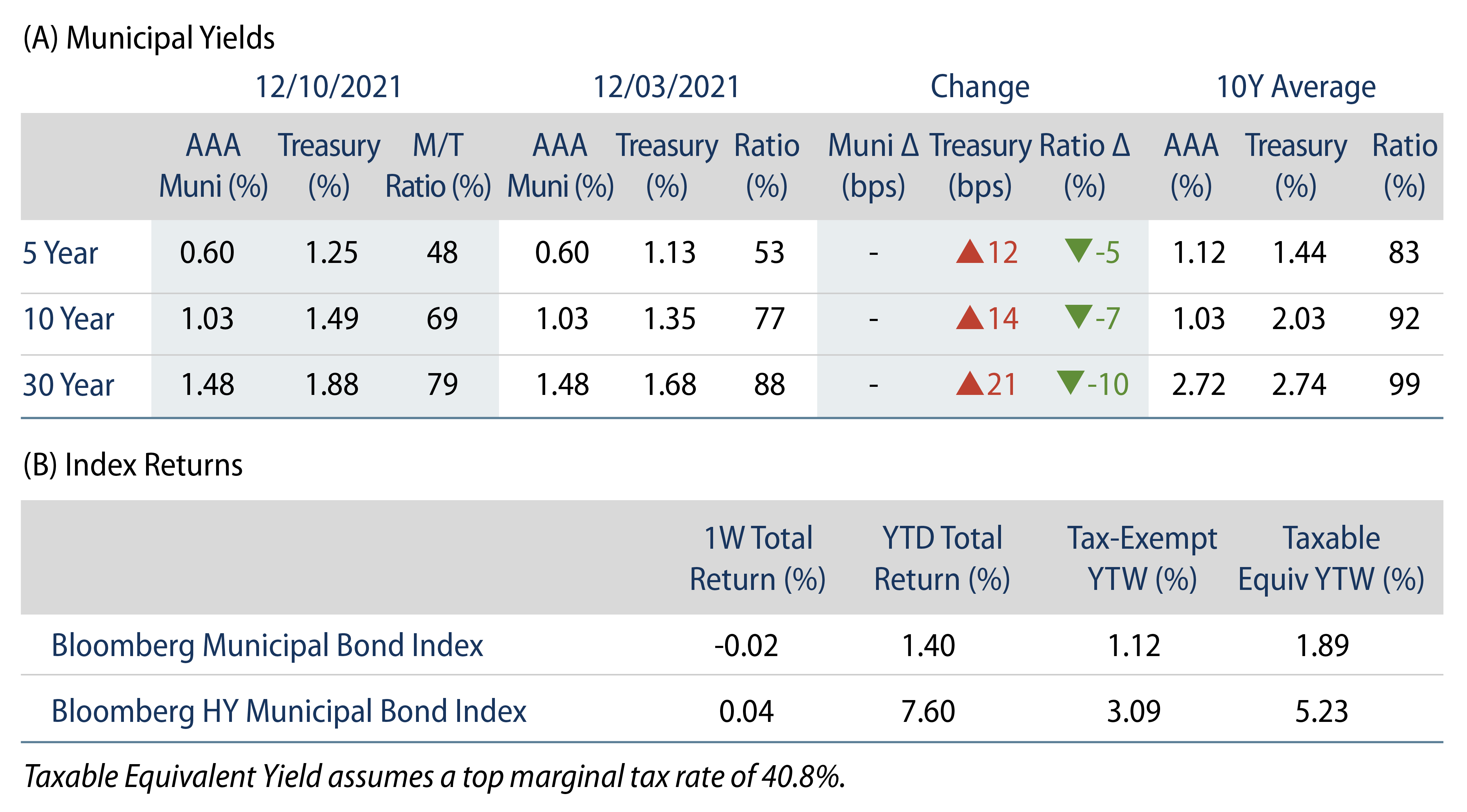

Municipal Yields Were Unchanged During the Week

The US AAA muni yield curve was unchanged during the week. Municipals shrugged off the rate selloff as Municipal/Treasury ratios were grinding tighter. Municipal fund inflows extended their record pace. The Bloomberg Municipal Index returned -0.02%, while the HY Muni Index returned 0.04%. This week, we review municipal supply over the last year, and highlight our 2022 supply expectations.

Municipal Demand Remains Resilient Heading Into Year-End

Fund Flows: During the week ending December 8, municipal mutual funds recorded $804 million of net inflows. Long-term funds recorded $979 million of inflows, high-yield funds recorded $702 million of outflows and intermediate funds recorded $194 million of inflows. Municipal mutual funds have now recorded inflows 81 of the last 82 weeks, extending the record inflow cycle to $160 billion, with year-to-date (YTD) net inflows surpassing a record calendar year pace at $99 billion.

Supply: The muni market recorded $19.5 billion of new-issue volume during the week. This week’s new-issue calendar is expected to decline to approximately $7 billion. The largest deals include $800 million state of Connecticut and $572 million CSCDA Community Improvement Authority transactions.

This Week in Munis—Supply in Review

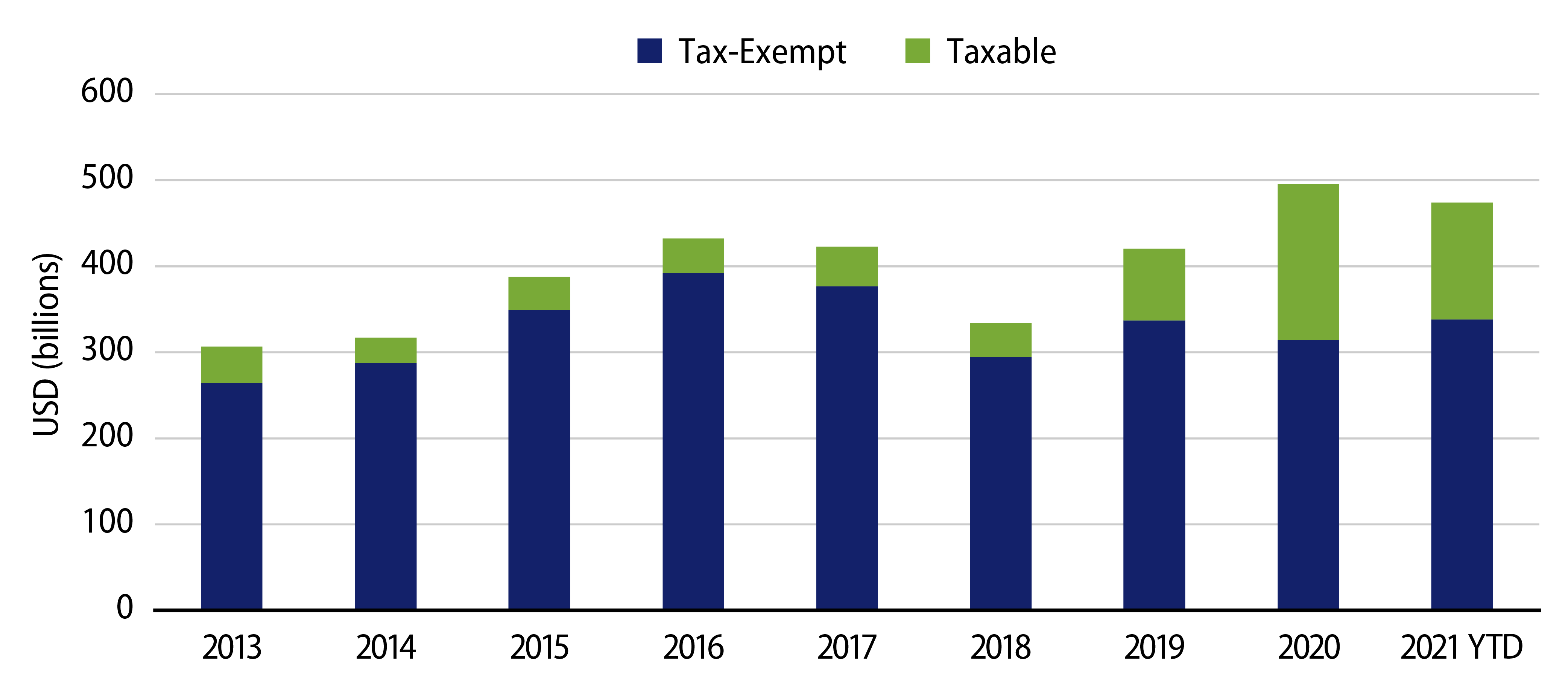

As we near the end of the year, we take note of 2021 municipal supply trends and look ahead to 2022. Through last week, total municipal issuance YTD of $474 billion has kept pace with last year’s levels, with tax-exempt issuance trending 12% higher year-over-year (YoY) and taxable issuance trending 22% lower YoY. Consistent with our expectation as detailed in one of our blog posts last year, we expect 2021 muni supply to close at or modestly above last year’s levels.

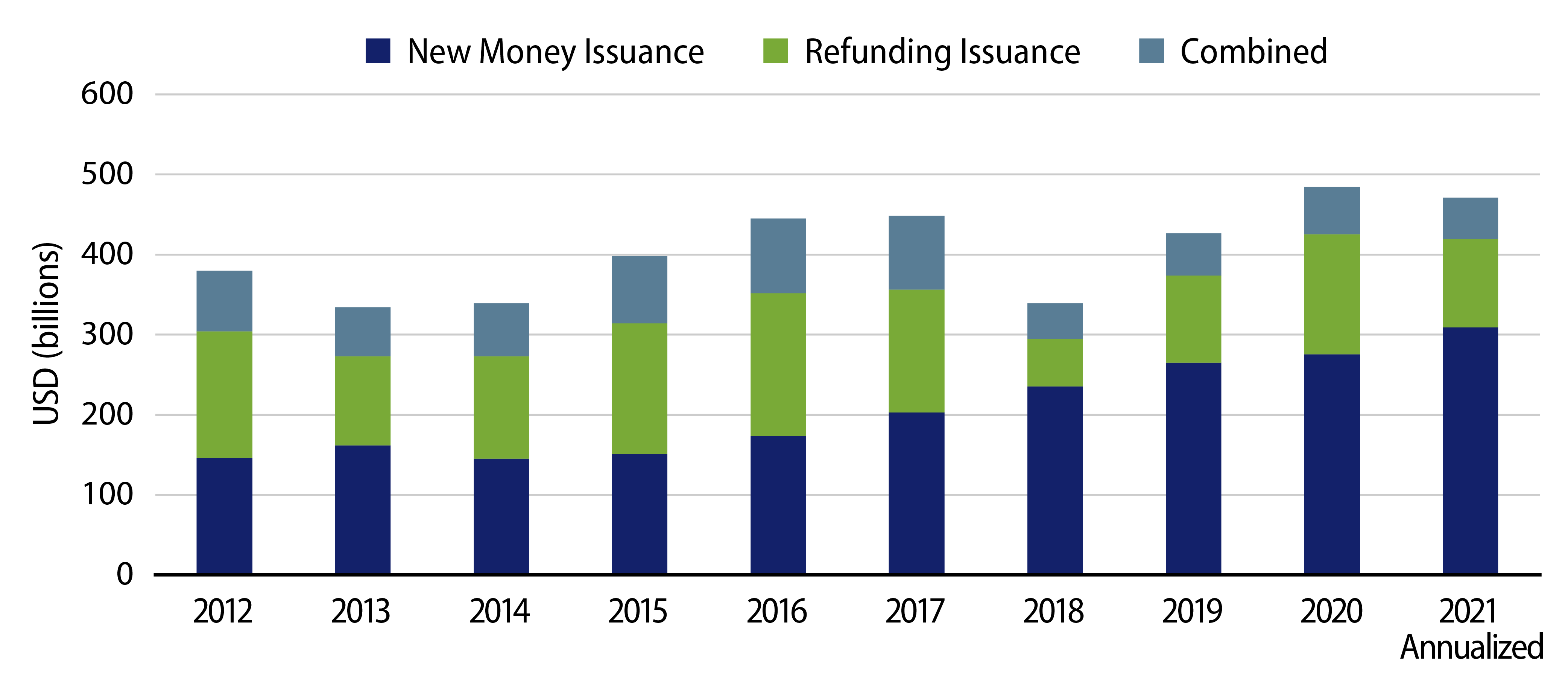

While 2021 absolute levels of supply are in line with last year’s levels, we have observed notable divergence between taxable and tax-exempt markets. Increased rate volatility, combined with the prospects for infrastructure legislation to support future taxable issuance, has contributed to the decline in taxable issuance from last year. Meanwhile, higher tax-exempt issuance was supported by demand for new projects, as The Bond Buyer reported new money issuance reached a decade high, on pace to exceed $300 billion in 2021.

Market participants hoped that federal policy would support a robust 2022 supply year to satisfy the increasing demand from both tax-exempt and taxable markets. However, the Infrastructure Investment and Jobs Act (IIJA) and the latest draft of the Build Back Better spending bill did not include significant provisions to bolster municipal supply, either through a revival of a taxable direct pay program (similar to the BABs program) or through a reinstatement of tax-exempt advanced refunding. While the infrastructure legislation does include an expansion of private activity bonds (PABs) which should support new issuance, healthy municipal issuer balance sheets could diminish borrowing needs. Therefore, Western Asset anticipates 2022 issuance to be only modestly higher than 2021 levels which, when combined with ongoing redemptions, should continue to contribute to a favorable technical backdrop for tax-exempt municipals in 2022.