2015年02月12日時点

The headline retail sales data looked awful in both December and January, with total sales down -0.9% and -0.8%, respectively. However, much of that softness came from ephemeral declines in car sales and from plunging gas prices. For the control measure we track—total sales less cars, gas, and building materials—most of the previously announced December declines were revised away, and January showed a slight gain.

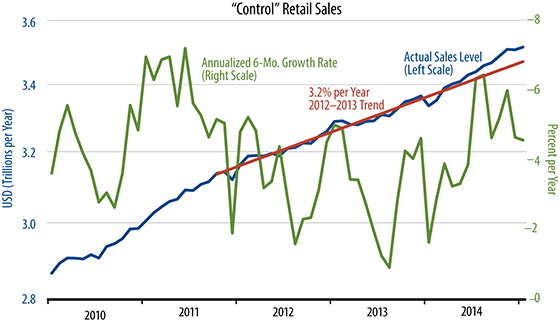

As seen in the accompanying chart, underlying retail sales have pulled back a bit from the heady growth rates of fall, but they remain a bit above the growth trend that had been in place from late-2011 to early last year. As per the green line in the chart, growth in nominal sales over the last six months—netting together the fall bounce and recent stall—comes to 5%, a modest acceleration, but not nearly as strong as one would expect given widespread talk of “booming” economic growth.

Among other things, our forecast line differs from the Wall Street consensus in that we are less sanguine about consumer spending. While job growth has been decent, many new employed workers are gaining wage income at the expense of lost unemployment (or disability?) compensation, so that total personal income has not risen as fast as wage income. Also, it is not clear that household deleveraging is yet over, since household saving rates remain well below pre-bubble levels. Finally, there are sound reasons for being suspicious of the claim that lower oil prices will stimulate consumer spending.