Municipals Posted Positive Returns Last Week

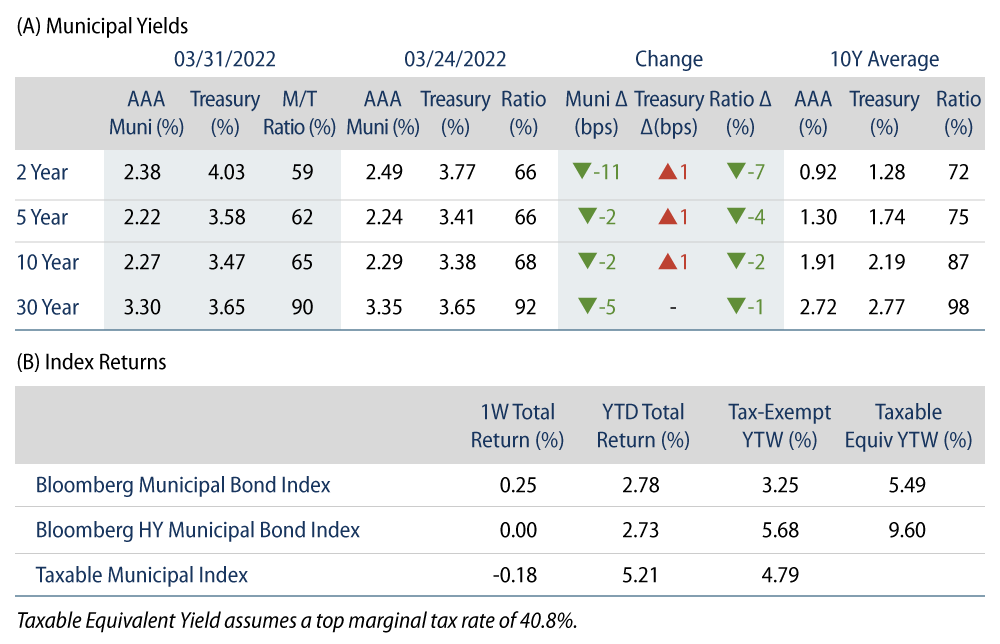

Municipals posted positive returns last week, with high-grade muni yields moving lower across the curve. Munis shunned the Treasury adjustment higher on a reversal of the flight-to-quality sentiment observed in prior weeks. The Bloomberg Municipal Index returned 0.25% during the week, the High Yield Muni Index returned 0.00% and the Taxable Muni Index returned -0.18%. As March Madness concludes, this week we highlight an update on state and local gaming revenues.

Technicals Weakened Amid Fund Outflows, Higher Supply

Fund Flows: During the week ending March 29, weekly reporting municipal mutual funds recorded -$194 million of net outflows, according to Lipper. Long-term funds recorded $198 million of outflows, high-yield funds recorded $149 million of inflows and intermediate funds recorded $103 million of outflows. This week’s outflows extend (year-to-date) YTD net outflows to $1.7 billion.

Supply: The muni market recorded $5.6 billion of new-issue volume last week, up 56% from the prior week. YTD issuance of $75 billion is down 18% year-over year (YoY), with tax-exempt issuance down 16% YoY and taxable issuance down 25% YoY. This week’s calendar is expected to increase to $7 billion. Large transactions include $2.6 billion State of California and $800 UPMC Medical Center transactions.

This Week in Munis: Muni March Madness

In March 2021, we highlighted online sports betting expansion in certain states and the impact on state tax revenues. Over the past two years, 10 additional states have legalized sports betting, with 36 states and Washington, D.C. having legalized sports betting and nine additional states having active ballot initiatives. Only five states remain with no legalization plans on the table.

The proliferation of legalized sports betting has contributed to significant revenue growth for the gaming industry. In January 2023, the single-month sports gaming revenue grew nationally by over 58% YoY to $1 billion and iGaming revenue grew 21% to $482 million, according to the American Gaming Association.

Perhaps most notable of the new markets, New York, legalized sports betting in January 2022. New York applies a 51% tax rate on gross revenue of the operating companies, in line with New Hampshire and Rhode Island, but well above the average rate across states. New York’s steep tax proved successful in its first year of operations, as the state collected a total of $909 million in revenue and licensing fees, approximately 48% above fiscal-year 2023 projections, shining a light on the potential for additional growth. New York has channeled tax collections primarily into education, with smaller portions earmarked for youth sports and gambling addiction programs.

Considering the industry’s infancy, we are encouraged by the additional revenue flexibility provided to states, particularly ahead of a potential economic contraction. However, it is important to recognize that the overall impact is still limited. New York’s strong first year of collections still represents just 0.7% of total fiscal-year 2022 tax collections. We also are mindful of potential longer-term economic and social implications as the as the industry matures.