Municipals Posted Negative Returns Last Week

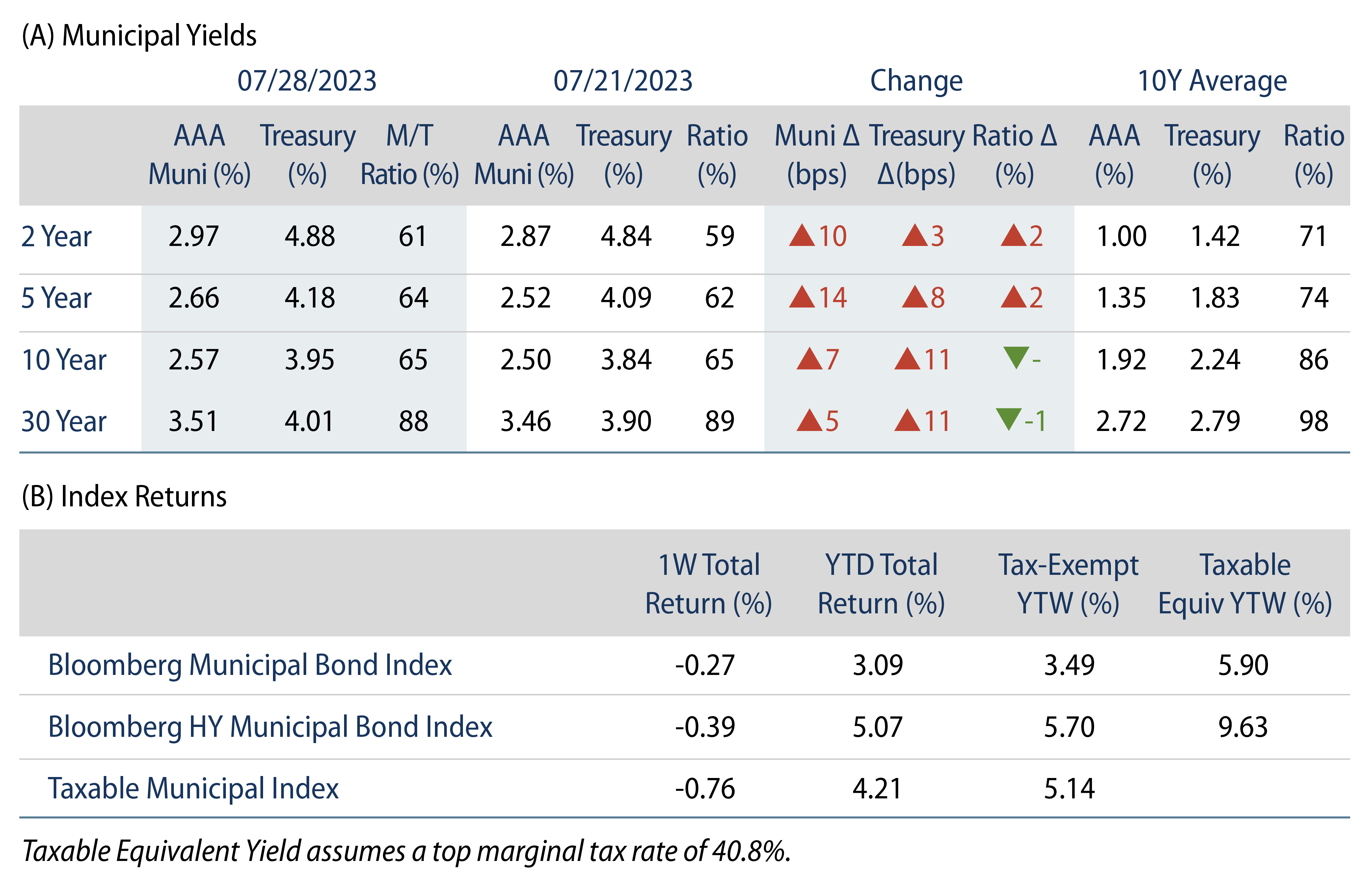

Municipals posted negative returns last week as high-grade muni yields moved higher with Treasuries across the curve. Munis underperformed Treasuries in short maturities and outperformed in longer maturities. Rates generally moved higher following strong GDP and lower jobless claims data that added uncertainty as to whether or not last week’s Fed hike, to a fed funds rate target range of 5.25% to 5.50%, was the final rate increase of the current hiking cycle. Technicals improved as municipal mutual funds recorded inflows amid lighter supply conditions. The Bloomberg Municipal Index returned -0.27% during the week, the High Yield Muni Index returned -0.39% and the Taxable Muni Index returned -0.76%. This week we evaluate the year-to-date (YTD) municipal default rates.

Fund Inflows and Light Supply Supported Market Technicals

Fund Flows: During the week ending July 26, weekly reporting municipal mutual funds recorded $552 million of net inflows, according to Lipper. Long-term funds recorded $591 million of inflows, high-yield funds recorded $223 million of inflows and intermediate funds recorded $186 million of inflows. This week’s inflows bring YTD net outflows to $6.8 billion.

Supply: The muni market recorded $6 billion of new-issue volume last week, down 46% from last week. YTD issuance of $199 billion is down 13% year-over year (YoY), with tax-exempt issuance down 8% YoY and taxable issuance down 43% YoY. This week’s calendar is expected to increase to $11 billion. Large transactions include $1.2 billion Dormitory Authority of the State of New York Sales Tax revenue and $798 million Washington Metropolitan Area Transit Authority transactions.

This Week in Munis: Defaults Tick Higher

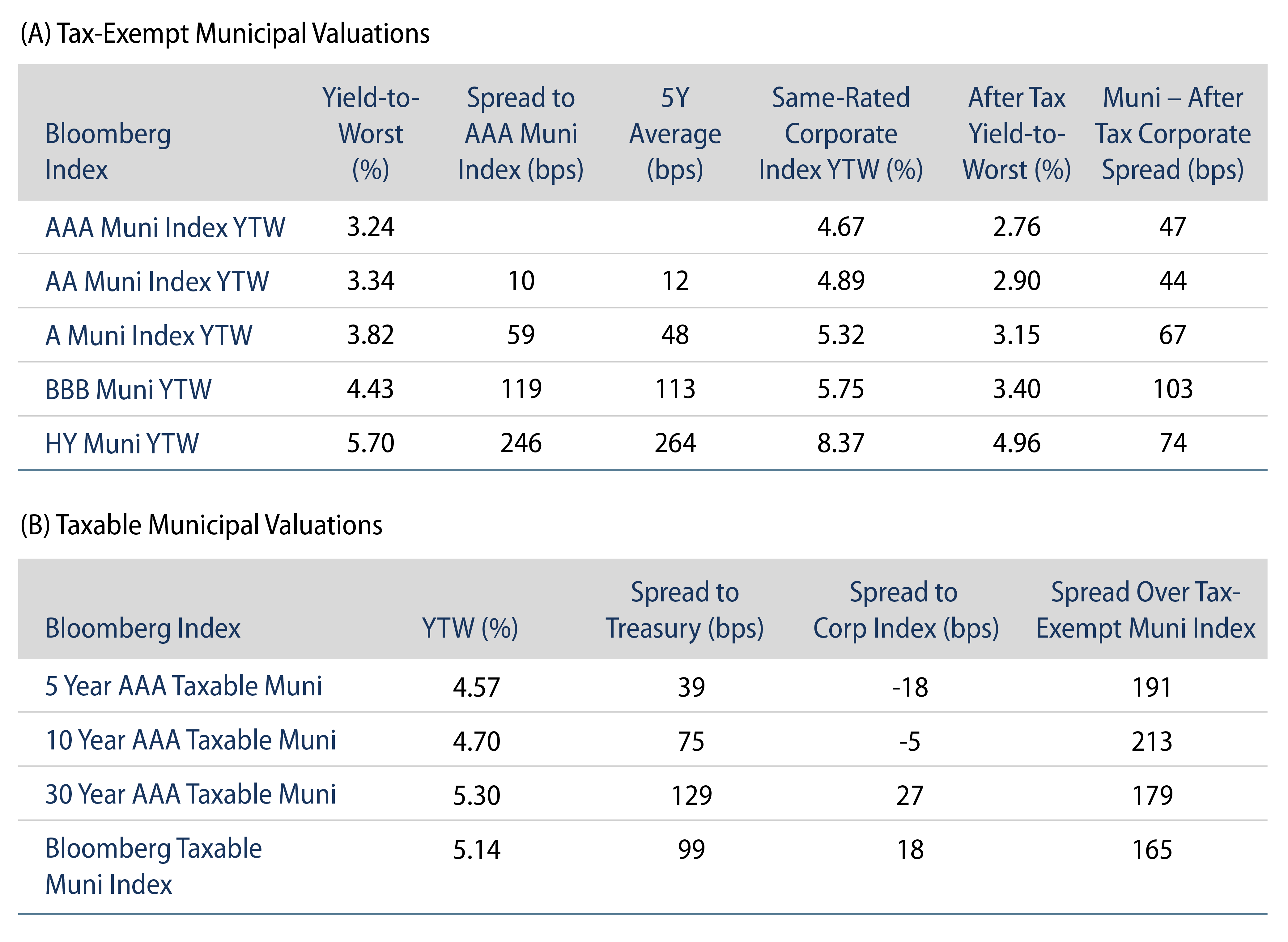

In prior posts, we highlighted how strong tax revenue collections and improving cash balances have supported traditional investment-grade municipal credit, and agency upgrades have surpassed downgrades. As economic growth continues to decelerate, the credit trajectory for the high-yield market has not observed a similar trajectory when focusing on municipal default rates, which have moved higher this year.

According to Bloomberg, through the month of July, first-time payment defaults totaled $1.5 billion, nearly double the $808 million of defaults that occurred through the first seven months of 2022. The majority of municipal defaults this year have been concentrated in the health care sector, particularly among continuing care retirement communities (CCRCs), hospitals and assisted living facilities, as both demand issues and elevated labor costs challenge the operating profiles of these institutions.

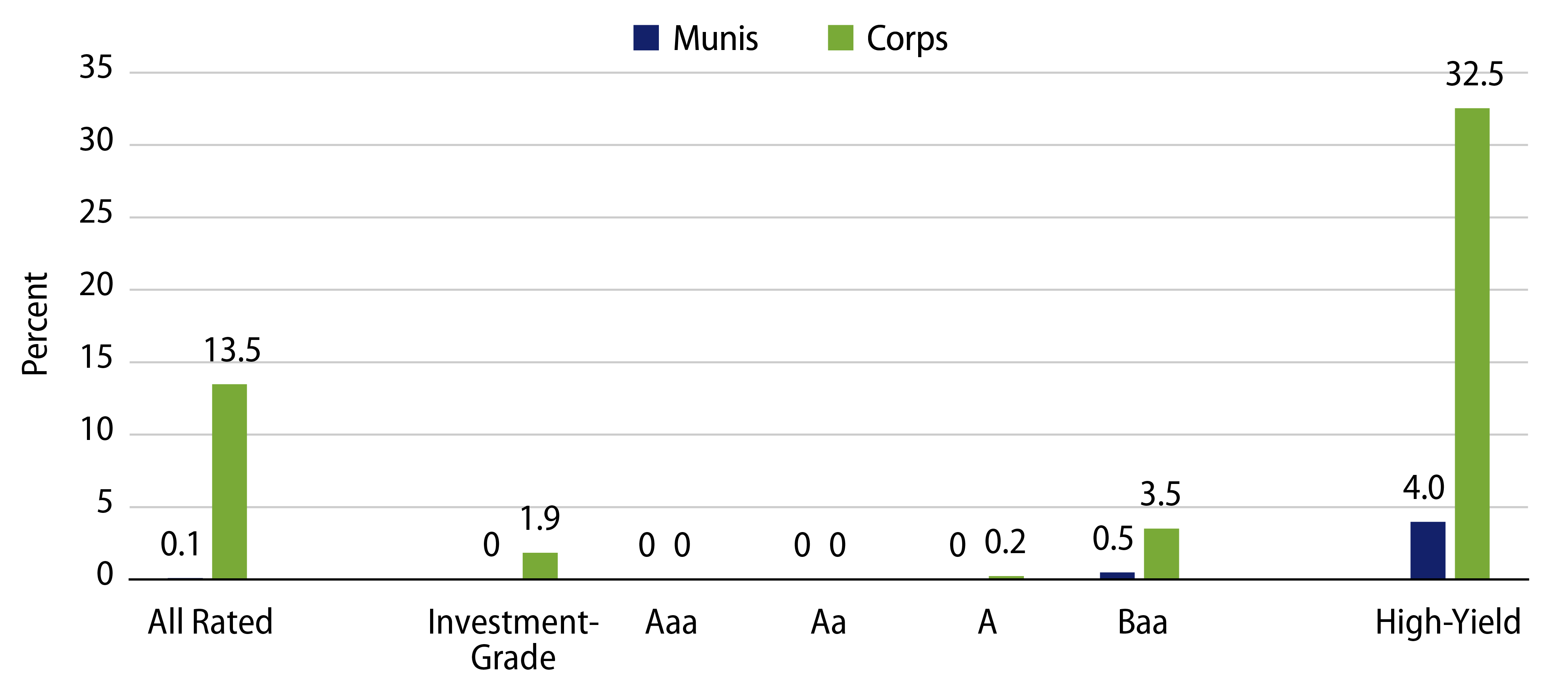

Despite the uptick in defaults this year, overall municipal default rates remain low and Western Asset anticipates defaults to be contained within the high-yield segment of the municipal market, particularly within those segments that are exposed to macroeconomic challenges such as high labor costs. This month, Moody’s released its annual default study which highlighted that municipal 10-year cumulative default rates from 2013 to 2022 remained just 0.09% when evaluating the agency’s rated universe, compared to the corporate universe default rate of 13.48%. The default rate for investment-grade municipals was 0.04%, while the default rate for high-yield municipals was a higher 3.97%, each representing a fraction of comparably rated corporates.

Western Asset continues to find value in municipal credit down the credit spectrum, considering after-tax value that can be achieved versus comparably rated corporate fixed-income. However, as defaults increased over the last year and considering the potential for slower economic activity going forward as the Fed maintains a restrictive monetary policy stance, we believe high-yield municipal defaults could be elevated relative to recent history. As such, we believe diligent research is required to help avoid downside outcomes associated with increased default activity in lower-rated market segments.