Municipals Posted Positive Returns Last Week

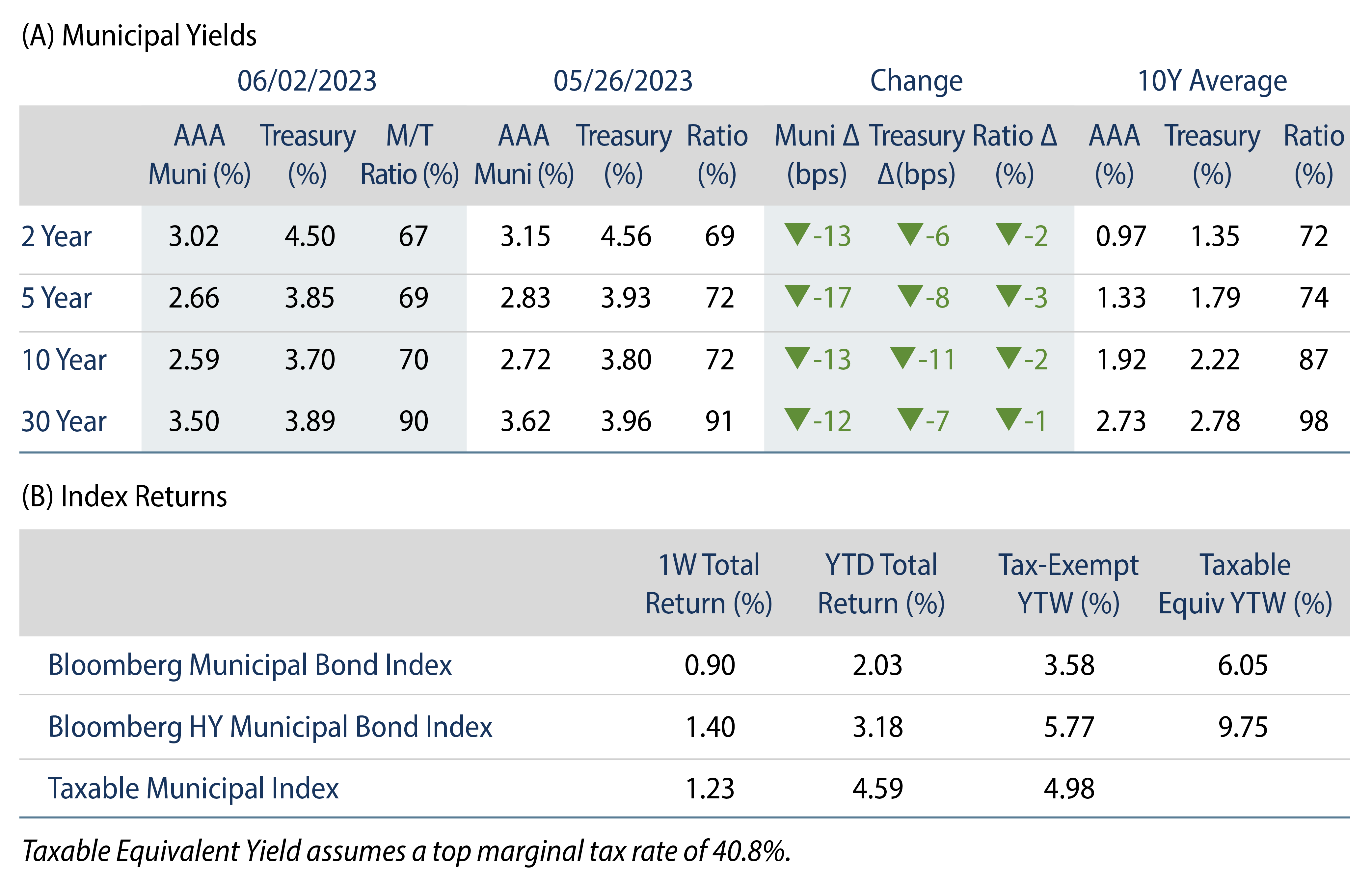

Municipals posted positive returns last week as muni yields moved lower across the curve. Munis outperformed Treasuries during a week of considerable volatility. Municipals followed Treasuries sharply lower early in the week on the passage of the debt ceiling package and declining unit labor cost data, but failed to move higher with Treasuries on Friday following the release of strong payrolls data. Technicals remained challenged by fund outflows and above average new-issue supply. The Bloomberg Municipal Index returned 0.90% during the week, the High Yield Muni Index returned 1.40% and the Taxable Muni Index returned 1.23%. This week we highlight the progress of ridership recovery trends across the municipal transportation sector.

Technicals Were Challenged by Fund Outflows, Above Average Supply, and Bank Bid Lists

Fund Flows: During the week ending May 31, weekly reporting municipal mutual funds recorded $1.3 billion of net outflows, according to Lipper. Long-term funds recorded $514 million of outflows, high-yield funds recorded $473 million of outflows and intermediate funds recorded $290 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows to $7.7 billion.

Supply:The muni market recorded $9.6 billion of new-issue volume last week, up 45% from the prior week. In addition to above average new-issue supply, the market contended with over $200 million of the FDIC window of Silicon Valley Bank municipal securities. YTD issuance of $144 billion remains down 18% year-over year (YoY), with tax-exempt issuance down 10% YoY and taxable issuance down 50% YoY. This week’s calendar is expected to drop to $2.6 billion. Large transactions include $892 million New York City Housing Development Corporation and $700 million Los Angeles Tax and Revenue Anticipation Note transactions.

This Week in Munis: Summer Travel

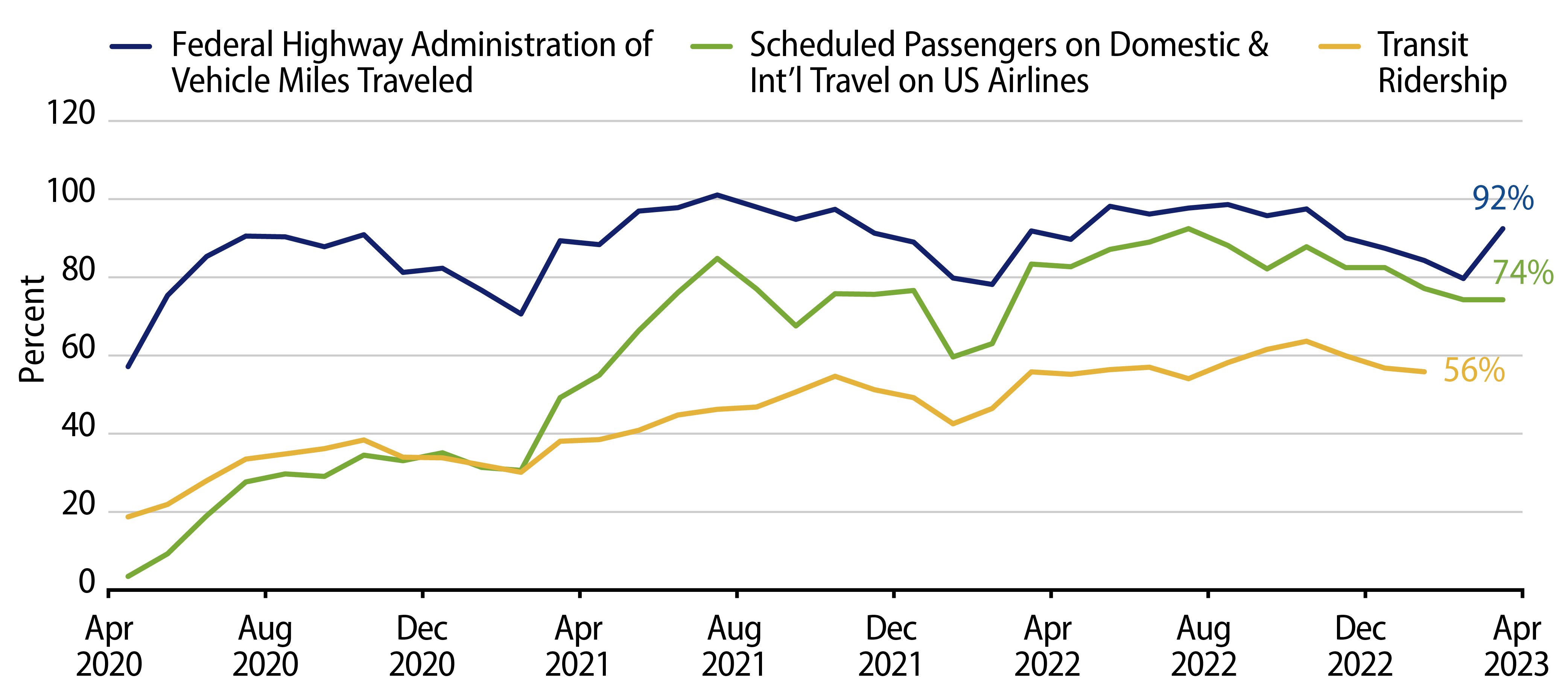

As summer travel season kicks off, we provide an update on the state of passenger traffic across the municipal transportation sector. In the early pandemic recovery, we highlighted the progress of vehicle traffic, airline traffic and mass transit ridership from pandemic lows. With pandemic pressures further easing, we continue to see traffic levels recover, but traffic still generally remains below pre-pandemic peaks which could introduce potential credit challenges as the impact of robust federal stimulus measures begin to fade.

- Vehicle traffic, including bridge and toll fares collected by municipal transportation agencies, was arguably least impacted by pandemic conditions and was also earliest to recover. After falling to a low of 57% of pre-pandemic levels in April 2020, ridership trends fully recovered to 101% of pre-pandemic levels in July 2022, and most recently the 271 million miles travelled in March 2023 was up 1% from the prior year.

- Airline traffic was arguably most impacted by the shutdowns, with US domestic passenger traffic falling to just 3% of its pre-pandemic peak in April 2020. Airline passenger traffic nearly fully recovered by July 2022, reaching as high as 92% of pre-pandemic levels. Since last year’s seasonal summer peak, passenger air travel has since cooled to 74% of the pre-pandemic high. Most recently, the 64 million passengers that traveled US airlines in March 2023 was approximately 11% below levels seen in March 2022, a potential signal of slowing demand amid inflationary headwinds.

- Public transit ridership was also among the hardest hit segments of the muni market during the pandemic, with ridership volumes falling to 19% of pre-pandemic levels in April 2020. We have since observed ridership gradually recover as return-to-office policies took shape over the past two years, and most recent January 2023 ridership levels of 511 million increased 33% YoY. However, the mass transit recovery has lagged vehicle travel and air travel, reaching just 56% of the pre-pandemic peak.

As the impact of federal stimulus measures fade, concerns around large mass transit systems’ ability to sustain below-expectation ridership have risen. Favorably, many public transit securities benefit from more than just ridership-dependent fare box revenues, but are also secured by sales taxes which continue to grow at robust levels In addition, transportation agencies are also lobbying for additional state support to fund ongoing operations. For example, last month, the New York Metropolitan Transit Authority (MTA) was successful in garnering additional support from the most recent New York State budget, including a $1.1 billion hike in payroll taxes for major companies based in NYC and an increased contribution of $165 million from the city to pay for a greater share of the para-transit costs. These efforts provide additional time for the ridership recovery to continue, which we anticipate will remain a slow grind upward as return-to-office policies are further formalized.

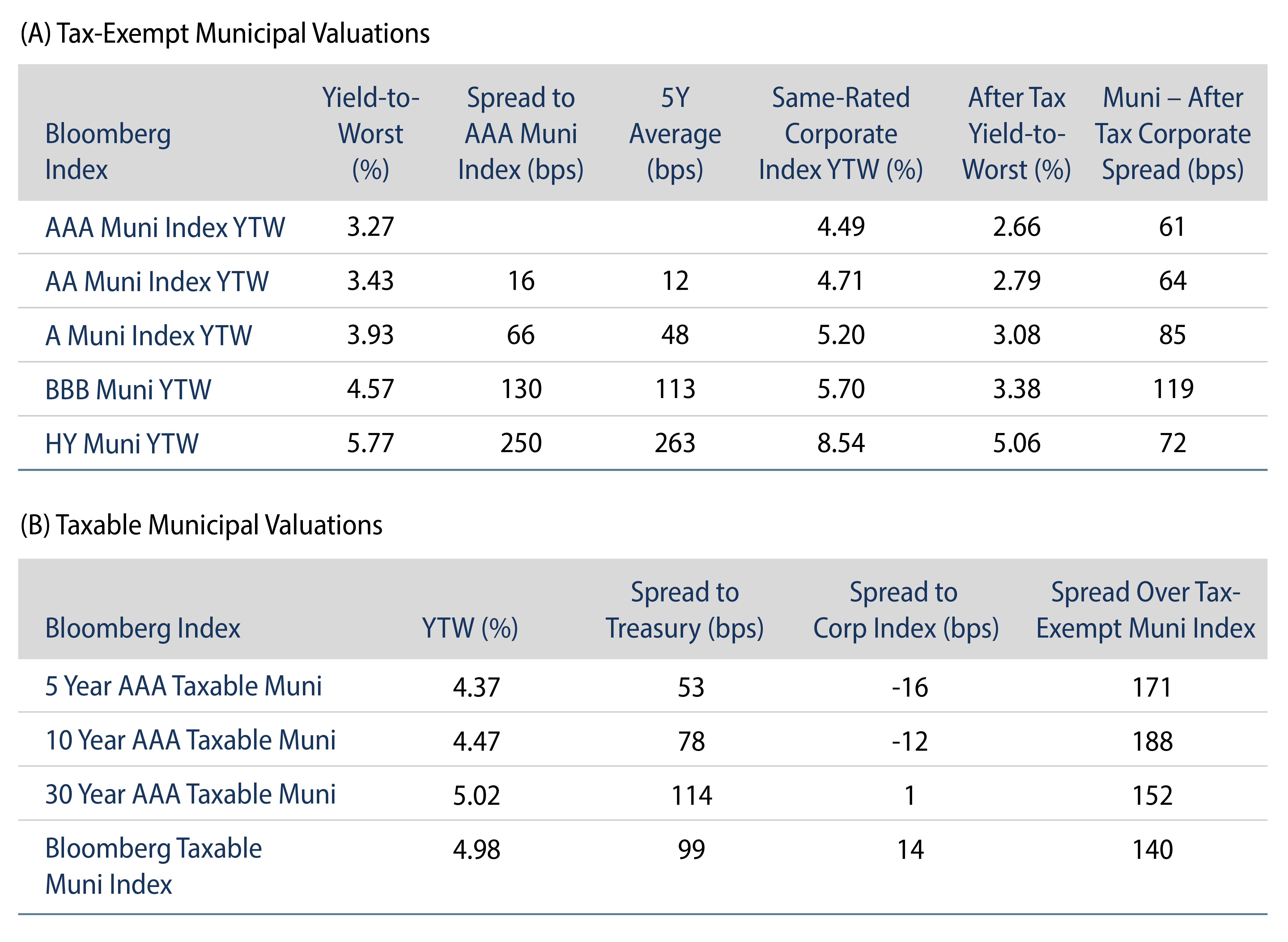

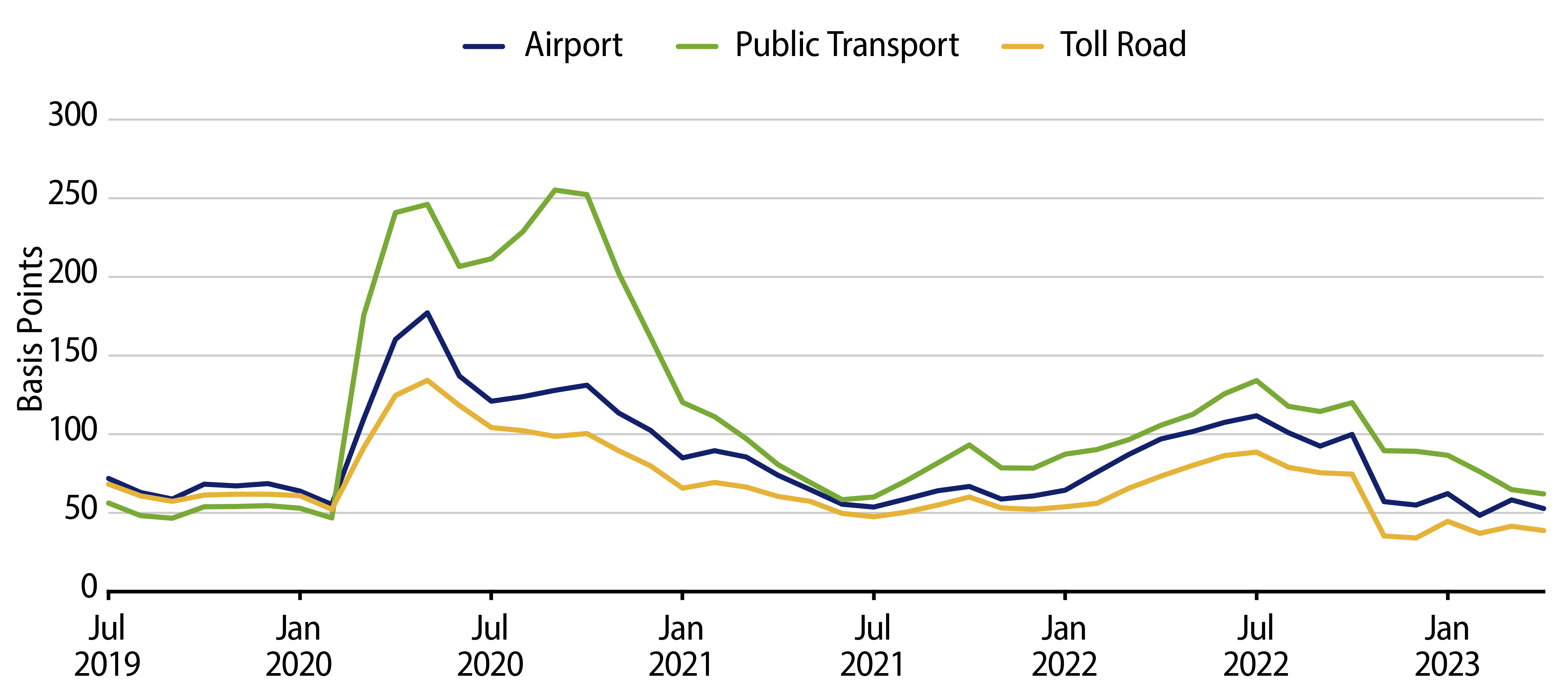

From a valuation perspective, municipal spreads within the transportation sector have compressed since the height of pandemic concerns, and the market now appears to be highlighting limited pricing differentiation between these three major transportation segments despite the diverging state of demand. In this environment, Western Asset believes value can be captured at the issuer level, and prefers systems with diversified revenues that can benefit from unforeseen volatility rather than liens reliant on fare box revenues.