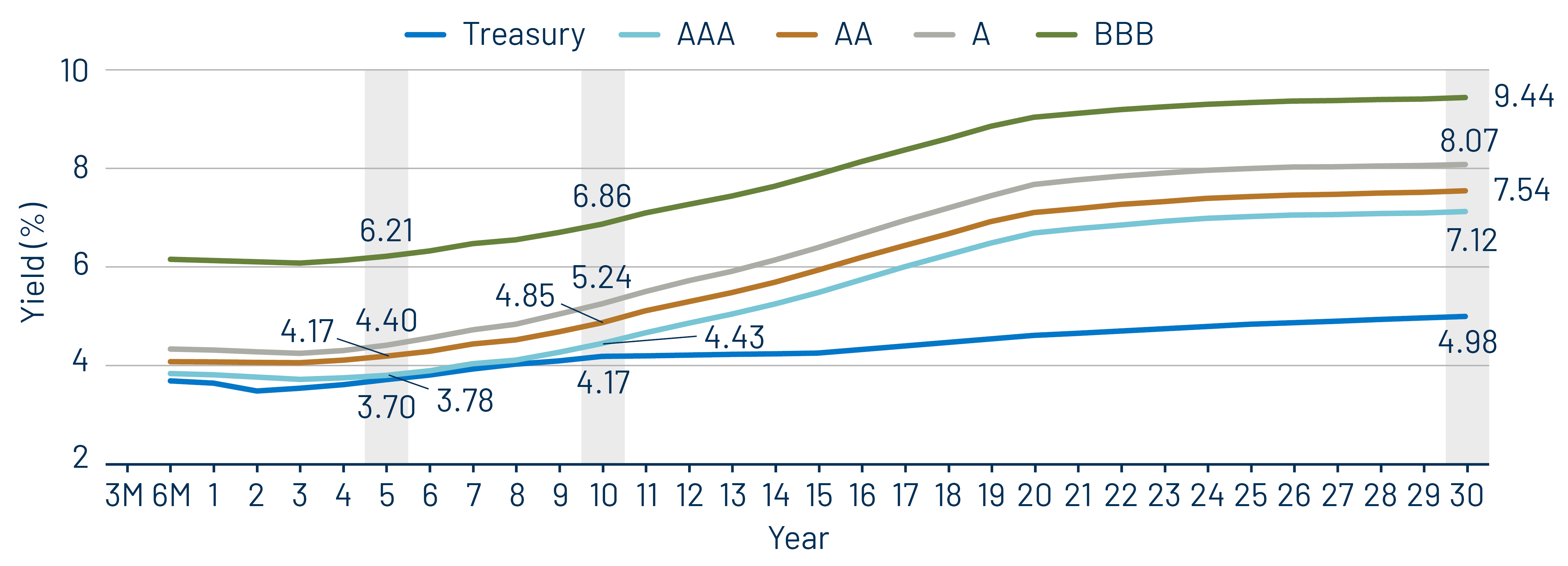

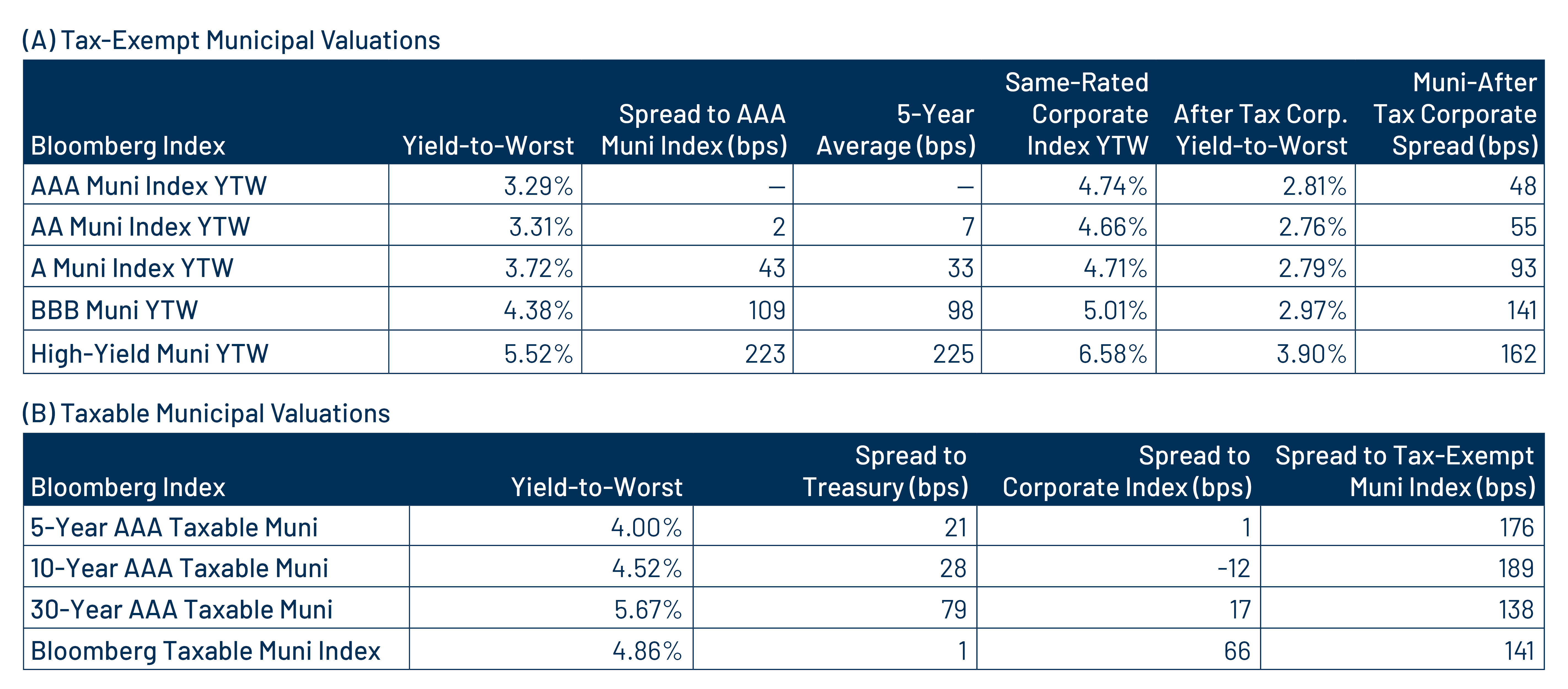

Theme 2: Munis offer attractive after-tax yield pickup vs. taxable alternatives.

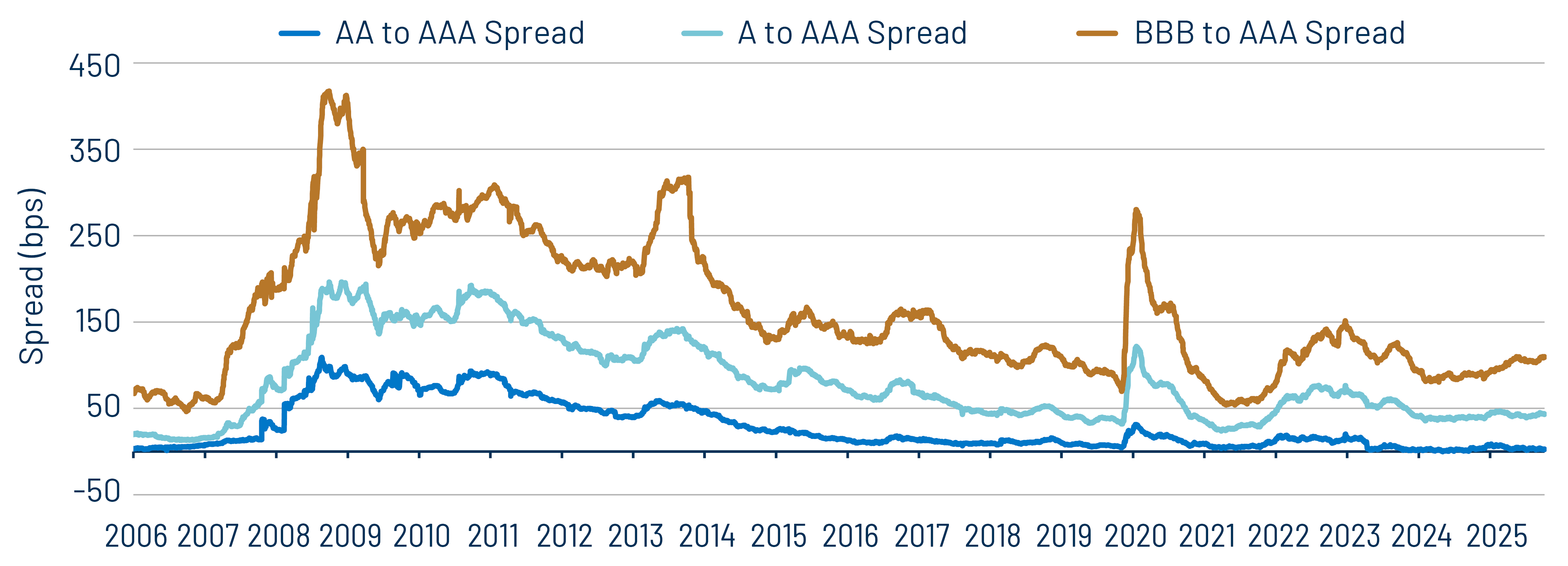

Theme 3: Tight municipal credit spreads demand disciplined credit selection.