Municipal Returns Close the Year Higher

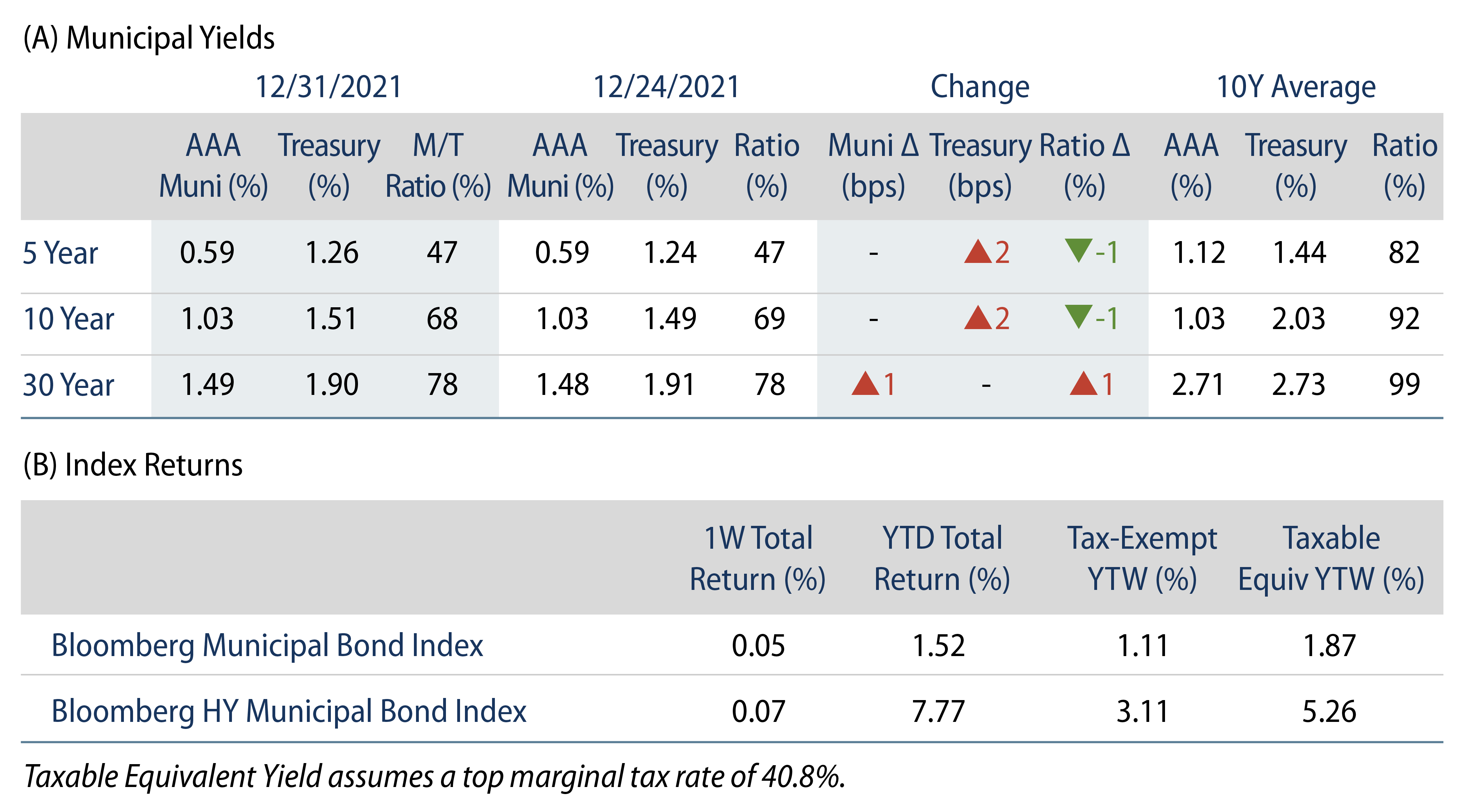

Municipal returns were positive during the last week of the year, as the AAA muni yield curve was generally unchanged during the week, with high grade municipal yields rising just 1 bp. Municipal/Treasury ratios declined modestly as Treasury rates moved 2 bps higher in short and intermediate maturities. Municipal fund flows extended a record pace while supply was limited over the holidays. The Bloomberg Municipal Index returned 0.05%, while the HY Muni Index returned 0.07%. This week we recap 2021 municipal sector performance and technical trends.

Municipal Mutual Funds Highlight Record Year of Demand

Fund Flows: During the week ending December 29, municipal mutual funds recorded $1.2 billion of net inflows. Long-term funds recorded $1 billion of inflows, high-yield funds recorded $442 million of inflows and intermediate funds recorded $180 million of inflows. Municipal mutual funds have now recorded inflows 84 of the last 85 weeks, extending the record inflow cycle to $163 billion, with year-to-date (YTD) net inflows marking a record calendar year at $102 billion.

Supply: The muni market recorded approximately $1 billion of new-issue volume each of the last two holiday weeks of the year. Total 2021 issuance of $464 billion is just shy of 2020 levels (-1.4%), with tax-exempt issuance trending 6% higher year-over-year (YoY) and taxable issuance trending 19% lower YoY. This week’s new-issue calendar is expected remain subdued at $1 billion, led by a $503 million Department of Airports of the City of Los Angeles transaction.

This Week in Munis—Year in Review

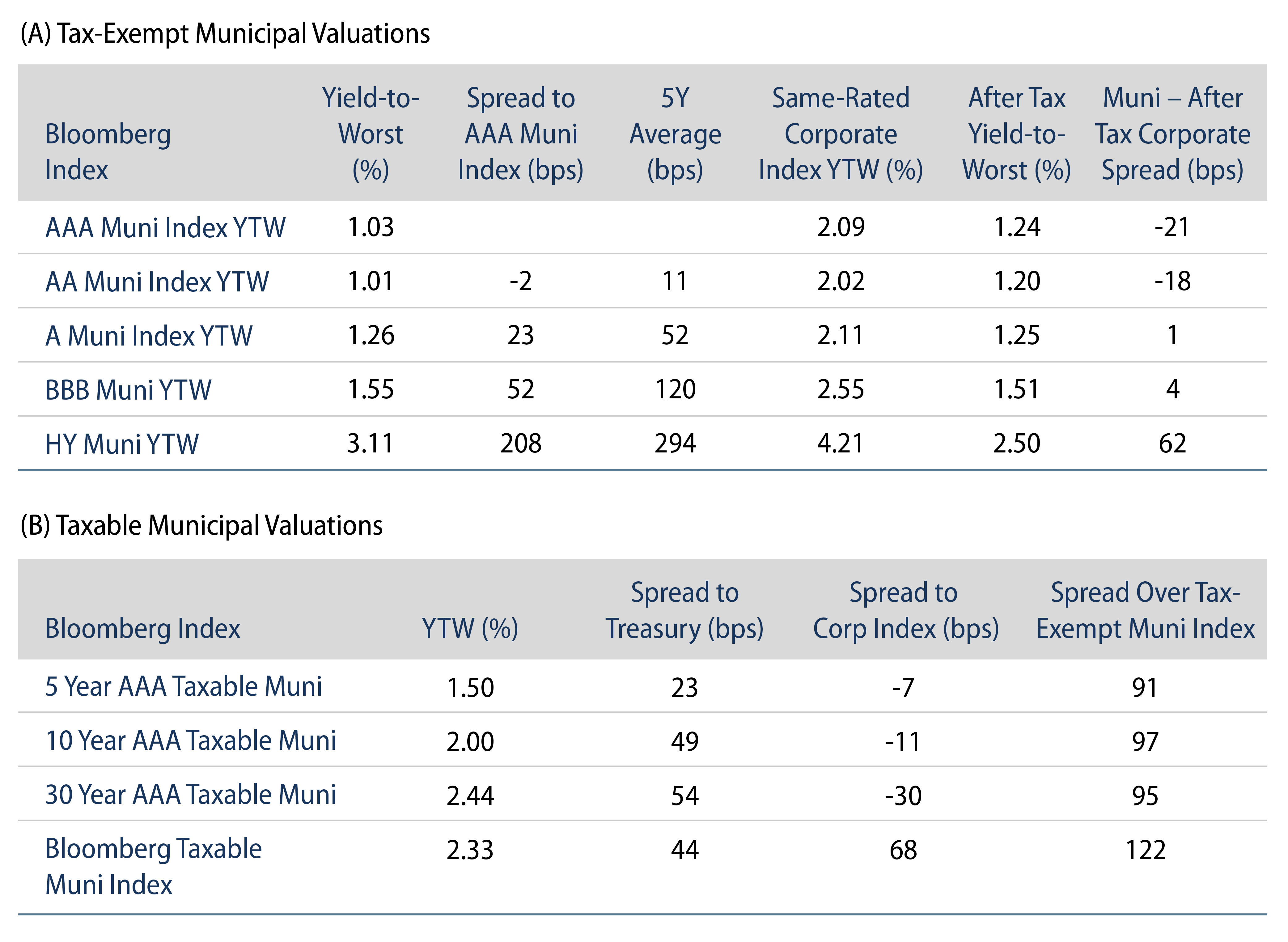

For the municipal market, the year 2021 could possibly be best characterized as a year of resiliency. Better than expected revenues from states and local governments, combined with additional direct federal aid measures, have supported a very strong fundamental credit picture for the municipal market. Meanwhile, concerns around higher federal tax rates drove record demand for the asset class, while net new-issue supply remained fairly limited. This fundamental and technical strength more than offset the inflation concerns and interest rate volatility that challenged most fixed-income asset classes, as the municipal market posted positive returns in 2021.

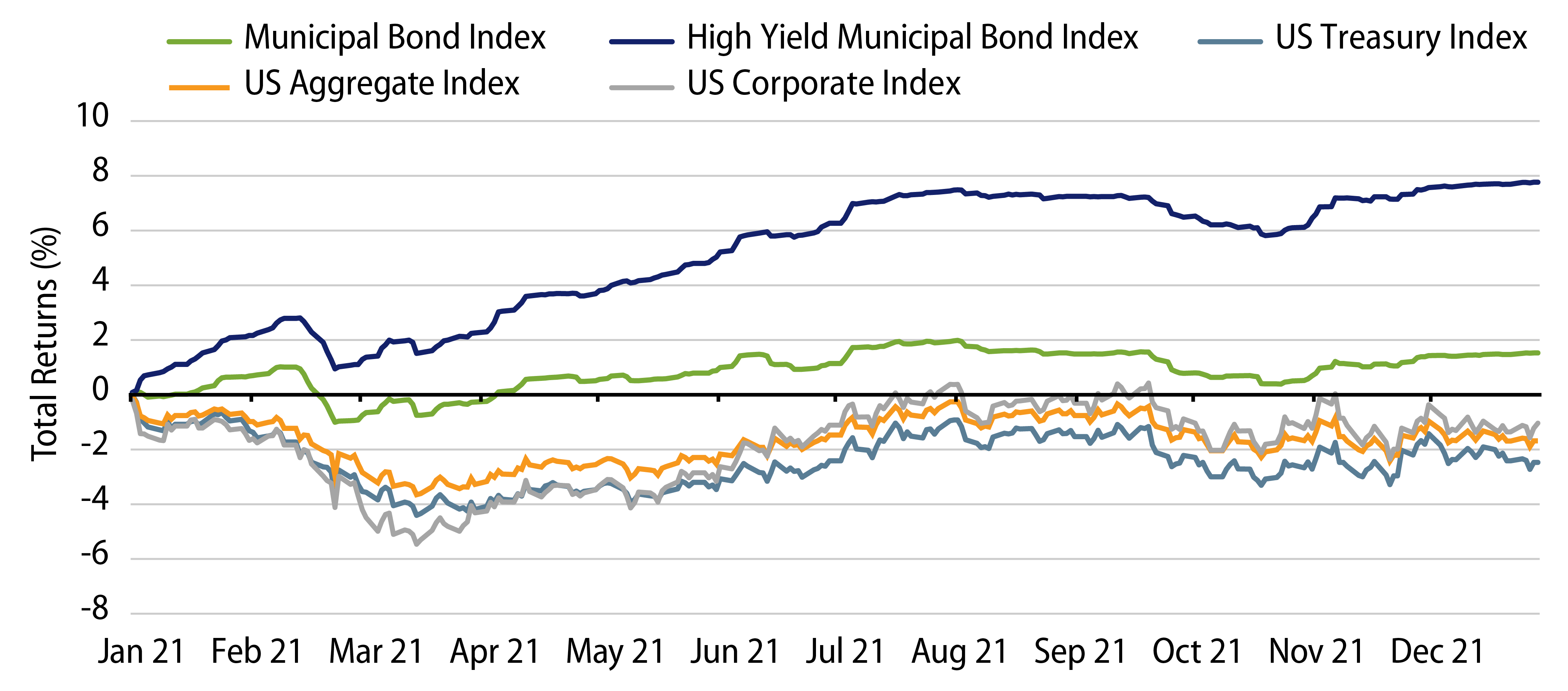

All told, the Bloomberg Municipal Bond Index returned 1.52% and the Taxable Municipal Bond Index returned 0.94%, materially outperforming most fixed-income asset classes when considering the Bloomberg Global Aggregate index return of -4.71%, the Bloomberg US Treasury Return of -2.32% and the US Corporate Index return of -1.04%.

Within the municipal market, we explore 2021 calendar-year performance drivers across curve, quality and sector perspectives:

Curve Returns

Longer maturity indices outperformed during the year as the high-grade municipal yield curve flattened. Bloomberg Long (22+) and 20-Year (17-22) indices returned 3.17% and 2.53%, respectively. Bloomberg 3-, 5- and 10-Year indices underperformed returning 0.40%, 0.34% and 0.97%, respectively.

Municipal Quality Returns

Municipal credit risk was rewarded in 2021, as lower quality municipals outperformed. Bloomberg High Yield, BBB and A rated indices outperformed the broader municipal market, returning 7.77%, 4.85%, and 2.25%, respectively. AAA and AA municipal segments underperformed, returning 0.47% and 0.92%, respectively.

Sector Returns

Revenue-backed sectors outpaced their general obligation (GO) counterparts. The Bloomberg Revenue Index returned 1.86%, while the GO index returned 1.01%. Top performing revenue sectors included the higher beta healthcare, lease-backed and transportation indices, which returned 2.72%, 2.41% and 2.40%, respectively. Higher quality pre-refunded, water and sewer, and housing sectors underperformed the broader index, returning 0.00%, 0.82% and 0.94%, respectively.

2022 Preliminary Outlook

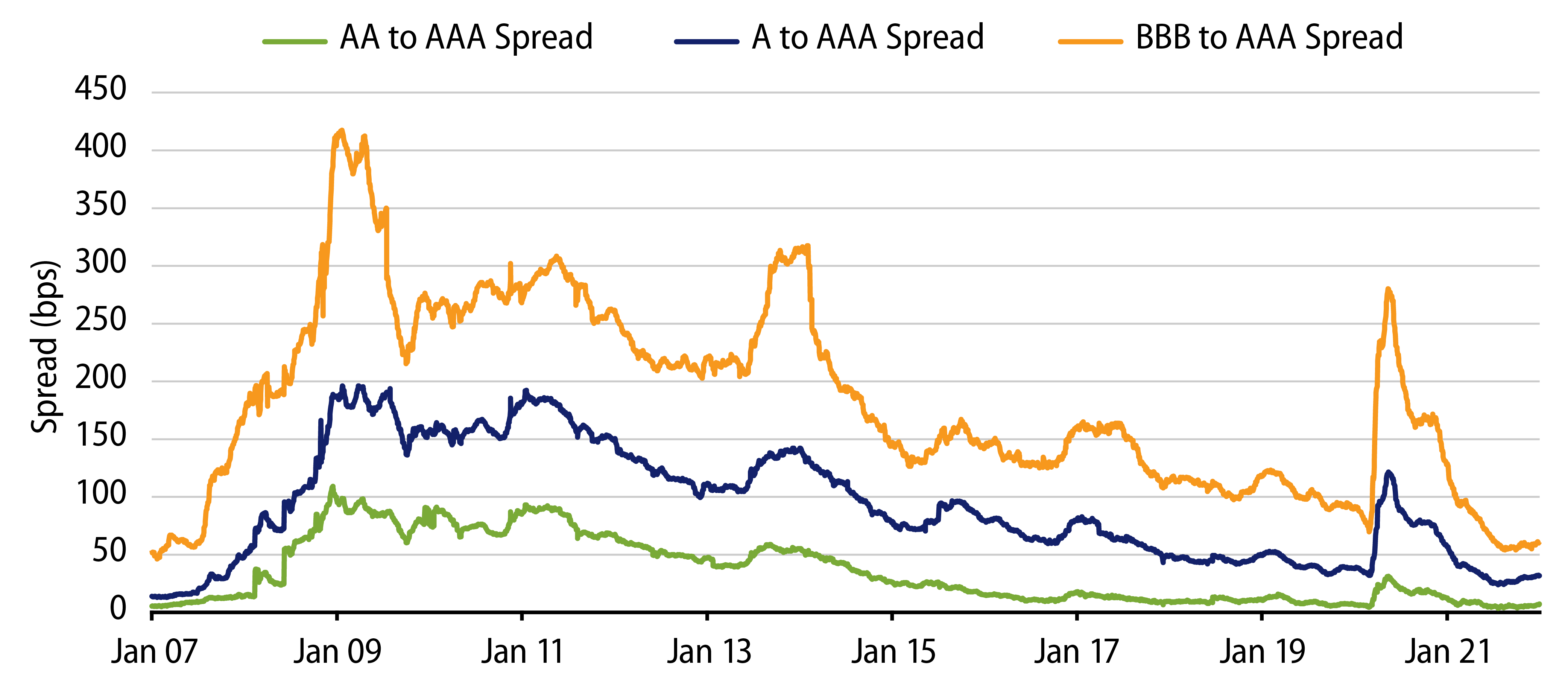

We expect state and local municipal fundamentals will continue to benefit from elevated tax revenues and federal aid that should continue to be rolled out in 2022. With this strong fundamental backdrop, we anticipate favorable municipal technicals of ongoing demand for high quality tax-exempt income and limited net supply trends that will support municipal valuations.

However, we believe incremental caution is warranted at current spread levels, which have retraced pre-pandemic levels to near-record tights. While this is not Western Asset’s base case expectation, extended inflation pressures have the potential to soften demand and contribute to a more volatile year ahead. From a fundamental standpoint, a re-emergence of unexpected regional shutdowns associated with new COVID-19 variants, combined with exhaustion around any additional federal policy support, could downshift favorable credit conditions.

Considering the strong fundamental and technical conditions along with these downside risks, Western Asset believes that value can be better achieved with individual issuer selection, given the individual credit and structural mispricings throughout the fragmented municipal market. We also believe that investors are facing lower opportunity costs to improve liquidity in their portfolios, which could provide the flexibility to take advantage of unforeseen volatility in the year ahead.