Municipals Posted Negative Returns Last Week

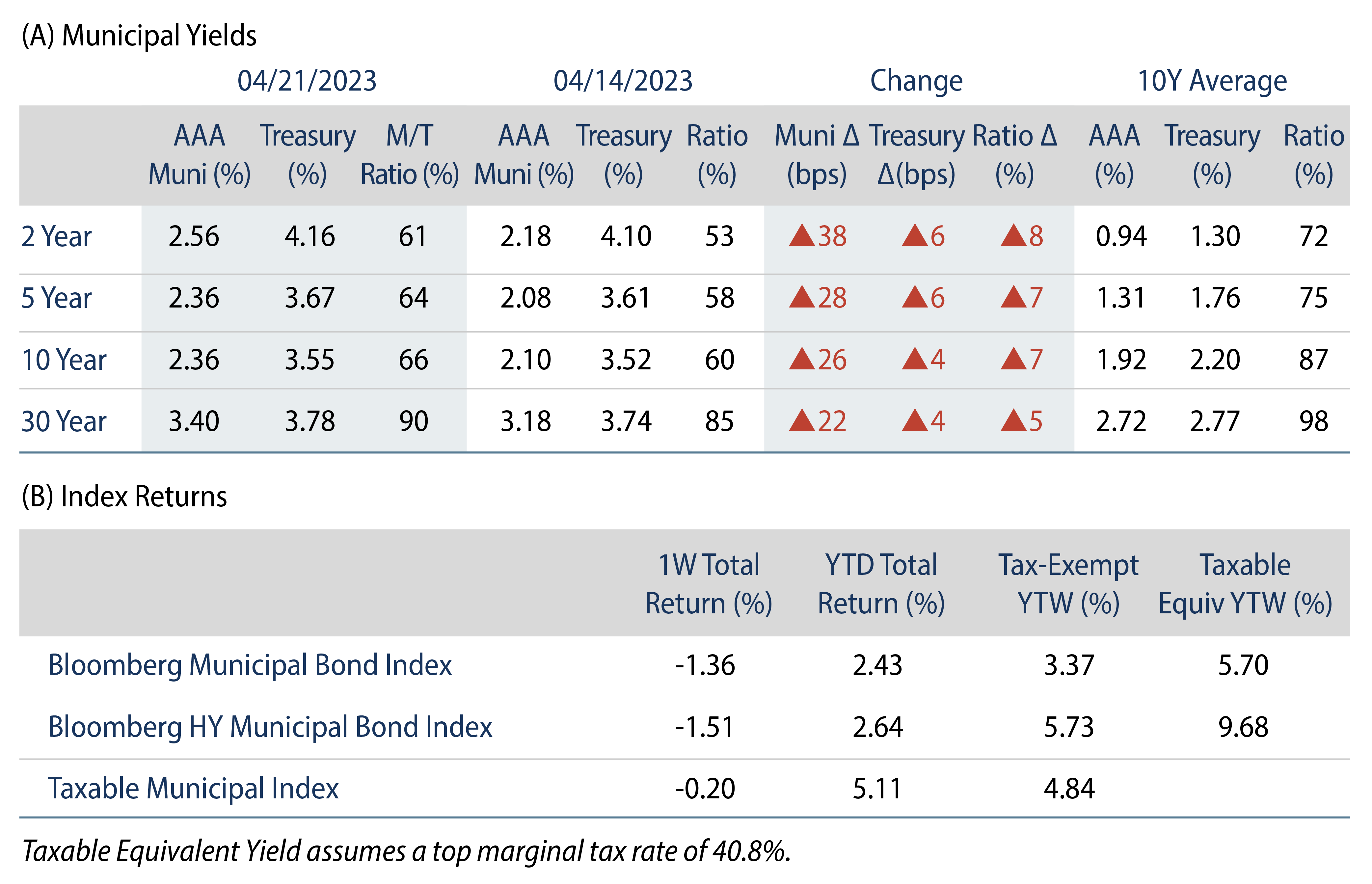

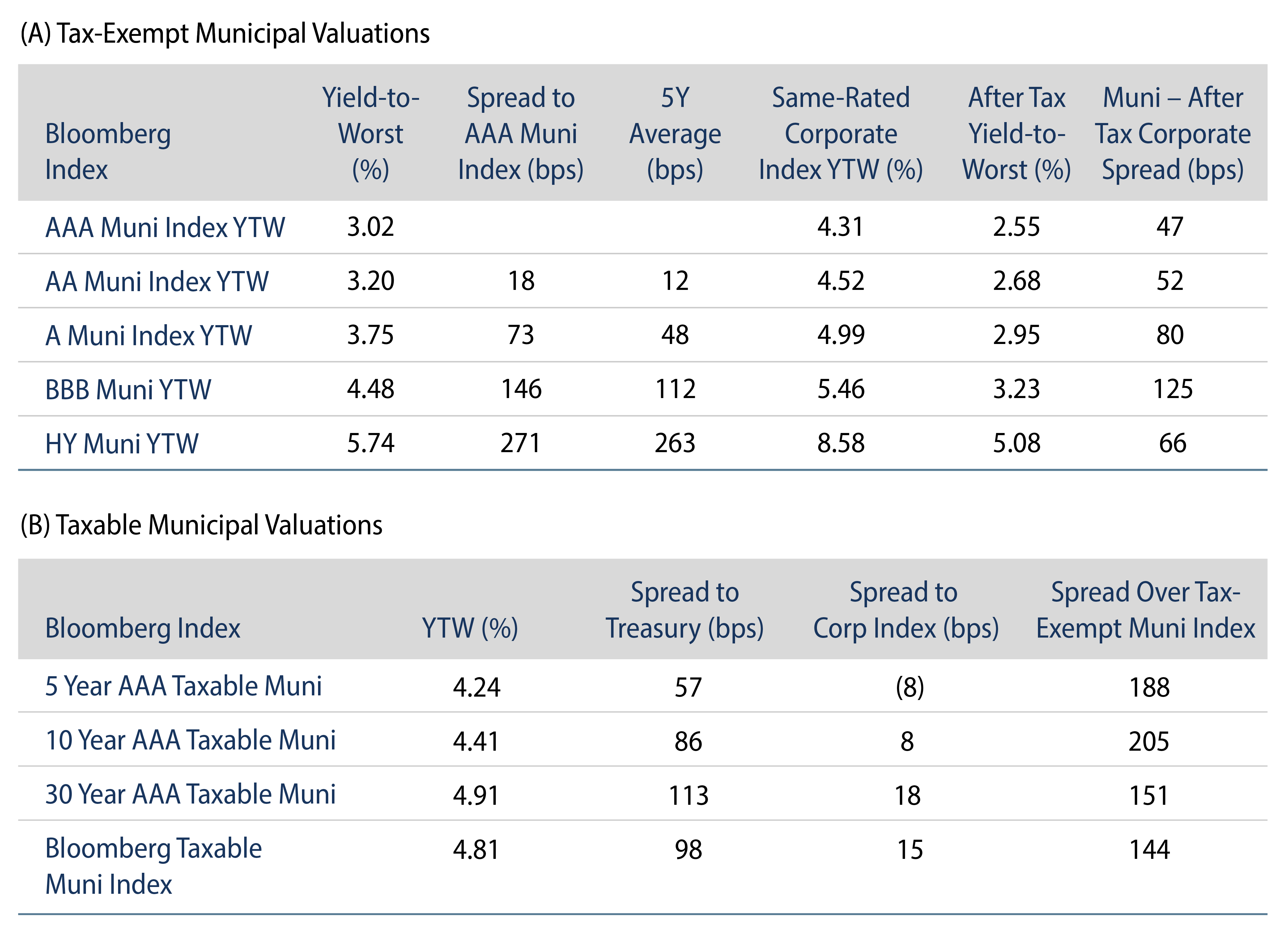

Municipal yields moved significantly higher across the curve last week, posting negative returns. Munis underperformed Treasuries across the curve, due to relatively rich starting valuations and weak technicals. The Bloomberg Municipal Index returned -1.36%, the High Yield Muni Index returned -1.51% and the Taxable Muni Index returned -0.20%. This week we highlight key upgrades during the current credit cycle and their impact on muni index composition.

Market Technicals Were Challenged With Heavy Outflows and an Elevated New-Issue Calendar

Fund Flows: During the week ending April 19, weekly reporting municipal mutual funds recorded $2.9 billion of net outflows, according to Lipper. Long-term funds recorded $2.3 billion of outflows, high-yield funds recorded $79 million of outflows and intermediate funds recorded $46 million of outflows.

Supply: The muni market recorded $12 billion of new-issue volume last week, up 82% from the prior week. Year-to-date (YTD) issuance of $101 billion is down 15% year-over year (YoY), with tax-exempt issuance down 10% YoY and taxable issuance down 41% YoY. This week’s calendar is expected to decline to $10 billion, still above recent averages. Large transactions include $1.3 billion State of Washington and $585 million Providence St. Joseph Health Obligated Group transactions.

This Week in Munis: Upgrades Abound

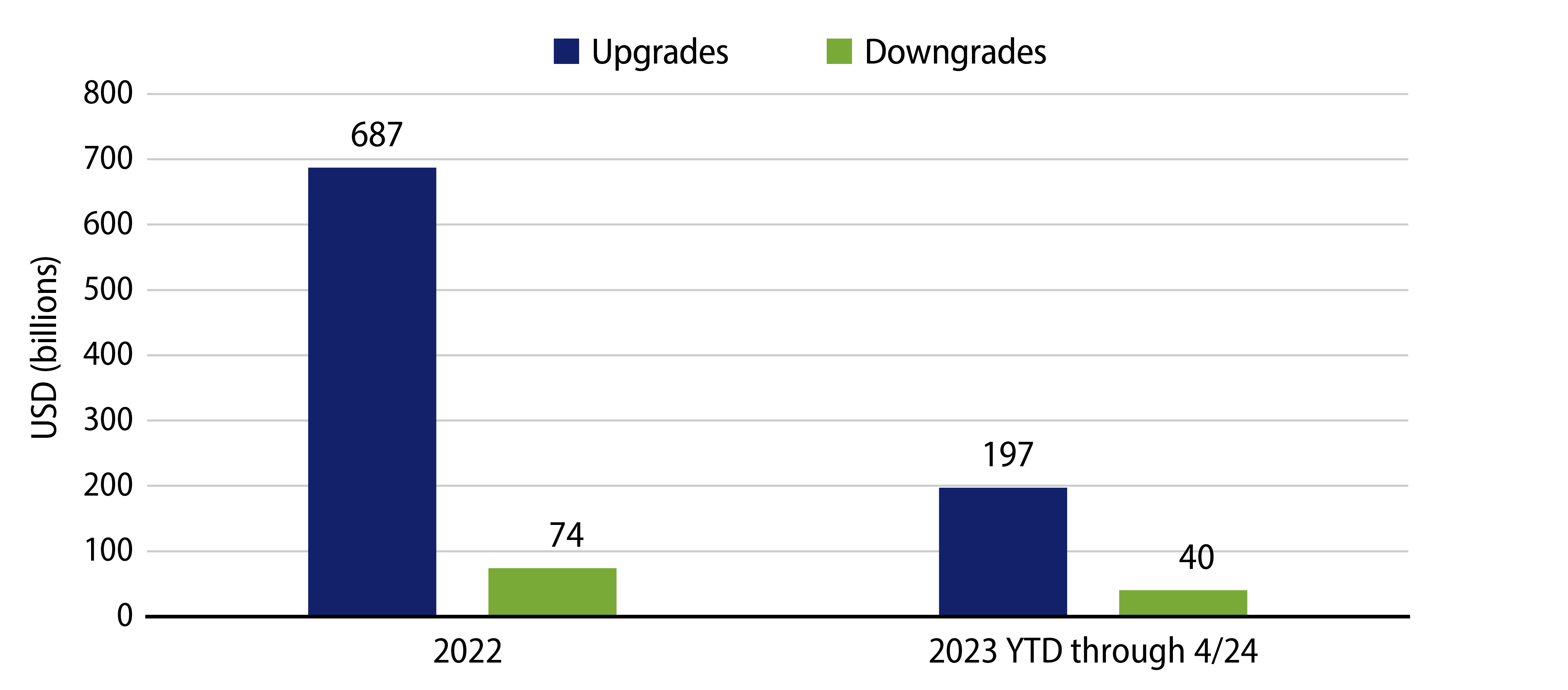

Over the past two years, we have highlighted how stronger than anticipated tax receipts and improving cash balances contributed to improving municipal credit quality. As a result, in 2022 and YTD 2023, major rating agency (Moody’s/S&P/Fitch) upgrades surpassed downgrades by a factor of over 8-to-1, with $884 billion of municipal debt upgraded and just $114 billion downgraded, according to Bloomberg.

Some of the most significant upgrades over this period include states with headline credit challenges prior to the pandemic. The State of New Jersey was upgraded six times from the start of 2022, including three times this month to A/A1/A+ by S&P, Moody’s and Fitch, respectively. The State of Illinois, which was on the precipice of being the only state with a high-yield rating at the early stage of the pandemic, was upgraded five times to A-/A3/BBB+.

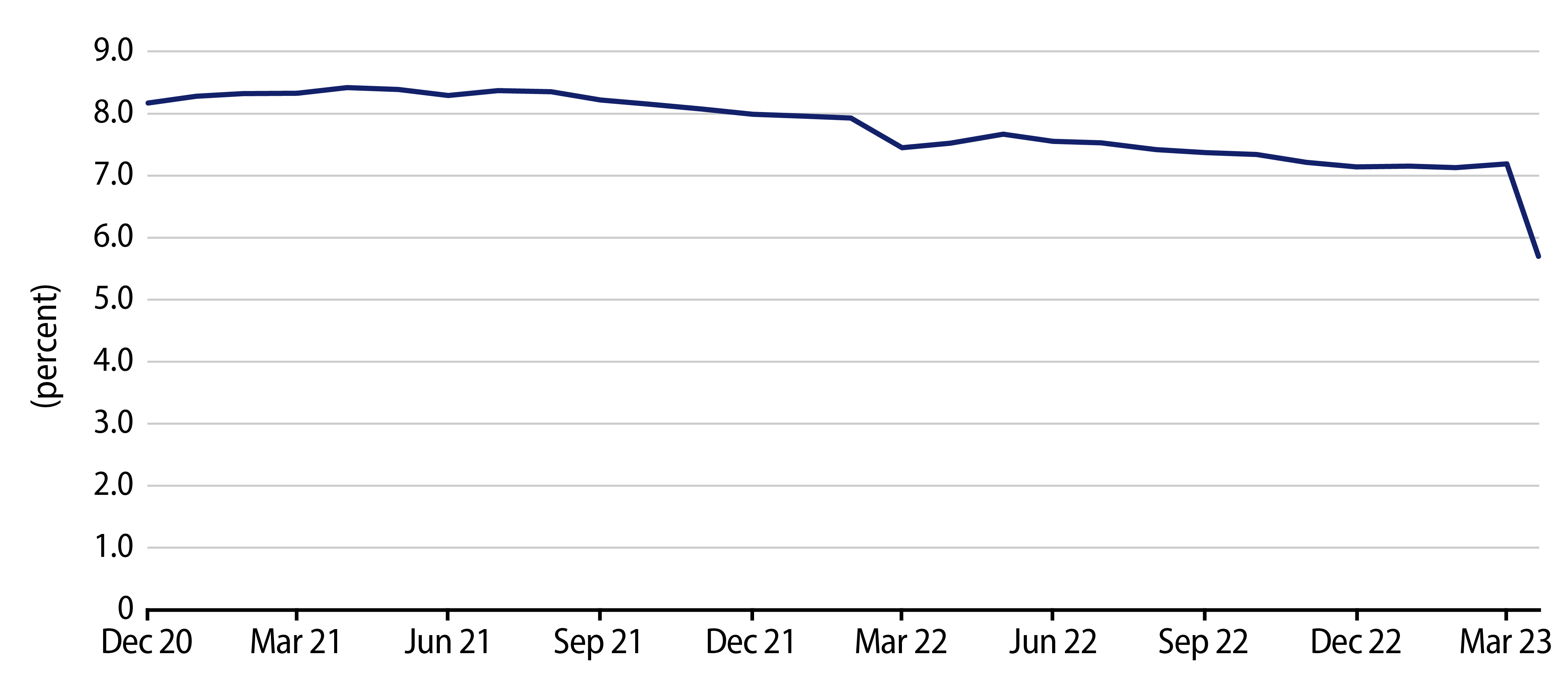

These upgrades have had a significant impact on the municipal index composition. At the start of 2021, 8.3% of the Bloomberg Municipal Bond Index was rated within the BBB cohort, with New Jersey and Illinois comprising approximately 30% of that BBB component. Following this upgrade cycle, BBB rated securities comprised only 5.7% of the Municipal Bond Index, and Illinois and New Jersey have now moved to the A Index. Fewer securities in the BBB index, particularly larger and more liquid names, could make it more difficult to source quality opportunities in lower-rated investment-grade credit.

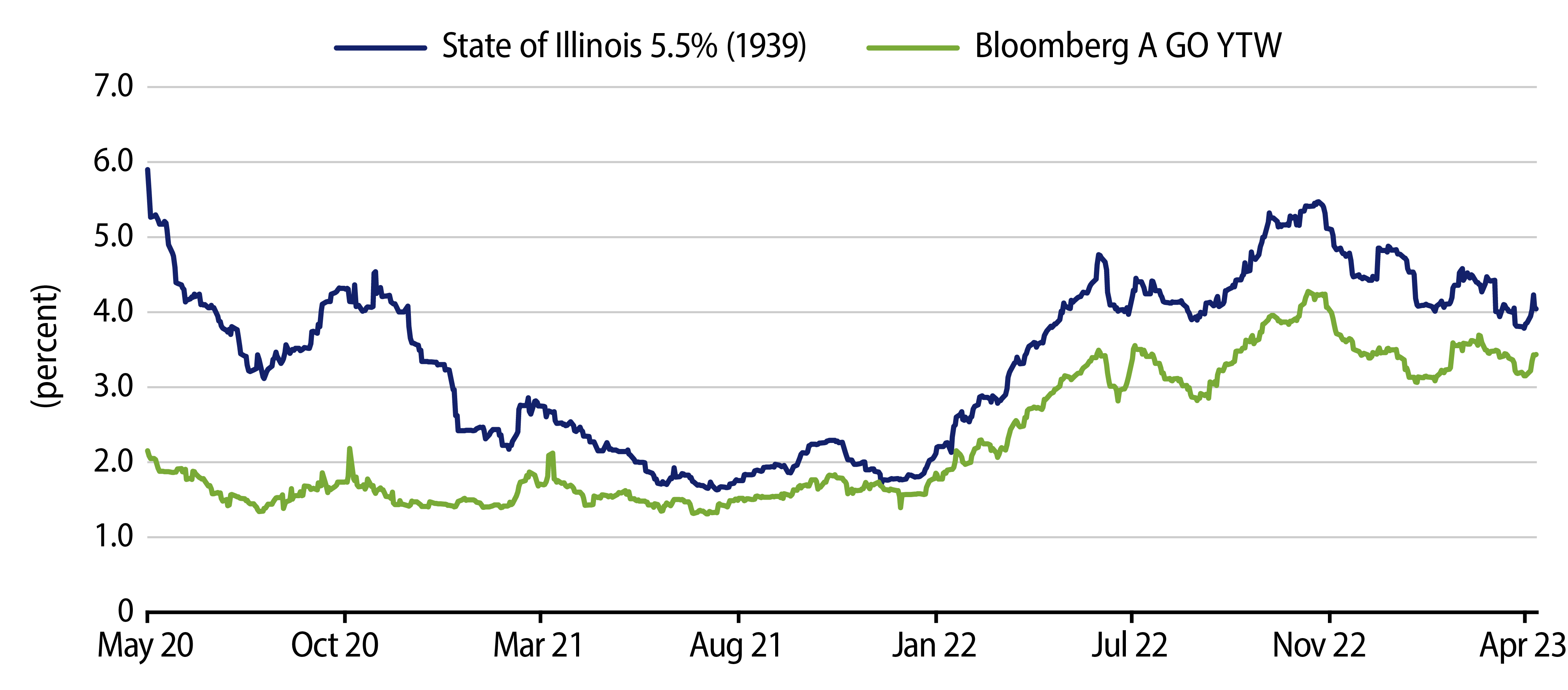

In addition to lower BBB supply, we anticipate higher ratings of these headline issuers to attract additional demand from investor vehicles that typically exclude BBB rated investments, including higher quality retail separately managed accounts to institutional insurance accounts. Illinois tested the impact of its new single A ratings just last week with a $2.5 billion issuance, which was well subscribed despite rate volatility, elevated supply and fund outflows observed during the week. As we anticipate the positive credit cycle could be peaking with Fed tightening slowing growth prospects, we are encouraged by the downside risks the market appears to be pricing into the State of Illinois, which continues to price with yields above traditional A rated general obligation (GO) securities.