Last month we attended the fall International Monetary Fund (IMF) and World Bank meetings in Washington, DC to meet with bond issuers, IMF staff and other market participants. The meetings provided a timely opportunity for us to refresh our views on the state of frontier markets with the US elections approaching (at the time) and 2025 on the horizon. In an environment characterized by persistent structural uncertainty, the underlying trajectory for sovereign fundamentals will help determine the resilience of this market segment. At the country level, the meetings generally highlighted progress. But policy implementation is far from uniform, and broad balance-of-payments (BOP) trends are the most obvious point of fragility, particularly where debt burdens are elevated. With tighter spreads implying higher risks as we move toward 2025, both country and security selection will be critical to get right as key drivers of investment returns in the new year.

The global macro environment has seen secular shifts confound key forecasts for the world’s three major economies repeatedly since 2022. While markets were focused on the US elections having a binary outcome, the reality is that the world economy will continue to be shaped by an unsustainable interdependence between the US and Chinese economies. China’s export-driven economic model is made possible only via ongoing “US exceptionalism,” characterized by a strong dollar, a deteriorating external position and high real-interest rates. While the contours of the US-China misalignment may change in response to political cycles, the underlying political-economic drivers are secular in nature and will require bold (and possibly painful) steps to address. The erosion of the post-war order adds complexity to the economic assessment but has probably impacted sentiment more than economic realities.

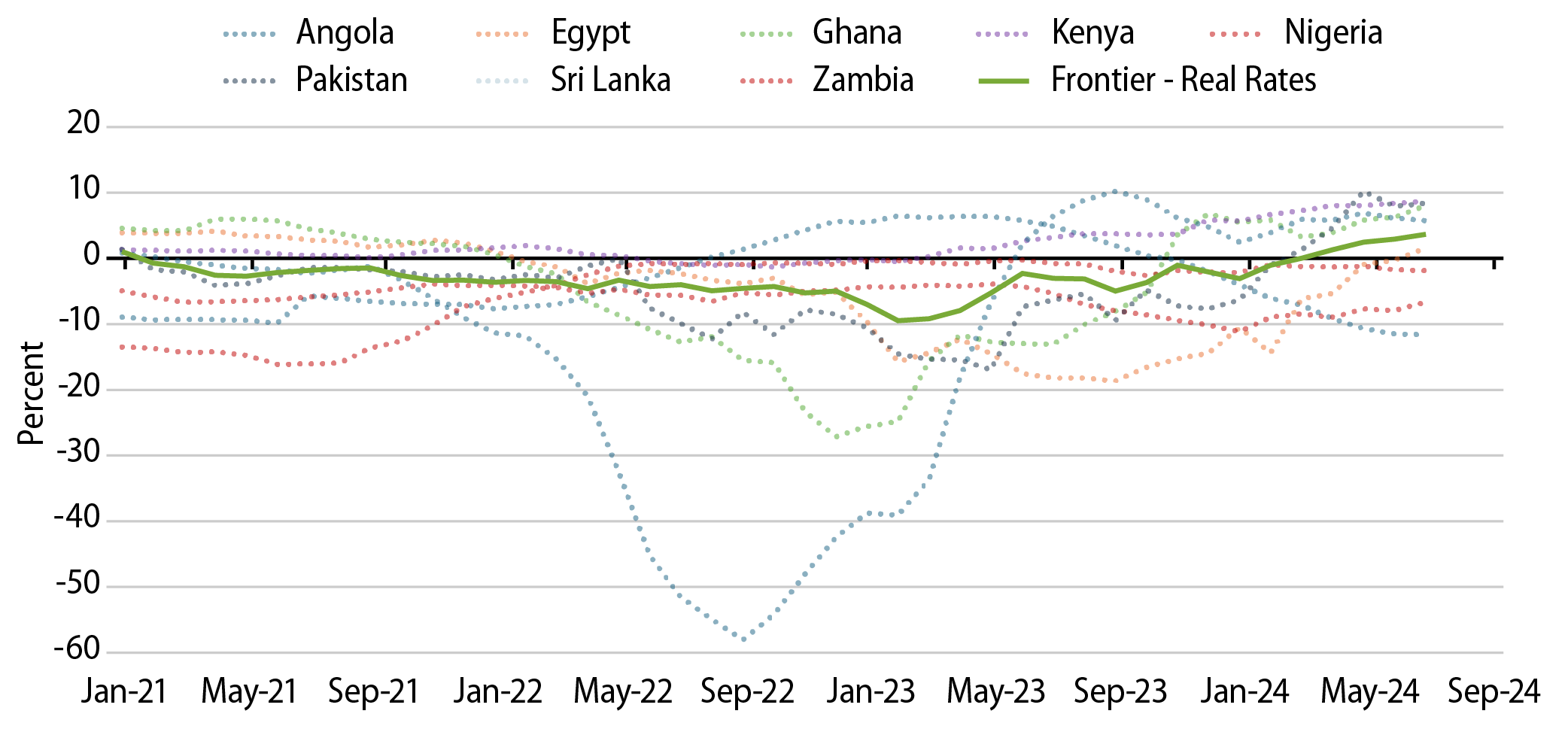

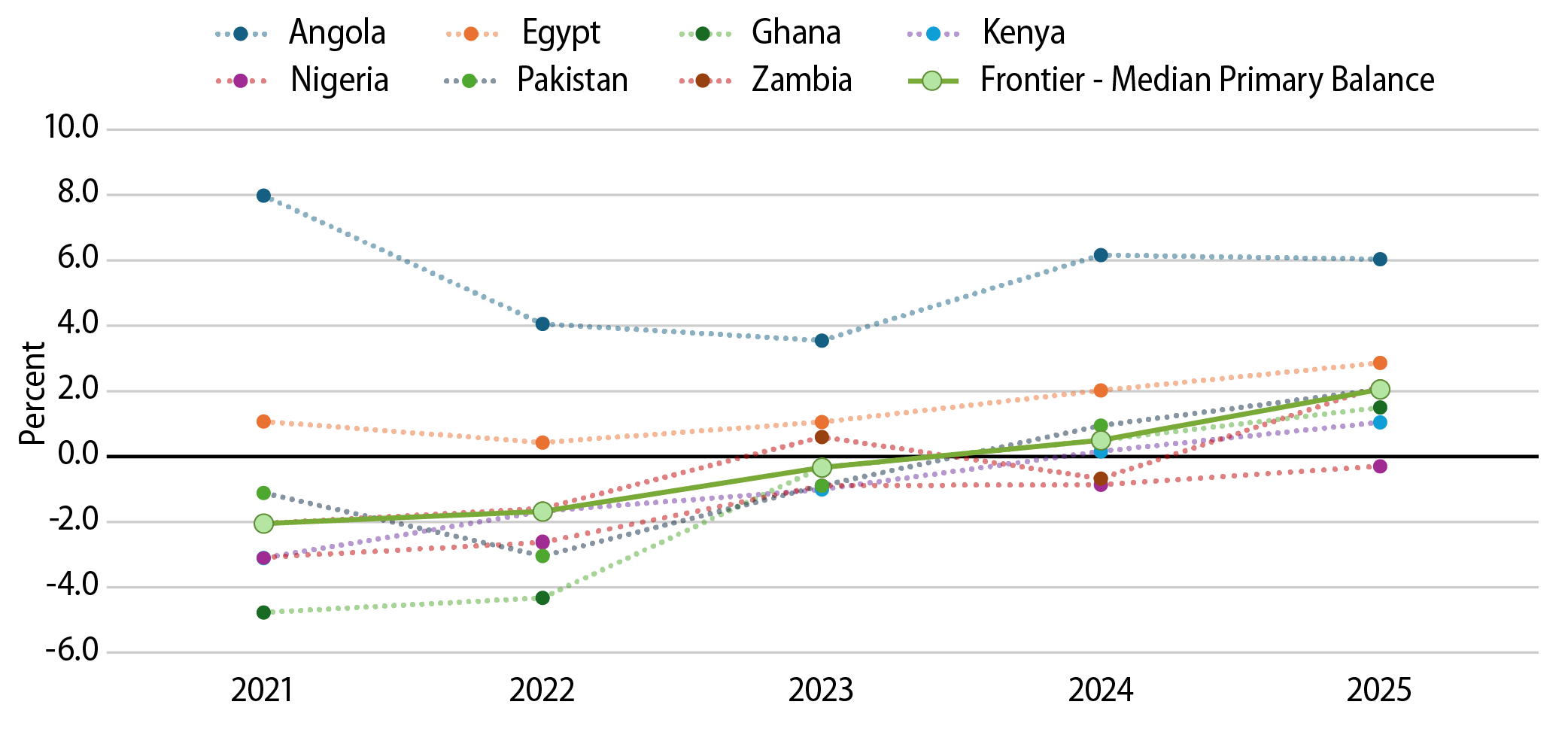

If this sounds like a complicated macro environment for frontier economies to navigate, that’s because it is. The shift away from a zero-interest-rate world brought with it a clear need for policymakers to return to orthodoxy. While the reaction function of policymakers within frontier markets was initially somewhat slow, our meetings in DC reinforced the idea that progress has been steady, if uneven.

Markets have taken notice of this progress. In conjunction with credit conditions thawing, at least partially for frontier market issuers, the positive trend on key fundamentals has helped drive strong year-to-date (YTD) returns. Indeed, spreads have finally reversed most of the overshoot witnessed in 2022-2023 and now trade at a more normalized differential relative to their investment-grade sovereign counterparts.

Is this where the story ends? Not exactly, for two reasons. The first is that most of these countries have an external financing gap, implying they need at least some access to external financial flows. That financing came from the market for much of the past decade but shifted meaningfully toward the official sector—generally anchored by IMF programs—from 2022 onward.

That shift has a limit, though, and in instances where countries have started to approach the upper bound of official sector exposure, it’s taken strong bilateral support—from regions like the Gulf Cooperation Council (GCC)—to fill the financing gap. The implication is that frontier markets will benefit as global financial conditions normalize and market access is more definitively reestablished.

The second reason we continue to look favorably at this segment of the market is that several idiosyncratic opportunities remain. We see this most clearly within frontier local markets, where a selection of currencies has potentially overshot to the downside and can stabilize or even rally. This potential inflection point for macro stability and exchange rate formation is driven by fiscal adjustments, positive (ex-ante) real rates, and supply-side developments that improve the export outlook. But it’s worth noting that we also see potentially compelling event-driven stories in external debt, as well.

Our time spent in DC reinforced the view that getting frontier markets right in 2025 will require investors to understand the implications of structural macro dynamics, the cyclical macro environment (where the implications of US elections will matter), and the multi-dimensional nature of a country’s underlying credit trajectory. Understanding the social mood, the importance of political messaging and policymakers’ capacity to execute will be as important as any of the underlying economic variables. Our long-held sovereign investment framework helps us make these determinations, and should prove a critical tool in an investment environment characterized by tighter spreads, less margin for error and a genuinely challenging global macro context.