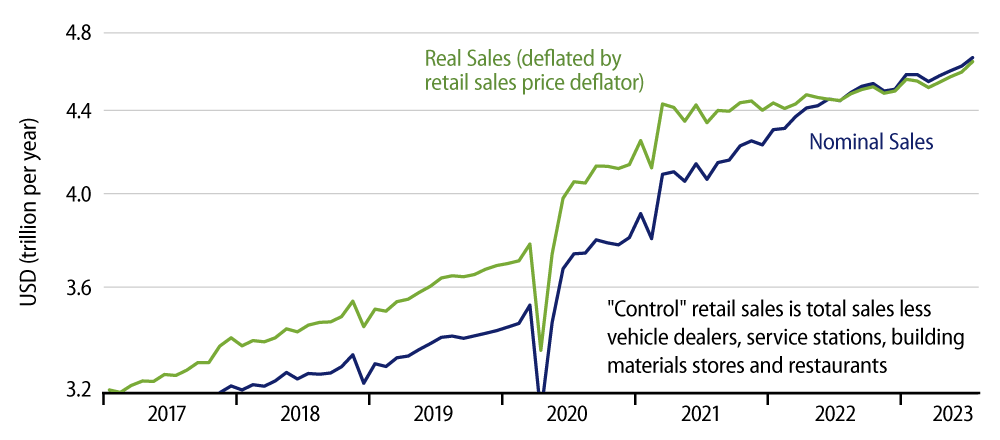

Headline retail sales rose 0.7% in July, with the June sales estimate revised upward by 0.3%. The closely watched “control” sales aggregate rose an even stronger 1.0% in July, also with a +0.3% revision to June. These gains occurred despite likely widespread declines in retail prices in July, as suggested by last week’s CPI data, so that increases in real sales looked even better.

As usual, online vendors led the way, with their 1.9% increase accounting for most of the gain in control sales. Also, while they are not included in the control sales data, restaurant sales rose 1.4% in July on top of a large, +1.0% revision to June. Previously, restaurant sales had looked to be flagging, but the July growth and June revisions put the sector back on the growth trend it had been following prior to softer data earlier this year.

Sales at durable goods stores were generally soft in July, but no softer than we had been seeing in prior months. Durable goods spending should be most visibly affected by higher interest rates, but again, there is little indication of any further softening in sales of durable goods following the Fed’s hiking regimen that began last year. Motor vehicles are the highest-profile durable good in this regard, and sales there have held up well, which is fortunate given the torrent of production carmakers have unleashed in recent months.

Meanwhile, within the various nondurable goods sectors, sales have been growing steadily for the last few months, even after adjusting for prices, so that here too, evidence of a meaningful response to Fed tightening is hard to find. This doesn’t mean such a response is not coming, but the retail sector has clearly held up better and longer in the face of higher interest rates than we expected.