Municipals Posted Positive Returns Last Week

Municipals posted positive returns last week as they underperformed Treasuries across most maturities, resulting in higher muni/Treasury ratios. High-grade municipal yields moved 5-10 bps lower across short and intermediate maturities. Muni demand softened as municipal mutual funds record outflows. The Bloomberg Municipal Index returned +0.38%, the HY Muni Index returned +0.37% and the Taxable Muni Index returned +1.46%. This week we touch on the expanded opportunity within the taxable muni asset class following year-to-date (YTD) underperformance.

Muni Mutual Funds Revert Back to Outflows

Fund Flows: During the week ending November 23, Lipper reported weekly reporting municipal mutual funds recorded $438 million of net outflows following the prior week’s inflows. Long-term funds recorded $156 million of inflows, high-yield funds recorded $35 million of outflows and intermediate funds recorded $131 million of outflows. The week’s outflows extend the YTD net outflows to $113 billion.

Supply: The muni market recorded $3 billion of new-issue volume last week, down 66% from the prior week due to the holiday-shortened week. Total YTD issuance of $341 billion remains 20% lower than last year’s levels, with tax-exempt issuance trending 9% lower year-over-year (YoY) and taxable issuance trending 53% lower YoY. This week’s new-issue calendar is expected to remain steady at $3 billion of new-issue volume. Larger deals include $700 million Commonwealth of Massachusetts and $375 million Illinois Finance Authority (University of Chicago Medicine) transactions.

This Week in Munis: Taxable Muni Value Continues

The YTD relative underperformance of the taxable municipal asset class has expanded the opportunity set for global investors seeking a high-quality income. Taxable munis have underperformed broader investment-grade fixed-income markets through the first 10 months of the year, with the Bloomberg Taxable Index returning -17.84%, compared to the -9.32% return of the investment-grade tax-exempt muni index, the -15.43% return of the U.S. Corporate Index and the -16.47% return of the Global Aggregate Index. As fixed-income markets rebounded this month, taxable municipals have continued to underperform to the upside, returning +4.38% MTD through November 25, outperforming the 4.06% return of the tax-exempt municipal index, but underperforming the 5.12% return of the U.S. Corporate Index and 5.00% return of the Global Aggregate Index.

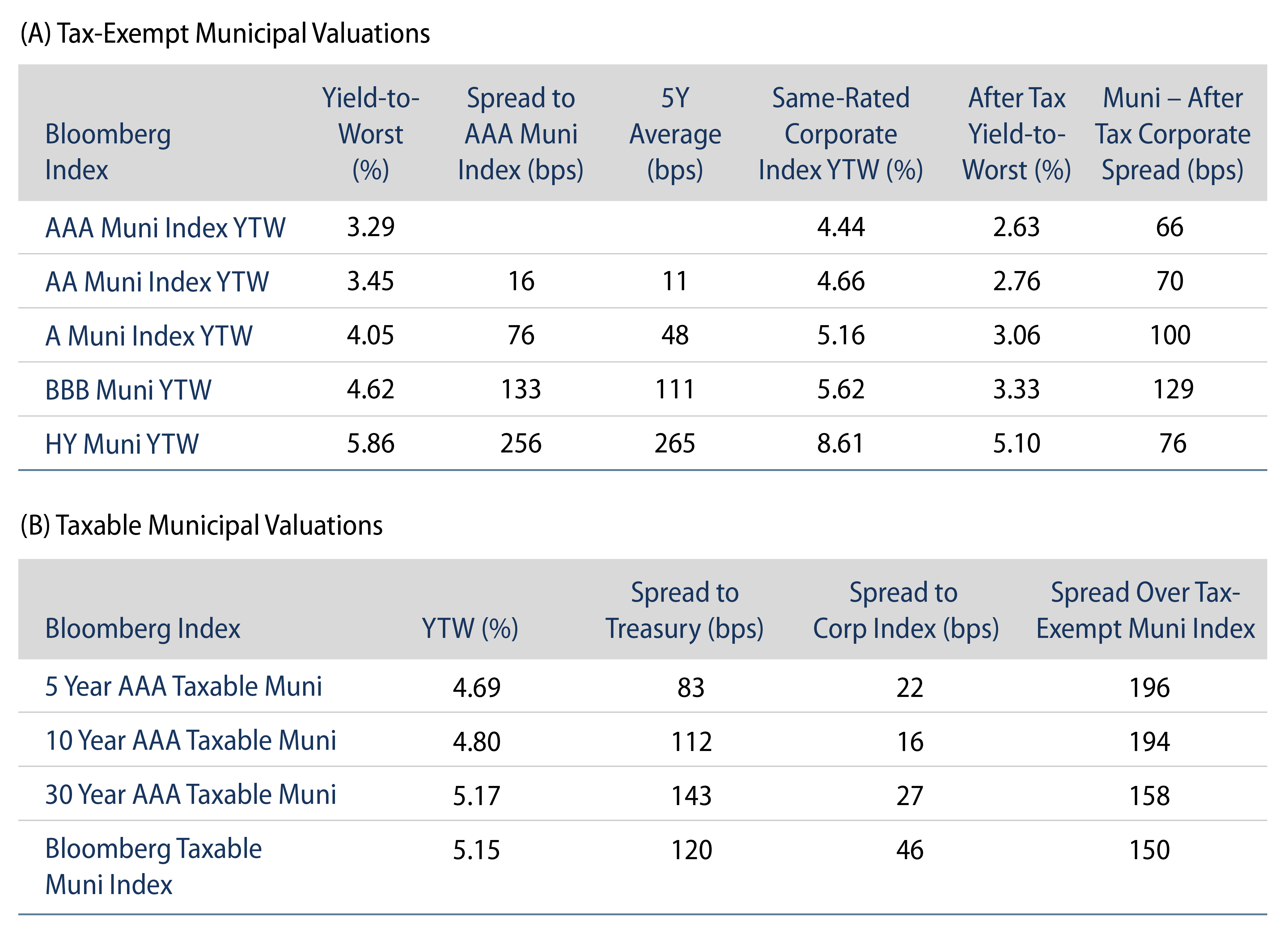

As a result of this year’s underperformance, taxable municipal spreads widened significantly from 94 bps at the beginning of the year to 131 bps today. This represents a spread pickup of 72 bps versus the Global Aggregate, and a 1-bp spread advantage versus the U.S. Corporate Index, despite the Bloomberg Taxable Muni Index’s relatively higher average quality.

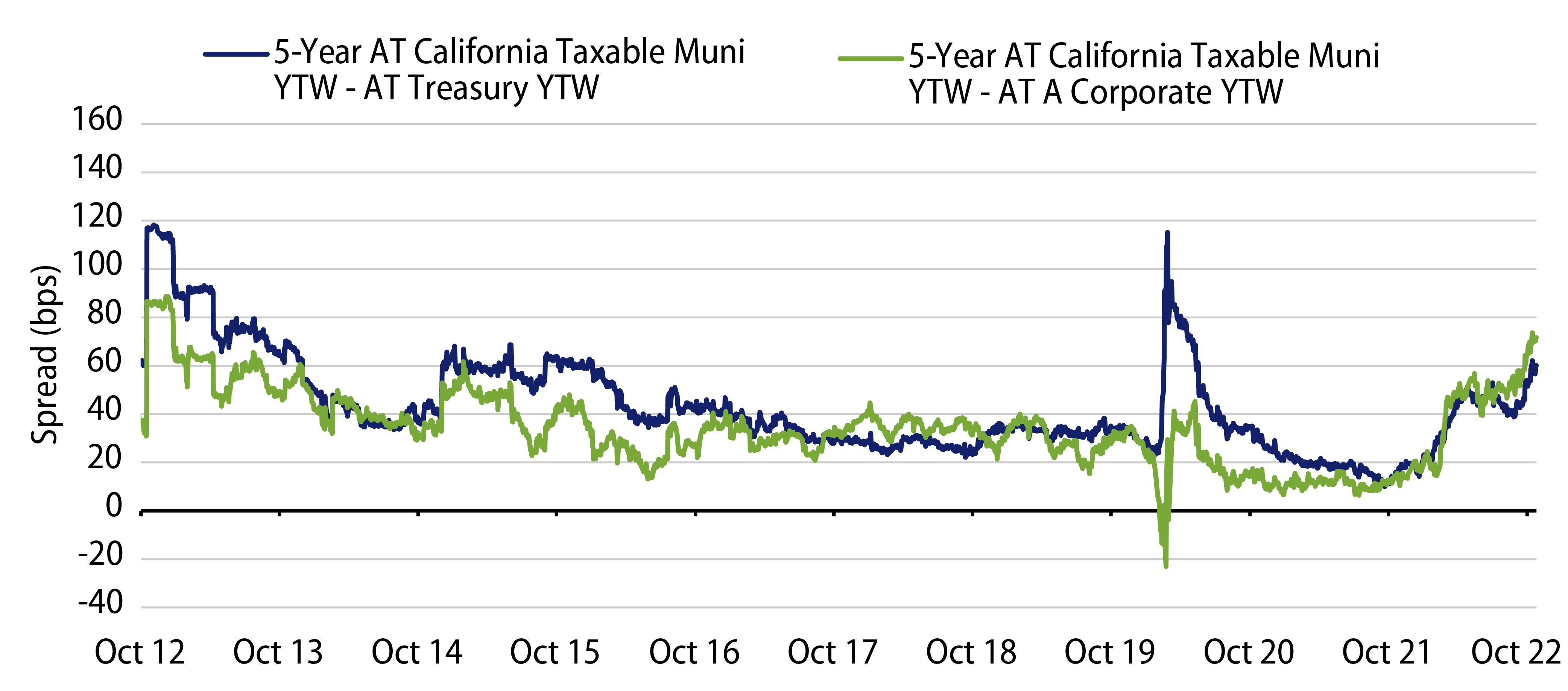

Taxable municipal valuations are also becoming more attractive to individual investors that can benefit from the state-tax exemption of taxable muni debt. Consider a California individual investor seeking a five-year fixed-income investment. The five-year California taxable municipal yield of 4.90% is 2.90% after the top federal tax rate, approximately 60 bps above the 5-year after-tax Treasury yield (also exempt from state taxes) and 72 bps above the five-year A-rated corporate yield of 2.18% (considering both federal and state taxes at the highest marginal rates).

Western Asset believes taxable municipals offer investors a wide range of benefits including a high-quality source of income, diversification and a favorable risk-adjusted return profile. At higher nominal rates, the in-state tax exemption of most taxable municipal issuance can also become increasingly valuable for individual investors and contribute to relative value opportunities within a diversified fixed-income portfolio. We attribute this year’s underperformance to liquidity challenges, which for long-term investors can serve as an attractive entry point to capture relatively high levels of risk-adjusted income.