Municipals Posted Positive Returns Last Week

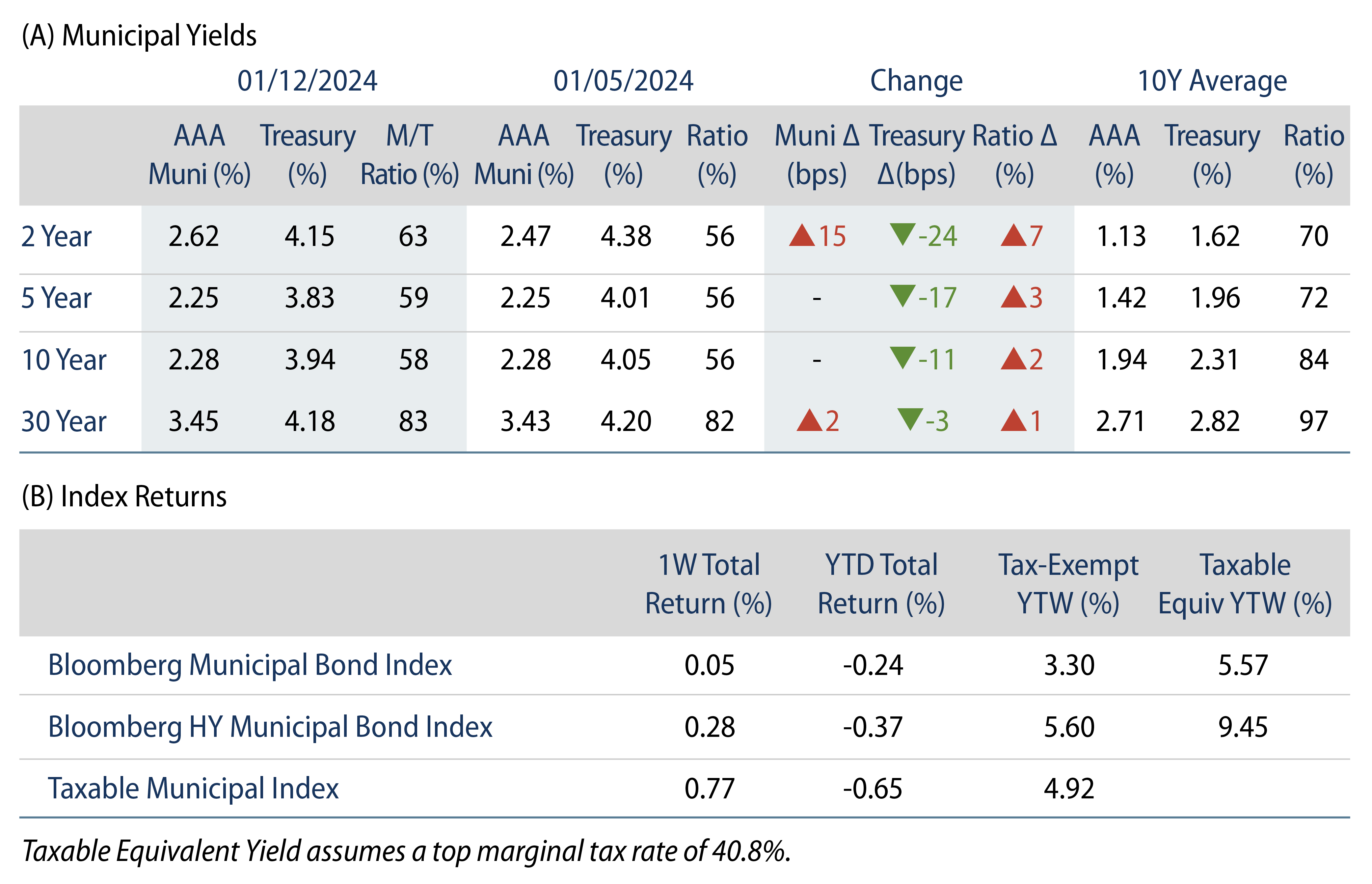

Munis posted positive returns last week, underperforming US Treasuries, which rallied despite hotter-than-expected Consumer Price Index (CPI) data. High-grade muni yields moved higher in short maturities, but were largely unchanged in intermediate maturities. Meanwhile, muni technicals improved as funds recorded inflows. The Bloomberg Municipal Index returned 0.05% during the week, the High Yield Muni Index returned 0.28% and the Taxable Muni Index returned 0.77%. This week we highlight key market themes we’re tracking for muni investors in 2024.

Market Technicals Improved as Muni Funds Recorded Inflows

Fund Flows: During the week ending January 10, weekly reporting municipal mutual funds recorded $39 million of net inflows, according to Lipper. Long-term funds recorded $367 million of outflows, high-yield funds recorded $346 million of inflows and intermediate funds recorded $237 million of inflows.

Supply: Last week’s total muni issuance reached $11 billion to begin the year, $10 billion of which was tax-exempt. This week’s calendar is expected to drop to $7 billion, which is still sizeable given the holiday-shortened week. The largest transactions include $532 million Scripps Health and $503 million Dallas Independent School District transactions.

This Week in Munis: What to Watch for in 2024

As we embark on a new calendar year, this week we highlight key muni market themes worth monitoring across municipal market supply and demand technicals, fundamentals and valuations.

Supply and Demand Technicals

Supply: Will supply increase as issuers take advantage of lower rates to come off the sidelines?

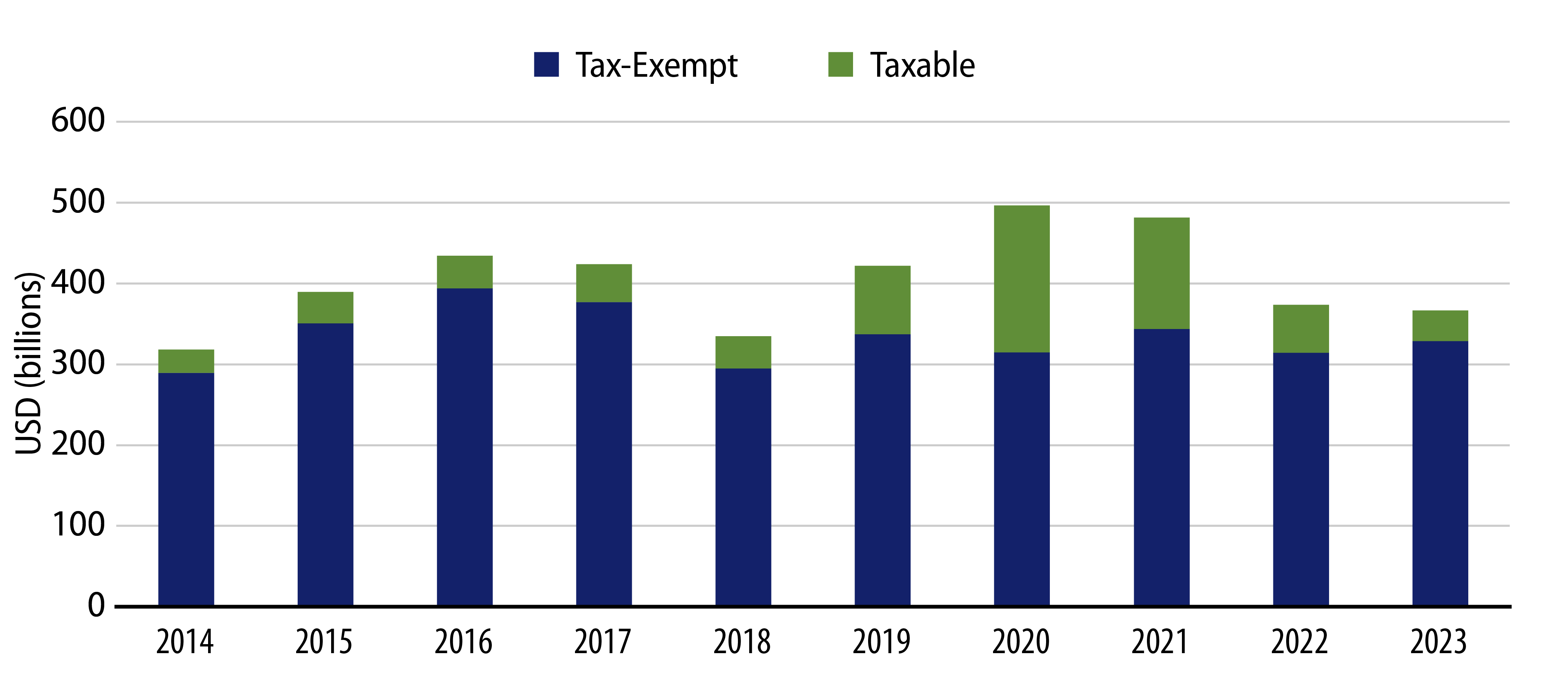

In 2023 municipal supply levels declined 2% year-over-year (YoY) to $367 billion, with tax-exempt muni issuance up 5% YoY and taxable muni issuance down 36% YoY. Many market participants are forecasting a significant increase in new issuance in 2024, with expectations that issuers will be attracted by lower rates than observed in 2022 and 2023 to issue over $400 billion in 2024.

Since 2018, supply has trended lower due to the limited ability for municipalities to refinance debt, following the Tax Cuts and Jobs Act. Meanwhile, a still-elevated rate environment, along with the potential for major infrastructure initiatives to be delayed past the election year, could again lead supply to disappoint market participants to the downside. Lower supply levels would be supportive of market conditions, but also challenge the income opportunities offered, particularly if demand increases in 2024.

Demand: Following two consecutive years of outflows, will municipal mutual funds see an inflow cycle this year?

Since the Fed began its hiking cycle and municipal mutual funds recorded over $120 billion of net outflows since January 2022, municipals have competed with relatively high cash yields from CDs, money market funds and short-term Treasuries for the high-quality portion of asset allocations. Through December 2023, total money market fund assets reached $7 trillion, up $2.4 trillion from December 2019.

As economic conditions continue to tighten and move past post-pandemic volatility, and market pricing and the Fed suggest short-term rates and will move lower, we expect investors to look for solutions to lock up income for longer time horizons. As a result, we anticipate that high-quality municipals will offer increasing after-tax income opportunities versus if cash rates decline, and this could contribute to an inflow cycle.

Fundamentals: Will strong muni credit fundamentals persist?

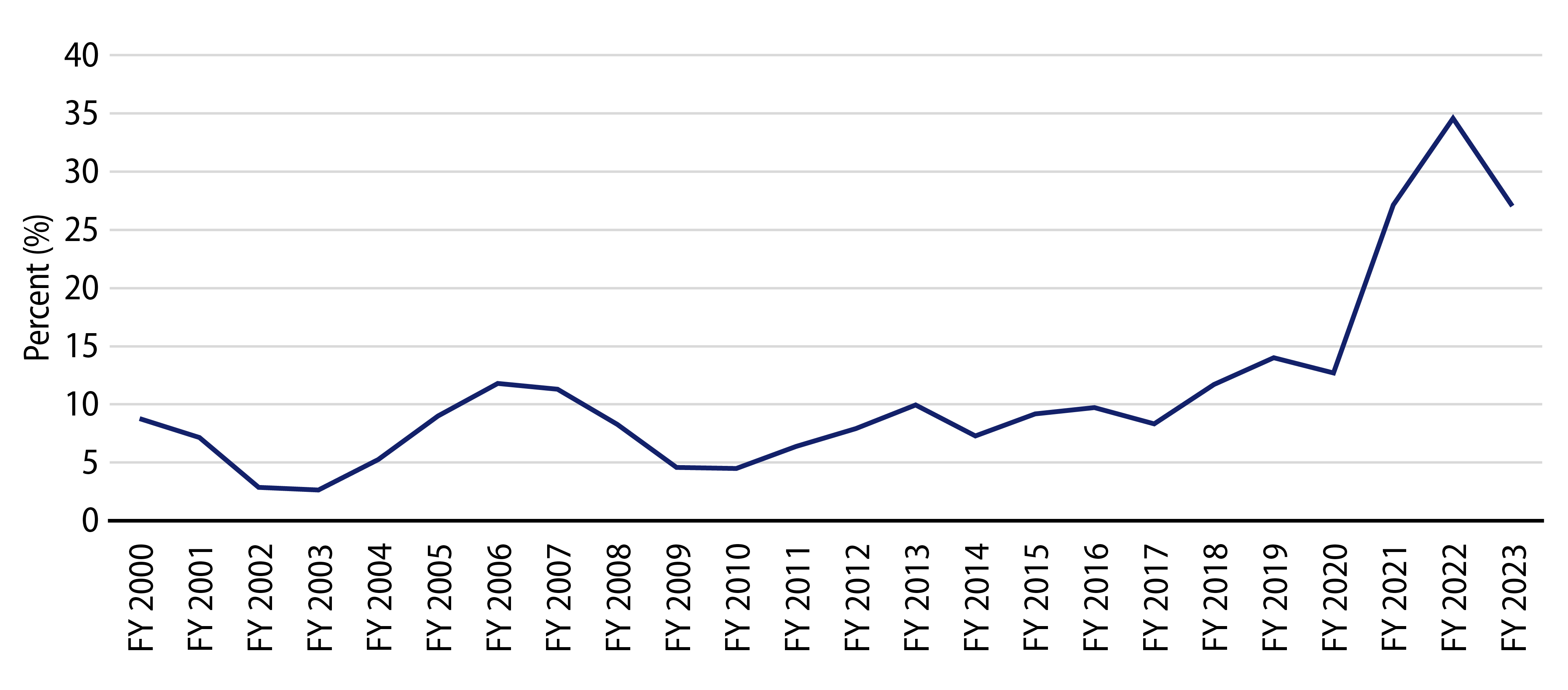

Quarterly state and local tax collections reached record levels at the end of 2022, supporting strong cash balances and upgrades that have outpaced downgrades for three consecutive years. While tax collections declined modestly through the first half of 2023, 12-month trailing collections remain just 2% off record highs, and cash balances remain elevated.

Considering tight monetary policy, slowing revenues and projected deficits, we expect the path of the muni credit cycle could slow but not break, and we anticipate downgrades could increase relative to recent years. We expect strong domestic labor and real estate markets to support tax collections throughout 2024, and that state cash balances will remain well above levels observed prior to the global financial crisis, which would be supportive of muni credit in an unexpected downturn.

Valuations: Is it too late to get in following a strong end-of-year rally?

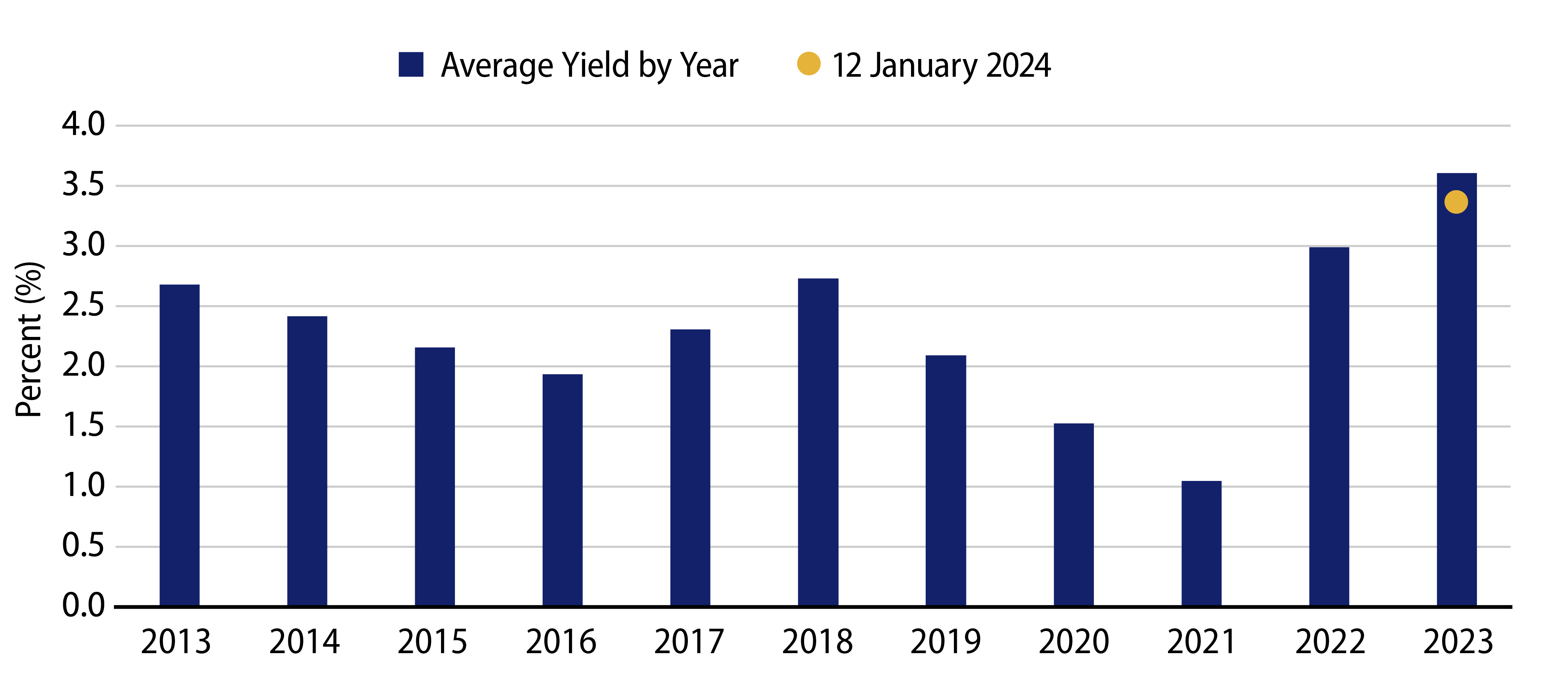

The Bloomberg Muni Bond Index yield-to-worst peaked at 4.50% in October, ahead of the index’s 8.3% total return observed in November and December which led the index yield lower to 3.22% by year-end 2023, pricing in Fed easing expectations in 2024. Moreover, highest quality AAA Muni/Treasury ratios within 10 years retraced near all-time low levels following the rally.

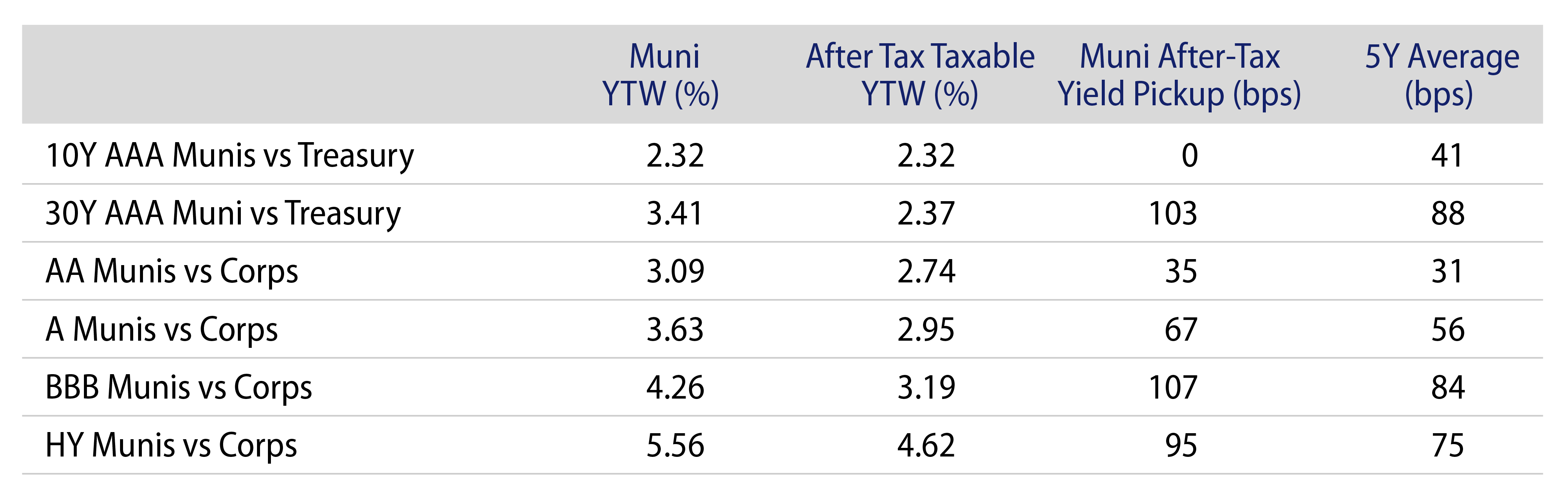

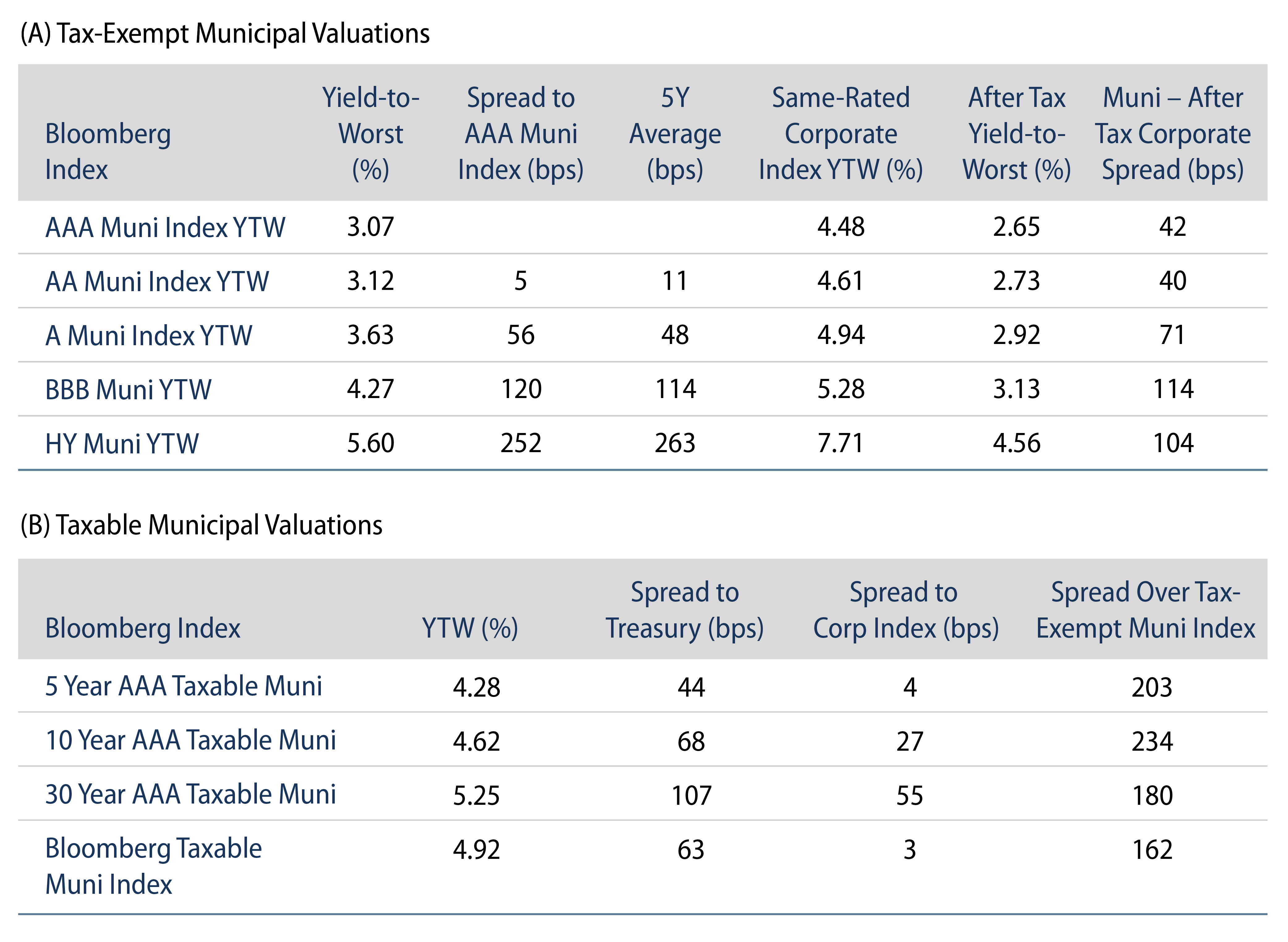

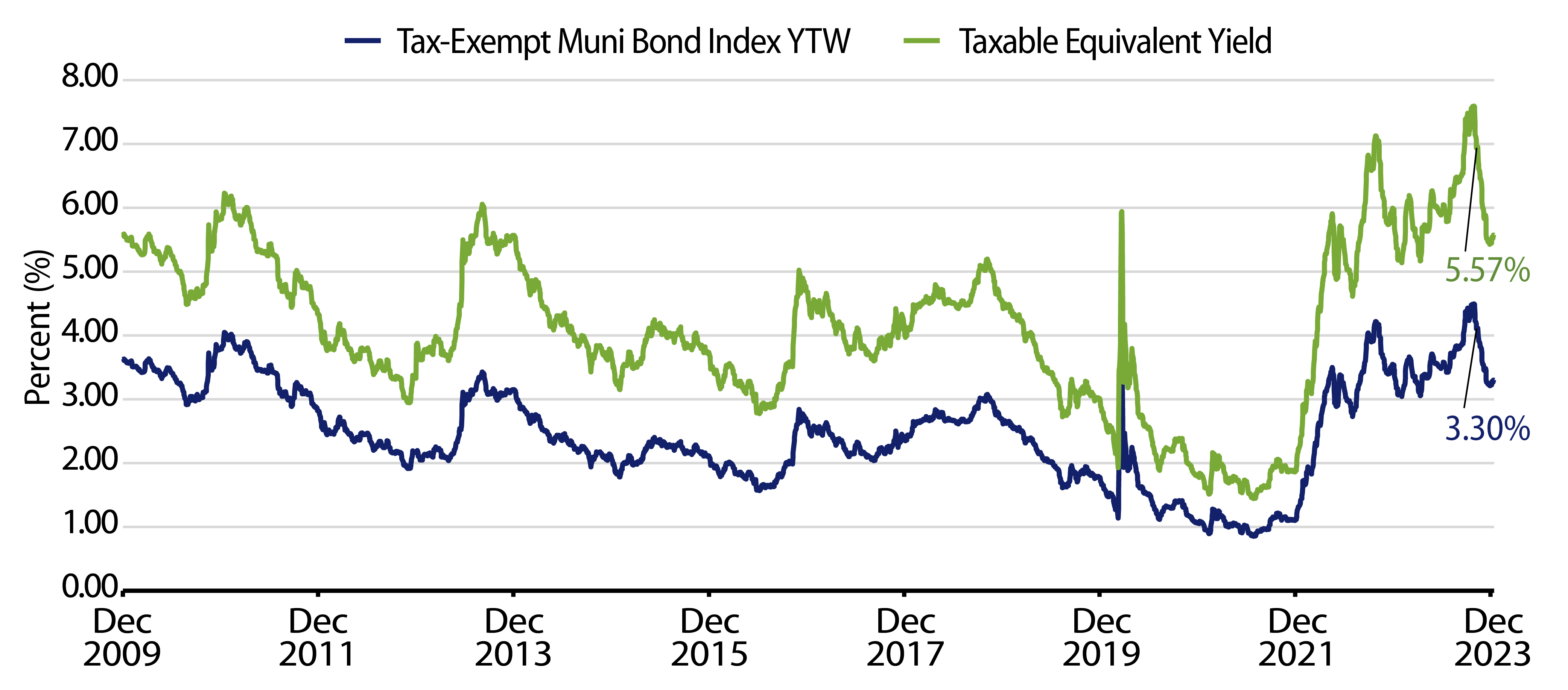

As of last week, the Bloomberg Muni Bond Index yield-to-worst of 3.30% (5.57% for taxable-equivalent) remains near the decade highs, and offers attractive after-tax yield pick-up versus other investment-grade credit counterparts. This tax-exempt carry can contribute to attractive long-term after-tax total return potential and we view the current entry point as favorable for long-term investors, considering the prospects of limited supply, higher demand and resilient credit fundamentals that could lead future income opportunities lower.

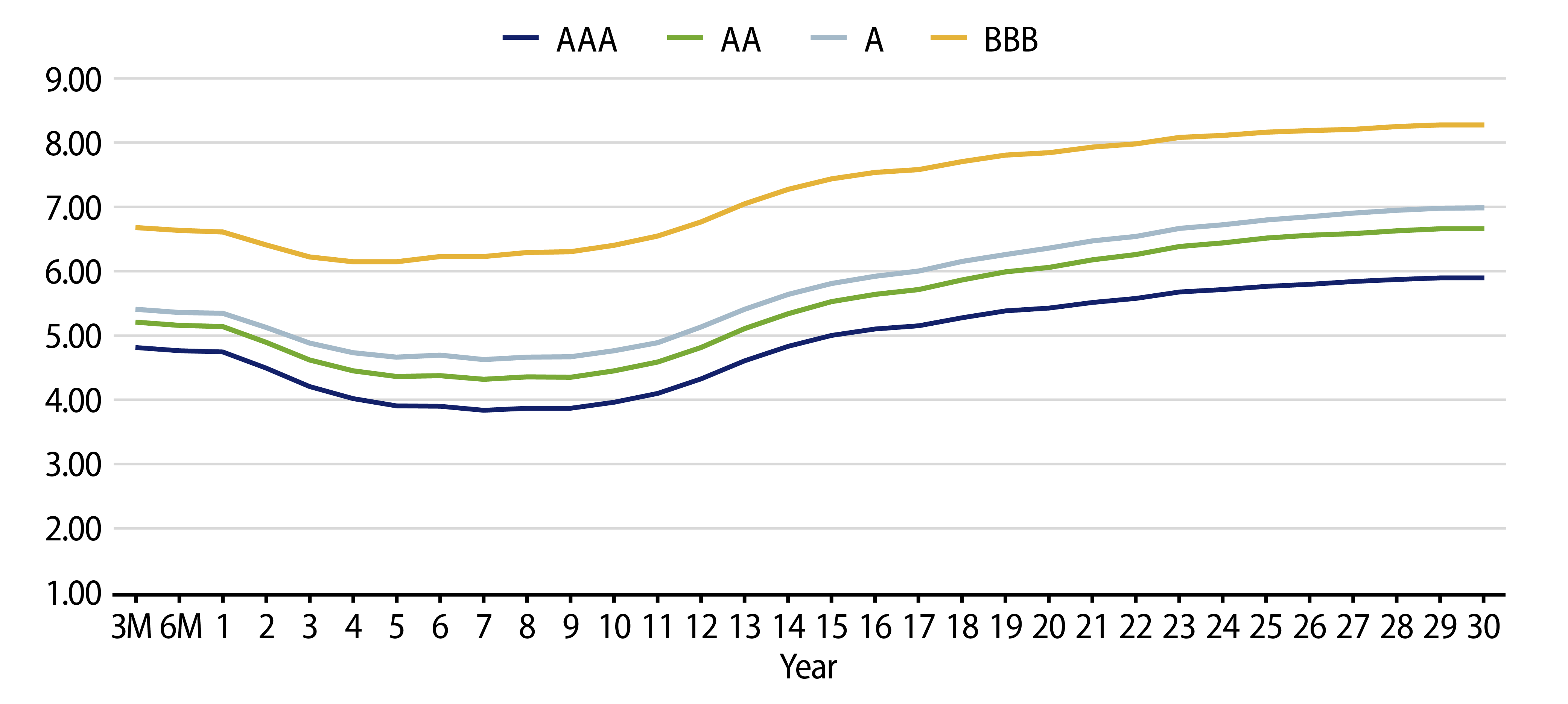

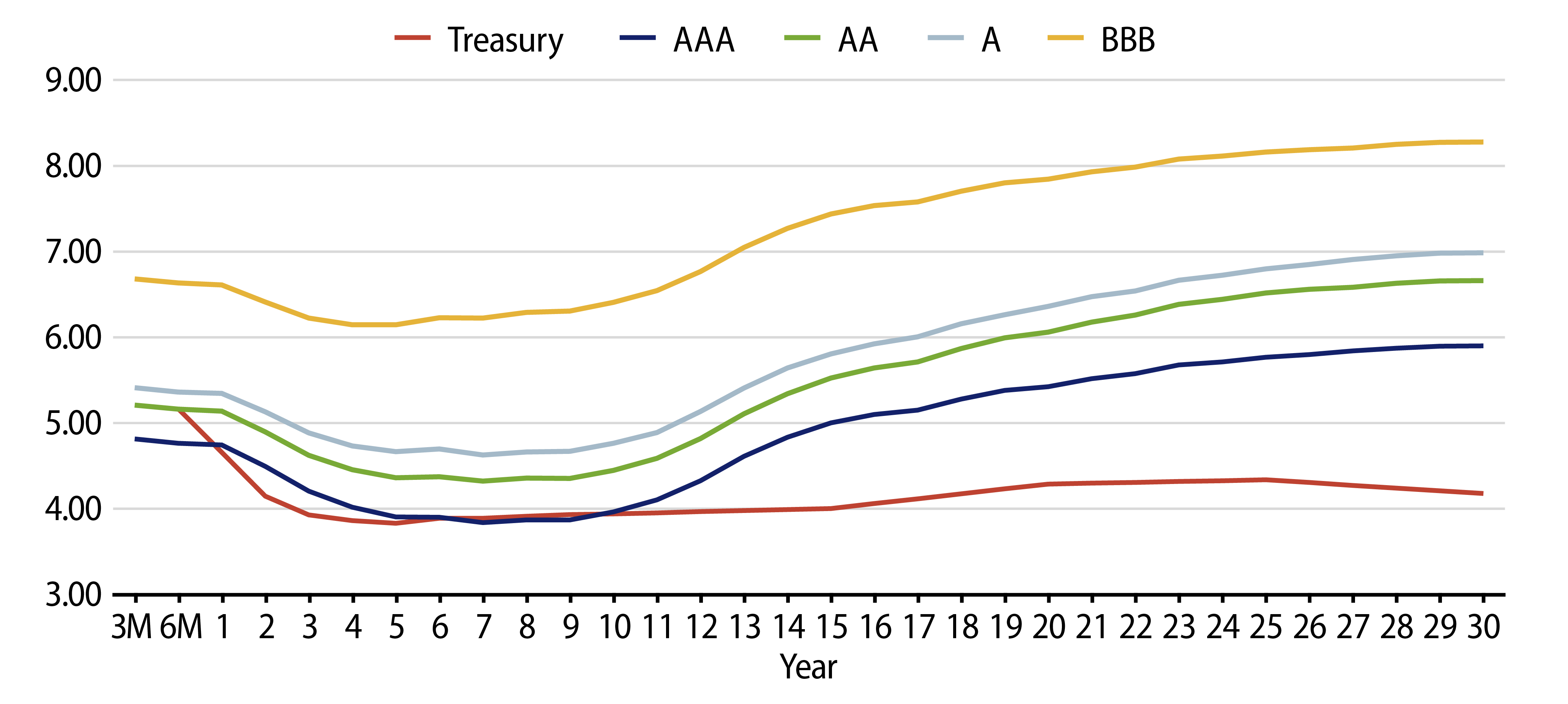

Theme #1: Municipal index yields and taxable-equivalent yields are above decade highs.

Theme #2: Recent steepening of muni yield curve highlights potential value in moving out to longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.