Municipals Posted Positive Returns Last Week

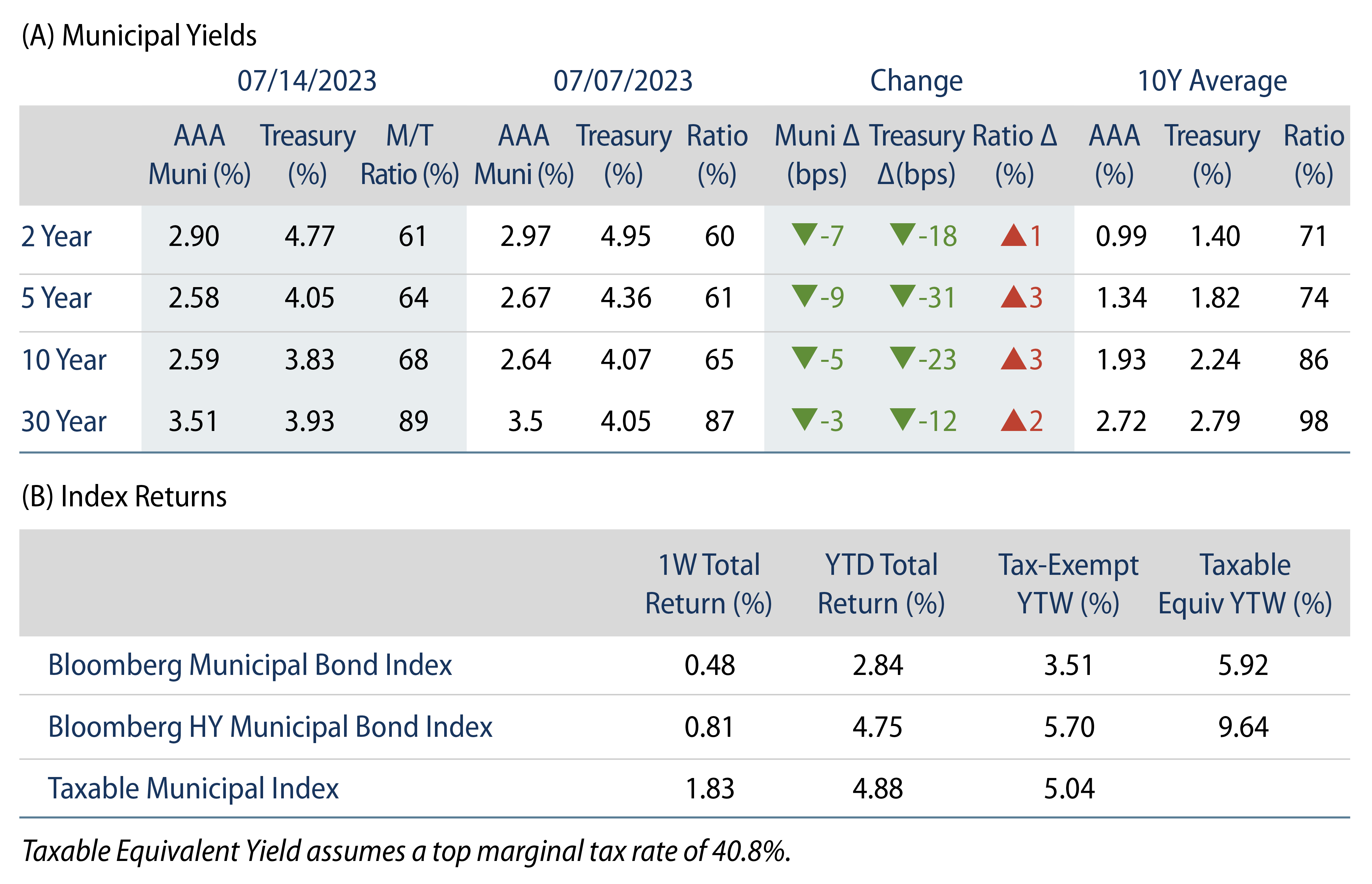

Municipals posted positive returns last week as high-grade yields trailed Treasuries lower across the yield curve. Municipals underperformed the strong Treasury rally amid weaker market technicals and an increase in both supply and fund outflows. The Bloomberg Municipal Index returned 0.48% during the week, the High Yield Muni Index returned 0.81% and the Taxable Muni Index returned 1.83%. This week we highlight the supply slowdown in the taxable muni market.

Market Technicals Weakened Amid Fund Outflows and Higher Supply

Fund Flows: During the week ending July 12, weekly reporting municipal mutual funds recorded $136 million of net outflows, according to Lipper. Long-term funds recorded $38 million of inflows, high-yield funds recorded $84 million of inflows and intermediate funds recorded $16 million of outflows. This week’s outflows bring year-to-date (YTD) net outflows down to $8.4 billion; however, other flow providers such as ICI have municipal mutual funds recording $5 billion of inflows YTD.

Supply: The muni market recorded $7 billion of new-issue volume last week, up from the prior holiday-shortened week. YTD issuance of $183 billion is down 13% year-over year (YoY), with tax-exempt issuance down 7% YoY and taxable issuance (not including municipal corporate CUSIPs) down 47% YoY. This week’s calendar is expected to jump up to $12 billion. Larger transactions include $1.7 billion DASNY Sales Tax Revenue and $950 million NYC Transitional Finance Authority transactions.

This Week in Munis: Taxable Supply Slowdown

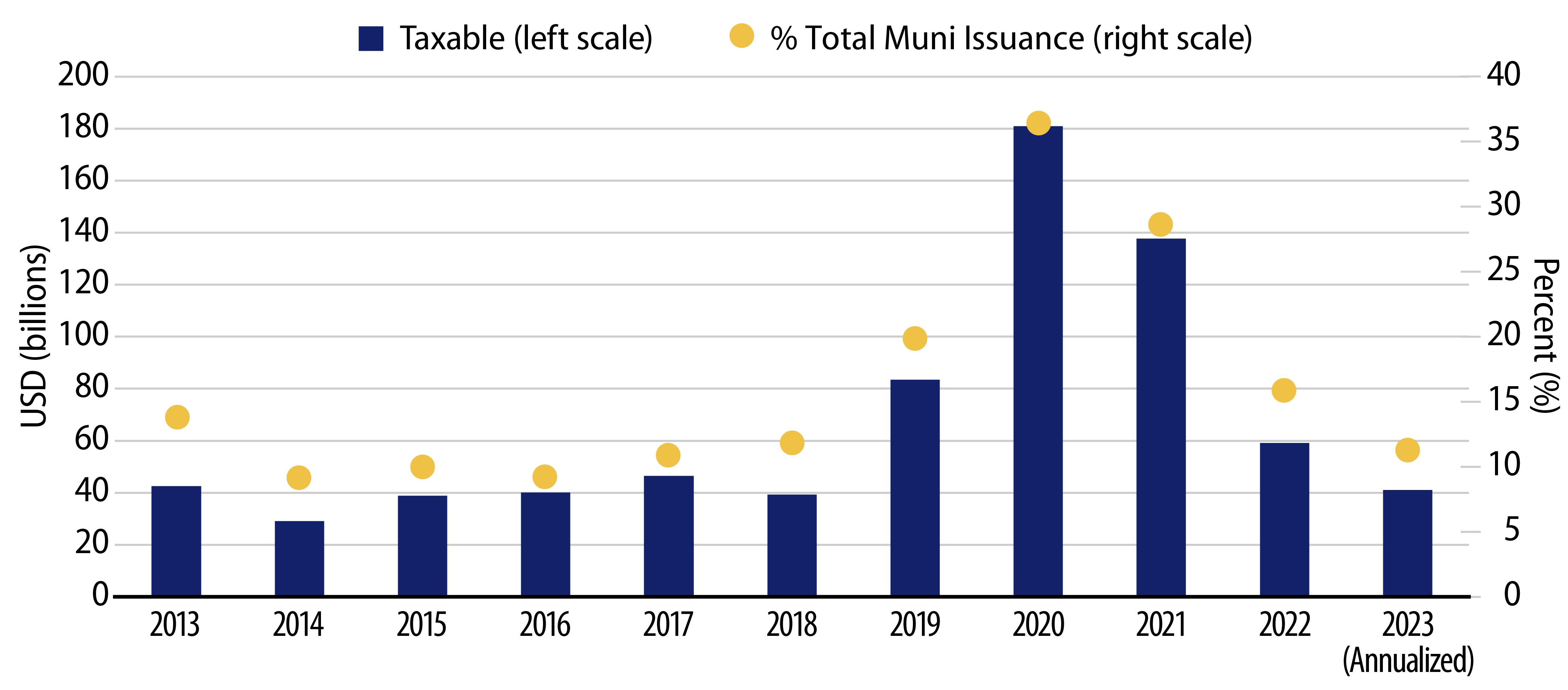

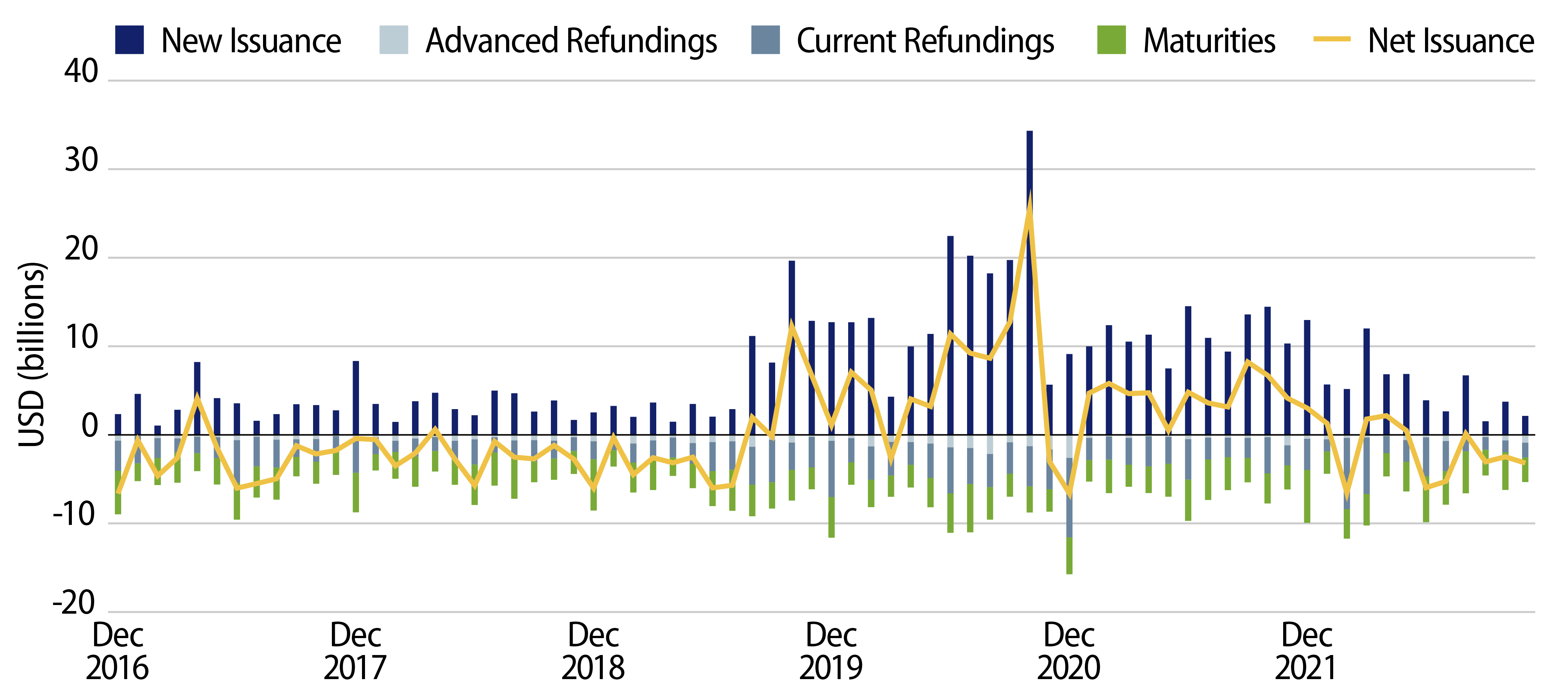

Following the Tax Cuts and Jobs Act (TCJA) in 2017, taxable municipal investors enjoyed a wave of new taxable municipal issuance in recent years as municipal issuers could no longer advance refund tax-exempt issuance with new tax-exempt paper. With taxable rates remaining lower than legacy tax-exempt debt from 2018 to 2021, municipal issuers continued to find value in advanced refunding, just with taxable issuance rather than tax-exempt issuance.

As a result of higher refunding volume in 2019, taxable muni issuance doubled to $83 billion (19% of total municipal issuance), and doubled yet again to $181 billion (36% of total municipal issuance) in 2020. However, as interest rates moved higher in 2022, the economics around refinancing municipal debt deteriorated and taxable issuance declined 57% to $59 billion (16% of total muni issuance), and annualized issuance has declined an additional 30% thus far in 2023, reverting closer to longer-term averages of 11% of total issuance.

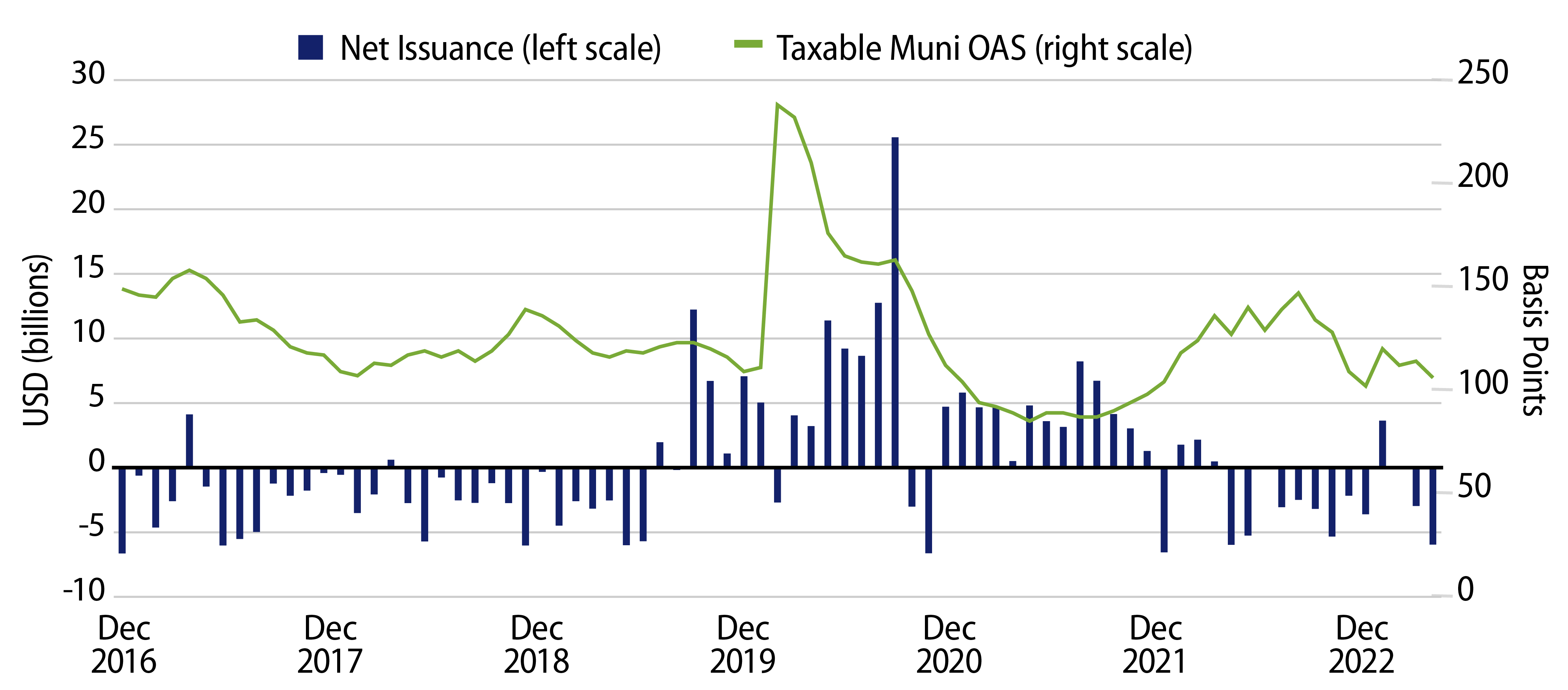

The effects of lower taxable new-issue supply declines have been more recently compounded by increased tender activity, where states and cities buy back taxable debt and replace it with lower cost tax-exempt issuance, accelerating taxable market redemptions. Bloomberg estimates tender activity has increased from $1.7 billion in 2020 to $9.6 billion in the first half of 2023. Declining new-issue supply levels, coupled with these increasing redemptions from the taxable muni market, have contributed to negative net supply levels, effectively shrinking the taxable municipal market by $37 billion since the start of 2022.

The negative net supply activity in the taxable municipal market has contributed to significant spread tightening this year, with the Bloomberg Taxable Municipal Bond Index option-adjusted spread (OAS) declining from 147 bps in October 2022 to 106 bps in June 2023. Western Asset believes that at higher nominal taxable interest rates, taxable issuance levels will likely come in lower and closer to longer-term averages, contributing to technical strength that could support the taxable municipal market over the medium term.