Single-family housing starts dropped -8.4% in January, to an annualized level of just under one million units per year. This level is consistent with what we have generally seen over the last eight months, once the effects and after-effects of the fall hurricanes are accounted for. That one million level is, in turn, down from the elevated number of starts a year ago, but in line with what we saw over most of 2023.

In other words, when weather vagaries are taken into consideration, single-family start activity has been generally steady for a while now. This contrasts with our forecast of emerging softness in single-family home construction, due to the overhang of excess inventories of unsold new homes.

As indicated in Exhibit 1, recent levels of single-family starts are consistent with new-home sales levels of about 800,000 homes per year. Instead, new-home sales have been running much slower, at about 650,000 units per year, and new-home inventories have been piling up ever since starts and sales diverged in 2021.

It would seem that builders are willing to live with the unsold inventories as long as sales are proceeding at ''decent'' rates. How long lenders will be willing to finance elevated inventories and what would happen should sales drop further due to higher mortgage rates are the pertinent questions. Builders are shrugging off those questions, at least for now.

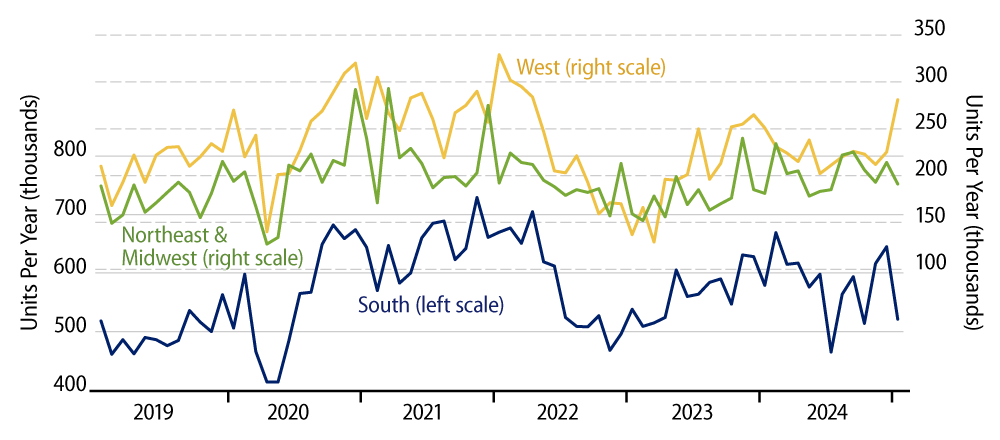

Digging down from the national data, there is a little more variation within the regions. As you can see in Exhibit 2, January declines were especially sharp in the South, down -19.2%, but that was partially offset by a big increase in the West, up 24.9%. While these swings seem to be equal-sized in the chart, note the difference in scales for the two, with activity in the South almost three times as large as in the West.

Single-Family Home Starts by Region

Both swings would seem to be seasonal noise, similar to the January blips discussed last week for the CPI and retail sales data. Also, it should be noted that the January decline in the South offsets elevated start levels there for November and December.

Averaging the last few months together for the South, to smooth out hurricane and post-hurricane effects, single-family starts in the South have been proceeding in recent months much more slowly than what we saw a year ago. In other words, the South seems to be exhibiting more of a swing (down recently) in activity than the rest of the country.

As ever, it will be interesting to see where the data go from here. We have to repeat that housing activity has not declined as noticeably as we expected a year ago. However, there do seem to be some cracks in the firmament. Higher interest rates have not killed the economy, but there is more vulnerability than common wisdom seems to perceive.