Performance Overview

Munis posted the best October return since 1990.

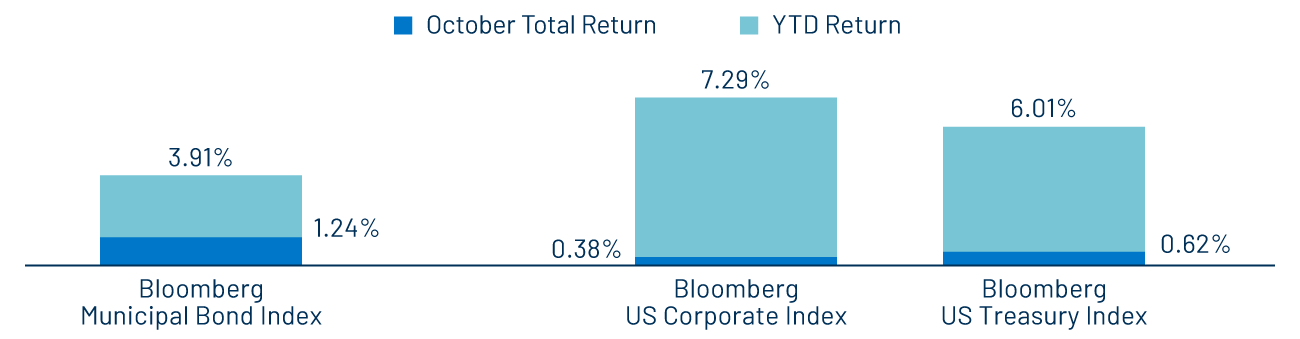

Fixed-income sectors generally posted positive returns in October amid limited economic data releases due to the partial federal government shutdown. Markets were focused on Federal Reserve (Fed) rhetoric as the Federal Open Market Committee reduced the fed funds rate for a second consecutive month by 25 basis points (bps), bringing the target range to 4.25%-4.50%. Heading into the month of October, municipals had significantly underperformed taxable fixed-income sectors in 2025, as the Bloomberg Municipal Bond Index returned just 2.64% year to date (YTD) through September 30—less than half the Bloomberg U.S. Treasury Index return of 5.36% and well below the Bloomberg U.S. Corporate Index return of 6.88%.

October’s Municipal Bond Index total return of 1.24% not only bucked the historically negative average October return of -0.15% since 1990, but also marked the highest October total return since 1990. This was only the second positive October on record. The 1.24% gain was nearly double the Treasury Index return of 0.62% and more than triple the Corporate Index return of 0.38%. The strong monthly performance lifted the Muni Index YTD return to 3.91%, narrowing the gap but still trailing Treasuries at 6.01% and corporates at 7.29%.

Supply and Demand Technicals

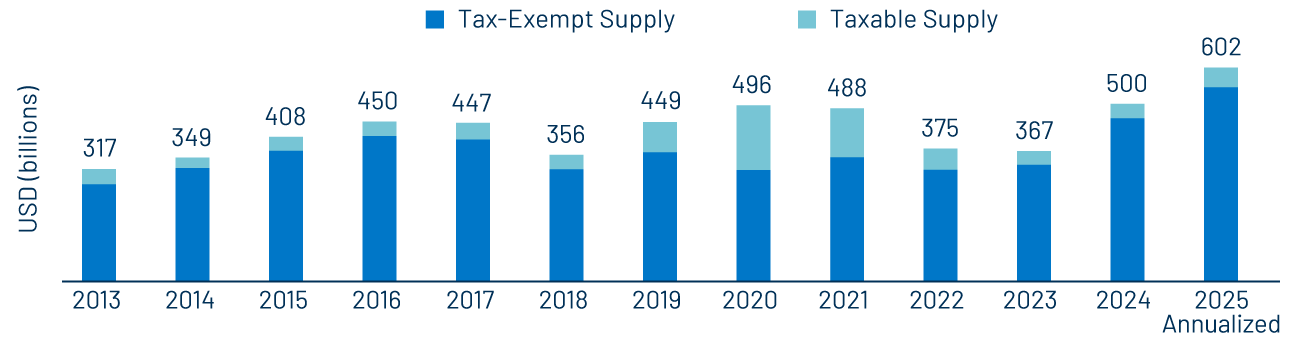

Muni demand improves as supply remains at a record pace this year.

Municipal supply maintained a record pace in October, with total new-issue volume reaching $62 billion, a 27% increase from September’s levels. YTD municipal issuance totaled $502 billion, 16% higher year-over-year (YoY) and surpassing last year’s full-calendar record of $500 billion. YTD tax-exempt supply stood at $456 billion, up 12% YoY, while taxable municipal issuance reached $46 billion, 27% above prior-year levels.

Municipal demand remained robust in October, particularly for longer-duration bonds as the Fed cut rates for the second consecutive month. Municipal mutual funds reported $6.5 billion in net in-flows according to Lipper, up from $5.5 billion the prior month and marking the strongest monthly inflow of the year. The long-term category continued to capture the majority of flows with $4.6 billion of net inflows, followed by the intermediate category at $1.6 billion and high-yield funds at $1.2 billion. This accelerating investor demand, especially into longer maturities, contributing to an improved technical backdrop that fueled October’s strong performance.

Fundamentals

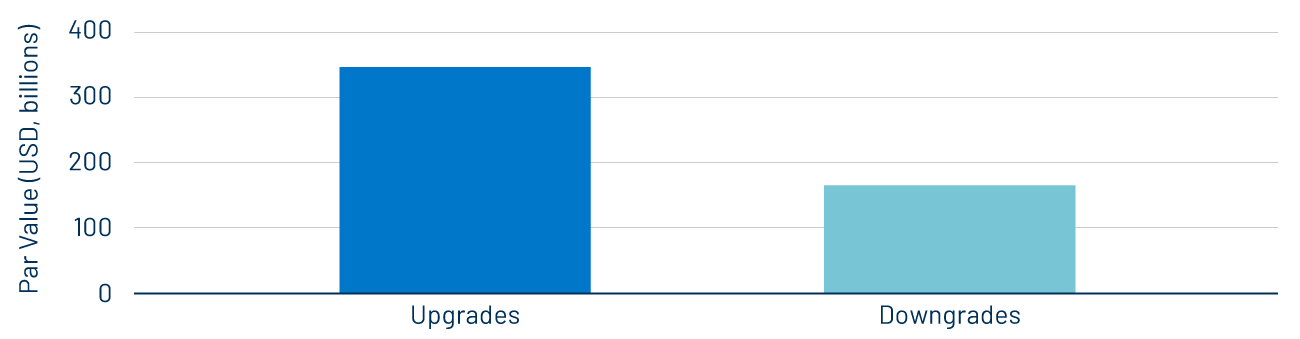

Despite signs of slowing, upgrades continued to outpace downgrades this year.

In October, Moody’s upgraded the state of Illinois to A2 from A3 while maintaining a stable outlook. The action represented the state’s 13th positive rating action by the major agencies since 2020 and its fourth upgrade from Moody’s over that span. The upgrade reflects sustained improvement in Illinois’ financial metrics, reserve levels and structural balance, capping a multi-year turnaround from near-junk status during the pandemic.

The state’s upgrade comes as broader credit momentum has shown early signs of deceleration. 3Q25 marked the first quarter since the pandemic recovery began in which Moody’s downgrades outnumbered upgrades. Despite the quarterly slowdown, the upgrade cycle remained firmly intact on a YTD basis, with approximately $347 billion in municipal debt upgraded across the major agencies through November 7, over double the $165 billion downgraded, according to Bloomberg.

Valuations

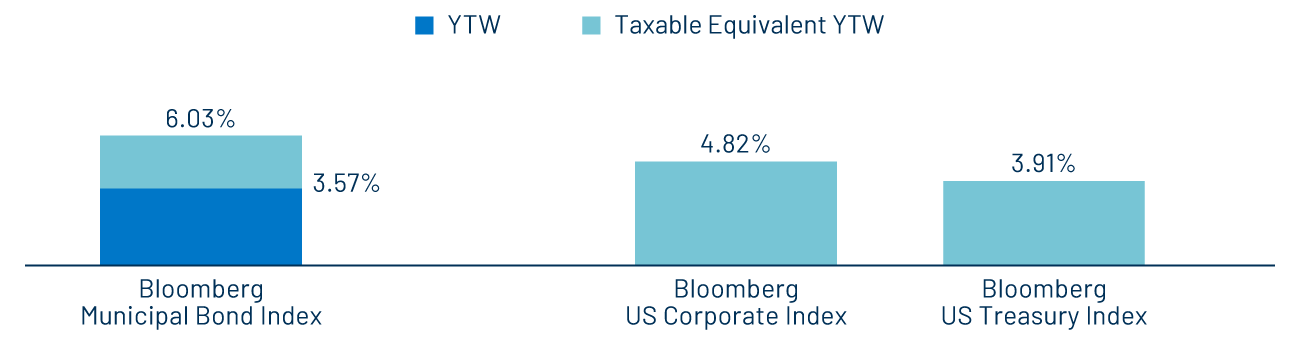

Tax-exempt muni income levels remain near generational highs.

Despite the muni market narrowing the performance gap during the month, tax-exempt income levels remain near generational highs, and the relative YTD underperformance continues to offer potential demand catalysts, especially as the Fed is expected to continue its rate-cutting cycle into 2026. Sustained inflows, combined with the likelihood of seasonally lower supply heading into the holidays, support a constructive outlook for munis to gain further ground versus their taxable counterparts. Western Asset believes investors are well positioned to capitalize on this year’s elevated supply-driven valuations, which may not persist at the same level through 2026.