Municipals Began 2024 with Negative Returns Last Week

Munis shrugged off the Treasury selloff last week and posted positive total returns, following stronger than anticipated payroll data and just $400 million of new-issue supply. The high-grade muni curve steepened, declining 5 bps in 2-years and increasing 1 bp in 30-years. The Bloomberg Municipal Index returned -0.29% during the week, the High Yield Muni Index returned -0.64% and the Taxable Muni Index returned -1.41%. This week we recap 2023 muni performance and market trends.

2023 Performance: Municipals Stage a Comeback

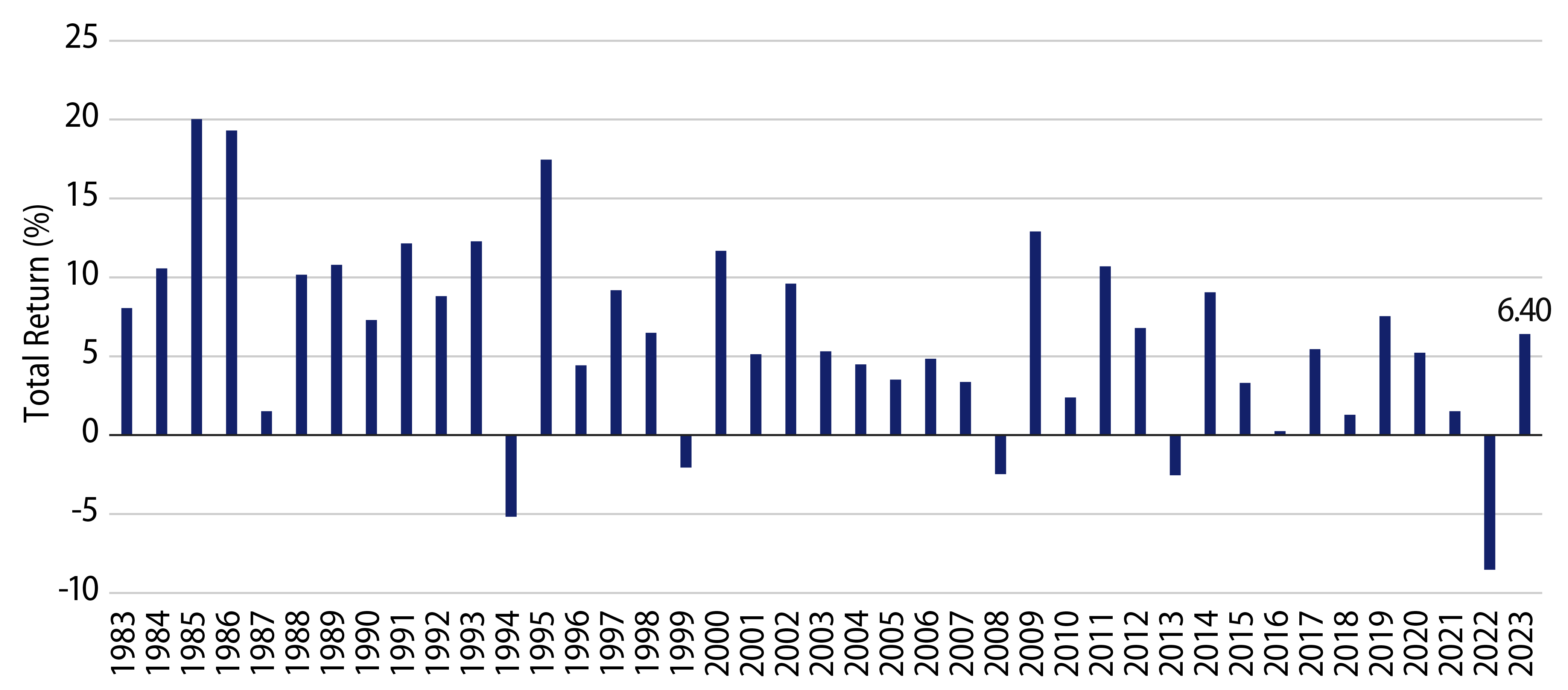

Following the worst calendar year return in 40 years in 2022, the Bloomberg Municipal Bond Index returned an above-average 6.40% in 2023. The majority of the year’s positive performance arrived during the final two months of the year, as the index returned 8.82% in November and December.

Longer-term and lower credit quality municipals outperformed during the year, as the Bloomberg Long Muni Index returned 9.35% and the Bloomberg High Yield Muni Index returned 9.21%. Longer-duration taxable municipals also posted strong performance, considering the Bloomberg Taxable Muni Index returned 8.84%.

Weak Supply and Demand Technicals Weighed on the Market for Much of the Year

Market technicals were generally weak throughout the year, considering mutual fund outflows and higher tax-exempt supply.

From a demand perspective and following the record $116 billion municipal mutual fund outflow cycle observed in 2022, according to ICI, muni mutual funds recorded an additional $6 billion of outflows in 2023. Muni open-end funds recorded $15 billion of net outflows and municipal ETFs recorded $16 billion of net inflows. While overall fund demand has been lackluster over the year, continued SMA demand has kept high-quality munis at the front end of the curve well supported.

From a supply perspective, total municipal issuance of $367 billion was down 2% from 2022 levels. Tax-exempt muni supply reached $328 billion in 2023, 5% higher than the prior year’s level, but still nearly 17% below pre-2018 levels when the Tax Cuts and Jobs Act limited tax-exempt refinancing activity. Taxable issuance remained lackluster in the higher rate environment, falling 36% year-over-year to $38 billion, or 12% of total issuance, which is more aligned with longer-term averages.

State and Local Credit Remained Resilient

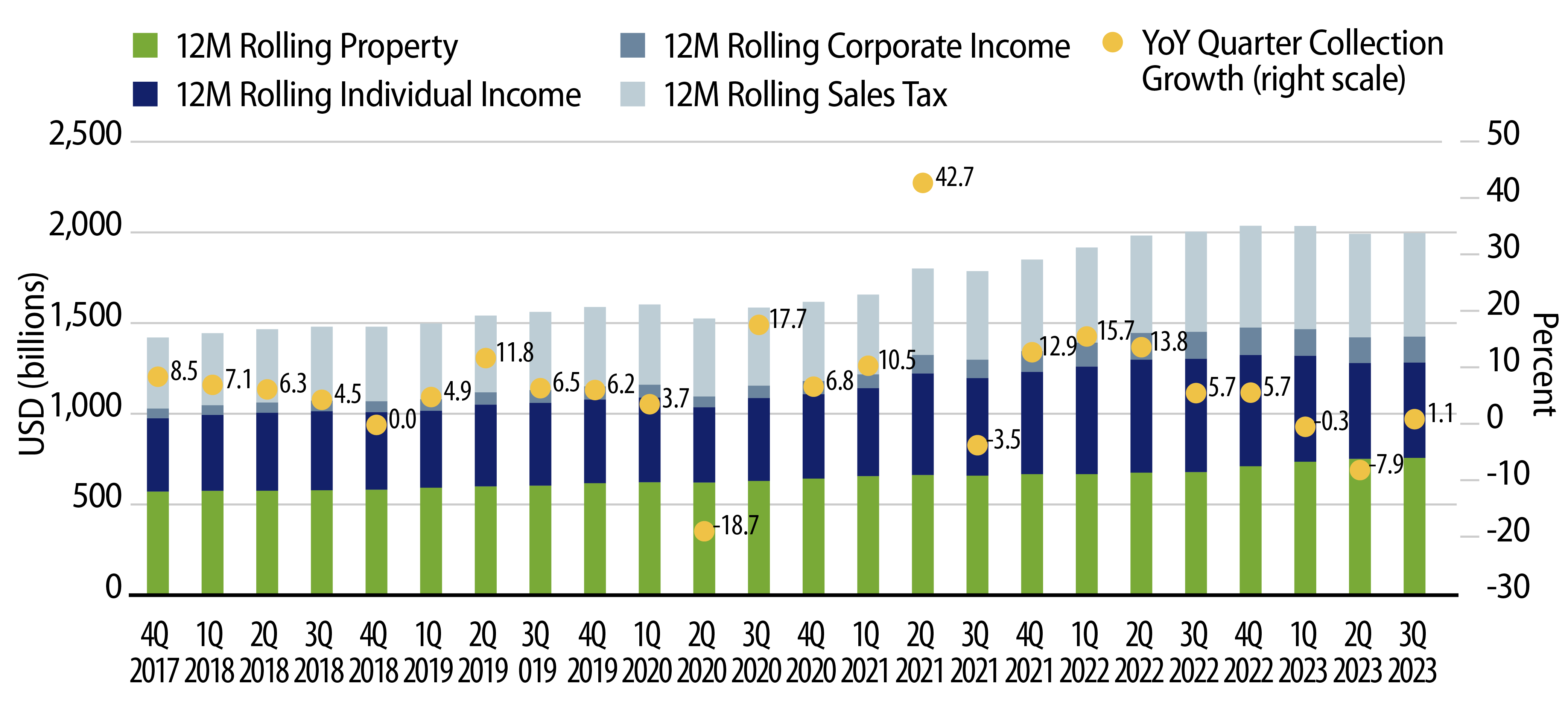

State and local revenues trended lower with tightening economic conditions through the first half of the year before rebounding marginally in the third quarter, according to Census estimates. Twelve-month trailing state and local revenues as of September were unchanged from the prior year at $2.0 trillion, just 2% shy of record levels set in the fourth quarter of 2022. While slowing tax collections are expected to contribute to headline deficits in 2024, strong labor and real estate markets should continue to support historically high state and local revenues, elevated cash balances, and favorable budgetary flexibility.

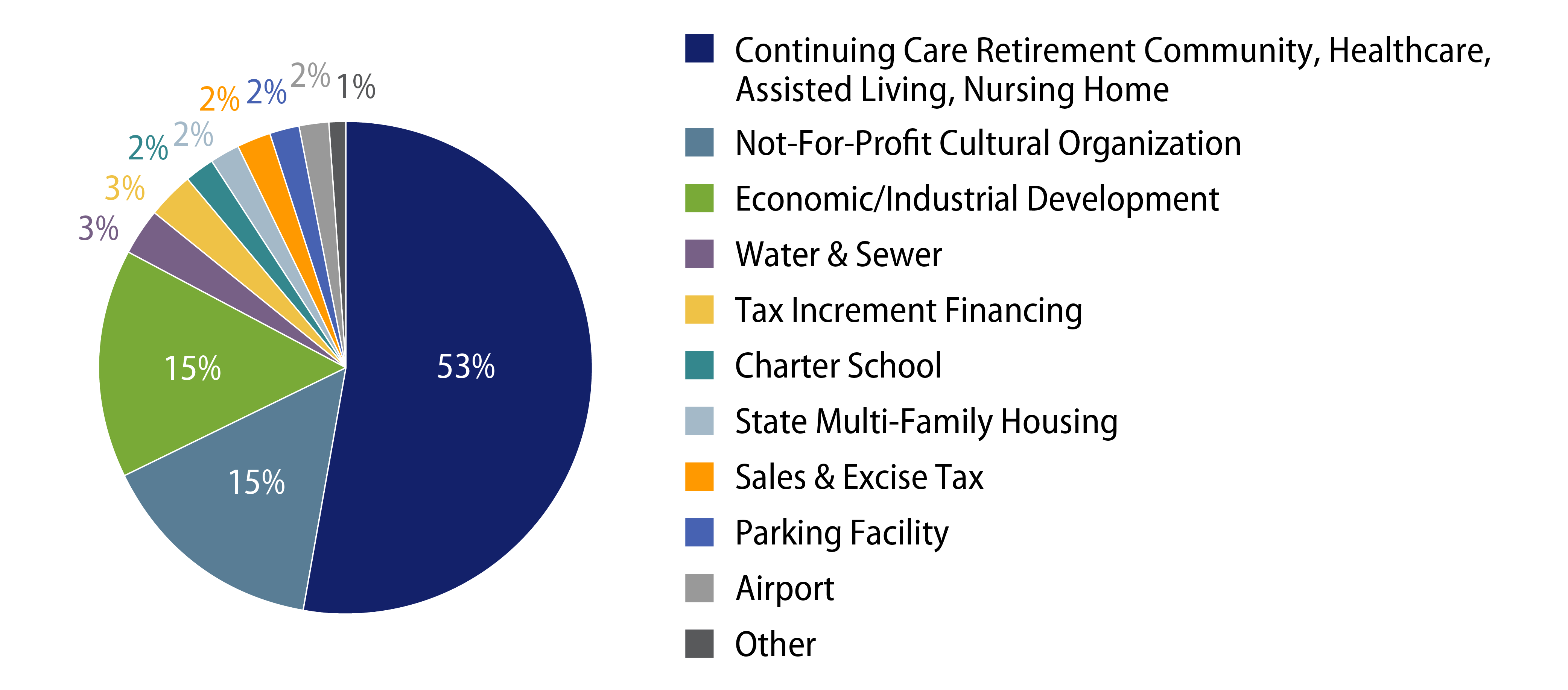

Municipal defaults remained limited and contained to select high-yield sectors in 2023. According to Bloomberg data through December 19, the municipal market recorded 53 first-time debt service payment defaults totaling $1.9 billion, up from the 47 defaults that totaled $1.3 billion in 2022. Similar to recent years, over 50% of outstanding defaulted par was driven by high-yield Continuing Care and Retirement Community (CCRC), Assisted Living, and Health Care sectors still affected by labor cost pressures.

Overall, the muni credit improvement observed over the last three years continued to contribute to significant upgrade trends. According to Bloomberg data through December 19, Moody’s, S&P and Fitch upgrades surpassed downgrades 7:1 by par value in 2023.

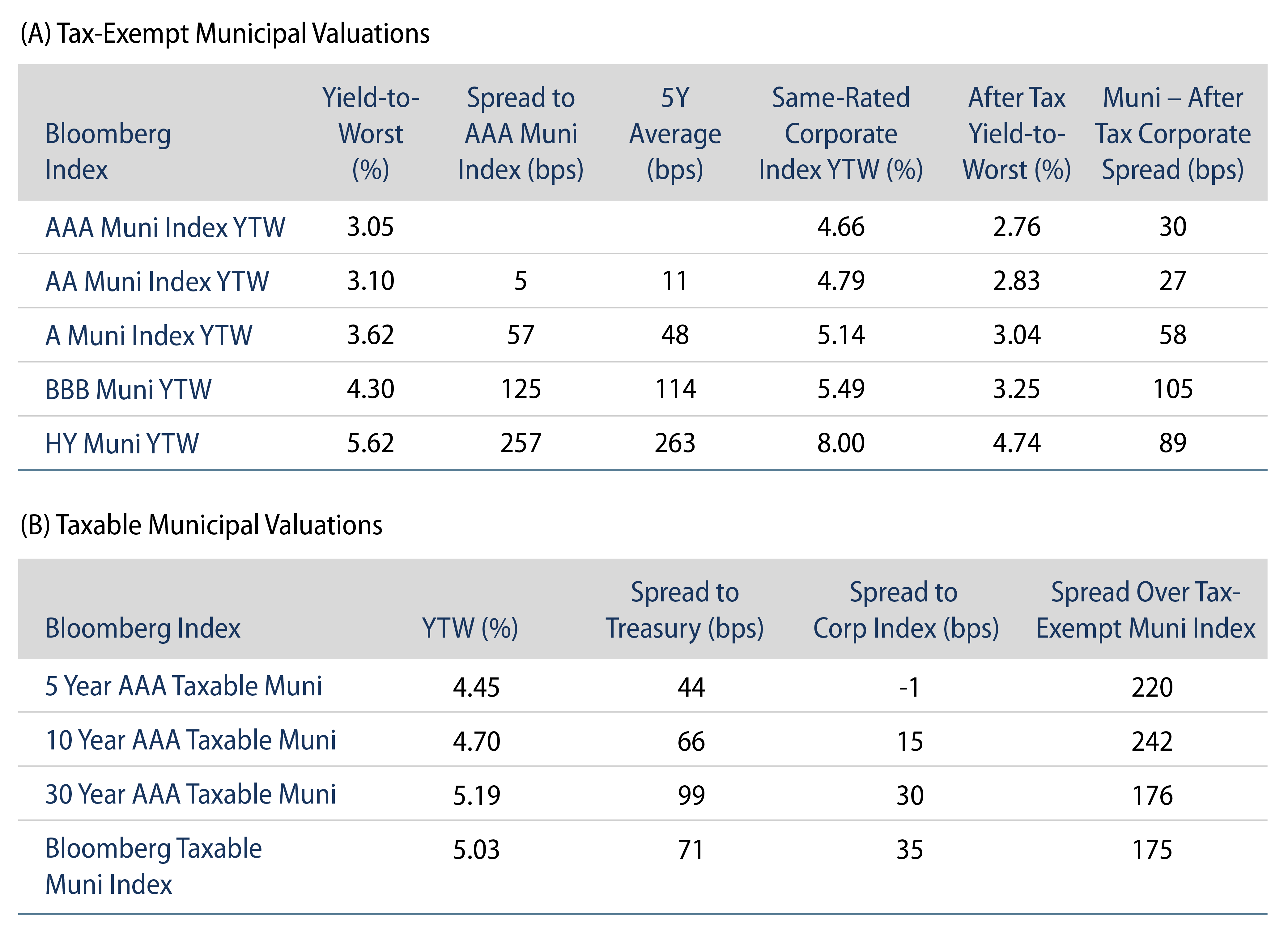

Valuations: Tax-Exempt Income Opportunities Remain Attractive

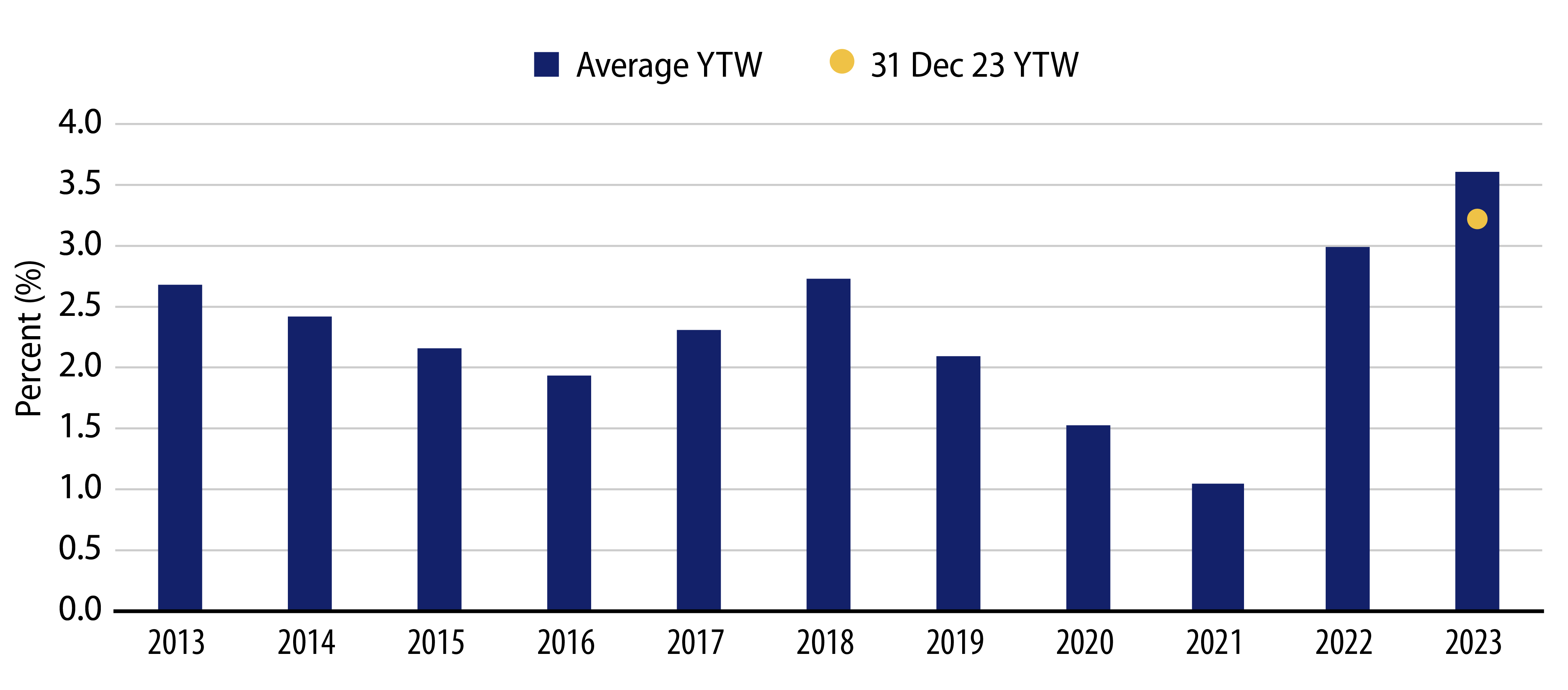

Despite strong performance of 6.40% during the year, the average Bloomberg Municipal Bond Index yield-to-worst (YTW) was down just 0.33% to 3.22%, or 5.43% on a taxable-equivalent basis. The elevated nominal yields and income opportunity offered by the muni market remains above the levels seen much of the past decade.

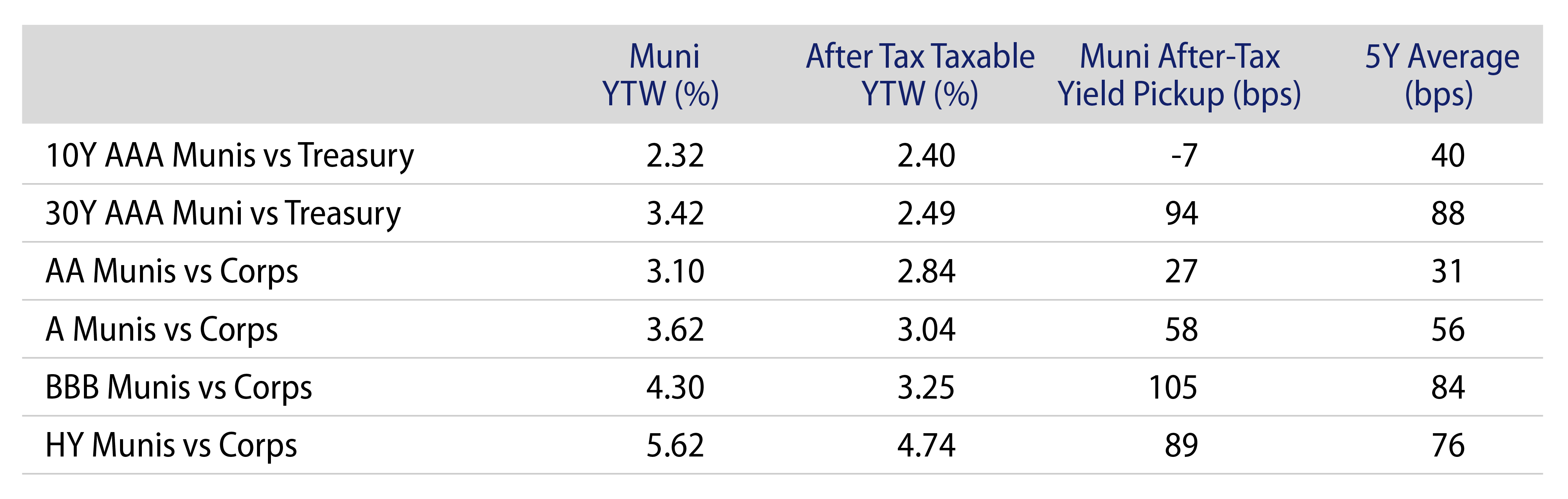

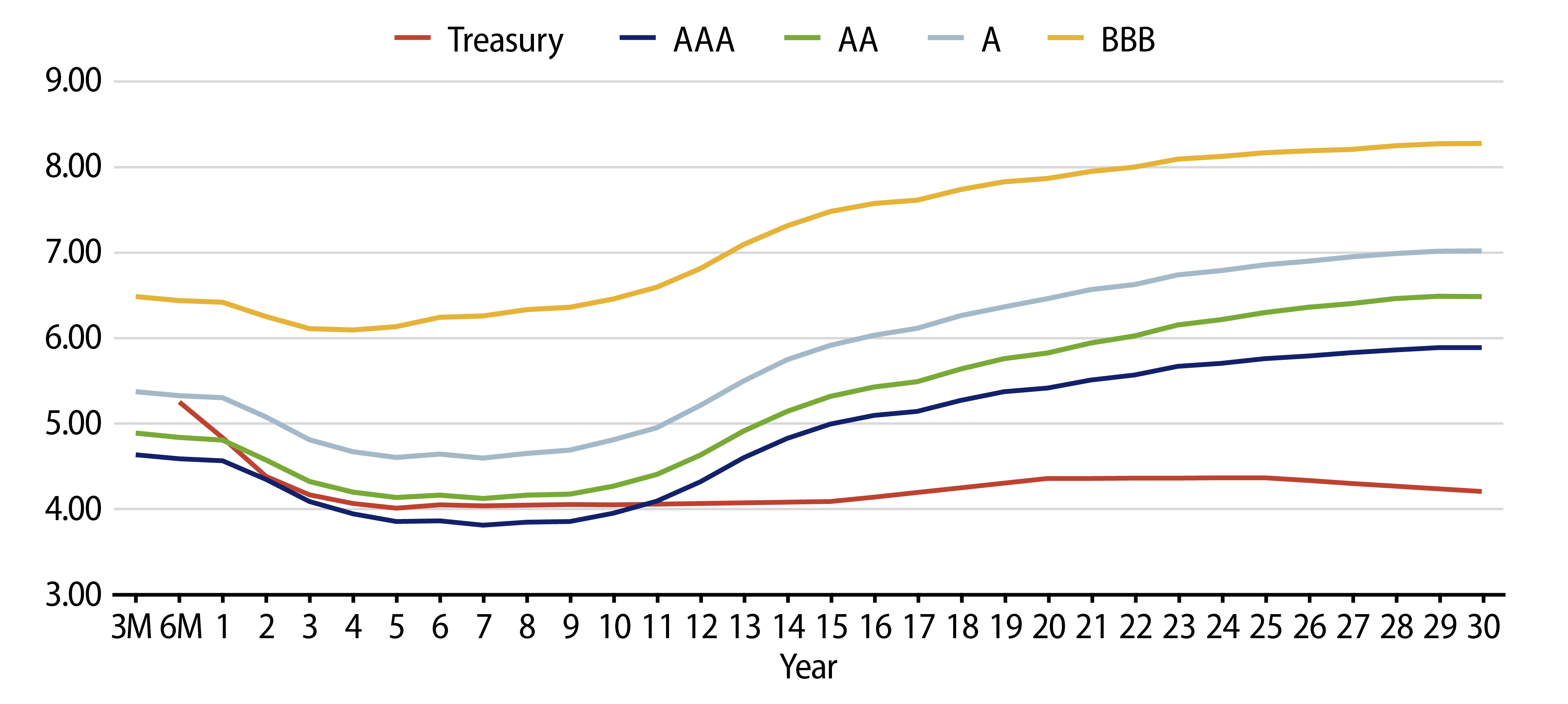

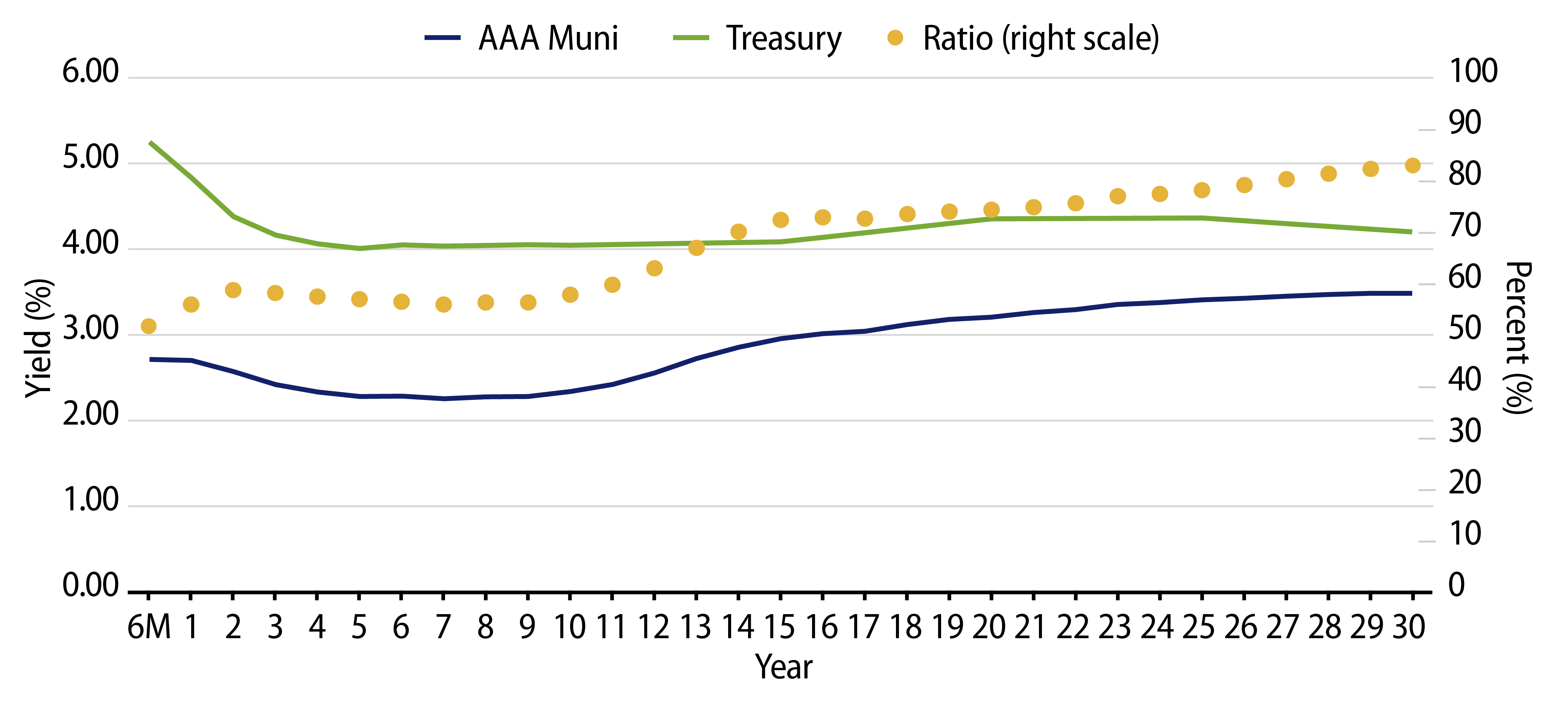

Considering the end-of-year outperformance, certain segments of the muni market do look less attractive, as top rated AAA muni/Treasury ratios declined to a below-average 56%. However, more value can be achieved down the credit spectrum as AA, A and BBB municipals offer more attractive after-tax yield pickup versus like-quality corporate counterparts.

Theme #1: Municipal index yields and taxable-equivalent yields are above decade averages.

Theme #2: Recent steepening of muni yield curve highlights value in moving out to longer maturities.

Theme #3: Munis offer attractive after-tax yield pickup versus long Treasuries and corporate credit.