''The exchange rate was created by God just to humiliate economists.'' ~Edmar Bacha

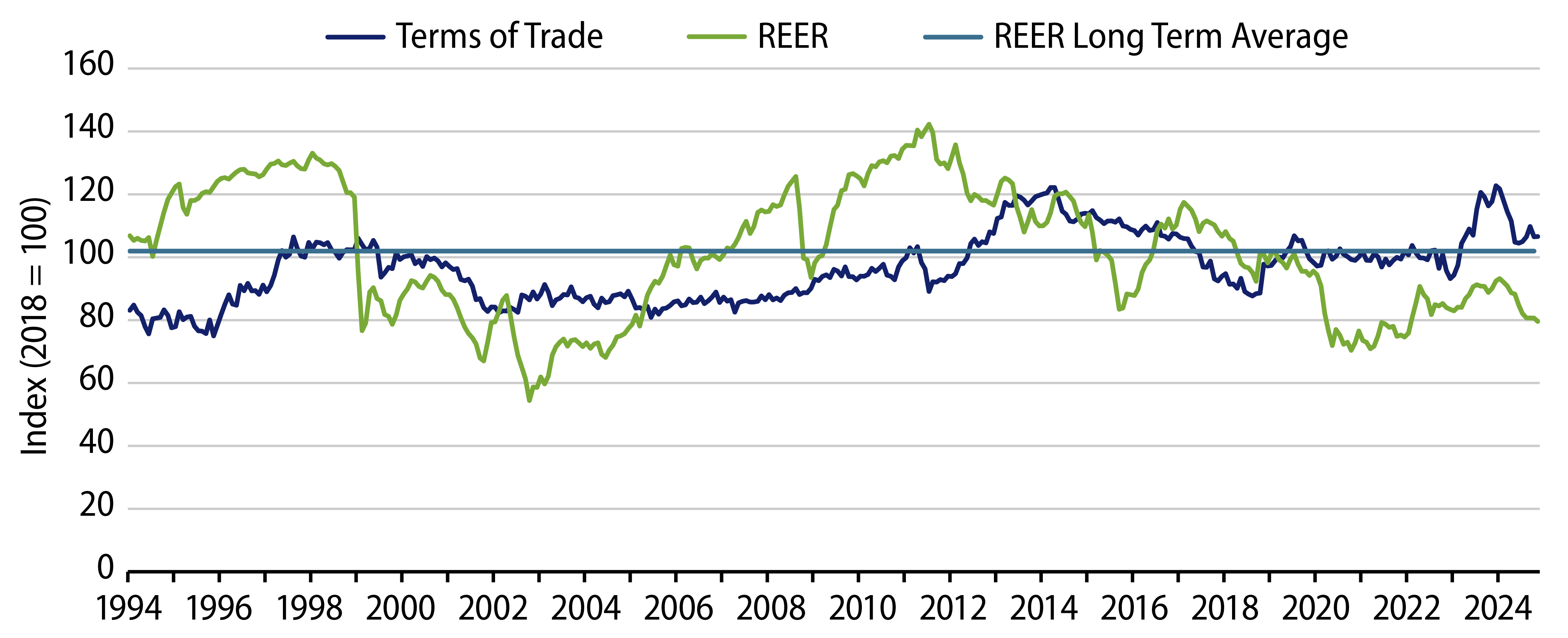

Despite significant depreciation in the Brazilian real (BRL) in 2024, we anticipate that the currency will stabilize in the coming months as the interest rate differential between Brazil and the US widens. The primary drivers behind the BRL’s depreciation have been the lack of credibility in the government’s fiscal policy and ongoing concerns over its monetary policy. As illustrated in the graphic below, the BRL’s performance in real terms has been poor since the COVID-19 pandemic. Notably, despite Brazil’s terms of trade remaining close to historical highs, as indicated by the blue line in the graphic, the real effective exchange rate continued to depreciate throughout the year (Exhibit 1).

Several key factors influenced the BRL’s depreciation in 2024. These include:

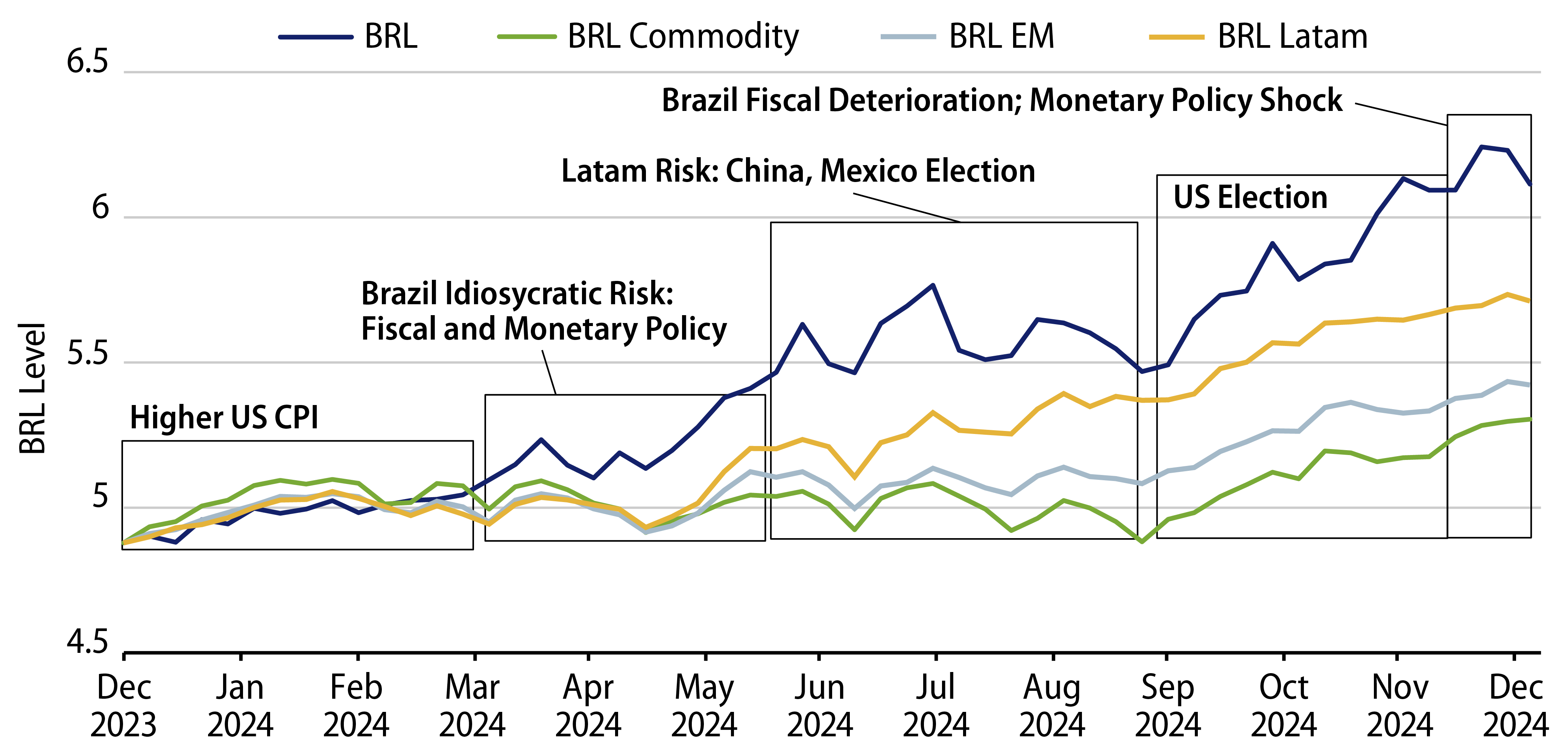

Interest Rate Differential: At the beginning of the year, the Central Bank of Brazil (BCB) cut the overnight rate while the Federal Reserve (Fed) maintained its rates, narrowing the interest-rate differential and contributing to the BRL’s depreciation. Despite the BCB later pausing the rate cuts and resuming rate hikes, the BRL continued to weaken.

Fiscal Policy Credibility: In April, the Brazilian government revised the fiscal target for 2025 from a 0.5% GDP surplus to 0%, causing a 4% depreciation of the BRL. In November, delays in announcing measures to reduce fiscal uncertainties and presenting underwhelming measures further pressured the BRL.

Monetary Policy Concerns: BCB President Roberto Campos Neto’s guidance on a slower pace of rate cuts, influenced by changes in US monetary policy, triggered market reactions. Additionally, a split decision during the May monetary policy meeting (Copom), where four members appointed by President Lula voted against the majority, resulted in negative market sentiment and further depreciation of the BRL.

Global Factors: In June, concerns about China’s economy accelerated the depreciation of Latin American currencies, including the BRL, due to their export connections with China. Additionally, the US presidential election in November strengthened the US dollar, further contributing to the BRL’s depreciation.

To illustrate the extent of the BRL’s movement in 2024, we created three series for the BRL, assuming it evolved as a simple average of the weekly change of a basket of currencies1 (Exhibit 2):

- LatAm Currencies: (light blue) BRL changes at? the same magnitude as Argentine peso, Chilean peso, Colombian peso and Uruguayan peso.

- EM Currencies: (green) BRL evolves according to a basket of emerging market (EM) currencies including the South African rand, Argentine peso, Chilean peso, Colombian peso, Peruvian sol, Polish zloty, Hungarian forint, Mexican peso and Turkish lira.

- Commodity Currencies: (orange) BRL evolves similarly to commodity currencies like the South African rand, Chilean peso, Colombian peso, Peruvian sol, Australian dollar and New Zealand dollar.

Conclusion

Our comparative analysis indicates that the BRL has already factored in several pessimistic elements, which we anticipate will correct over time. However, the absence of sustainable fiscal policy measures will continue to weigh on the BRL. The government delayed the approval of much-needed fiscal measures and had to actively intervene in the FX market by selling US dollars to stabilize the currency. On the positive side, market consensus anticipates that the BCB will further tighten monetary policy in the coming months. In December 2024, the BCB adopted a hawkish stance, raising rates by 100 bps and providing forward guidance of two additional hikes of the same magnitude in the upcoming meetings scheduled for January and March 2025. This should lead to a widening interest-rate differential between Brazilian local rates and US rates, which we view as supportive for the BRL.

ENDNOTES

1. The construction of these series was based on analysis presented by Livio Ribeiro in his blog ''All together and mixed: global and local effects on the exchange rate'' (IBRE, June 2024).