Munis Posted Positive Returns Last Week

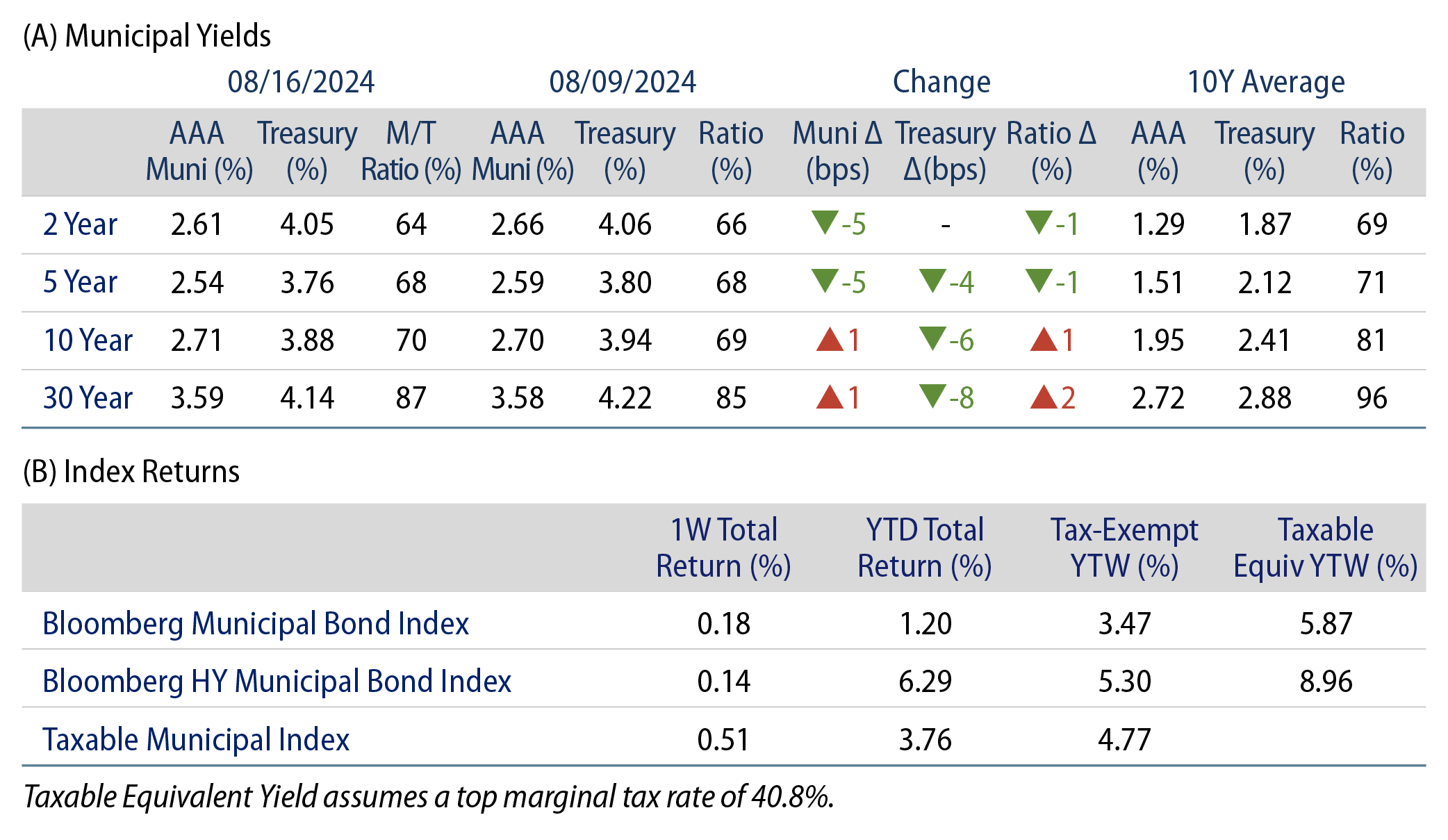

Municipals posted positive returns last week as they underperformed Treasuries. Long-term Treasury rates moved lower on softer-than-expected producer price data, as well as Consumer Price Index (CPI) data, which was in line with expectations but continued to trend lower as year-over-year (YoY) CPI growth fell to 2.9%, marking the lowest level since March of 2021. Meanwhile, the high-grade muni yield curve steepened, moving lower in shorter maturities and higher in long maturities, and supply remained elevated as muni funds recorded inflows. The Bloomberg Municipal Index returned 0.18% during the week, the High Yield Muni Index returned 0.14% and the Taxable Muni Index returned 0.51%. Following the July payrolls report and as we approach Labor Day, this week we highlight state and local payroll trends.

Supply and Demand Moved Higher

Fund Flows (up $529 million): During the week ending August 14, weekly reporting municipal mutual funds recorded $529 million of net inflows, according to Lipper. Long-term funds recorded $576 million of inflows, high-yield funds recorded $231 million of inflows and intermediate funds recorded $6 million of inflows. This week’s inflows led estimated year-to-date (YTD) net inflows higher to $18.4 billion.

Supply (YTD supply of $307 billion, up 40% YoY): The muni market recorded $11 billion of new-issue volume last week, down 28% from the prior week. YTD issuance of $307 billion is 40% higher than last year’s level, with tax-exempt issuance 43% higher and taxable issuance 8% higher YoY. This week’s calendar is expected to remain elevated at $10 billion. The largest deals include $1.5 billion New York City General Obligation and $1.3 billion Baycare Health System transactions.

This Week in Munis: Muni Payrolls

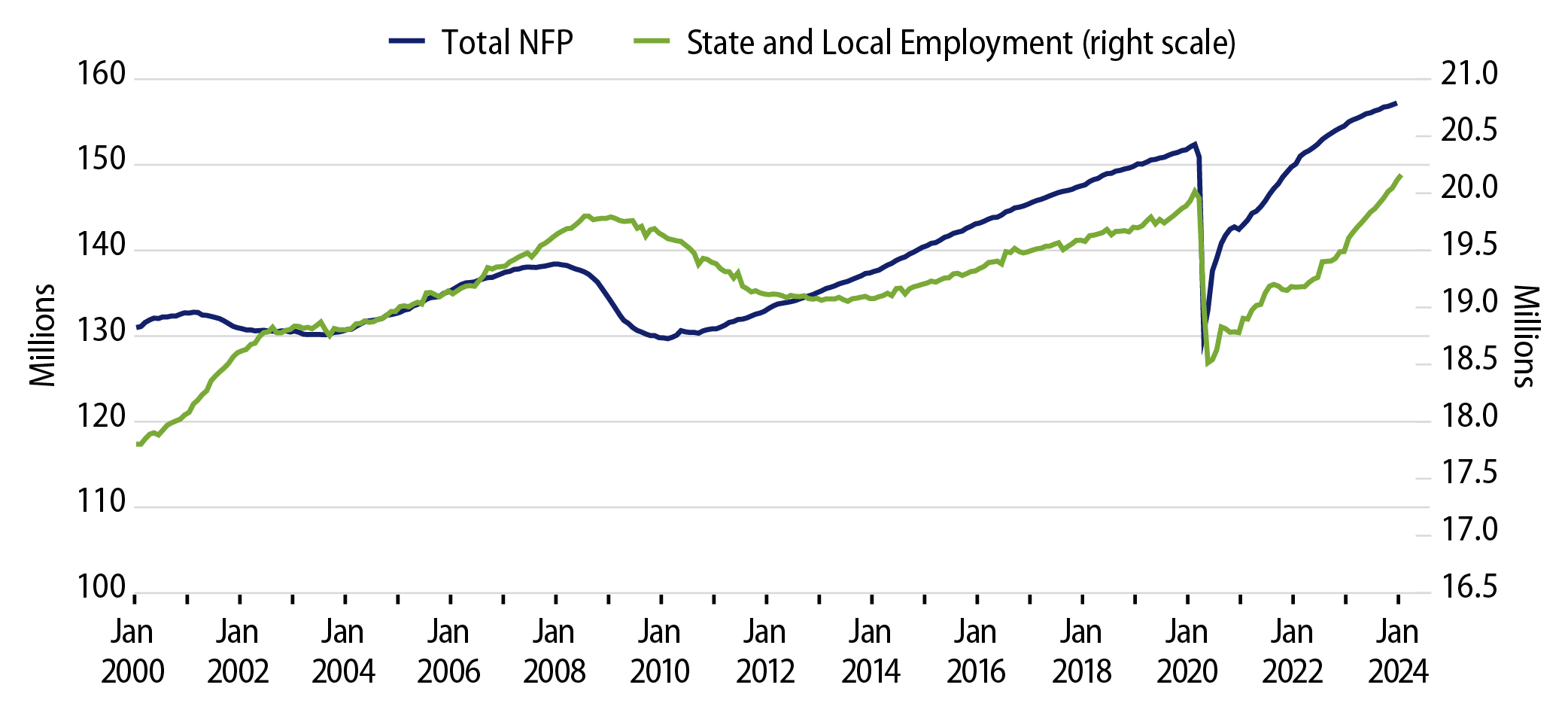

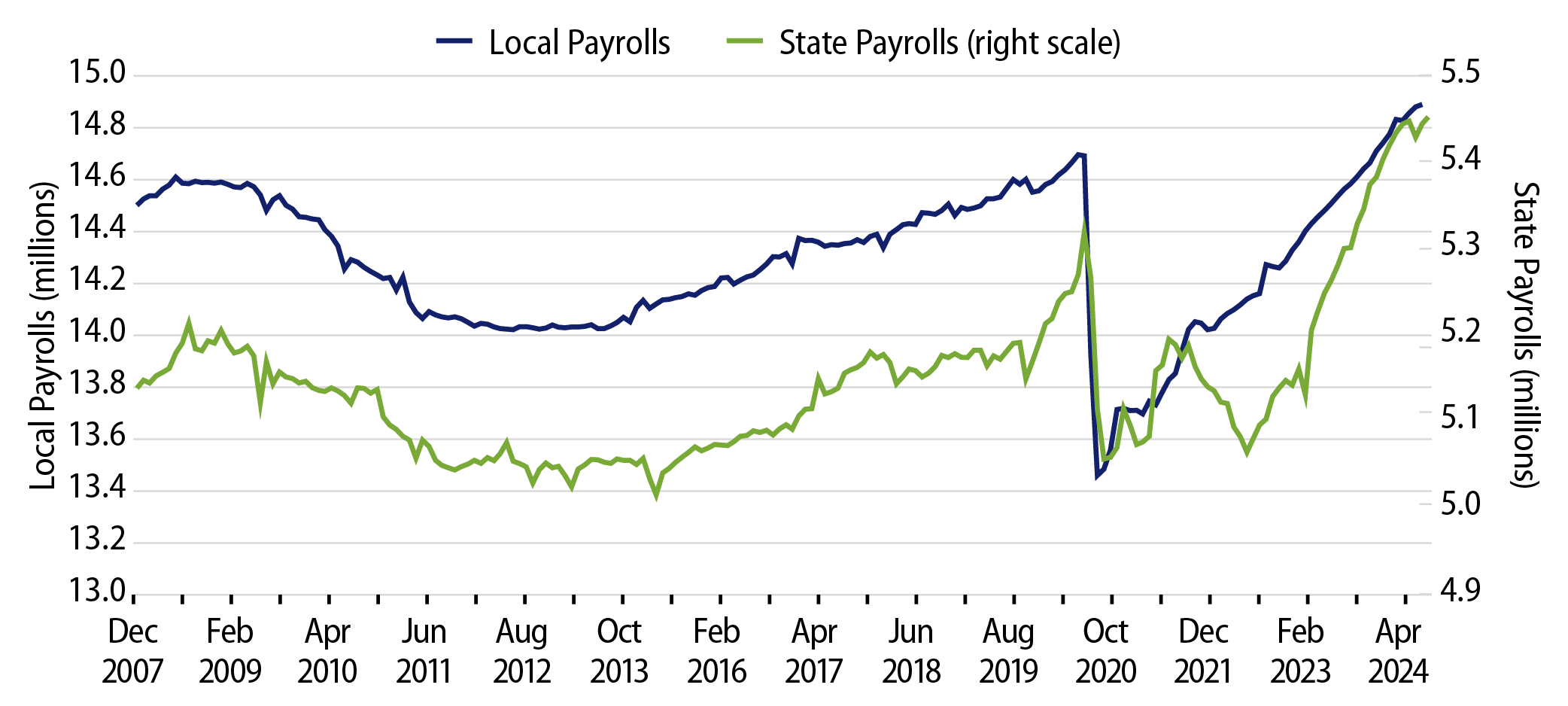

Earlier this year, we highlighted that state and local government employment recovered to pre-pandemic levels after lagging the recovery observed in the private sector following pandemic-driven drawdowns. While July’s nonfarm payroll data continued to show signs of slowing nationwide, so far this year, state and local hiring data demonstrated relative strength with state and local payrolls increasing 1.1% YTD, outpacing the 0.9% total nonfarm payroll growth observed this year.

The majority of government payroll growth has been driven by local employment, which is 1.2% higher YTD and now 1.3% above pre-pandemic levels. State employment increased 0.9% and is now 2.5% above pre-pandemic levels. Notably, state and local employment growth is not immune to the slowdown observed in other sectors, as YTD growth rates are relatively lower than what we observed in the 2023 calendar year when state and local employment increased 5.3% and 2.4%, respectively.

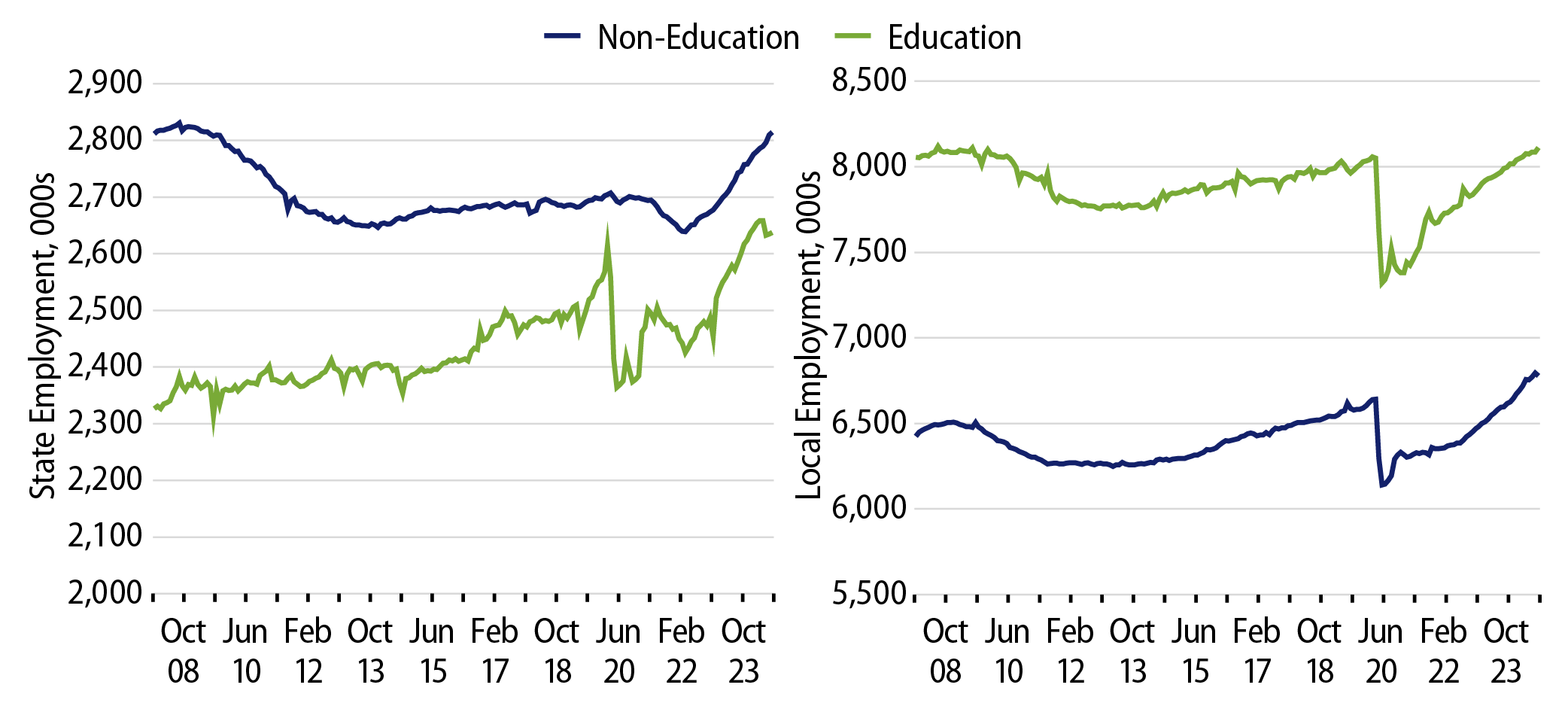

Within state and local government subsegments, non-education employment increased at above the national pace at 1.8% and 1.6%, respectively. Local education employment growth has kept pace with the national rate of employment growth at 0.9%, while state education employment lagged, remaining unchanged so far this year on a seasonally adjusted basis.

State and local payroll growth trends observed this year are largely reflective of the credit conditions we see in the municipal market. Overall government employment growth has slowed alongside national levels and with slower tax collections, but as these revenue collections remain near record levels and as cash balances remain elevated, better-than-national payroll growth remains a positive indicator for muni credit. At the same time, the lack of growth in state higher education employment this year highlights dispersion observed in certain sectors, and as economic conditions continue to tighten, we remain cautious on those issuers that are more susceptible to narrower operating margins and higher labor costs.

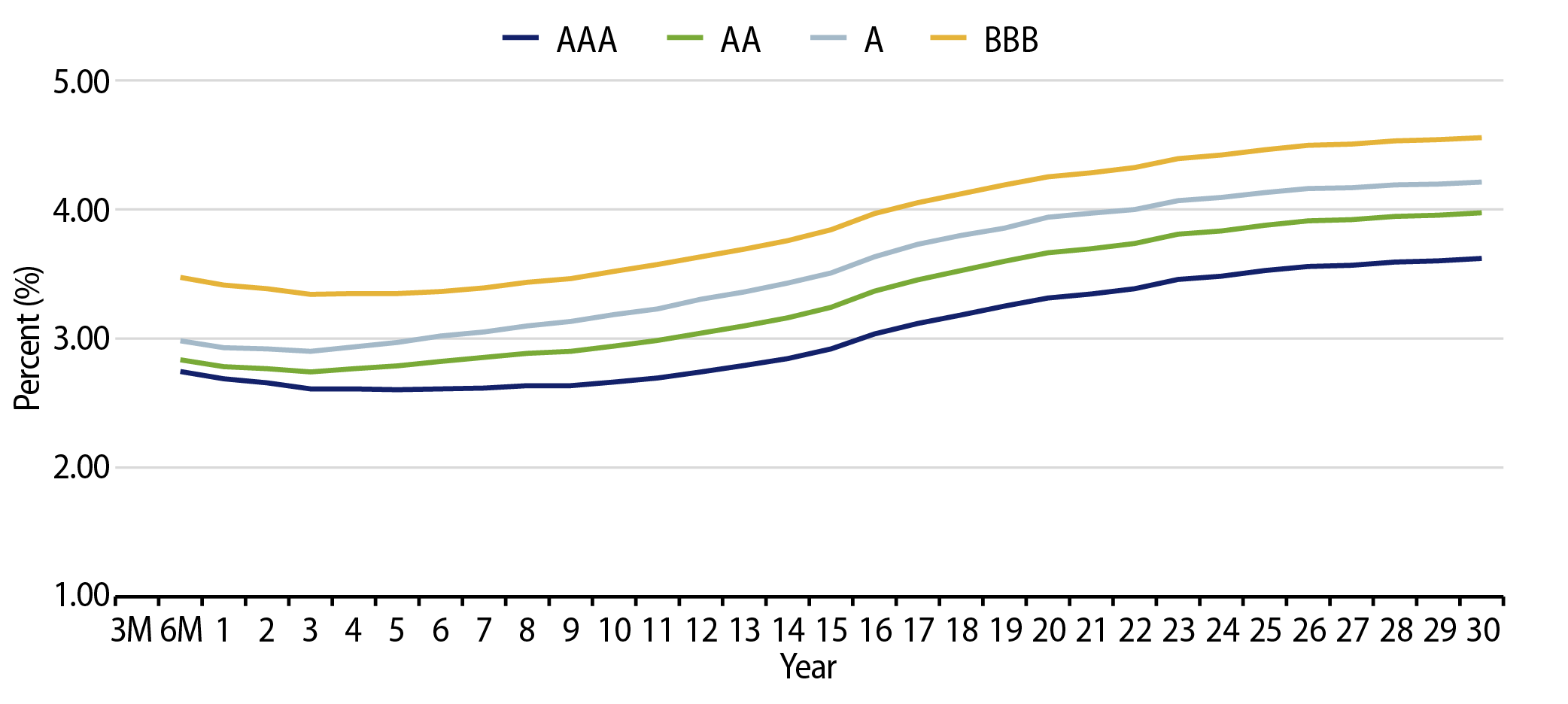

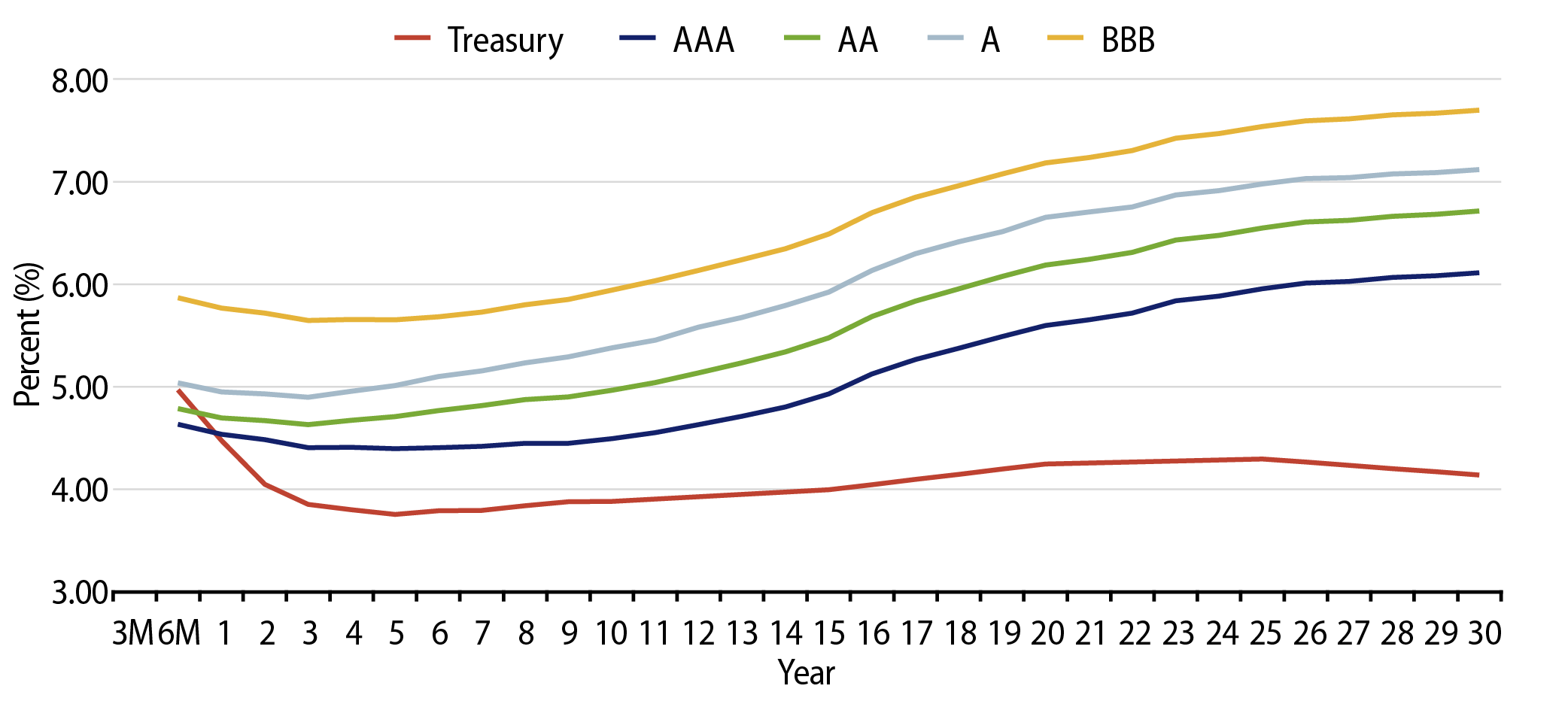

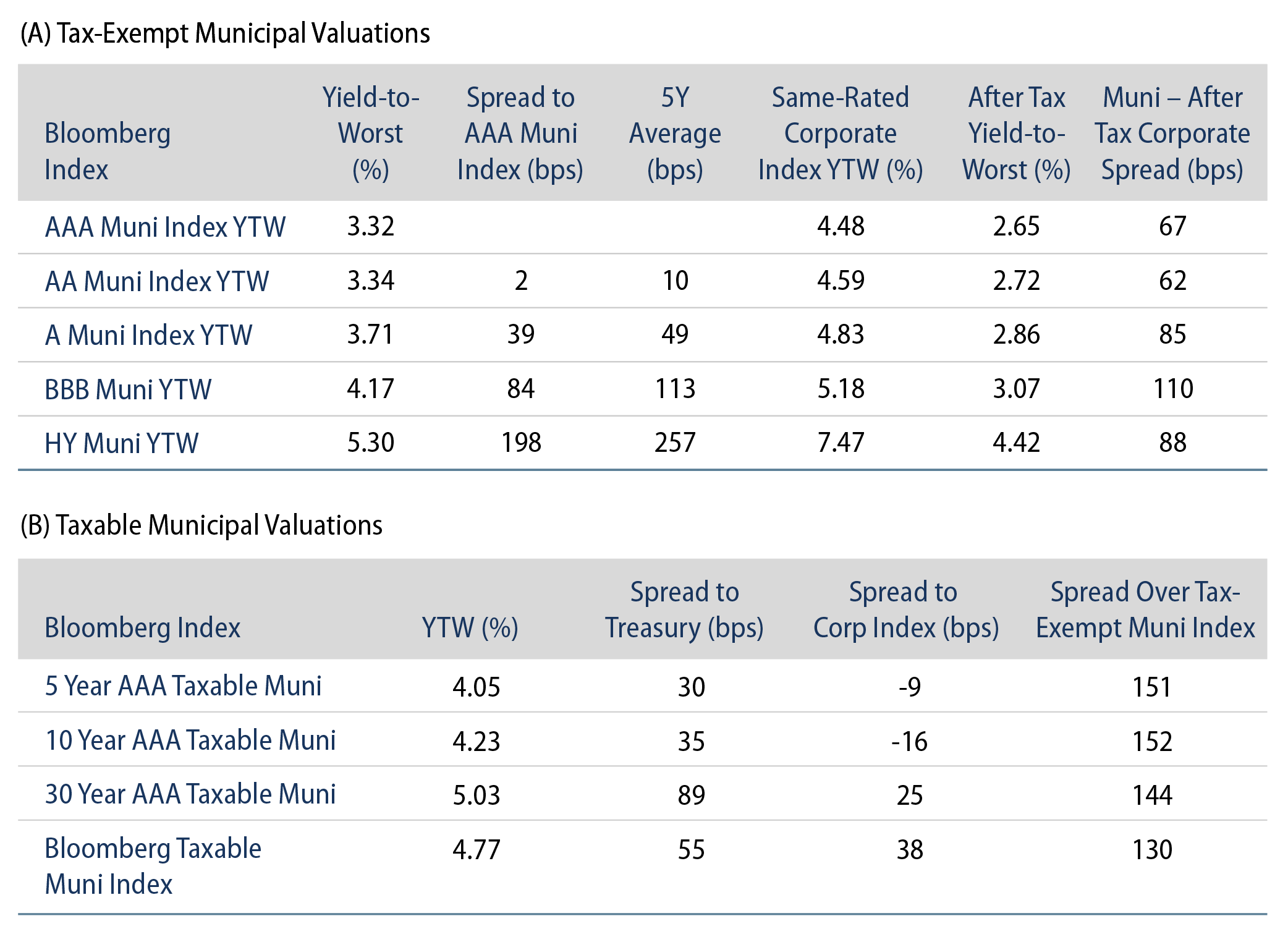

Municipal Credit Curves and Relative Value

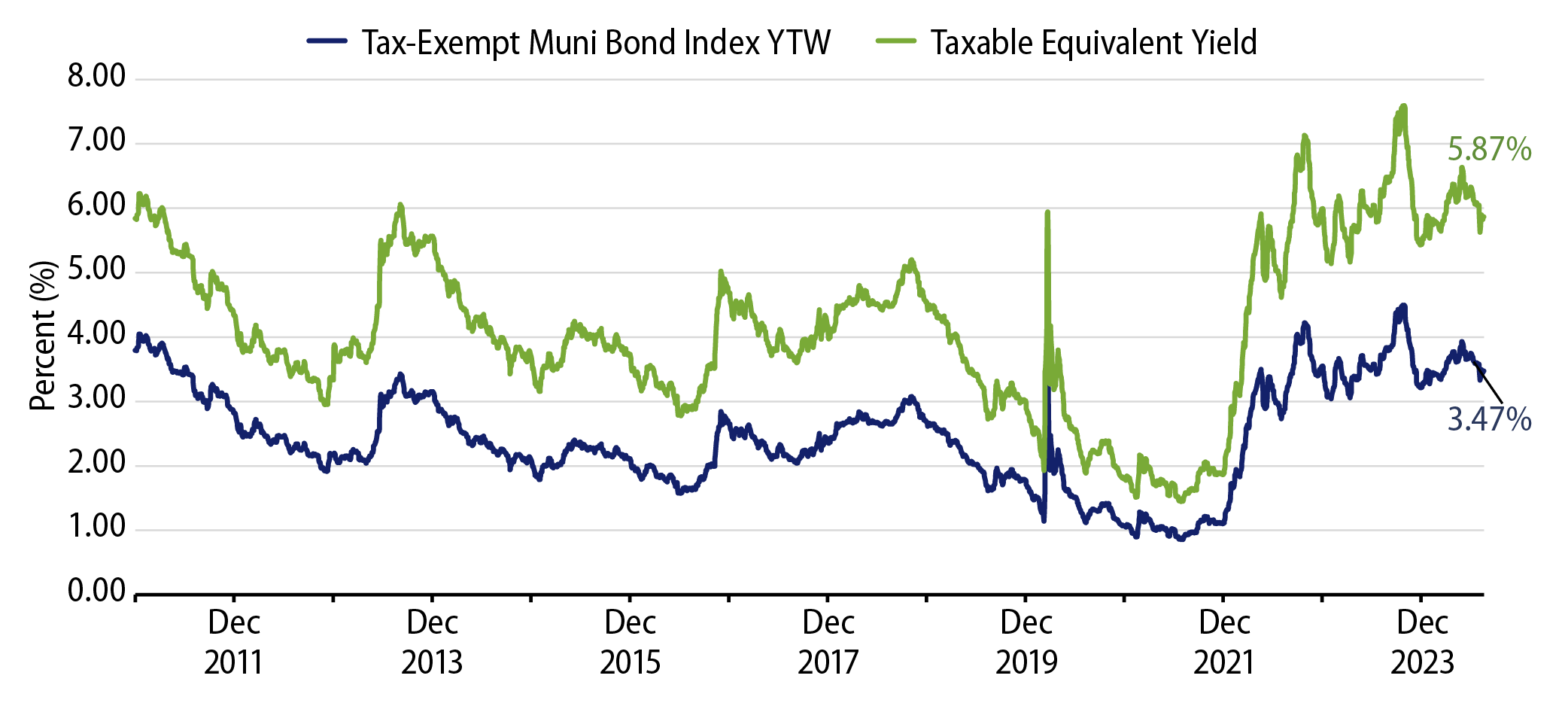

Theme #1: Municipal taxable-equivalent yields and income opportunities are above decade averages.

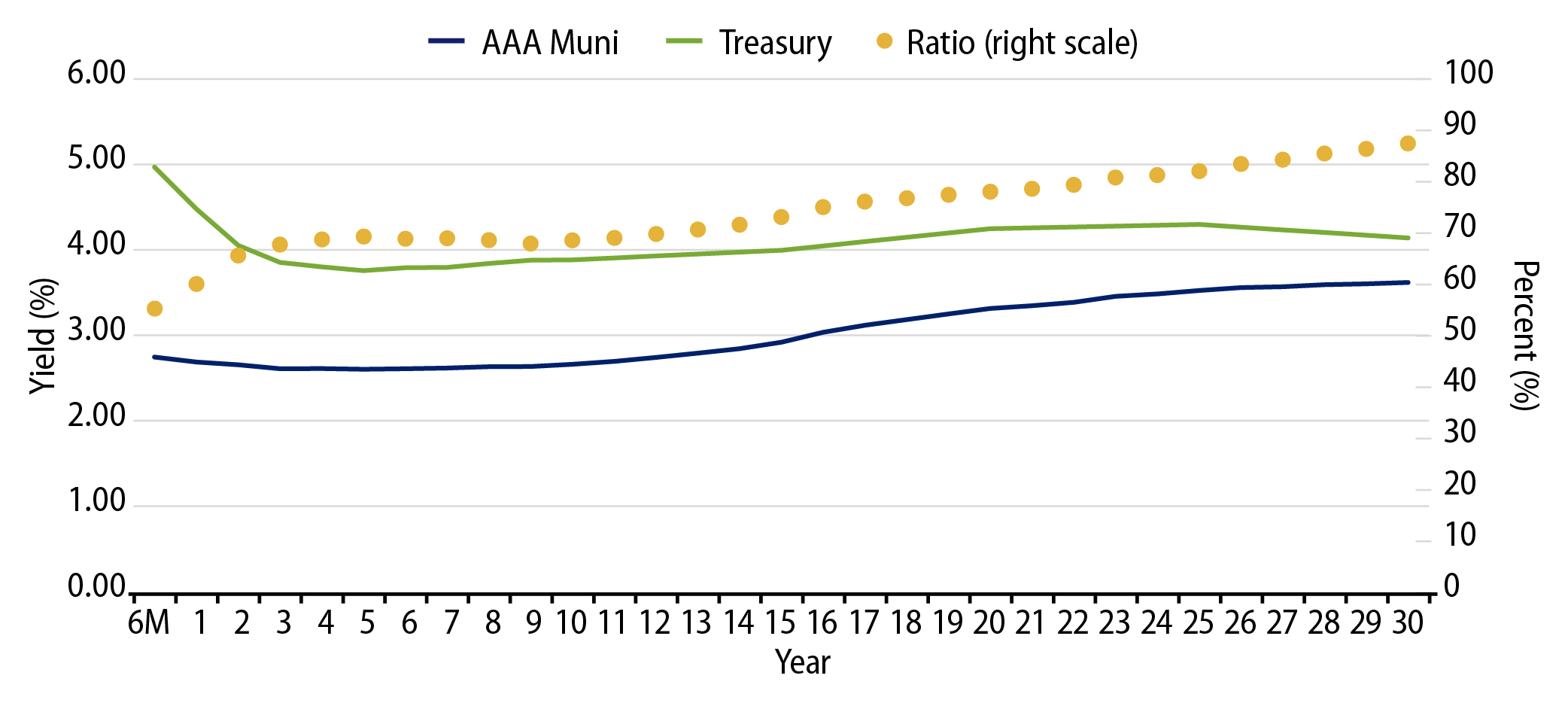

Theme #2: The muni yield curve has largely disinverted, offering potential value in extending maturities.

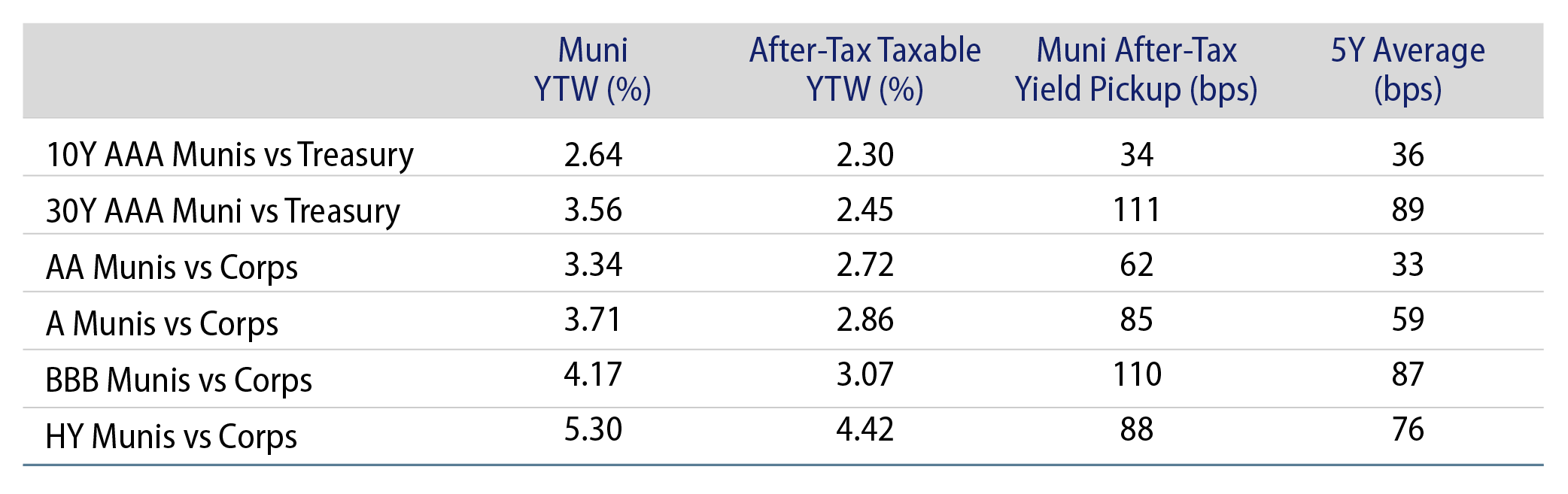

Theme #3: Munis offer attractive after-tax yield pickup versus longer-dated Treasuries and investment-grade corporate credit.