2015年10月02日時点

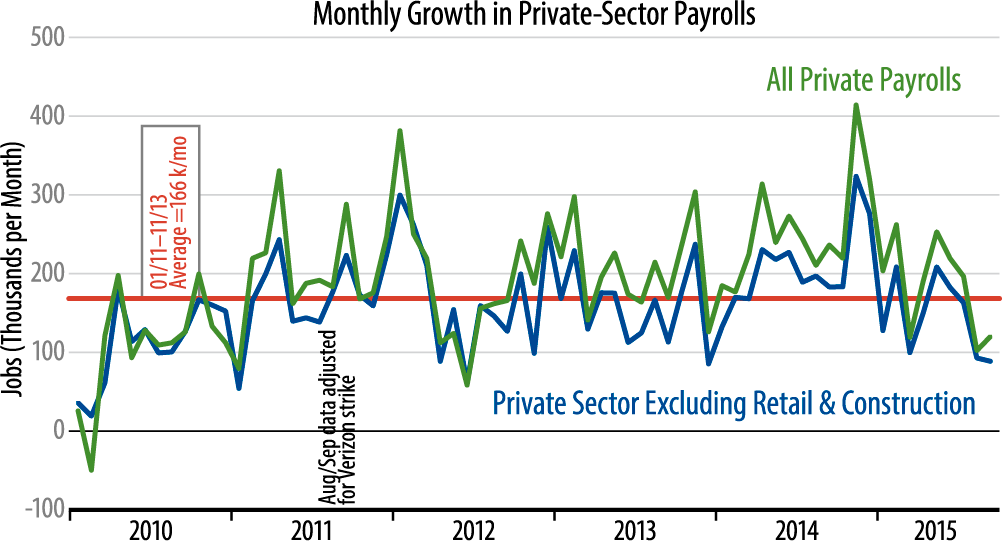

Employment data came in well below expectations today. Private-sector payroll jobs rose only 118,000 in September, against expectations of a gain above 200,000, and August jobs data were revised downward a whopping 69,000. The “core” measure we track, excluding construction and retailing, showed gains of only 86,000 in September, after an August gain of 91,000; both tallies were well below the 166,000 per month average that has prevailed over the last five years (see chart).

Only a month ago, the consensus view was that initial August payroll tallies were always weak and that they would be revised upward subsequently. That belief was little in evidence this morning, and soft September news piled onto that of August.

In addition, manufacturing payrolls weakened again, with declines in both production workers and production hours. This continues a declining trend in manufacturing activity that stretches back to late-2014.

Today’s news is bound to intensify claims from some that the economy is lapsing into recession. While we have been looking for softer growth than the consensus view, we are not in the recession camp, and as soggy as today’s data were, we would still be resisting such a call. As seen in the chart, the jobs swings of the last two months are still well within the range of what we have seen in recent years, and while 90,000 per month job gains (or 120,000 for the whole private sector) are disappointing, they are a long ways from zero or negative.

Still, today’s news should keep the Fed on hold for quite a while. It is all but unthinkable that the Fed would boost short rates in the wake of such job prints alongside all the other news that has recently buffeted investors. So, hikes are off the table in October and possibly December.