Emerging market (EM) corporate bonds have come a long way over the past 15 years—from a handful of investment-grade-rated issuers to a full-blown asset class with approximately $1 trillion of outstanding bonds. As clients look to expand their credit allocation into EM corporates, one common pitfall that some asset managers make is analyzing EM corporates in a similar manner to how they analyze developed market (DM) corporates. While Western Asset’s EM team would argue that EM corporates make a great complement for existing DM credit allocations, we recognize that top-down research, specifically sovereign analysis, goes hand-in-hand with proper EM corporate fundamental analysis. This blog post discusses how sovereign factors can often drive an EM corporate credit story.

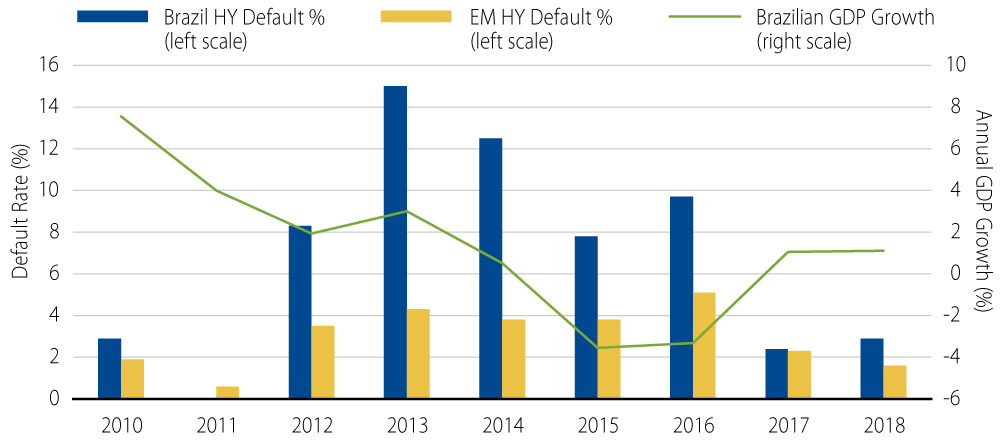

Domestic business cycles can be a large driver of an individual credit’s fundamentals, ratings and even default probability. The EM corporate universe is composed of bonds from over 50 countries, each of which can have an economic cycle delinked from one other as well as from DM macro trends. At Western Asset, we believe that the diversity of the EM investment universe is a key attribute of the asset class, allowing us to construct diversified portfolios with less correlation to US assets. However, this means that attempting to forecast the macro environment is a much more complicated and impactful task in EM corporate credit analysis than, for example, it is in the US investment-grade market. The importance of getting your country call right is illustrated by the 2014-2016 economic downturn in Brazil, which caused severe stress for many Brazilian corporates. The chart below shows how the downturn in Brazilian GDP growth correlated with a spike in Brazilian corporate defaults. Going into this downturn, an investment manager could have chosen a solid credit from a bottom-up standpoint, yet could still have been run over by severe economic and political undercurrents.

Given a proliferation of EM countries issuing bonds over the past 10 years, bankers have increasingly placed the onus for picking sovereign winners and losers on investment managers. While both corporate bonds in a high quality domicile such as Chile are less likely to be impacted by sovereign volatility, issuance by companies in smaller and lower-rated countries have elevated the sovereign credit risk embedded in the EM corporate market. Economic, political and even ESG-related developments can rapidly form headwinds for corporate bond issuers with an otherwise favorable industry or asset base. Instead of just looking at a company in a vacuum, Western Asset endeavors to make sure that our clients are being paid for sovereign risk in addition to traditional sources of credit risk such as those based on business models or competitive dynamics.

One of the historical criticisms of the EM corporate bond market has been its tendency to promote a currency mismatch between a company’s revenues and debt load. This issue highlights a key aspect of EM corporate credit analysis—assessing the vulnerability of a company to changes in domestic demand and earnings power in US dollars. An example comes to mind of a large EM telecom bond issuer whose revenues, which were partially denominated in Haitian gourde and Papua New Guinean kina, had been a drag on otherwise stable operations. In response to these concerns, export-oriented industries with US dollar-correlated revenues such as pulp and paper have seen strong investor interest and spread performance in recent years. As a result, when it comes to assessing vulnerable sovereigns, Western Asset places a premium on EM corporates with improving domestic conditions and resilient sources of revenue.

While bottom-up credit selection will always be a first line of defense for EM corporate managers, Western Asset believes that incorporating macro and sovereign analyses into the investment process is key to performance. Our EM investment professionals who are located throughout our global offices and our cohesive, team-based approach allow us to integrate this information into thoughtful portfolio construction and risk/reward outcomes. When it comes to EM corporate credit analysis, we believe there is truly no substitute for having local professionals in the markets where the credits originate.