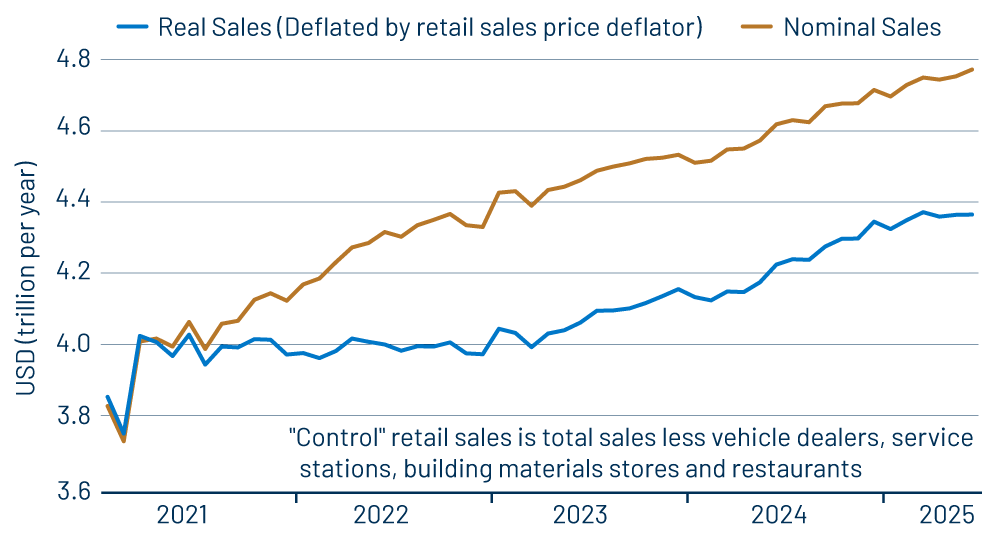

Headline retail sales rose 0.6% in June, on top of a +0.1% revision to the May sales estimate. The more closely watched “control” sales measure rose 0.5% in June, after a -0.2% revision to its May sales estimate. (The control measure abstracts from sales at car dealers, service stations, building material stores and restaurants to focus on retail sectors catering more to consumer rather than business customers.) These sales gains are reported before adjusting for inflation, and with goods prices up about 0.5% in June outside of motor vehicles, we estimate that real control sales were flat in June and have remained so since March. To repeat, we have seen no growth in real control sales for the last three months.

Last month, we took a more upbeat take on the retail sales data than the headline measure suggested. Both car sales and gasoline sales fluctuated to the downside in May, so that control sales looked a lot better than the headline data would have suggested. Our take moves in the opposite direction in June, thanks to price increases taking a substantial bite out of the reported nominal sales gains. So it goes.

The nominal and real sales trends shown in Exhibit 1 provide an interesting contrast. Nominal sales look to be growing steadily, right on the trends of the last four years. Real sales, however, have gone flat since March, as we have already mentioned.

The same can be said on a sector-level basis. In nominal terms, virtually every type of store has seen remarkably steady growth trends lately across both durables and nondurables retailers. However, again, real sales for these sectors have flatlined as tariffs have taken effect.

This is exactly what monetary theory would suggest. The theory states that growth in nominal expenditures over the long term are driven by monetary policy, while developments in the real economy—including tariffs—determine the split of nominal sales between real growth and price changes.

Of course, one would expect some “friction” in the short term, with consumers continuing real spending trends for a while when prices rise, dipping into their savings to sustain living standards until they can adjust. It is interesting, then, how stable nominal sales trends have been across the board (i.e., for virtually every type of good), even while tariffs have their disparate effects on various goods prices.

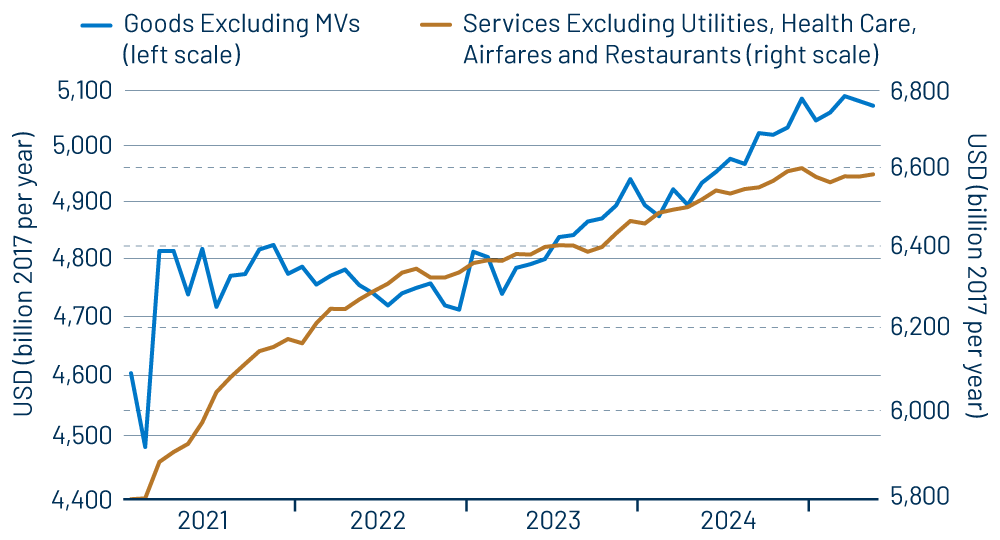

Meanwhile, the overall consumer picture is a little more complicated. Tariffs have essentially no effect on services prices, and indeed, services prices have moderated in recent months, despite the bump in goods prices. Nevertheless, real services spending has also gone flat since the first of the year, slowing even before goods spending did. (Exhibit 2 shows real consumer spending by type through May, as we reported in our June 27, 2025 post.)

In sum, the consumer picture looks to have softened. Real spending is not plunging, but it has ceased to grow. The flattening in goods spending seems to be related to tariffs, but services spending softened earlier, for reasons apparently unrelated to tariffs.

2Q25 real GDP is still likely to show decent growth, as the “fluke factors” that held down reported 1Q growth are reversed. (Cf. our May 2, 2025 post.) However, for 3Q GDP to show similarly healthy growth, consumer spending will have to rebound over the next few months. Job and income growth have been accommodative for such a pickup. We’ll see whether the consumer indeed follows through in 3Q after an apparent 2Q “pause.”