2014年5月02日時点

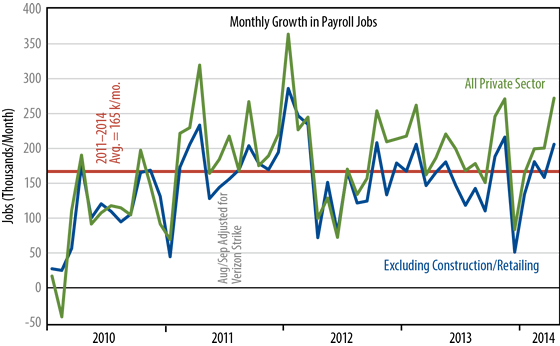

After a soggy GDP report, the data gods gave us a better payrolls report today, with total nonfarm payroll jobs up 288,000, private-sector payrolls up 273,000, and the core job measure we track (i.e., net of construction and retailing) up 207,000. That latter gain is relative to an average monthly gain of 165,000 over the previous four years. In addition, private-sector payrolls for March were revised upward by 27,000.

So, this is a better result than we were seeing a few months ago. In addition, unlike what we are seeing in retail sales, home sales, or factory orders, it is hard to attribute the April job gains to catch-up from the winter weather. We already saw that in March.

Still, looking at a chart such as that below, it is hard to see the April news, alone, as a game-changer. We experienced similar one-month bursts in job growth in early-2011, early-2012, and early-2013, only to see data fizzle in subsequent months. Meanwhile, the fact remains that even with April's gains, only 58.9% of adult Americans are employed, down from 59.4% at the trough of the recession (June 2009), and from 62.9% at the onset of recession (November 2007).

If we can sustain coming months' gains at or near the April rates, that would be significant, but that is a big if. Looking at ongoing trends in consumer, business, and construction spending, it is hard to see a recent "lift" that would propel faster job growth on a sustained basis. We will find out one way or another in the months to come.