We were surprised to see virus shutdown effects pull down the March jobs data as much as they did 12 days ago, but these declines in March sales were fully expected. Nevertheless, seeing the magnitude of declines reported for various sectors was impressive (depressive?). Keep in mind that these declines reflect only about half a month of shutdown, so the numbers for April will show even bigger declines.

Sales declines occurred in March at clothing stores (-50%), furniture stores (-27%), restaurants (-26%), motor vehicle dealers (-26%), book/hobby/sporting stores (-23%), gas stations (-17%), and electronics dealers (-15%). Opposite such declines, the drop in total store sales was tempered by big gains at the store types "benefitting" from virus "stockpiling" (the nicest description we can apply to this activity). Thus, grocery store sales rose 26%, with smaller but still substantial gains at general merchandise store (+6%), drug stores (+4%), online vendors (+3%) and building material stores (+1%).

The general merchandise category bears further comment, as it consists of department stores, warehouse retailers and the like. So, the +6% gain there breaks down into a -20% decline at traditional department stores and a +12% increase at discount and warehouse stores. Quite a contrast.

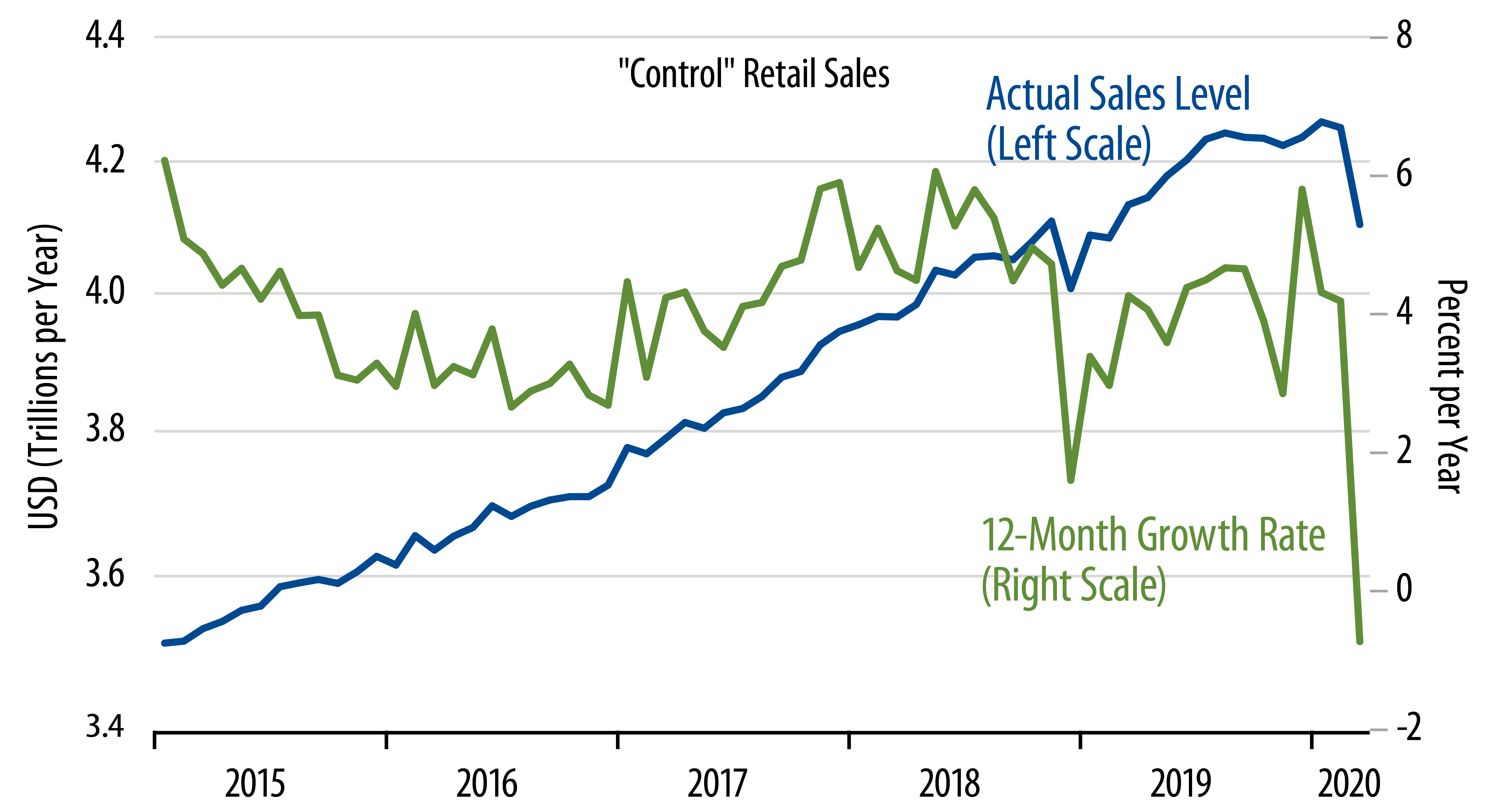

We should also remark that our "control" sales measure includes (plunging) restaurant sales, so that it shows a much weaker result than the "consensus" core measure, which actually rose +1.7%.

Once again, the March declines reflect only about half a month’s worth of shutdown effects. April’s results will show a full month’s worth, and they won’t have the "benefit" of the big gains at grocery and warehouse stores. That is why the April data stand to show a larger decline than has March. Online vendors will see further large gains in April, but we’ll see how much that can make a dent in the aggregate declines.

It is worth stating that these declines are "self-inflicted," the result of an intentional economic shutdown by various levels of government. In past slumps, declines were sometimes unintended consequences of restrictive policies, but there is nothing accidental about the present milieu, necessary as it might be. The upshot of this point is that as shocking as the March sales decline are, they are in effect, artificial, and we still believe they can be quickly recouped when and as the economy is taken off life support.

At least you didn’t have to pay your taxes today. Stay well!