However, that softness in demand was offset somewhat by unexpected gains in inventories and foreign trade, both of which had looked like they would subtract from 1Q18 growth. That left 1Q18 growth below the pace of preceding quarters, but better than what was feared might be the case.

The story of 1Q18 GDP growth has been a real saga. Back in February, 1Q18 growth estimates were as high as 5.4%. Those estimates then came down steadily and sharply as actual data for the quarter have rolled in. Even as the outlook for 1Q18 growth softened, analysts were quick to disparage the slowdown as a fluke.

No, there wasn't any spate of blizzards or natural disasters restraining 1Q18 activity. Rather, the data just didn't match the narrative of accelerating economic growth, so it was explained away.

It all comes down to that blockbuster November retail sales print we have talked about so much in previous "By the Numbers" installments. That strong sales gain seemed to signal just the acceleration in consumer spending that various analysts were expecting. It also single-handedly boosted demand growth within the 4Q17 GDP data.

However, again, retail sales have since been soft enough to reverse all the above-trend spending signaled by November retail sales. As reported above, consumption growth dropped to 1% in 1Q18, from 4% in 4Q17. The 2.5% average growth for the last two quarters is right in line with growth we recently experienced, i.e., no acceleration.

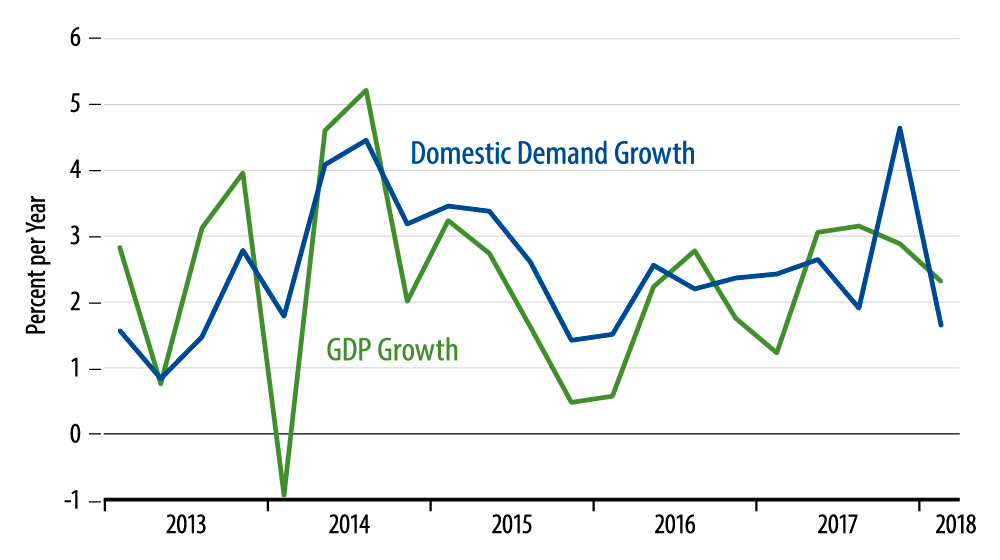

The accompanying chart compares growth in domestic demand and GDP. As you can see, GDP growth perked up in 2Q17 and 3Q17, even while demand growth was lackluster. Demand growth then perked up in 4Q17, thanks to that November retail sales print, but it has since come back to ground.

To our eyes, it is 4Q17 that looks like the aberration, not 1Q18. Meanwhile, note that nothing in recent experience looks to be a notable departure from the experience of the last five years. Yet, consensus thinking is locked onto the notion that growth is picking up from its Obama-era torpor.

We think otherwise, but our take is contrarian. Going forward, consumer demand will most likely perk up over the rest of the year from its 1Q18 pace. However, it is doubtful that inventories and foreign trade can continue to boost GDP growth the way they did in 1Q18. We anticipate growth in the 2.0%–2.25% range over the rest of the year, compared to Fed forecasts of 2.7% and some Wall Street forecasts of around 3%.