Municipals Posted Positive Returns for the Second Consecutive Week

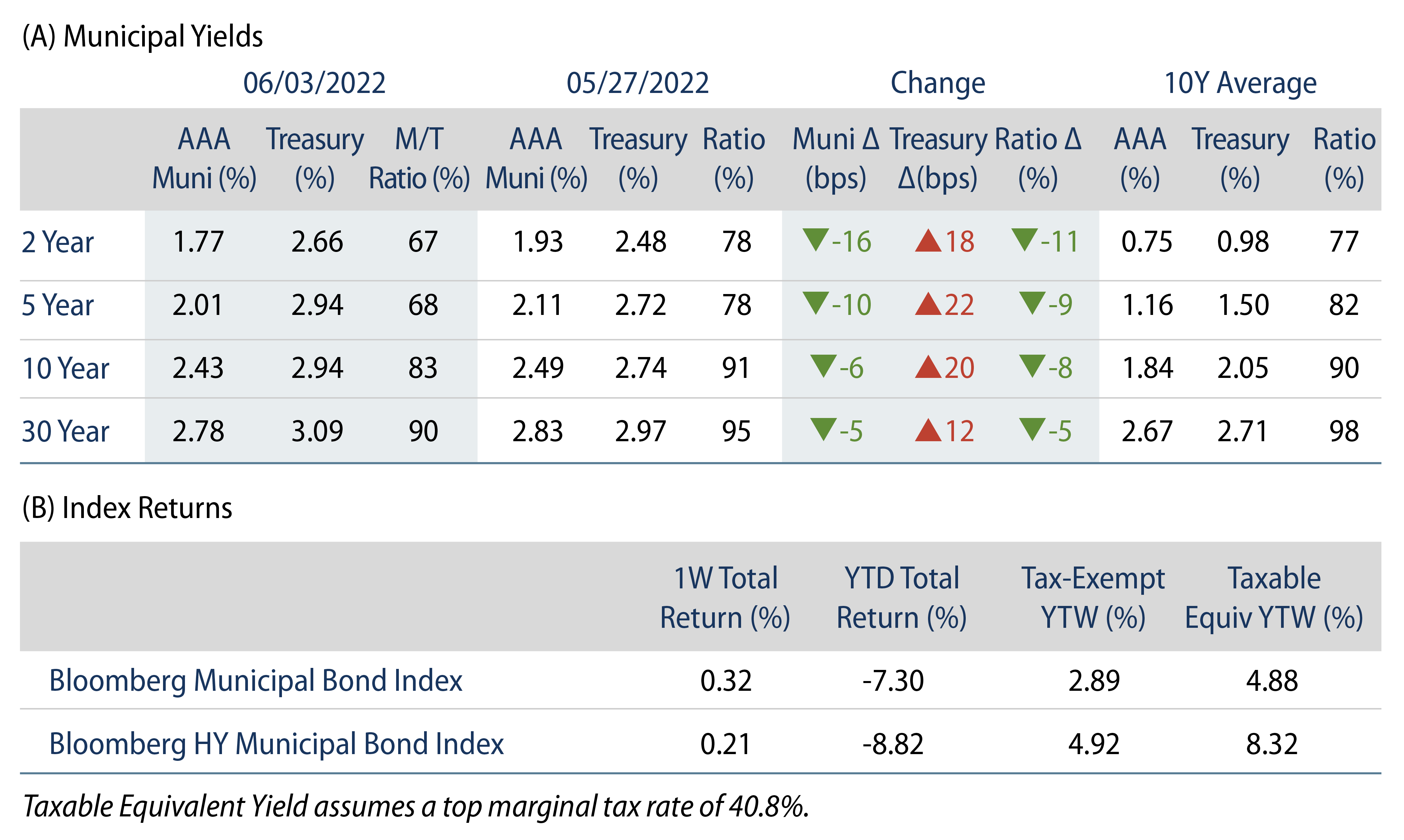

Munis posted positive returns for the second consecutive week, as high-grade municipal yields moved 5-16 bps lower across the curve. Munis outperformed Treasuries, resulting in lower Municipal/Treasury ratios. Weekly reporting municipal mutual funds recorded inflows, breaking an outflow streak from February. The Bloomberg Municipal Index returned 0.32%, while the HY Muni Index returned 0.21%. This week we highlight the taxable municipal relative value proposition following year-to-date (YTD) underperformance.

Municipal Mutual Funds Recorded Net Inflows, Ending a Streak of Outflows

Fund Flows: During the week ending June 1, weekly reporting municipal mutual funds recorded $1.2 billion of net inflows, according to Lipper. Long-term funds recorded $1.4 billion of inflows, high-yield funds recorded $1.2 billion of outflows and intermediate funds recorded $177 million of outflows. The week’s fund inflows were the first weekly reported inflows since February 9, and YTD net outflows stand at $59.4 billion.

Supply: The muni market recorded $6.8 billion of new-issue volume, up 3.1% from the prior week. Total YTD issuance of $79 billion is 2% higher from last year’s levels, with tax-exempt issuance trending 12% higher year-over-year (YoY) and taxable issuance trending 28% lower YoY. This week’s new-issue calendar is expected to increase to $8 billion. Large deals include $577 million Atlanta Airport and $265 million Texas Water Development Board transactions.

This Week in Munis: Taxable Muni Relative Value

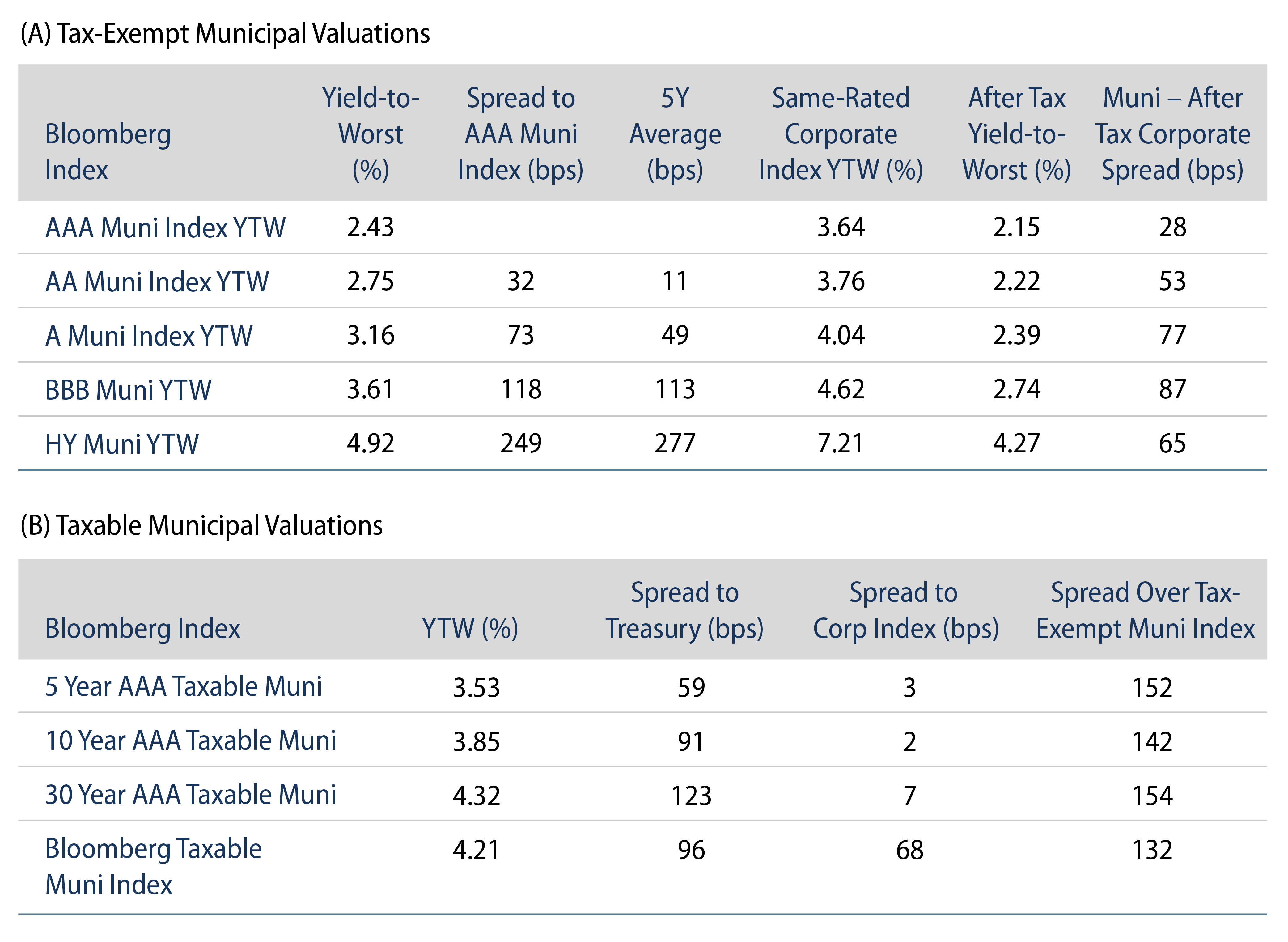

In recent weeks we highlighted the relative value that has emerged in the tax-exempt municipal market following the sector’s YTD relative drawdowns. This week we explore the taxable municipal relative value proposition that has emerged so far this year, considering the segment’s distinct buyer base and liquidity considerations.

The Bloomberg Taxable Municipal Bond Index returned -13.8% YTD through June 3, underperforming the Bloomberg Municipal Index (tax-exempt) return of -7.3%. The taxable market’s underperformance is largely attributable to the longer duration of the taxable index (9.3 years) versus the tax-exempt index (6.1 years). However, even the shorter Intermediate Taxable Municipal Index (4.6 years duration), which returned -7.6% YTD, has underperformed the tax-exempt index as well as the comparable duration (3.9 years) Intermediate Treasury Index return of -5.5%.

Weaker taxable municipal market conditions have arrived despite a significant slowdown in supply. Taxable muni issuance of $37 billion YTD is tracking 36% below 2021 levels, as interest-rate volatility has contributed to diminished refunding activity. This relative dearth in supply was not enough of a factor to offset the relative illiquidity of the asset class, considering a narrower institutional buyer base, some of which shifted allocations to the tax-exempt market amid the significant retail flow volatility.

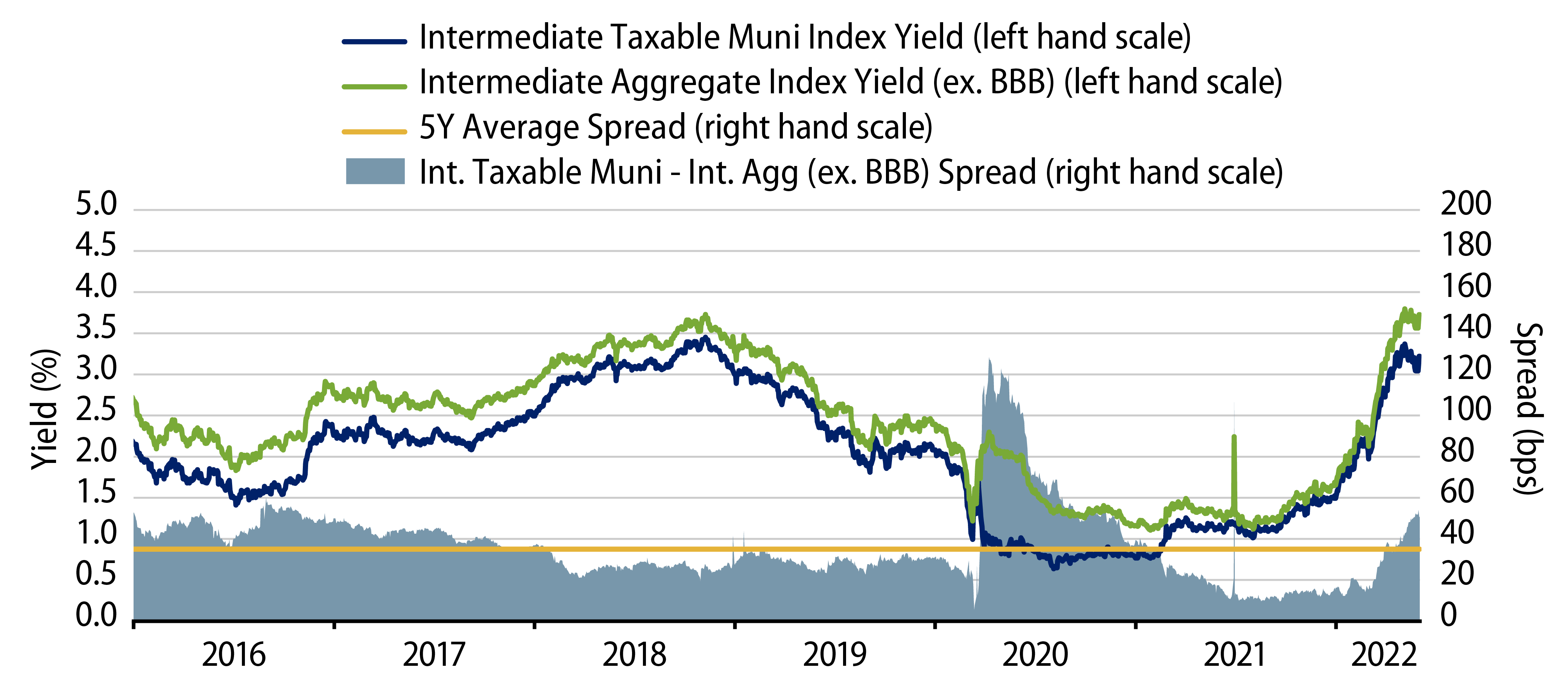

The relative underperformance of the taxable municipal market YTD has improved the relative value proposition for global buyers that can benefit from longer duration, high-quality income. As shown in Exhibit 1, the yield pickup between comparable duration Bloomberg Intermediate Taxable and comparably structured Bloomberg Intermediate Aggregate Index (ex. BBB) narrowed to 9 bps in late-2021 as global investors entered the market amid declined hedging costs. This year’s volatility has increased the marginal yield pickup to 54 bps, 54% above the five-year average spread of 35 bps.

Western Asset believes this dynamic illustrates that periods of volatility in less liquid markets can offer value opportunities for long-term investors seeking diversified income sources. Considering the recent improvement in relative value versus both corporates and tax-exempts over the last month, we believe the taxable muni asset class could attract institutional demand in the coming weeks.