Municipals Posted Positive Returns Last Week

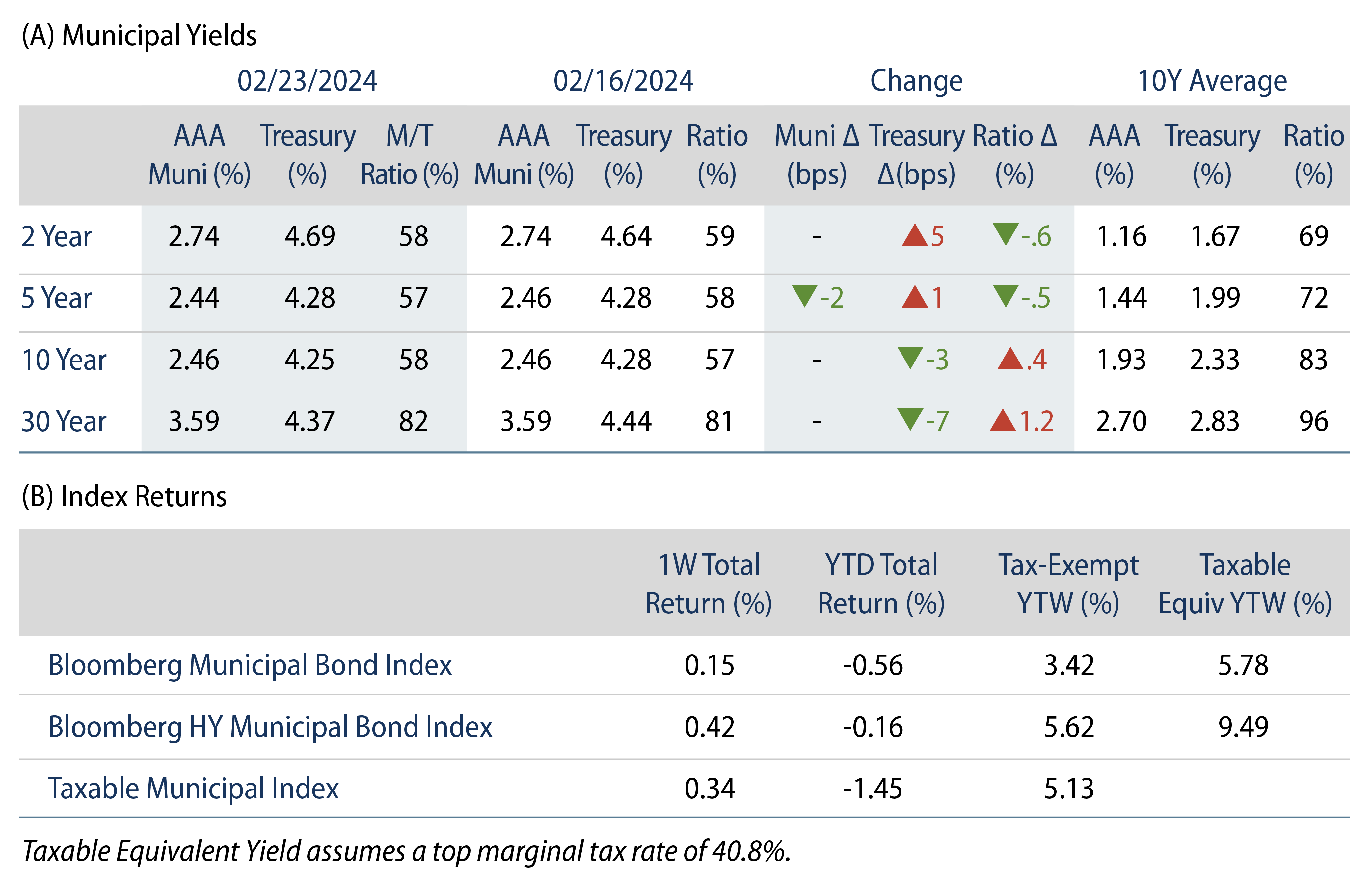

Munis posted positive returns but generally underperformed Treasuries, as the Treasury curve flattened during the week. High-grade muni yields were generally unchanged during the week, moving just 2 bps lower in 5-year maturities. Meanwhile, technicals were mixed as modest fund outflows were offset by lower new-issue supply levels. The Bloomberg Municipal Index returned 0.15% during the week, the High Yield Muni Index returned 0.42% and the Taxable Muni Index returned 0.34%. This week we highlight the deteriorating supply trends in the taxable muni market.

Modest Fund Outflows Were Largely Offset by Lighter Supply Conditions

Fund Flows: During the week ending February 21, weekly reporting municipal mutual funds recorded $4 million of net outflows, according to Lipper. Long-term funds recorded $406 million of outflows, high-yield funds recorded $403 million of inflows, intermediate funds recorded $296 million of outflows and short-term funds posted outflows of $95 million. This week’s outflows lead estimated year-to-date (YTD) net inflows lower to $3.3 billion.

Supply: The muni market recorded $5.4 billion of new-issue volume last week, up 5% from the prior week. YTD issuance of $55 billion is 47% higher than last year’s level, with tax-exempt issuance 49% higher and taxable issuance 17% higher year-over-year (YoY). This week’s calendar is expected to increase to $6 billion. The largest deals include $1.2 billion New York City General Obligation and $600 million Hurst-Euless-Bedford Independent School District transactions.

This Week in Munis: Taxable Relative Value Persists Amid Dwindling Supply

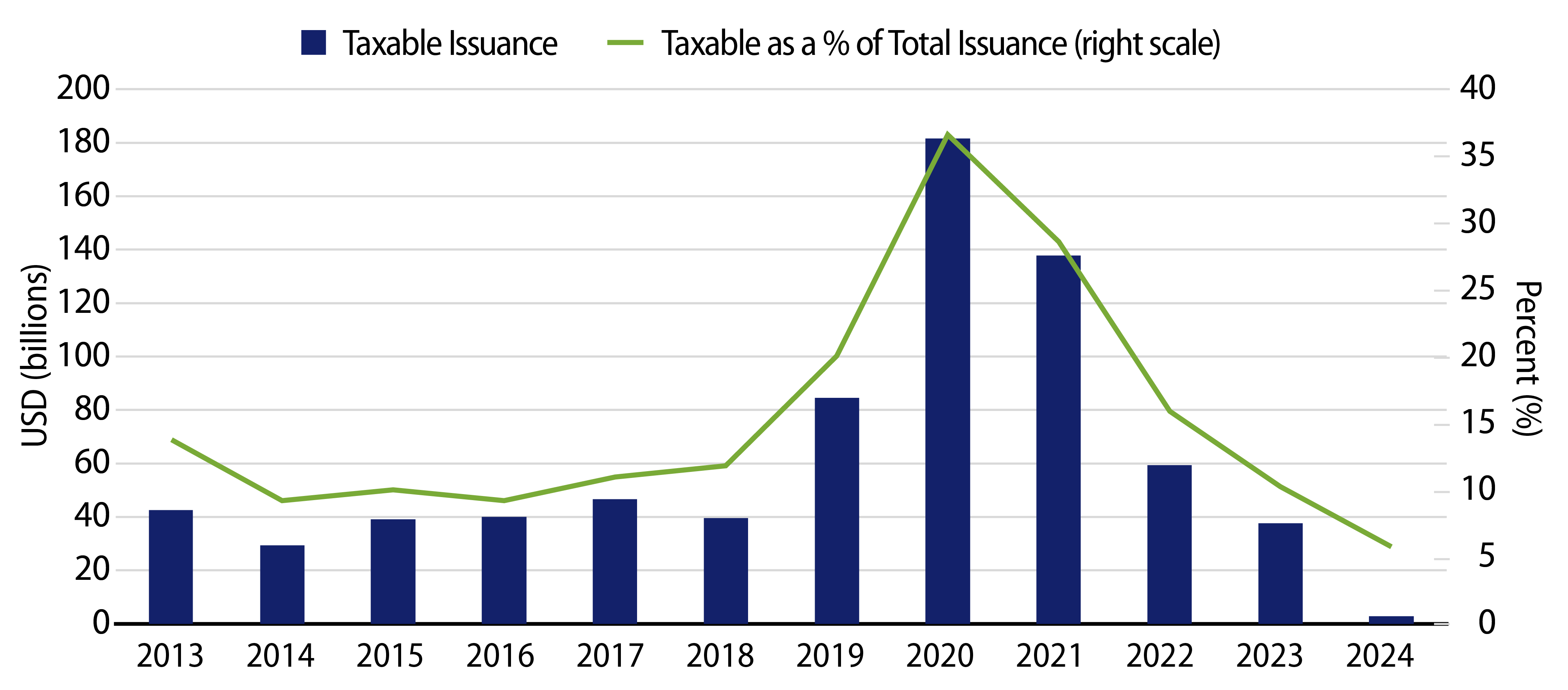

The municipal market observed a wave of taxable new issuance in the years that followed the 2017 Tax Cuts and Jobs Act, as the law prohibited the advanced refunding (refinancing) of tax-exempt issuance with new tax-exempt debt. From 2018 to 2021 taxable municipal market yields were generally lower than originally issued tax-exempt yields, and municipal issuers were able to utilize the taxable municipal market to refinance outstanding debt. As a result, taxable municipal issuance multiplied from $40 billion (12% of total municipal issuance) in 2018 to as high as $182 billion (37% of issuance) in 2020 and $138 billion (29% of issuance) in 2021.

As interest rates moved higher in 2022, the favorable economics of refinancing muni debt deteriorated and taxable municipal issuance declined materially. In 2023, taxable municipal issuance declined 80% from the high watermark set in 2020 to $38 billion, a below-average 10% of total issuance. The declining trend continued so far in 2024, with $3 billion of taxable municipal issuance YTD comprising just 6% of total issuance.

The effect of lower taxable new-issue supply has been more recently compounded by increased tender and redemption activity, where states and cities can redeem outstanding debt. As municipal-to-Treasury ratios approach near-record lows, the tax-exempt market has become relatively appealing to municipal issuers, accelerating taxable market redemptions. Declining new taxable supply levels, coupled with these increasing redemptions have contributed to negative net taxable supply levels of nearly -$100 billion since the start of 2022.

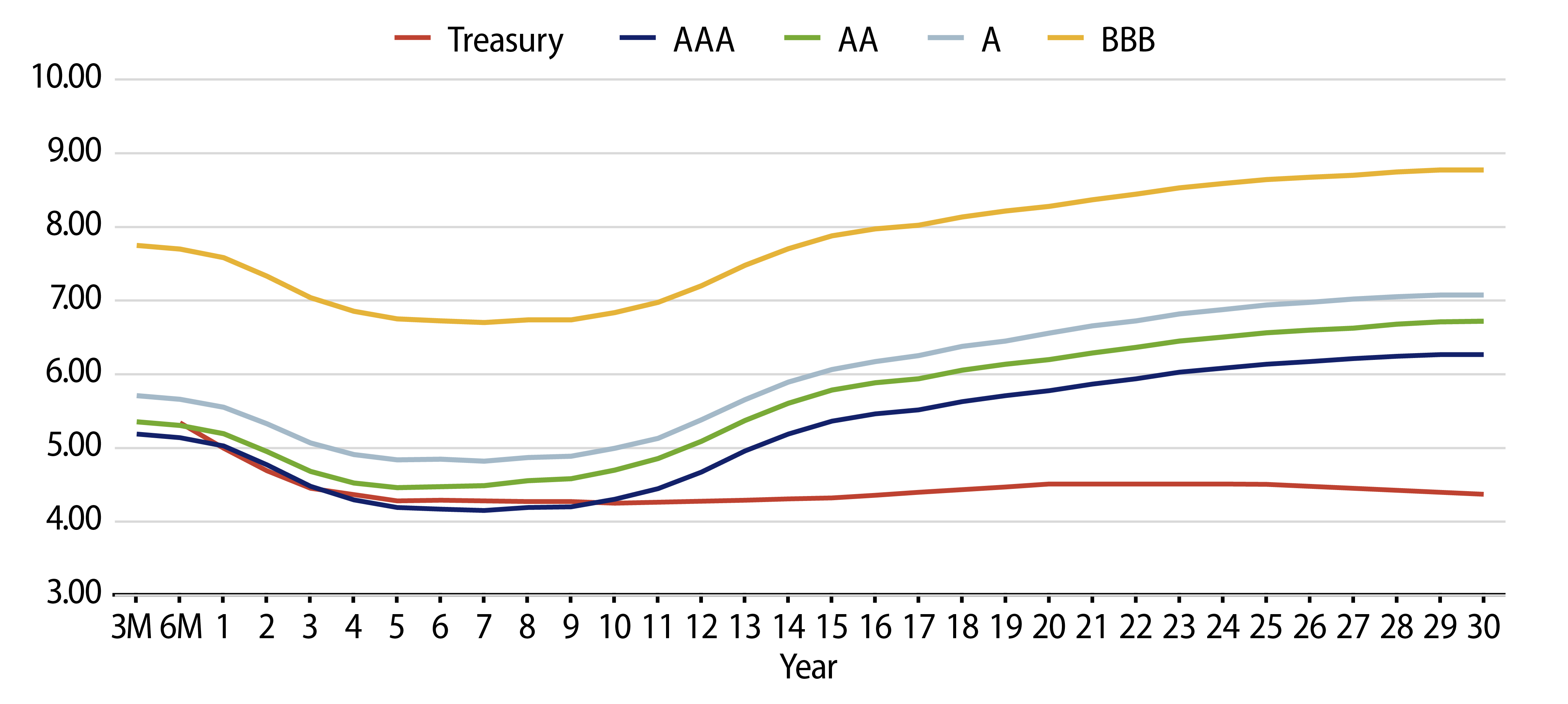

The strong supply technicals have supported the strong performance of the taxable municipal market as well as relative spread compression. However, limited liquidity of the asset class and recent corporate spread-tightening have still contributed to an appealing relative value proposition for investors seeking high-quality, longer-duration bonds. Over 75% of the Bloomberg Taxable Municipal Index is rated AA and higher, and index yields highlight a 9- to 37-bp yield advantage versus the Bloomberg US Corporate Index, which Western Asset deems as an appealing relative value proposition.

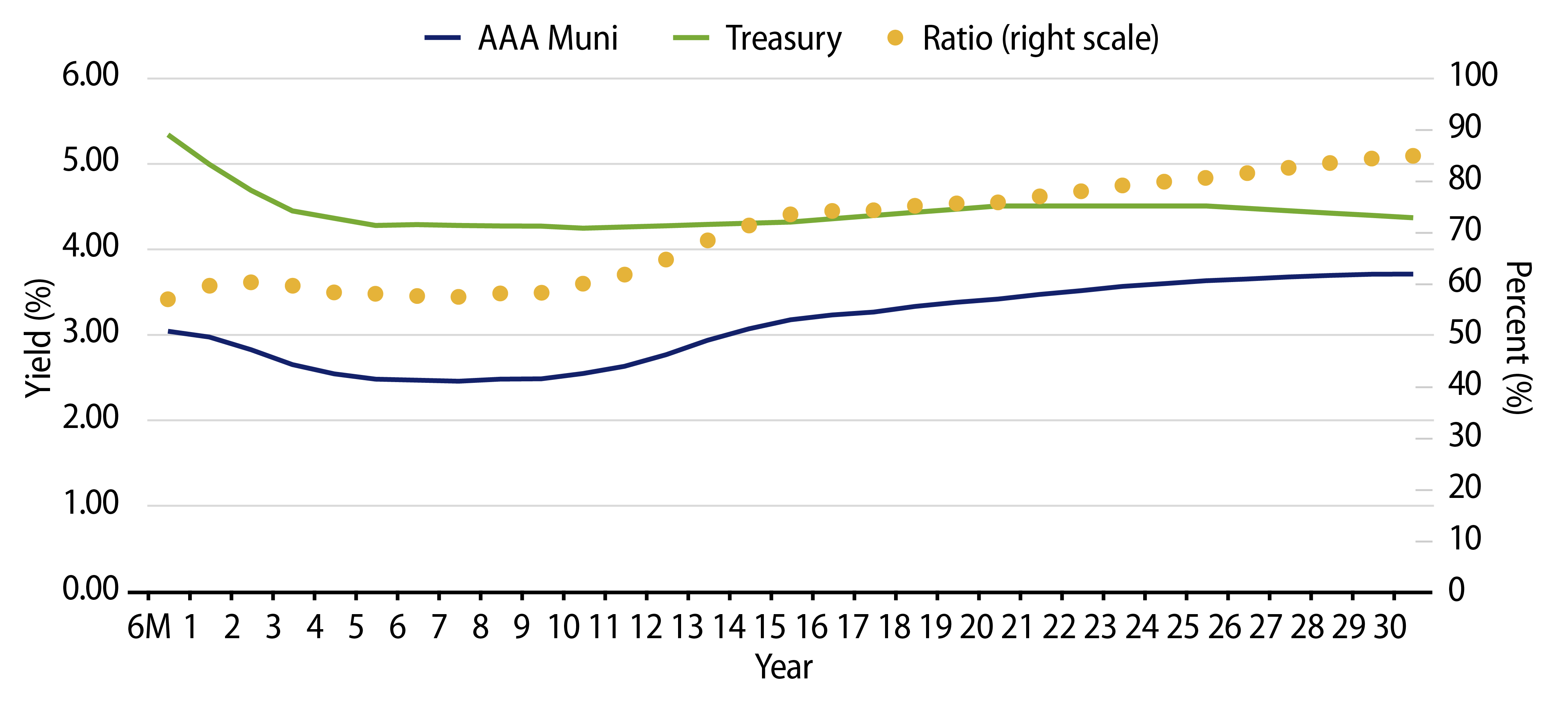

Municipal Credit Curves and Relative Value

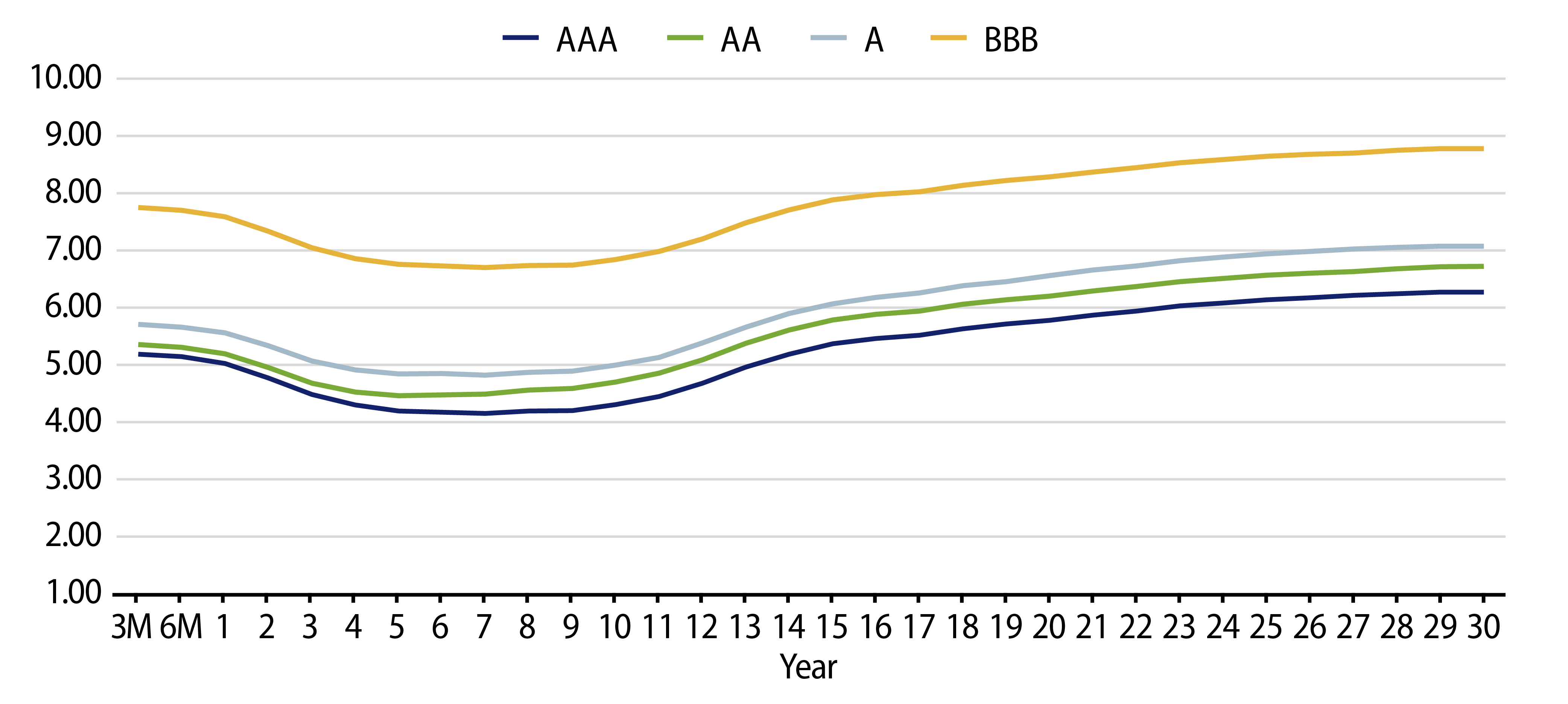

Theme #1: Municipal taxable-equivalent yields are above decade averages.

Theme #2: Recent yield curve steepening has highlighted relative value in longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.