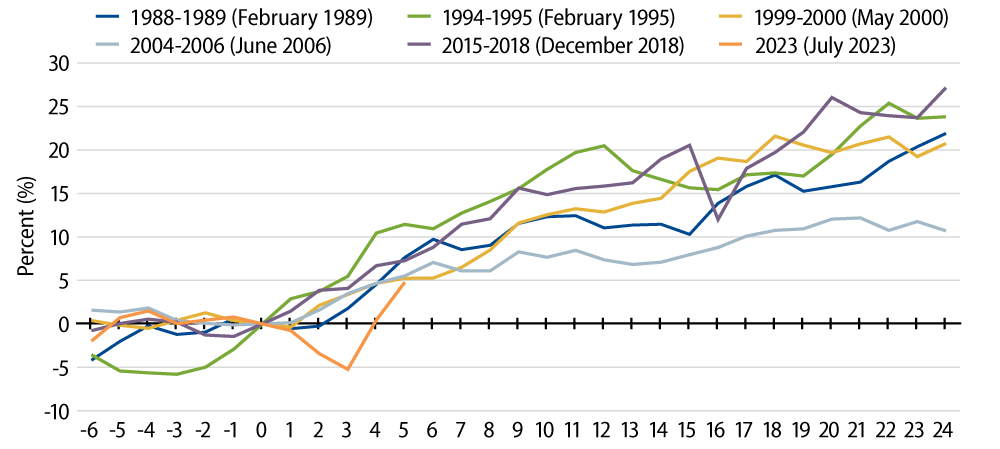

Reviewing past monetary policy transitions—from the end of a Federal Reserve (Fed) interest-tightening cycle to an easing cycle—shows that historically, US investment-grade credit has performed well in total return terms after the end of such tightening cycles (Exhibit 1). Much of this move is driven by underlying Treasury yields reacting either to the impetus for the pause in tightening or to the anticipated easing cycle.

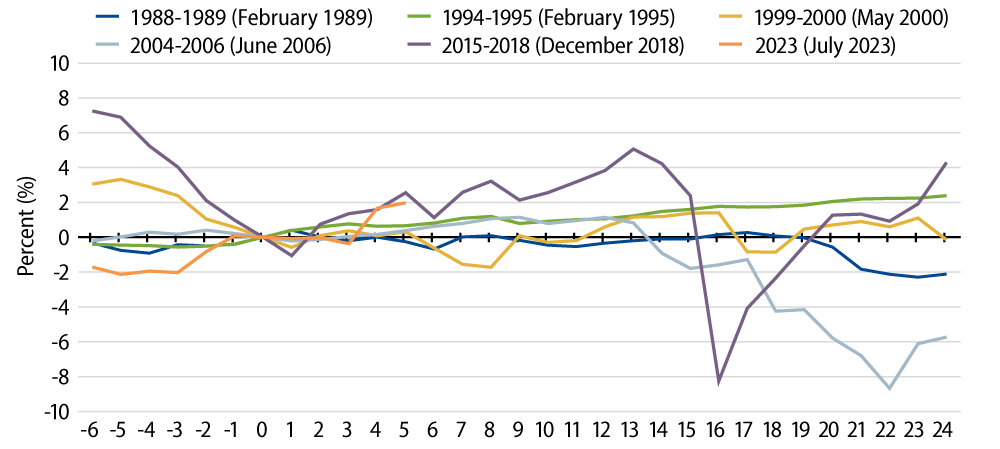

Relative to equivalent-duration government bonds, investment-grade credit has also generally outperformed government bonds for a period of time after the last rate hike (Exhibit 2). While the circumstances for each interest-rate cycle are different, and one must remain vigilant about the “long and variable lags” of monetary policy along with the potential for a shift in corporate management behavior, the additional carry that credit offers has often helped to generate additional returns for some time.

Exhibit 2 illustrates the last five rate cycles and shows that in the 12 months after a Fed pause, credit outperformed in four of the five transitions, with the 1989 pause being the exception. When looking out 24 months after a Fed pause, once the long and variable lags have had more time to bite, credit outperformed in two of the five most recent cycles, pushed in one, while underperforming in the 1989 and 2006 experiences. Those last two periods do share a similar theme in that the financial sector underwent a rebalancing of excesses—regarding both the savings and loans crisis of the late ’80s/early ’90s, then during the global financial crisis when volatility peaked in 2008.

Where Are We Today?

With rates currently around 5%, all-in investment-grade yields are still elevated. Index yields are off recent highs, but they are still a healthy bit above the pre-Covid range of 3%-4%.

Disinflation, Monetary Policy and the Backdrop Today

Going forward, we believe that inflation in the US has peaked and will continue to head lower. As John Bellows articulated in a recent blog post, “The dramatic decline in realized inflation reflects a wide range of improvements.” The Fed has recognized these improvements and has left its policy rate unchanged since July 2023. At its most recent December 2023 meeting, the Federal Open Market Committee (FOMC) stated via the Summary of Economic Projections (SEP) that it has lowered the 2024-2026 expectations for both inflation and policy rates. The current SEP dot plot suggests three rate cuts in 2024, while the markets have raced ahead and priced in even more.

The rest of the backdrop for credit is also balanced from a total return perspective. In addition to still elevated yields, we view the following factors as largely constructive:

- Economic Growth—Our base case is for decelerating growth, not a hard landing; investment-grade companies’ balance sheets remain robust enough to weather a slowing economy.

- Valuations—Overall spreads are near the tighter end of our expected range but this reflects still-solid corporate fundamentals. Should the economy be weaker than anticipated, falling Treasury yields may offset spread-widening. Spreads are currently pricing in a soft landing and, should that unfold, the experience of the mid-’90s may be the closest parallel.

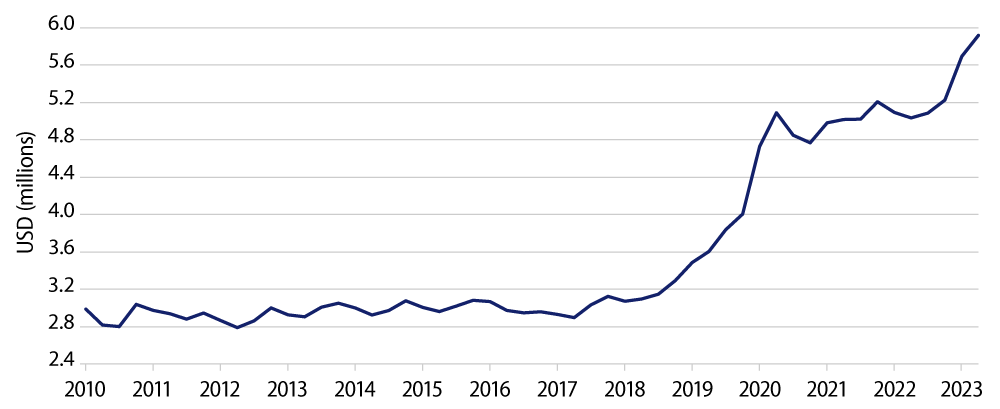

- Technical Backdrop—The current economic environment is a continuing tailwind. Corporate issuance is forecast to remain stable in 2024 compared to 2022/2023 levels. But demand is expected to be robust as the massive flows that went into cash (Exhibit 4) could be redeployed given the anticipated central bank policy rate cuts. Overseas demand should also increase as FX hedging costs are expected to ease.

- Active Management—As always, there are certain industries that we believe will benefit from fundamental tailwinds (e.g., banking, metals & mining—especially copper), while others face headwinds (e.g., utilities, lower-quality technology). There may also be a better entry point for longer-dated credit as spreads there are historically tight due to the recent supply/demand imbalances; yield-based buyers locking in attractive all-in yields in 2H23 were met with dwindling long-end supply (corporations being prudent by not wanting to lock in high financing costs for a long period of time).

While investment-grade credit returns, as measured by the Bloomberg US Corporate Index, have already turned the corner (+8.5% in the last three months, as of December 31, 2023), history suggests that there may still be room to run, especially as we believe the current backdrop remains supportive.