Investment-Grade Munis Posted Positive Returns Last Week

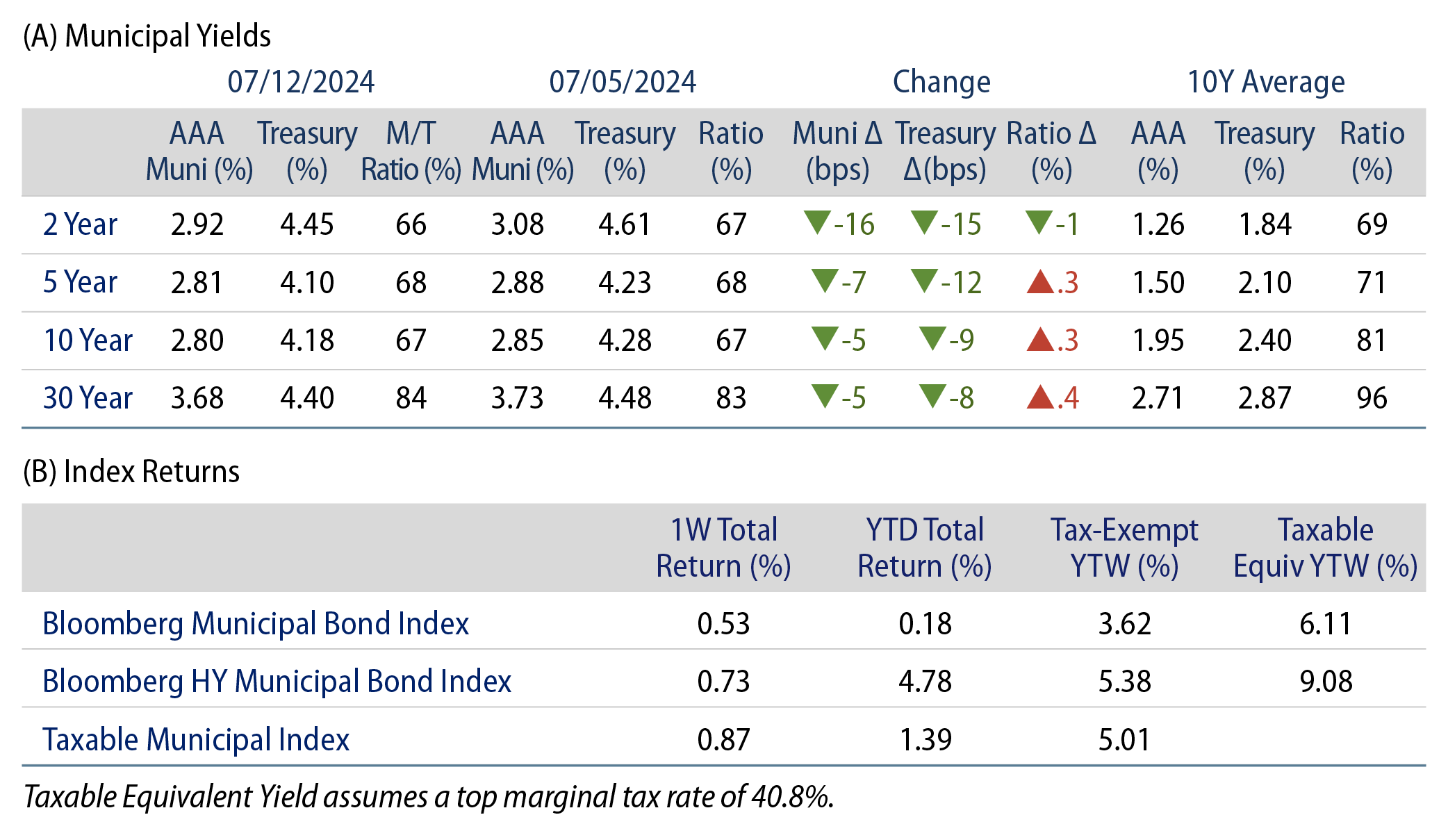

Investment-grade municipal bonds posted positive returns last week as high-grade muni yields moved lower across the curve with Treasuries, which rallied on lower-than-expected inflation data. Muni supply and demand picked up after the holiday-shortened week. The Bloomberg Municipal Index returned 0.53% during the week, the High Yield Muni Index returned 0.73% and the Taxable Muni Index returned 0.87%. This week we present an update on the transportation sector as we enter the summer travel season.

Muni Supply and Demand Both Picked Back Up After the Holiday Week

Fund Flows (up $775 million): During the week ending July 10, weekly reporting municipal mutual funds recorded $775 million of net inflows, according to Lipper. Long-term funds recorded $670 million of inflows, high-yield funds recorded $276 million of inflows and intermediate funds recorded $204 million of inflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $12.4 billion.

Supply (YTD supply of $249 billion, up 43% YoY): The muni market recorded $10 billion of new-issue volume last week. YTD issuance of $249 billion is 43% higher than last year’s level, with tax-exempt issuance 47% higher and taxable issuance 4% higher year-over-year (YoY). This week’s calendar is expected to remain elevated at $11 billion. The largest deals include $1.8 billion New York City Transitional Finance Authority and $1.0 billion Texas Transportation Commission transactions.

This Week in Munis: Summer Travel

Amid summer travel season, we provide an update on the state of passenger traffic and credit implications across the primary municipal transportation sectors of toll roads, airports and mass transit.

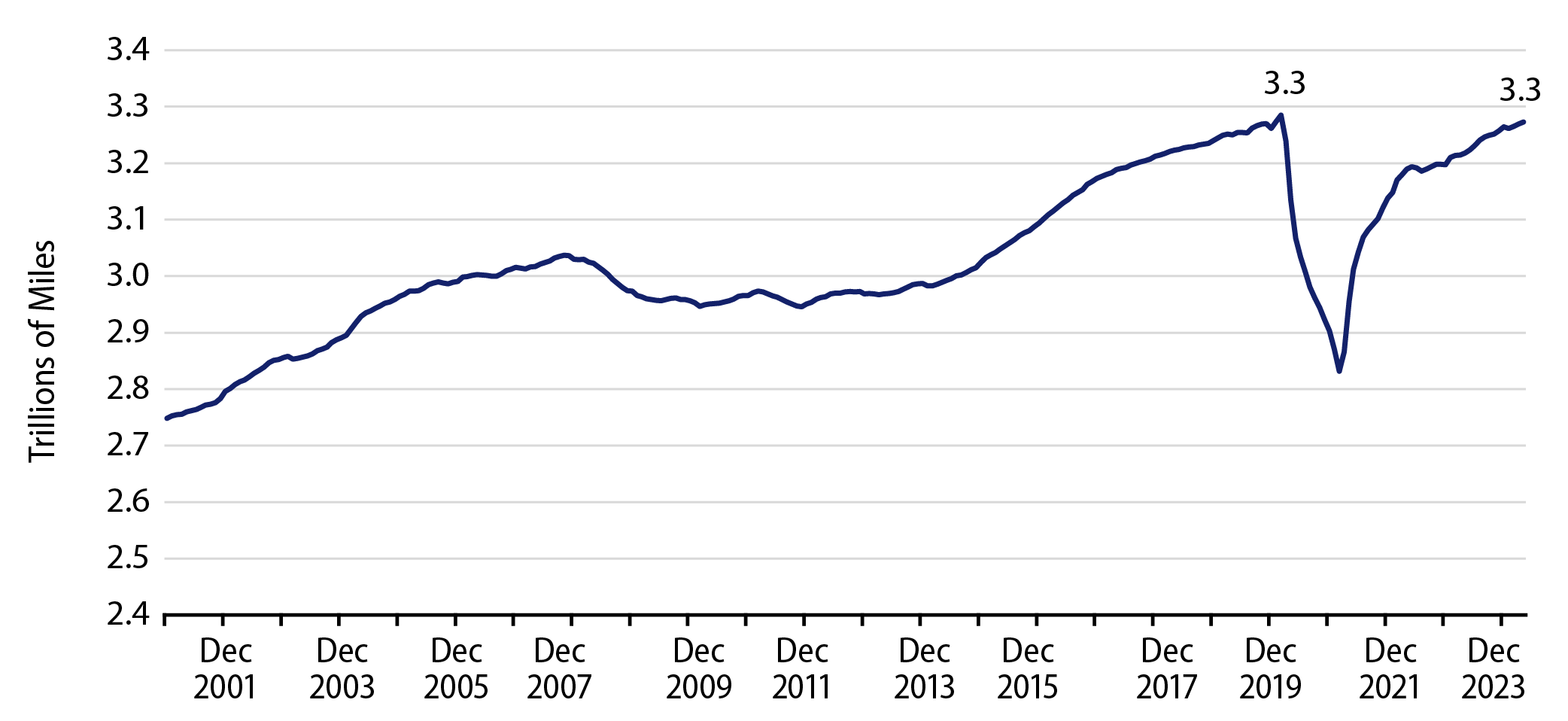

Toll roads—Americans are back on the road. After a brief pandemic-related drop, monthly miles driven have fully recovered to pre-pandemic levels despite potential effects of shifting work patterns. Notably, recovery has not been even across issuers. While most major turnpikes and toll revenue projects have recovered, we note that recovery trends are broadly divided into three categories:

- Mature systems that are largely returning to normal growth rates that follows long-term economic activity,

- Systems in southern and sunbelt states that are experiencing hyper-growth related to positive demographics, and

- Laggards in select suburban communities which have seen seemingly permanent traffic decreases ranging up to 30% due to the high percentage of employees that continue to work from home.

Western Asset sees higher risk-adjusted value in those mature systems, as well as those systems that are experiencing significant growth. However, we remain cautious on toll roads that have not recovered from pre-pandemic levels and do not offer material additional value for the incremental risks.

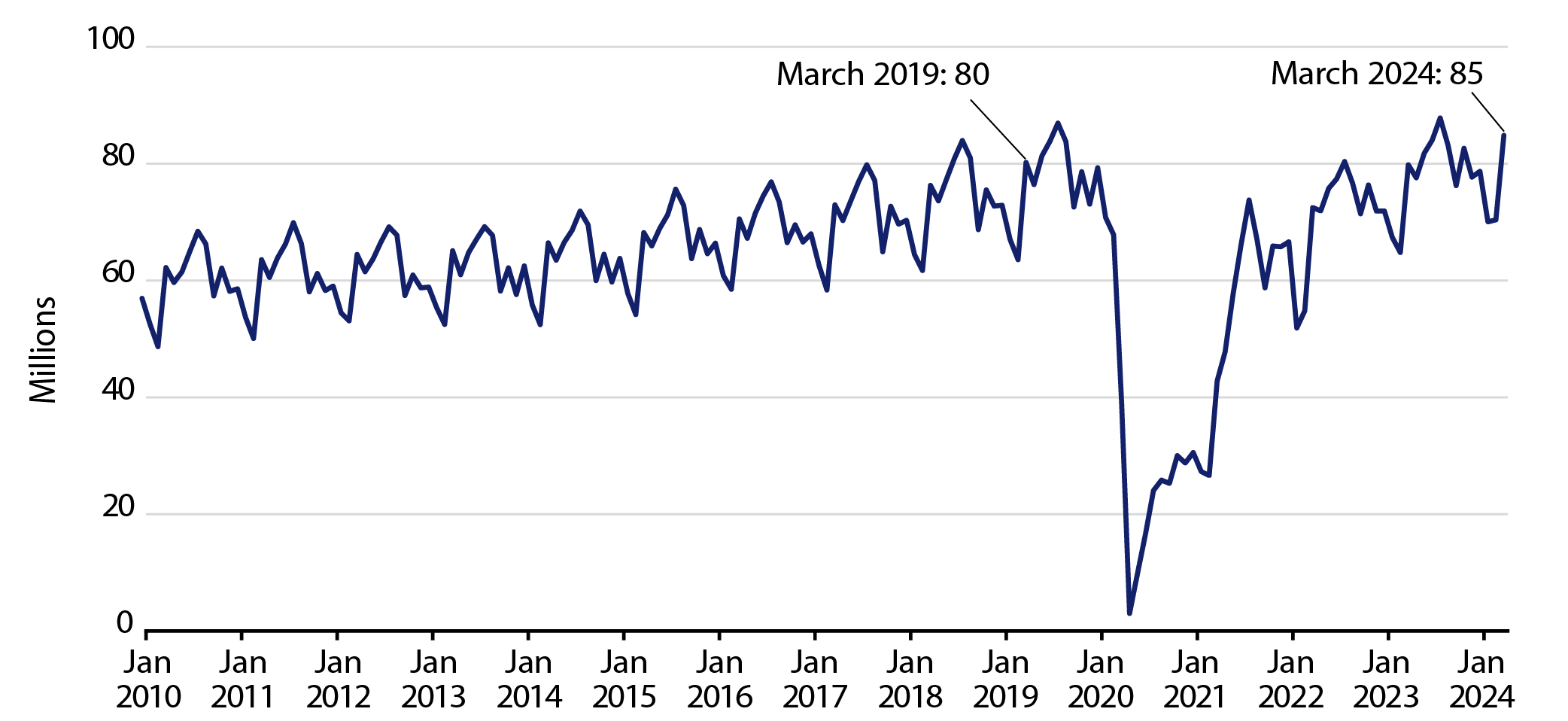

Airports are busy. As of March 2024, passenger aircraft enplanements at US airports are up 6% from 2019 levels, continuing a strong pattern of recovery. Western Asset notes that one result of this strong demand is an increased appetite for airports and airlines to take on debt for both airside and landside infrastructure modernization updates. New terminal construction activity is elevated, and the amount of debt required for such projects can easily range into billions of dollars. While the credit metrics currently support these investments, it is worth watching for winners and losers that may emerge from the ever-escalating battle to provide the best traveler experience.

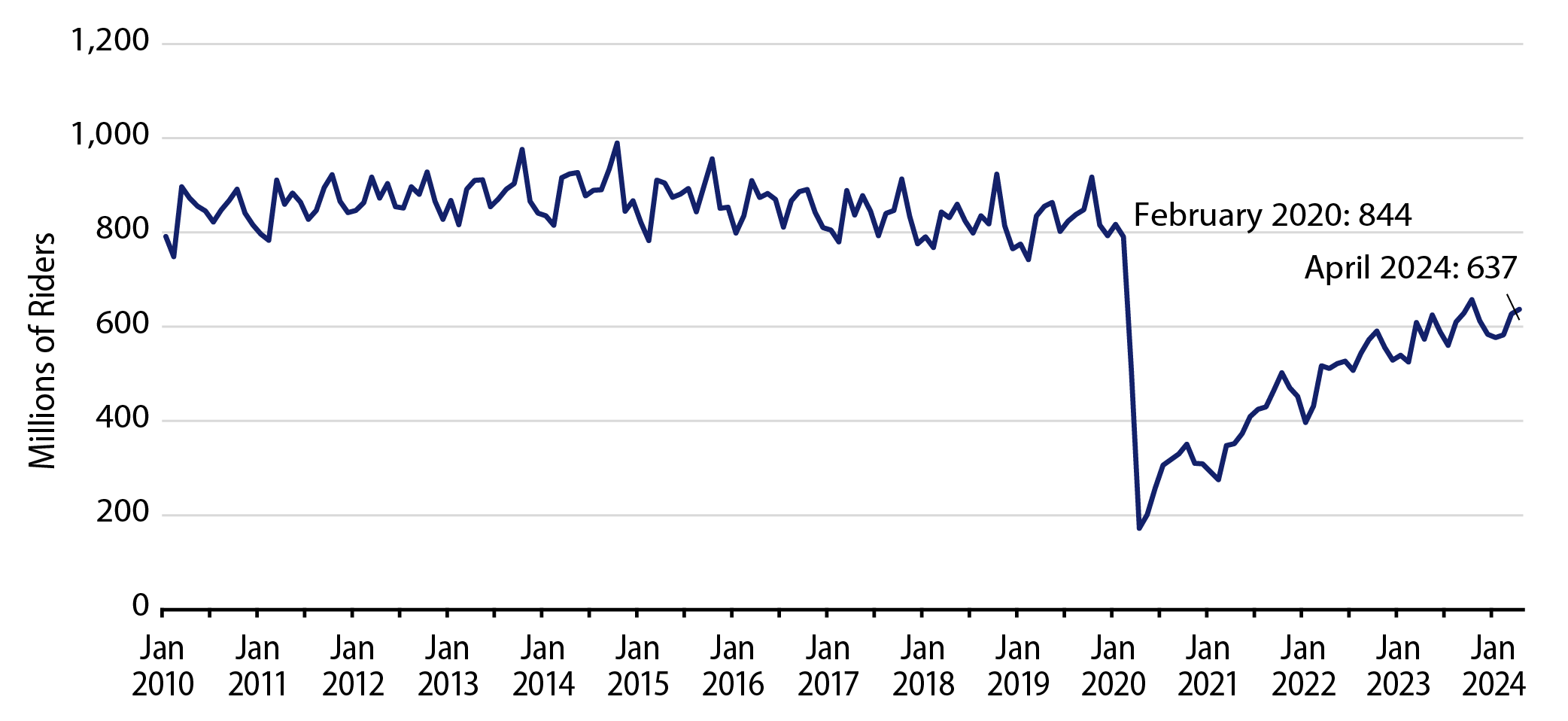

Mass transit ridership lags the pre-Covid era. It is evident that work-from-home policies have contributed to a more permanent demand deterioration for mass transit, as ridership remains 25% below pre-pandemic levels, according to the Federal Reserve Bank of St. Louis. Western Asset has long believed that additional public support would be required to supersede post-pandemic farebox revenue declines, and evidence of such support is now being seen. Enacted and proposed funding mechanisms are varied and include fees on oil and gas production, increased sales taxes, increased business taxes and traditional state appropriations. Taken together, these measures are expected to offset most of the farebox revenue decreases sector-wide and return stability to the sector, evident by recent agency upgrades within the sector.

Western Asset maintains a favorable view of the transportation sector, which comprises a significant 16% of the Bloomberg Muni Bond Index, as we expect the higher beta revenue sector to remain supported by resilient economic activity. However, the dispersion recovery between different modes of transportation highlights the value that an active manager with a well-resourced credit team can provide to take advantage of shifting credit trends and risk-adjusted income opportunities.

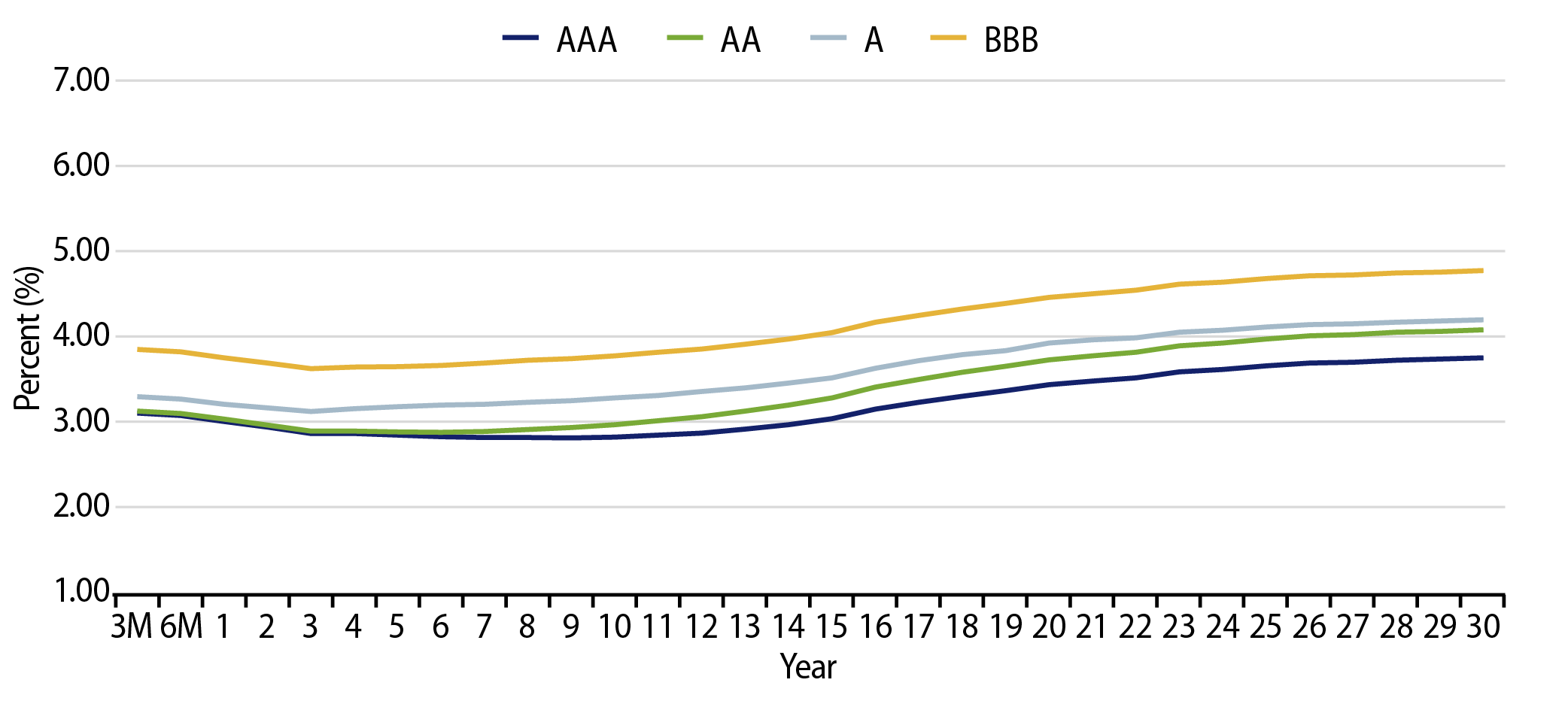

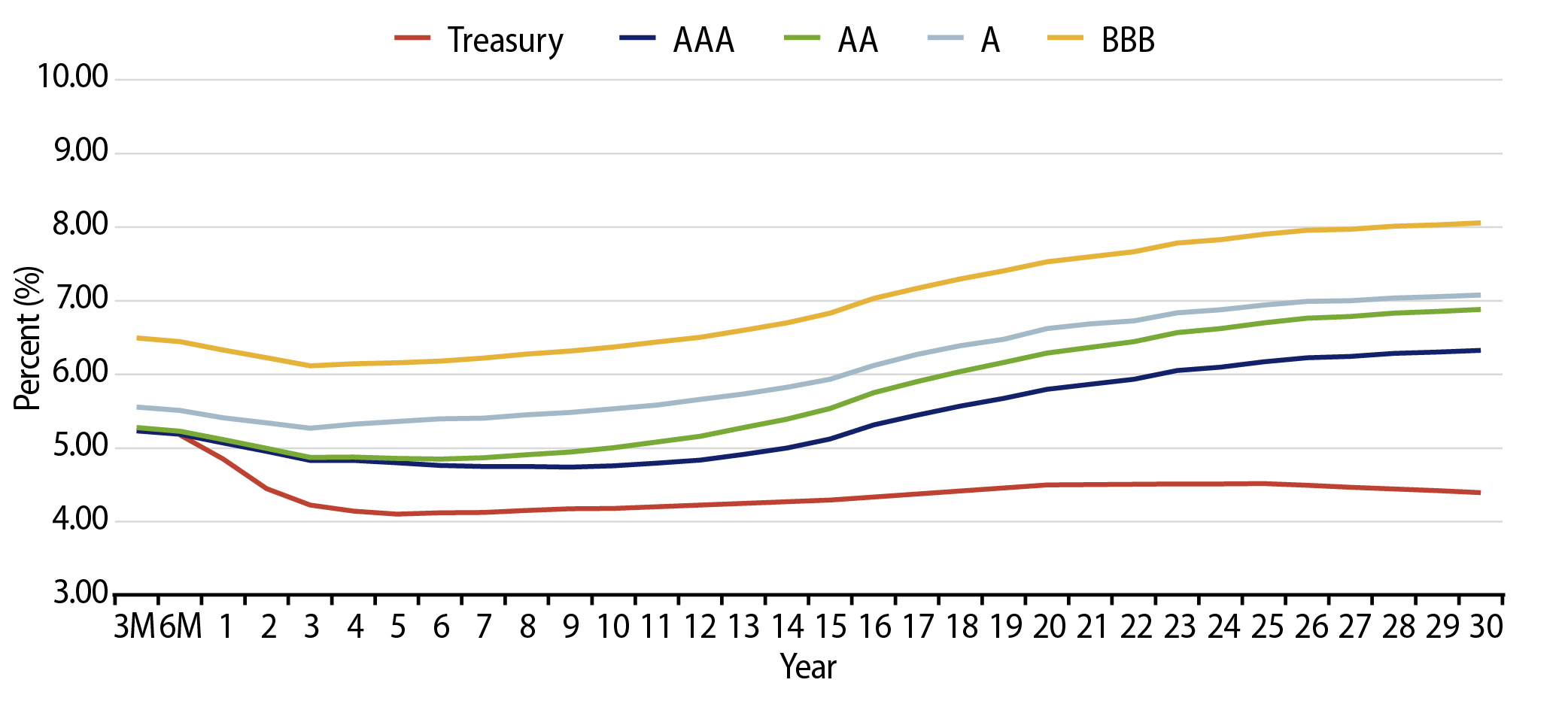

Municipal Credit Curves and Relative Value

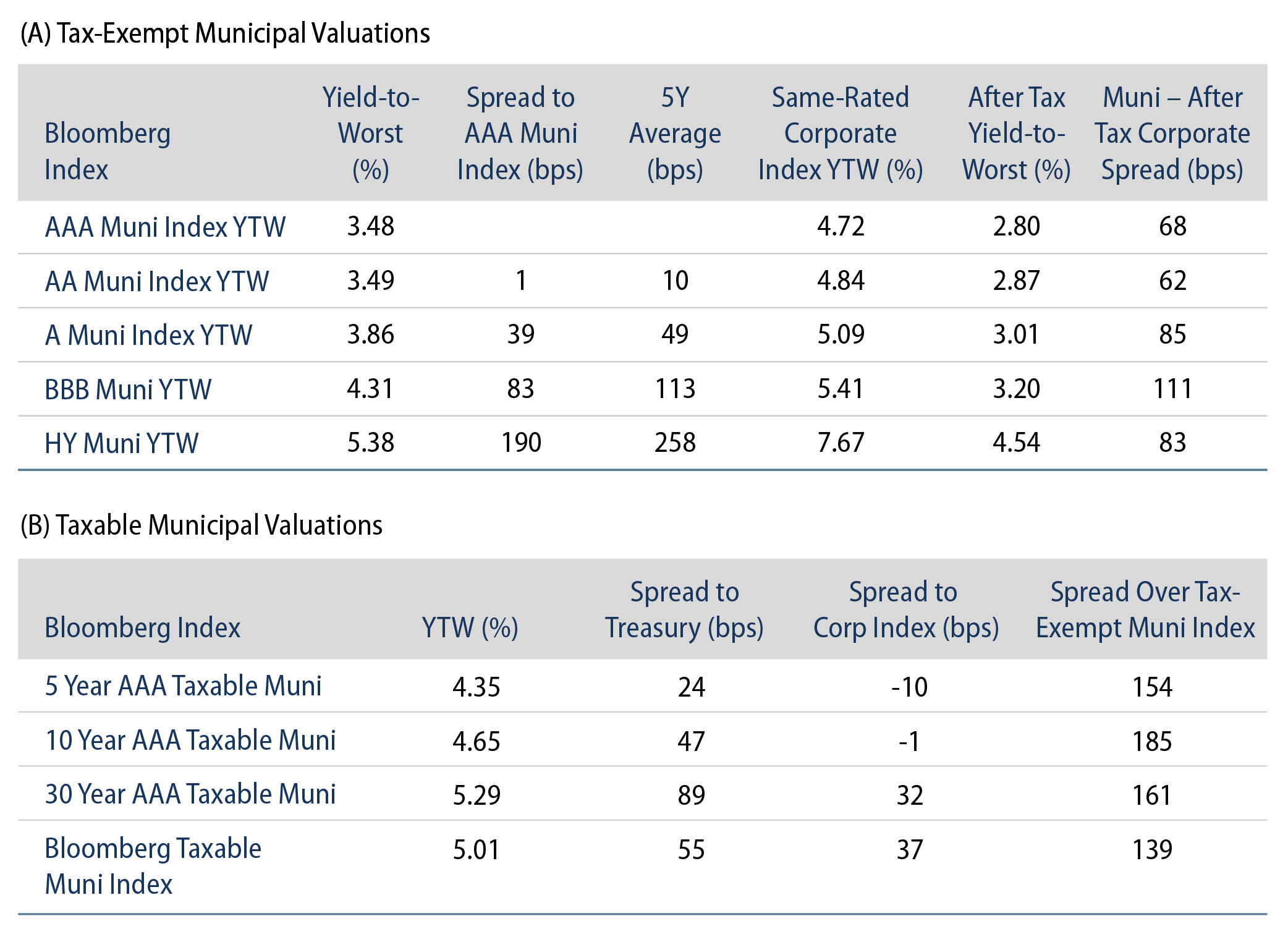

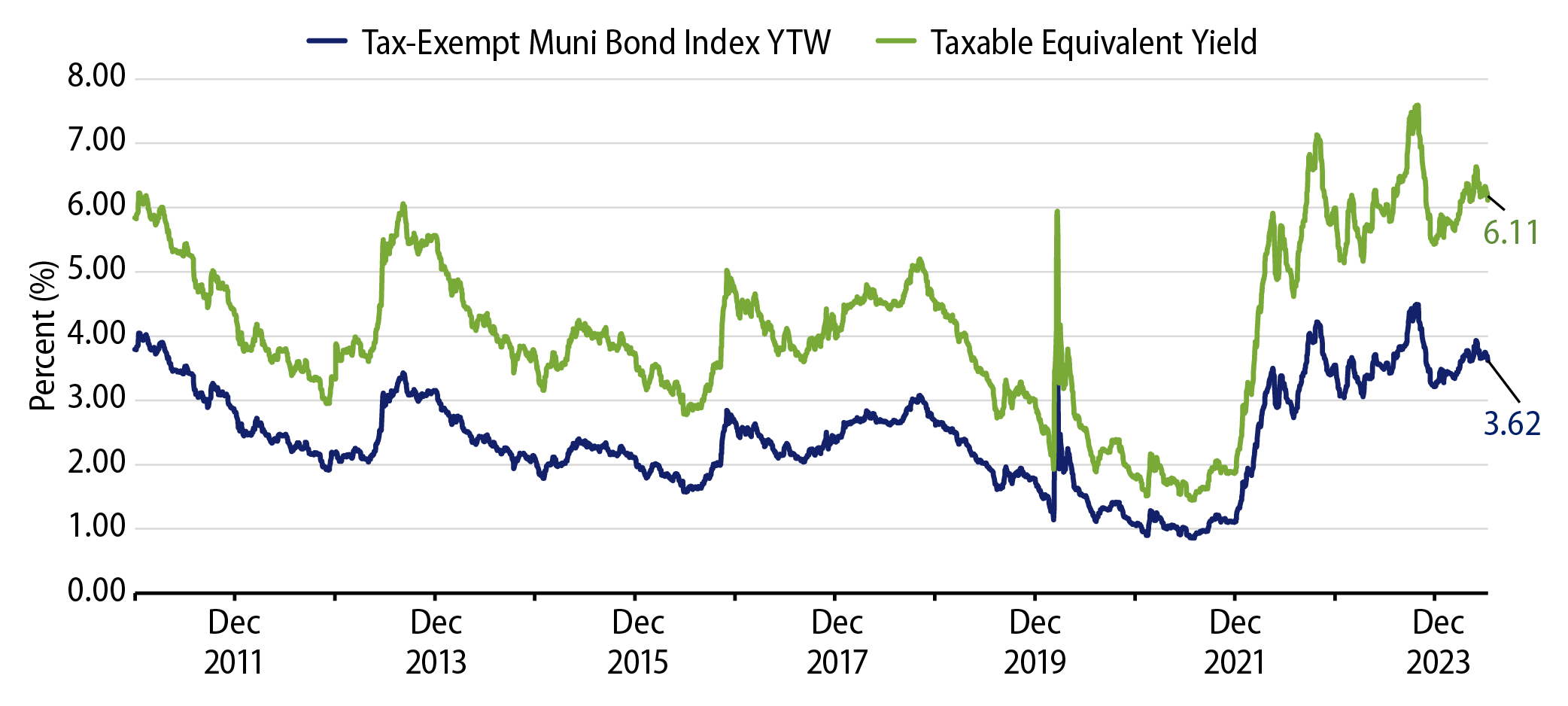

Theme #1: Municipal taxable-equivalent yields, and income opportunities, are above decade averages.

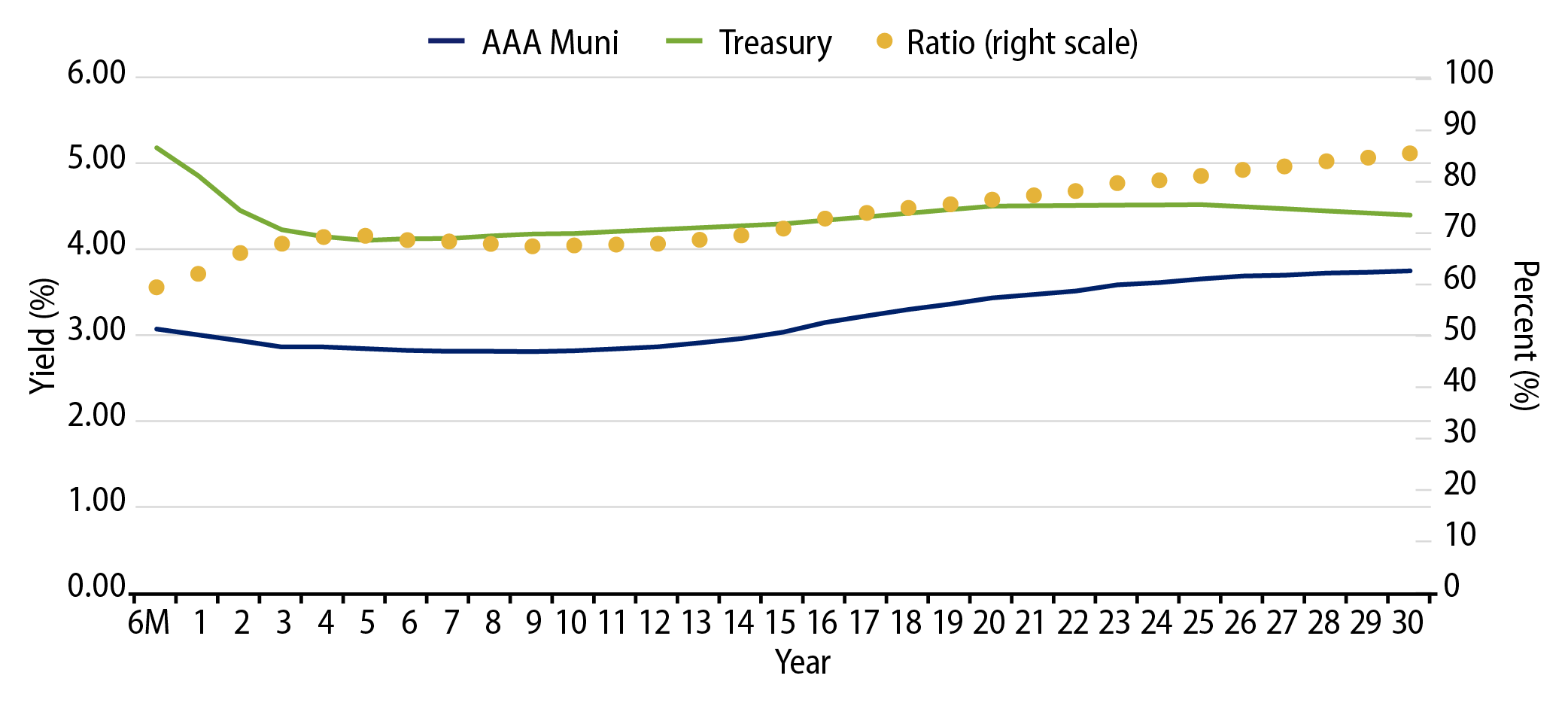

Theme #2: The muni yield curve has disinverted in recent weeks, offering greater value in longer maturities.

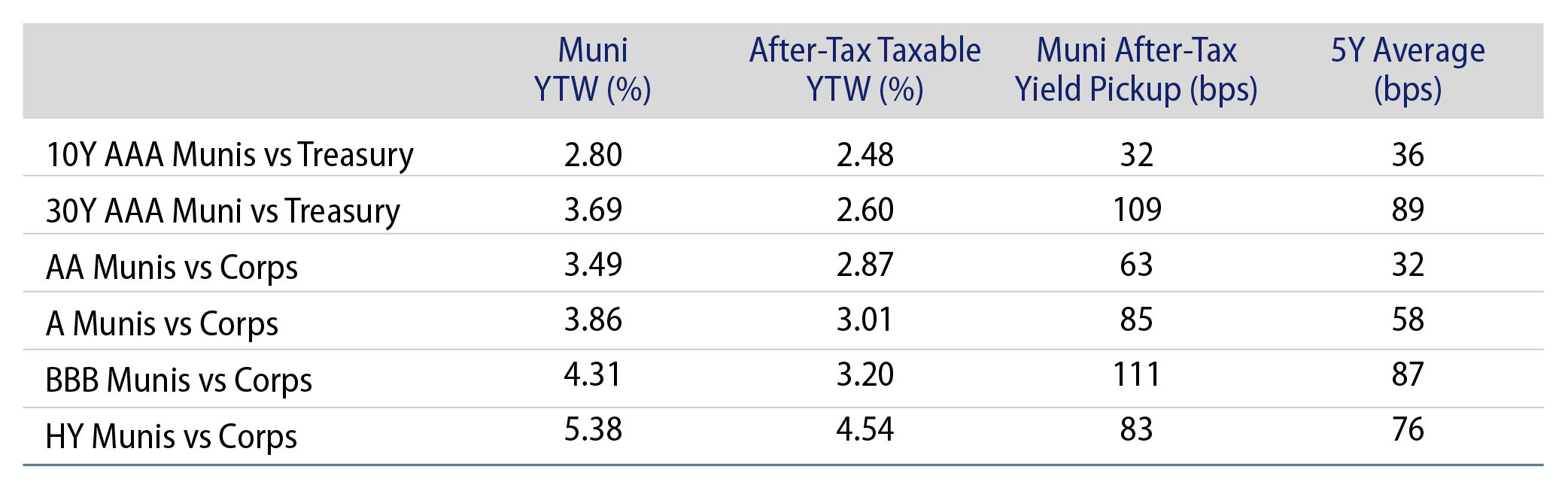

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.