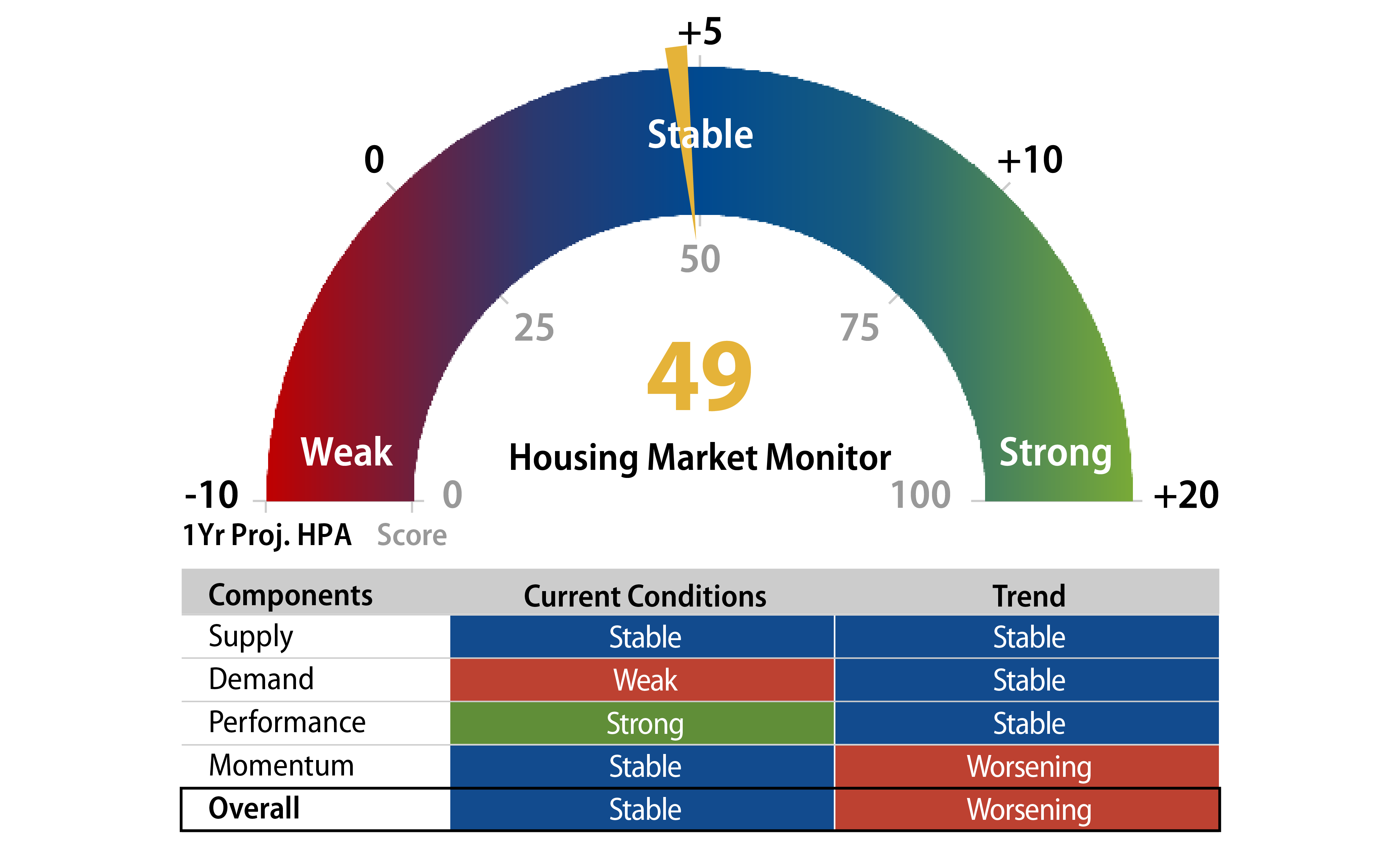

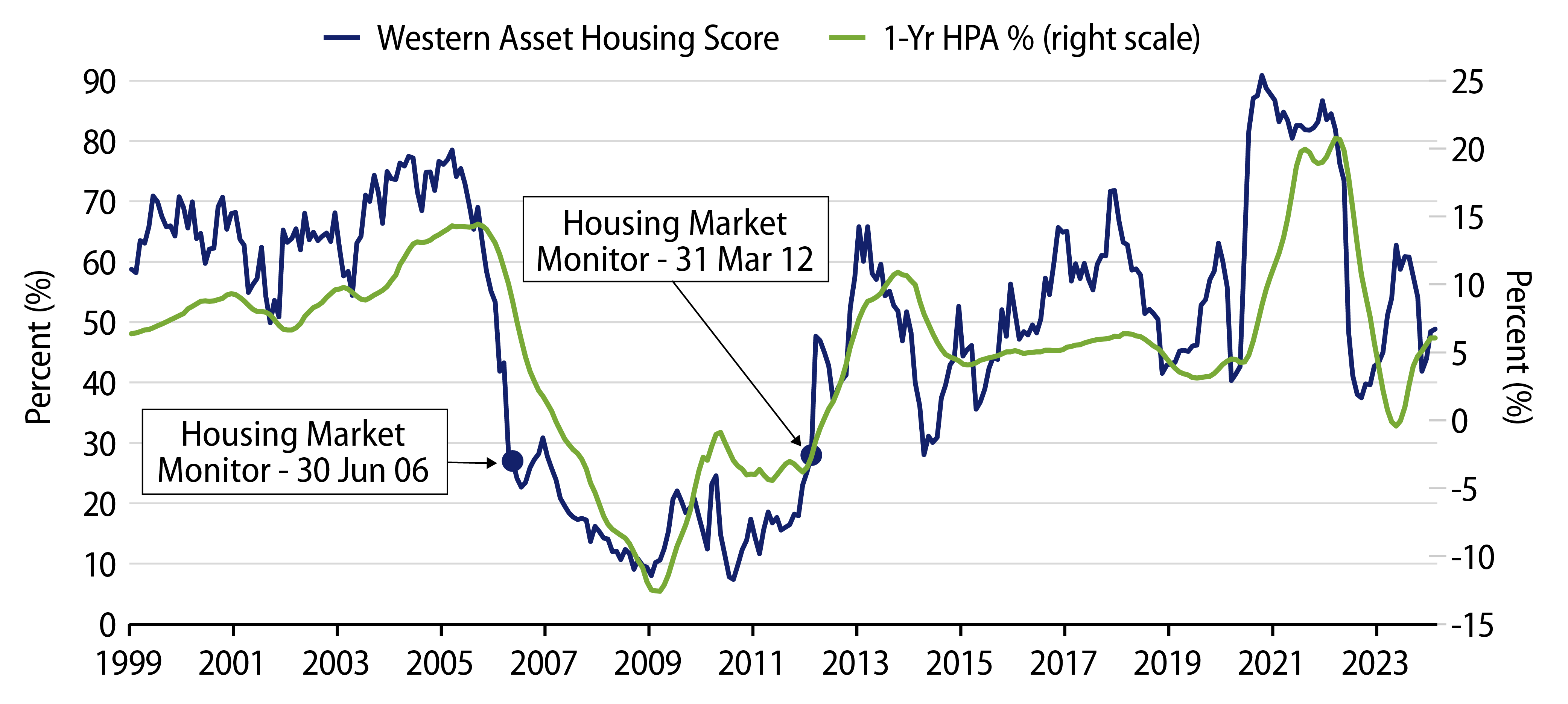

Our Housing Market Monitor gained three points over the first quarter of 2024, moving from 46 at the start of the year to 49 by the end of March. The main drivers for the mild increase were the drop in months of supply for existing-home sales as well as the increase in the Mortgage Bankers Association (MBA) Purchase Index, a leading indicator of impending home sales. At the end of the first quarter, mortgage rates were once again peaking close to 7% and applying pressure to affordability metrics. New-home supply remains elevated while existing-home sales have bounced from historically low levels, possibly showing that homeowners are becoming more willing to move in this elevated mortgage rate environment. The rate of change in home prices continues the deceleration that began toward the end of 2023, after prices surged in the middle of last year.

Supply

- Sales of new single-family homes dropped 0.3% in February to a seasonally adjusted annualized rate (SAAR) of 662,000 units, against expectations for a moderate increase. January sales were revised up to 664,000 from 661,000. The number of months of existing homes for sale moved down slightly, to 2.9 months from the prior reading of 3 months of supply.

- Existing-home sales increased by 9.5% to a rate of 4.38 million units (SAAR) in February, significantly above expectations. The median sales price of all existing homes increased 0.5% month-over-month (MoM). The number of months’ supply of new homes for sale increased to 8.4 months from 8.3 months of supply the prior month.

Demand

- The MBA Purchase Index finished the quarter at 145.7, up 14% from the end of February and down 5.7% from the start of the year. The index is now down 12.5% year-over-year (YoY).

- While the National Association of Home Builders (NAHB) Traffic of Prospective Buyers Index, a key indicator of home builder confidence, is up on the year—with a reading of 34 at the end of March, compared to 29 at the start of the year—we are still below the peaks seen during the summer of 2023, when readings were at 40.

Momentum

- The S&P CoreLogic Case-Shiller Home Price Index increased by slightly less than expected based on the January data. The index increased by 0.14% MoM in January, which was slightly below consensus expectations for a 0.20% increase; on an annual basis, the index rose 6.6% YoY in January.

The overall outlook for the residential housing market remains positive. As the inventory of new homes remains elevated, the amount of inventory of existing homes is on the decline toward levels seen at the start of 2023. With the prospect of mortgage rates remaining elevated for perhaps longer than expected at the start of the year, we are modestly more comfortable with our anticipated range of home price growth of 4%-5% in 2024.